Tenants In Common Hawaii Form

Description

Form popularity

FAQ

Getting rid of a timeshare in Hawaii can be accomplished through several methods, including selling, donating, or transferring your ownership. Utilizing the Tenants in Common Hawaii form can make the transfer process smoother if you choose to pass it on to someone else. Additionally, consider consulting a reputable timeshare exit company to explore your options. They can guide you through the steps involved and help you make an informed decision.

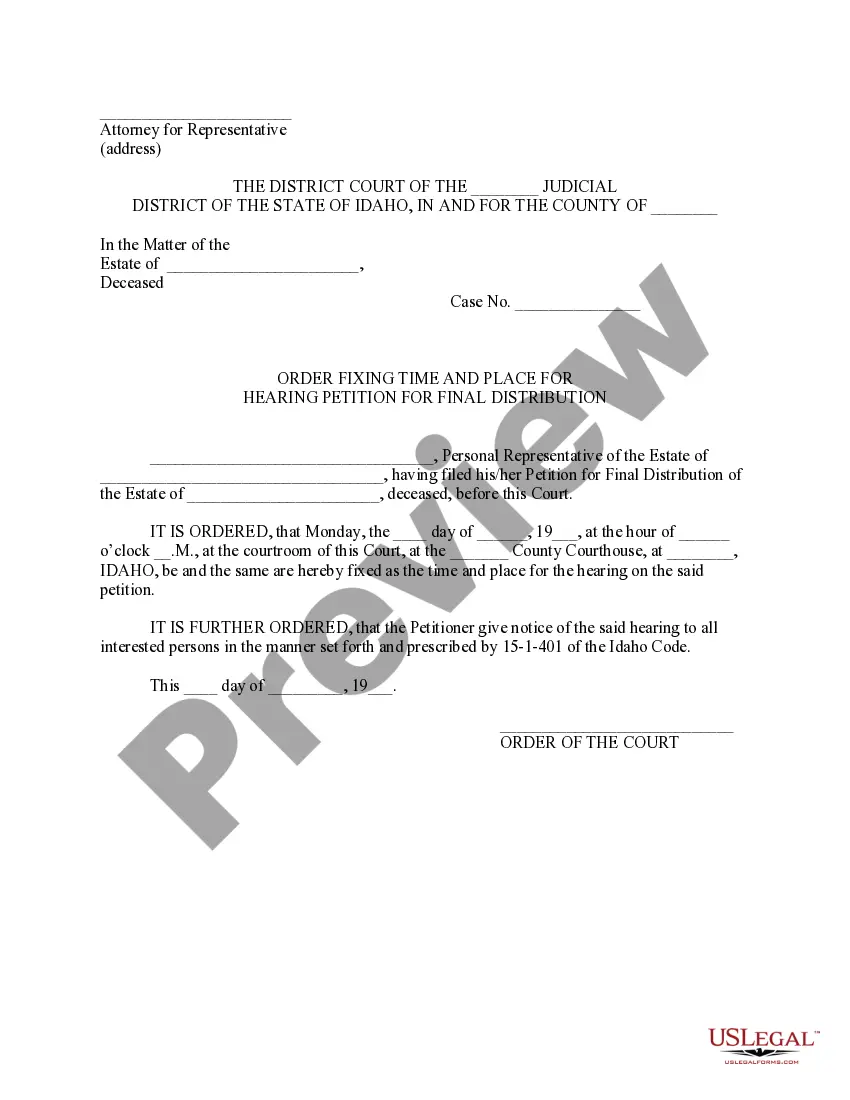

Transferring your timeshare to another person involves completing the appropriate transfer documents, including the Tenants in Common Hawaii form. This form provides the necessary details about the timeshare and the parties involved in the transaction. It's advisable to notify your timeshare company about the transfer, as they may require additional paperwork. Seeking assistance from services like US Legal Forms can streamline the process and ensure you meet all legal requirements.

To transfer ownership of a timeshare in Hawaii, you will need to complete a legal transfer form, such as the Tenants in Common Hawaii form. This document facilitates the change of ownership by outlining the rights and responsibilities of each party involved. Make sure to consult with a real estate attorney or a professional company that specializes in timeshare transfers to ensure compliance with state laws. Using the right forms and guidance helps avoid potential delays and complications.

Creating a tenant in common agreement involves drafting a legal document that outlines the ownership shares, responsibilities, and rights of each co-owner. You can use a tenants in common Hawaii form to ensure that all essential legal aspects are addressed clearly. Working with a real estate attorney or utilizing platforms like US Legal Forms can streamline this process and help protect all parties' interests.

Joint tenancy is the most common vesting for married couples because it offers equal ownership and the right of survivorship. This means that when one spouse passes away, their interest in the property transfers automatically to the surviving spouse. Nonetheless, if a couple wishes to maintain distinct ownership shares, they may choose tenants in common Hawaii form as an alternative.

The most suitable deed for a married couple often is a joint tenancy deed, as it establishes equal ownership and benefits like seamless transfer between spouses. However, if couples require more control over how their property is divided after death, they might consider tenants in common Hawaii form. This approach allows for individualized ownership shares and can accommodate personal estate planning desires.

Most married couples typically opt for joint tenancy due to its simplicity and benefits, like the right of survivorship. However, some couples prefer tenants in common, especially when they want to designate specific ownership shares or plan for heirs outside of the marriage. Ultimately, the choice depends on individual circumstances and future intentions regarding the property.

A tenant in common in Hawaii refers to a property ownership arrangement where two or more people hold title to a property without the right of survivorship. Each owner can transfer their share independently, which can be advantageous for estate planning. Using tenants in common Hawaii form is essential to outline each owner’s rights and responsibilities clearly, ensuring all parties understand their interests.

Joint tenancy is commonly considered the best tenancy for married couples since it provides equal ownership and simplifies the transfer of property upon the death of one spouse. However, if you and your spouse have different ownership goals or plans for the property, tenants in common Hawaii form may be a better fit. This form allows you to set specific shares, giving flexibility in estate planning.

The best way to hold title as a married couple often depends on your specific situation. Joint tenancy allows both spouses to own the property equally and includes the right of survivorship, meaning if one partner passes away, the other automatically inherits the property. Alternatively, tenants in common Hawaii form can be used to specify ownership shares, which may be especially useful if you want to pass your share to someone other than your spouse.