Release Of Mortgage Sample With Promissory Note

Description

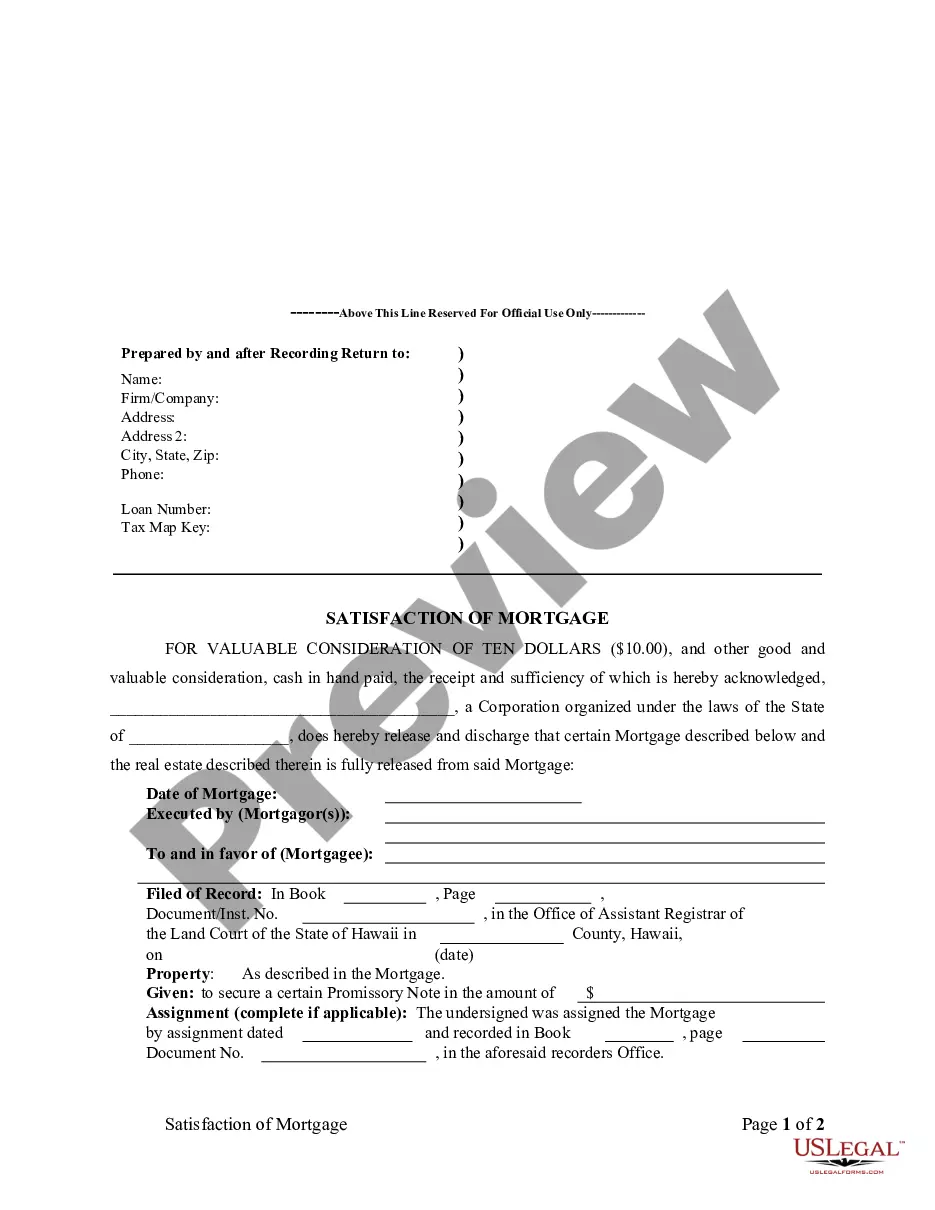

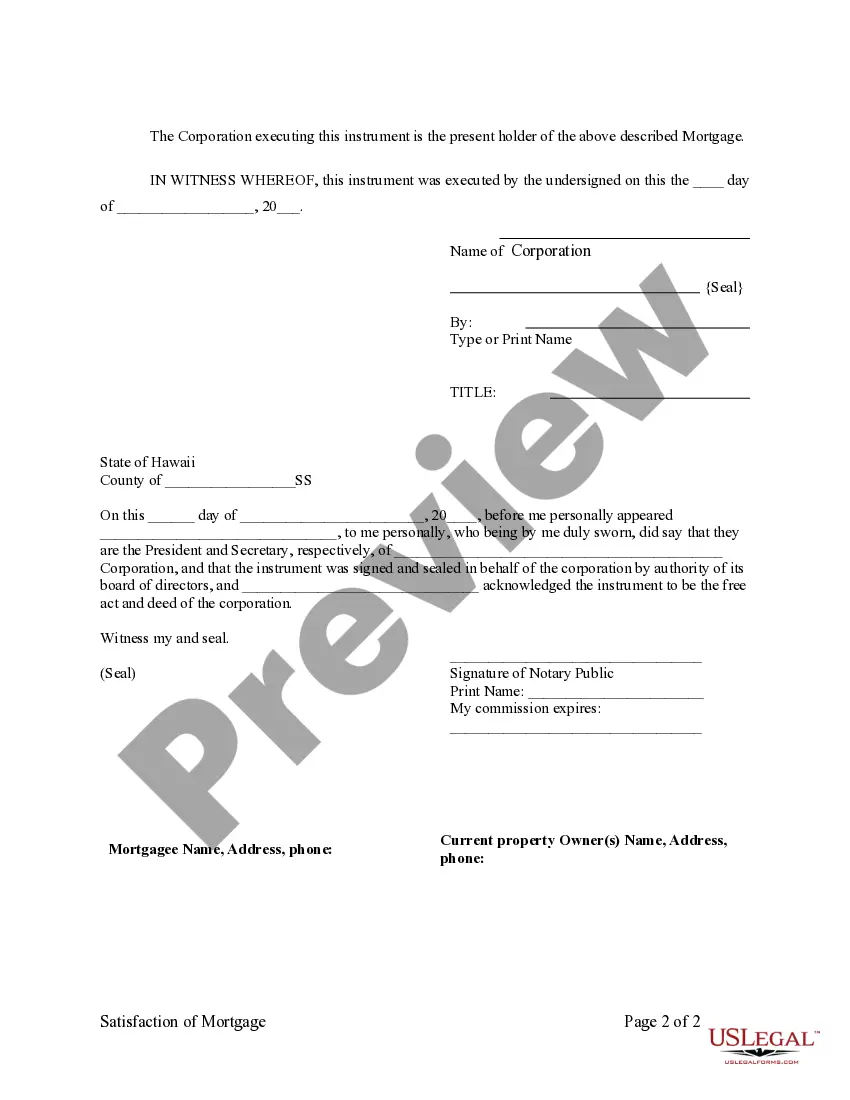

How to fill out Hawaii Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

No matter if you handle documentation often or occasionally need to provide a legal form, it's essential to find a resource where all the examples are relevant and current.

The initial step you must take with a Release Of Mortgage Sample With Promissory Note is to confirm that it is the most recent version, as this determines its eligibility for submission.

If you're looking to streamline your search for the most recent document samples, consider looking them up on US Legal Forms.

Forget about the hassle of dealing with legal documents. All your templates will be organized and verified with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes virtually any type of template you may need.

- Search for the forms you require, review their relevance immediately, and learn more about their application.

- With US Legal Forms, you can access over 85,000 form examples across various fields.

- Obtain the Release Of Mortgage Sample With Promissory Note templates in just a few clicks and store them anytime in your account.

- A US Legal Forms account allows you convenient access to all the samples you need with ease and less hassle.

- You only need to click Log In in the site header and enter the My documents section where all the forms you require are at your disposal, eliminating the need to spend time searching for the appropriate template or verifying its relevance.

- To acquire a form without an account, simply follow these steps.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Once a note has been paid off, it's time to wrap up any loose ends and release the parties from their duties. A clean break will provide peace of mind, discharge all obligations, and lead to an amicable conclusion. A release is the definitive end of the parties' commitments under a note.

The borrower and the lender execute the promissory note, and as a result, the borrower becomes legally bound to repay the loan to the lender. If the borrower does not repay the loan, the lender can pursue legal action. If the borrower does fully repay the loan, the lender should mark the promissory note paid in full.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Lenders have up to 20 days after the date the SBA approves your application to fund your PPP loan. In most cases, this funding happens within 2 to 3 business days after you sign your promissory note. To avoid delays, check your application Status Detail to ensure your bank info is complete.