Hawaii Special Poa For Trust

Description

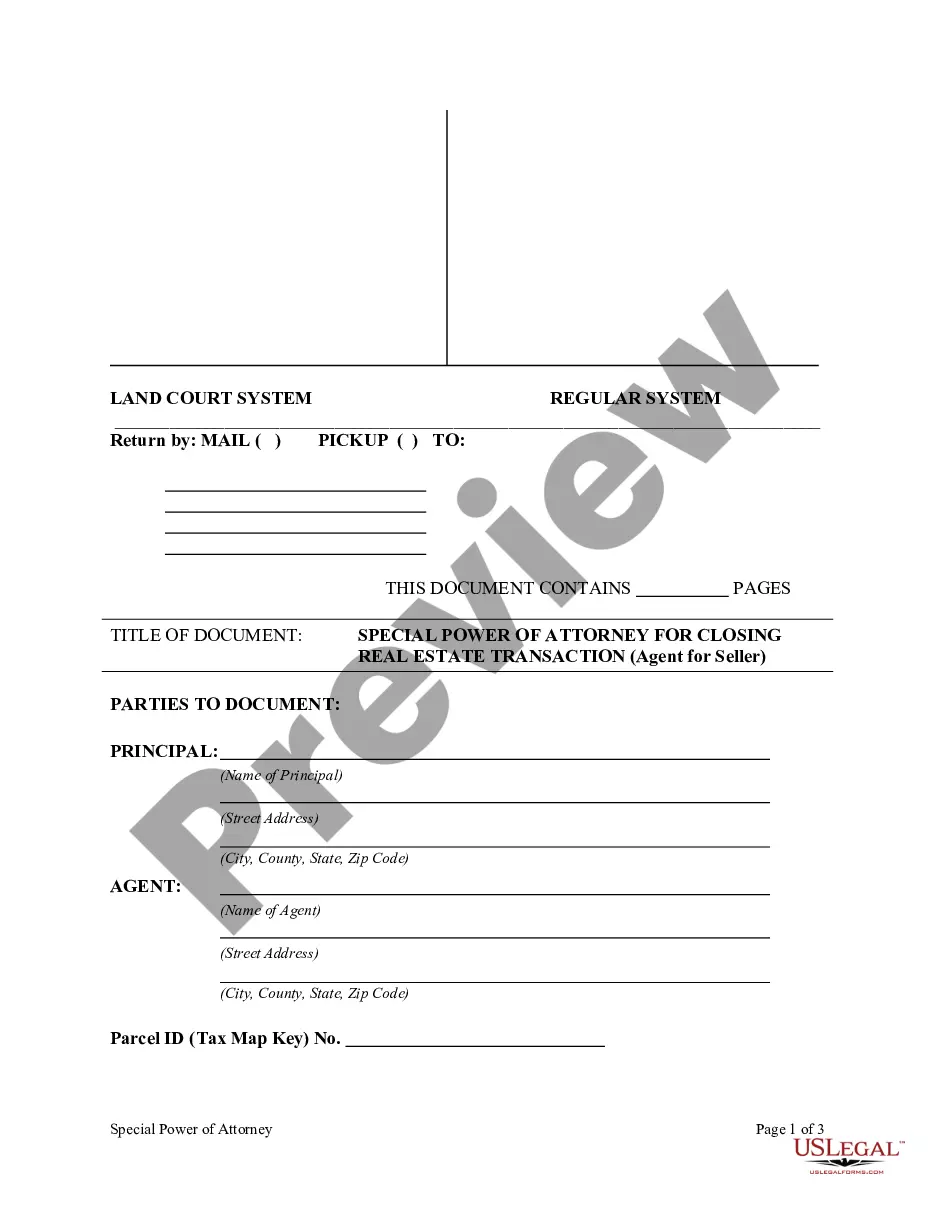

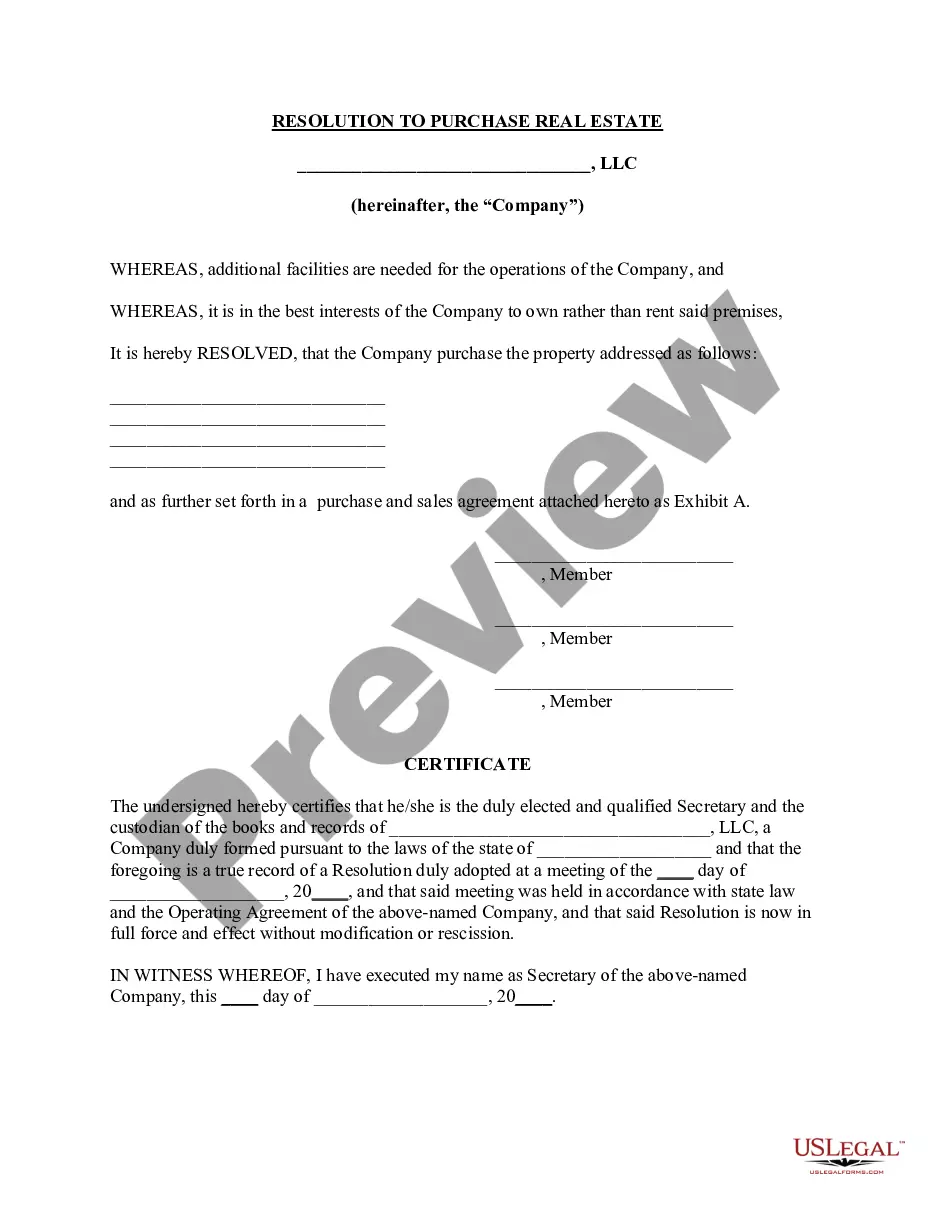

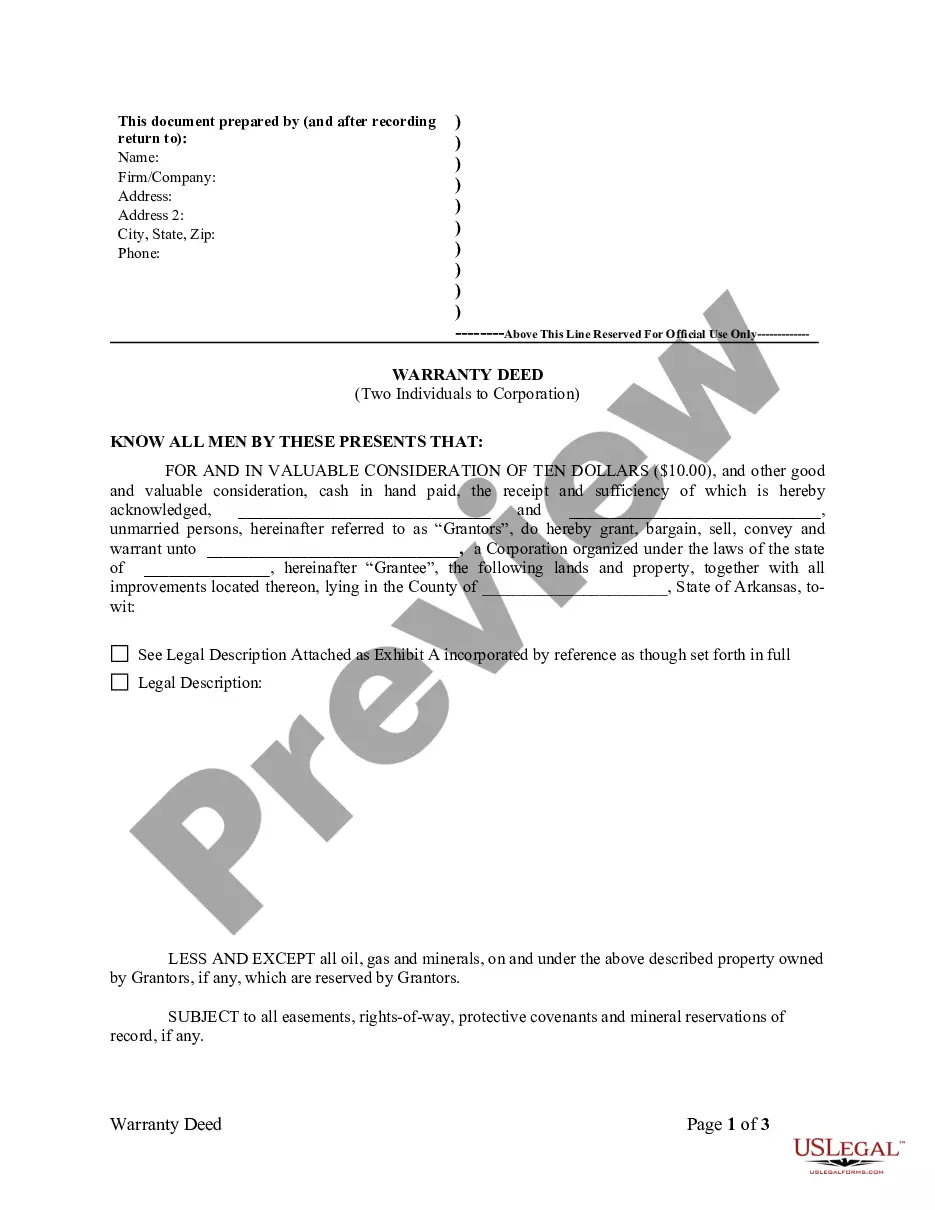

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

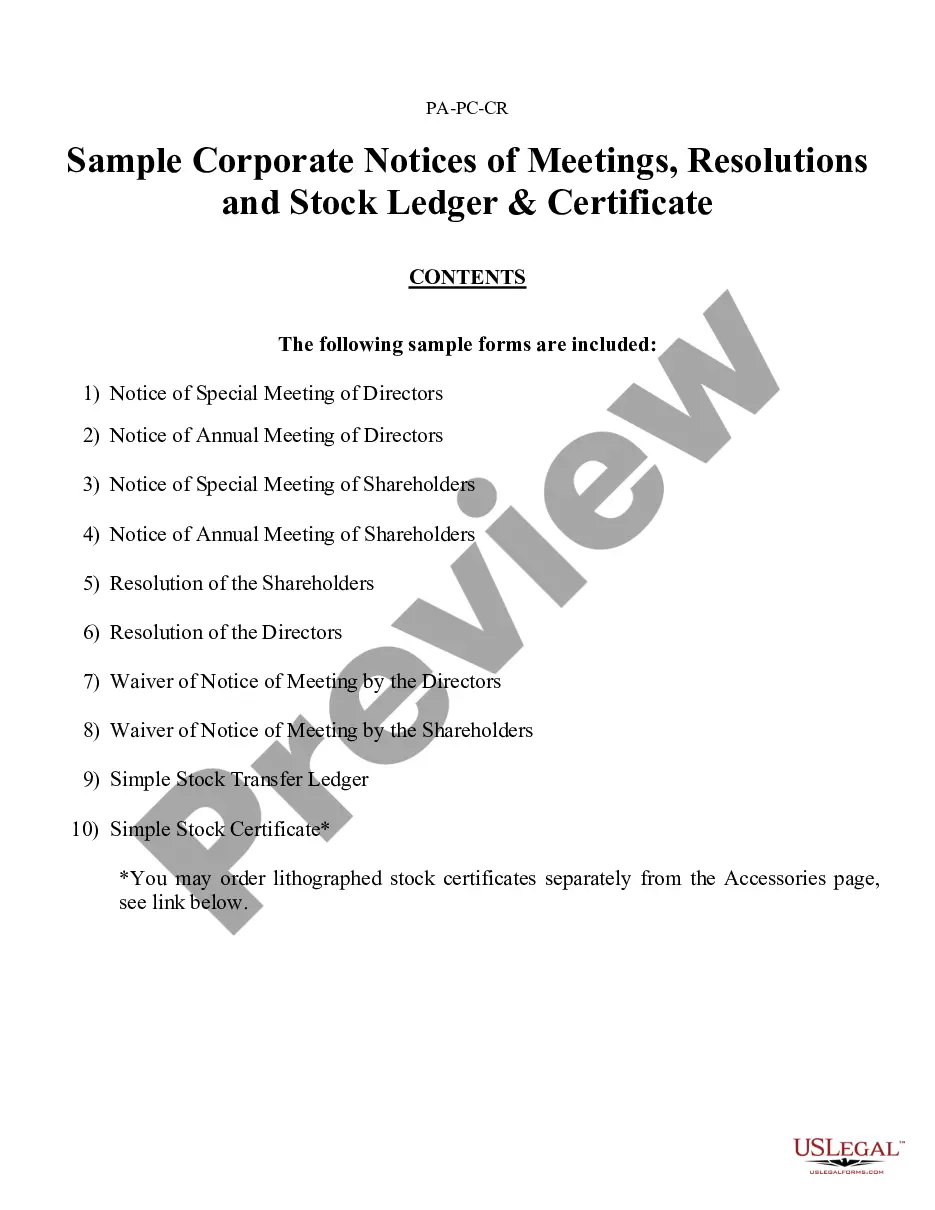

- Start by visiting the US Legal Forms website and explore their collection of Hawaii forms.

- Use the Preview mode to verify that the Hawaii special poa for trust aligns with your requirements and local regulations.

- If necessary, search for alternative templates until you find the exact form you need.

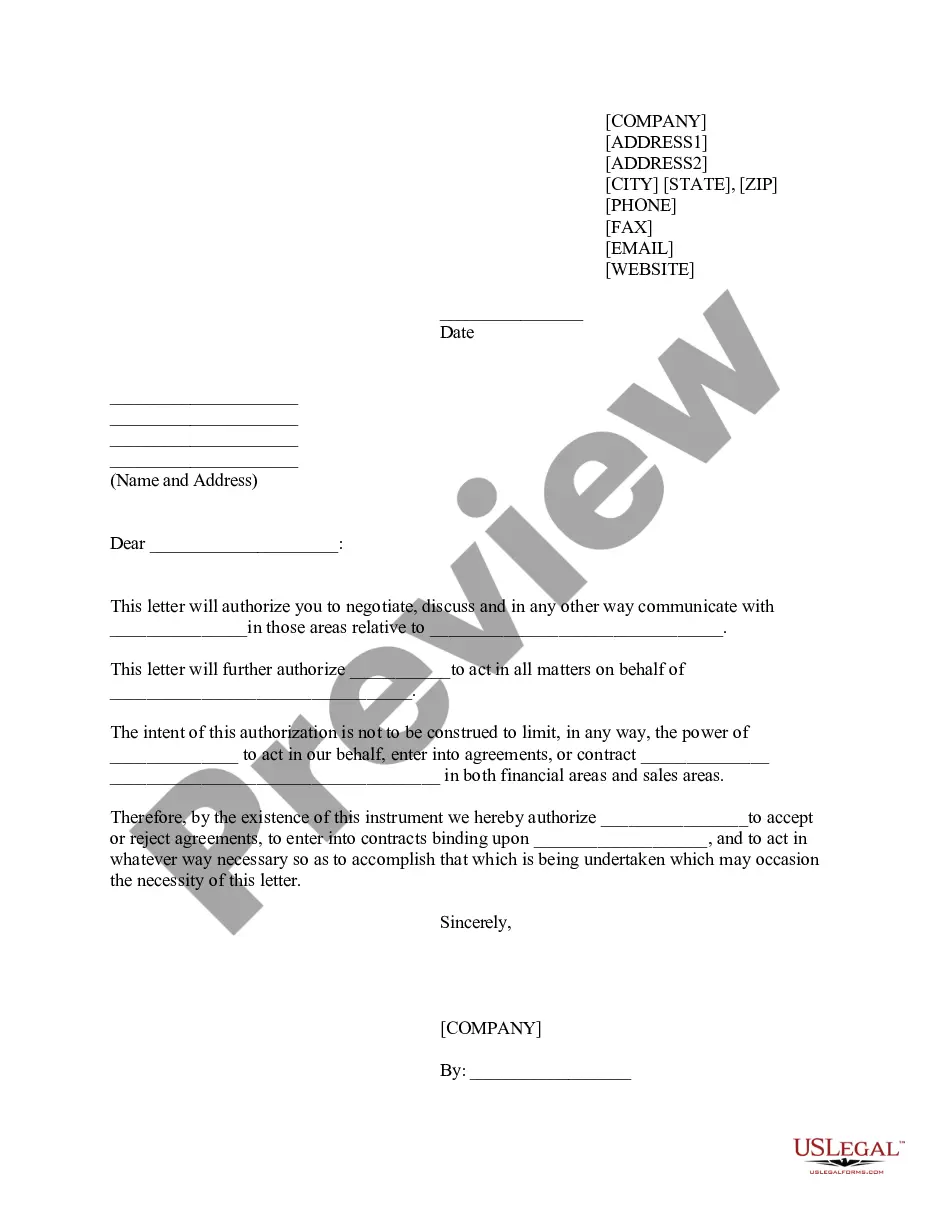

- To proceed, select the 'Buy Now' option and pick a suitable subscription plan, which requires account registration.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download the form directly to your device, and access it anytime through the 'My Forms' section in your profile.

Once you've obtained your Hawaii special poa for trust, you can easily fill it out or seek assistance from premium experts available on the US Legal Forms platform. This ensures your document is precisely tailored to your needs and legally sound.

Don't hesitate to streamline your legal documentation process today. Visit US Legal Forms and take control of your legal paperwork!

Form popularity

FAQ

Yes, a power of attorney can give your agent access to your bank accounts, allowing them to manage finances on your behalf. This access is especially crucial when setting up a Hawaii special POA for trust, as it ensures that your financial obligations are met while you are unable to manage them. It's essential to choose a trusted individual for this responsibility to safeguard your assets.

The most recommended type of power of attorney for long-term planning is the durable power of attorney. This type allows your agent to manage your financial and legal affairs even if you are no longer able to do so. When considering a Hawaii special POA for trust, a durable POA can provide peace of mind that your interests will be protected at all times.

A legal power of attorney generally cannot make decisions regarding your own healthcare, create or change a will, or make legal declarations on your behalf once you pass away. Understanding these limitations is vital, particularly when setting up a Hawaii special POA for trust. It ensures that you have the right documents in place to cover all important areas of your life.

A statutory POA allows someone to make decisions on your behalf for a specific purpose, while a durable POA remains effective even if you become incapacitated. This distinction is crucial when considering how to manage your affairs, especially in a Hawaii special POA for trust. Typically, a durable POA is more versatile and offers greater security for long-term planning.

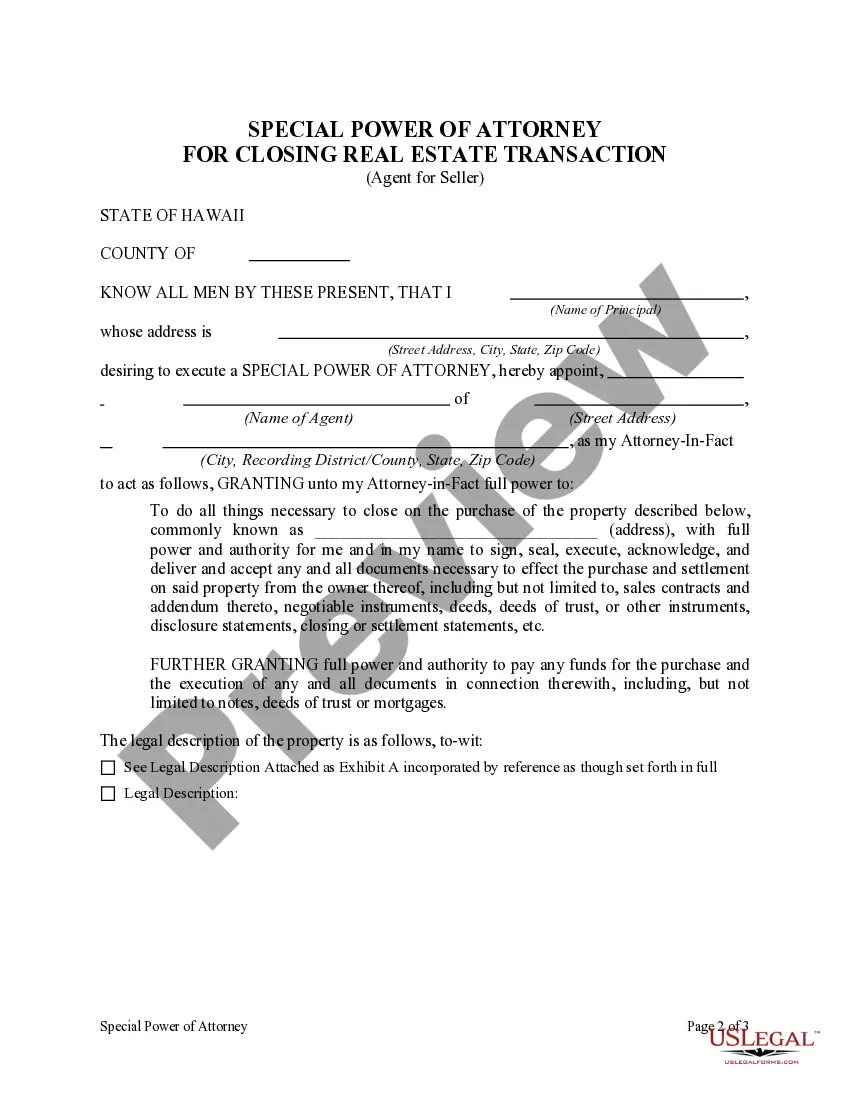

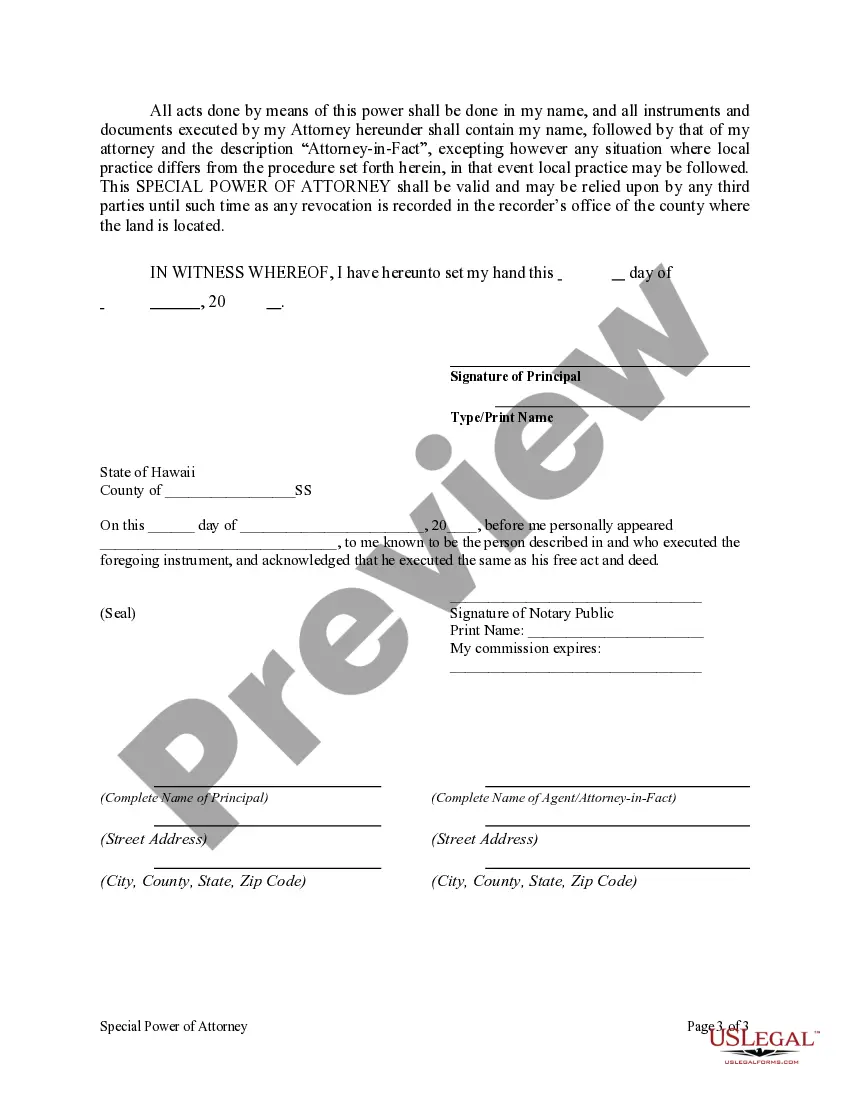

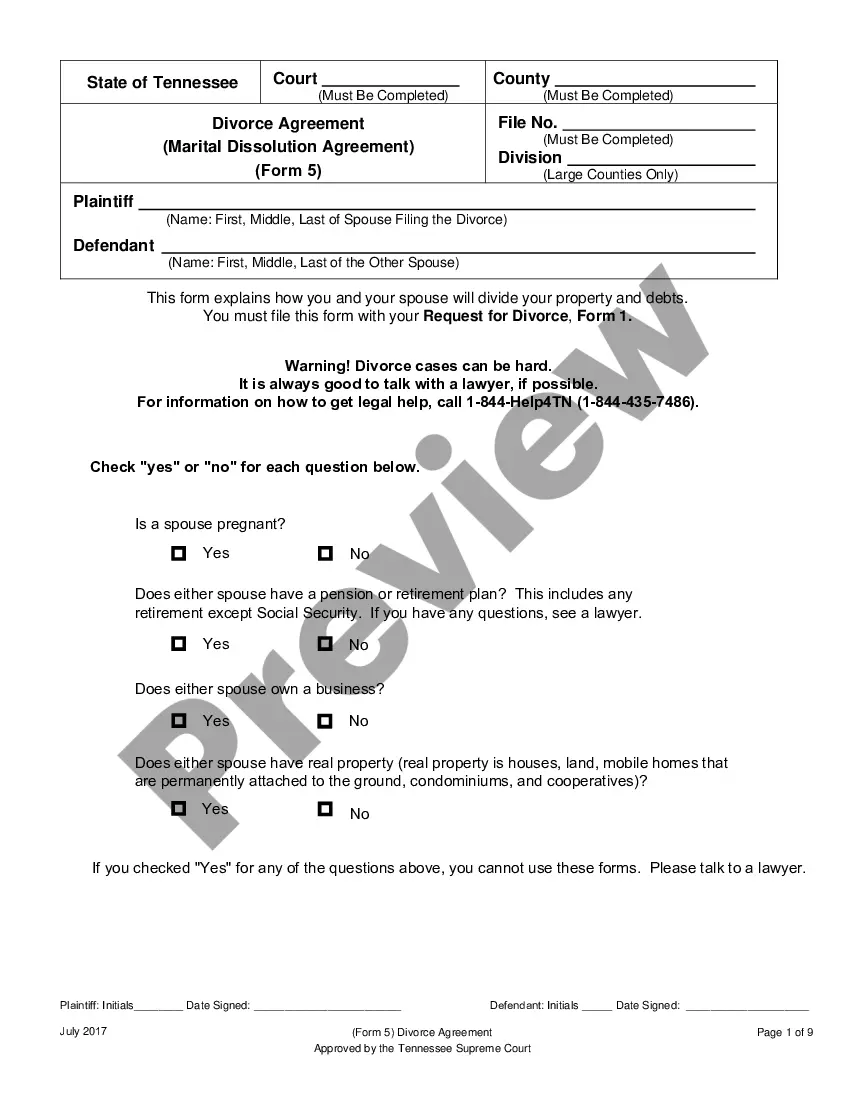

To obtain a power of attorney in Hawaii, you must complete and sign a Hawaii special POA for trust form, which designates someone to act on your behalf. This process involves choosing a trusted individual, clearly outlining their powers, and having the document notarized. You can create your POA easily using online resources like USLegalForms, ensuring you follow state regulations and protect your interests. Once executed, your POA becomes effective immediately or when you specify.

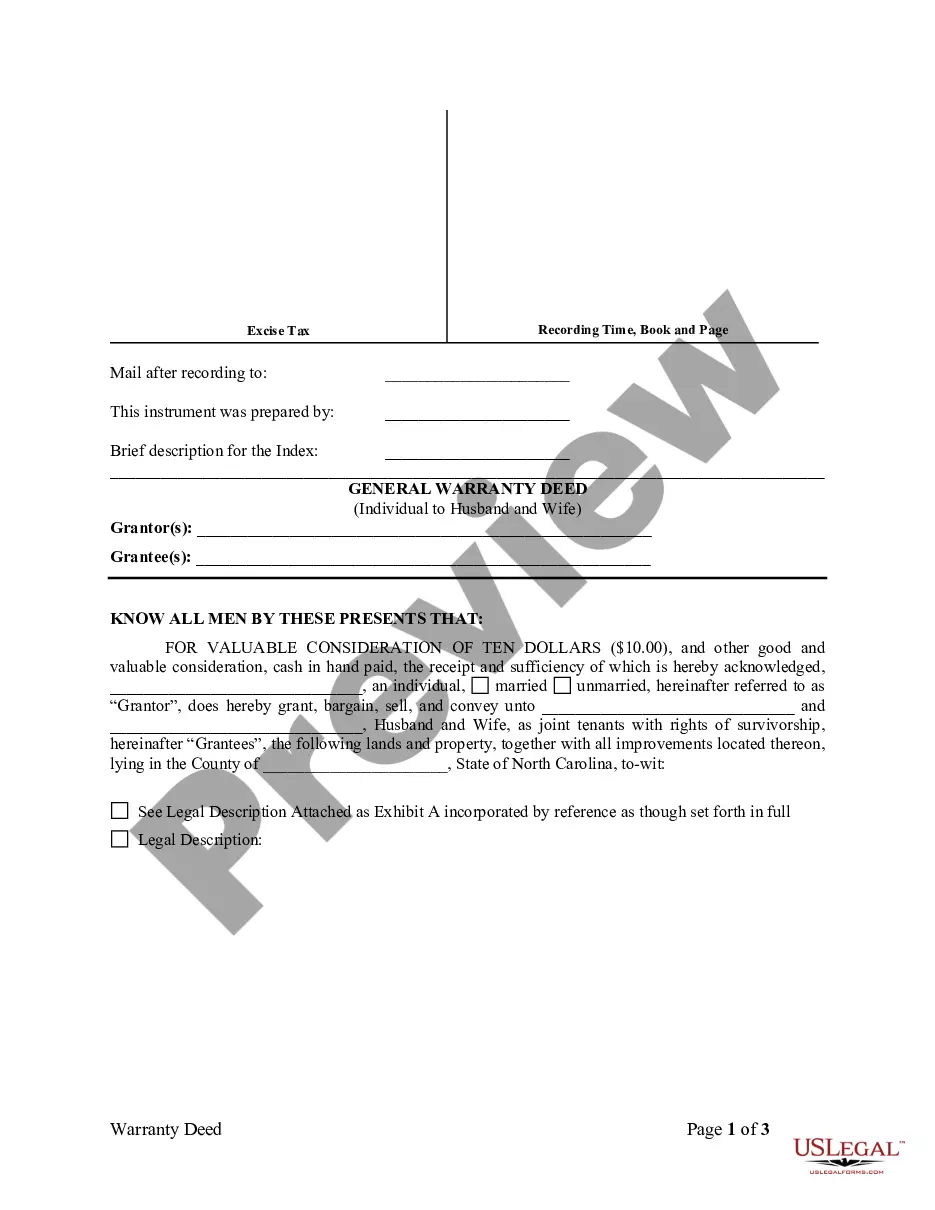

Yes, a power of attorney (POA) can indeed be added to a trust account in Hawaii. By including a Hawaii special POA for trust, you allow your chosen agent to manage the assets within the trust on your behalf. This can be particularly useful if you are unable to handle your financial affairs due to illness or absence. Always ensure that the POA document is properly drafted to meet your specific needs and legal requirements.

Yes, a trust can indeed appoint a power of attorney. This often happens when the trust document includes provisions for a Hawaii special POA for trust, allowing designated individuals to manage specific aspects of the trust effectively. It's a useful solution that ensures continuity in the trust’s administration while providing the trustee with necessary support. Reviewing your trust documents with a legal expert can clarify these arrangements.

The four types of power of attorney include general, durable, special, and healthcare. A Hawaii special POA for trust falls under the category of special POA, which grants specific powers tailored to particular tasks. Each type serves different purposes and levels of authority, making it essential to choose the right one based on individual needs. Consider consulting with an expert to select the best option.

One significant mistake parents often make is failing to fund the trust properly. Establishing a Hawaii special POA for trust without transferring assets into it leaves the trust ineffective. Additionally, neglecting to communicate plans with family can create confusion and conflict later on. Engaging with professionals can ensure a smooth setup and clear transfer of assets.

A power of attorney is not allowed to make decisions that exceed the authority granted in the document. For instance, a Hawaii special POA for trust cannot change the terms of the trust or divert assets without proper authorization. Additionally, a POA cannot engage in self-dealing or act against the best interests of the principal. Therefore, clear directives are crucial.