Hawaii Poa Sales Withholding Tax

Description

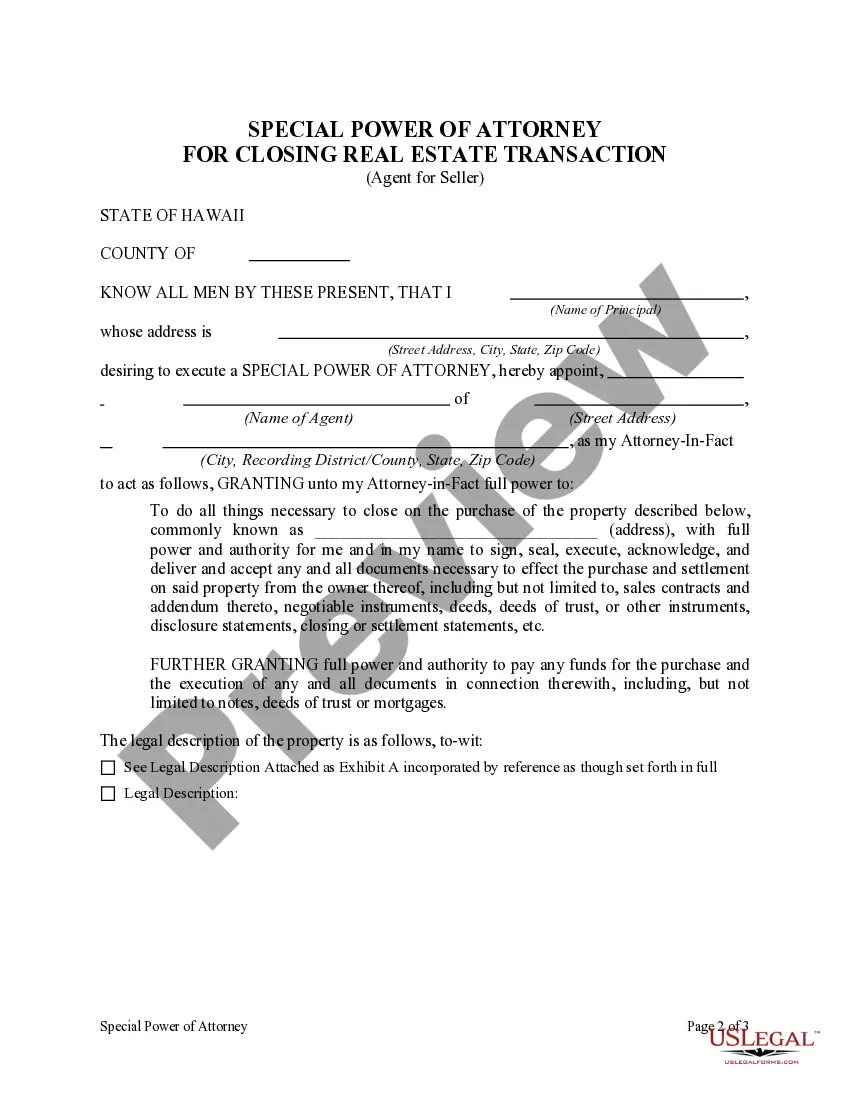

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- Log into your US Legal Forms account if you’re a returning user and ensure your subscription is active.

- If you are a new user, start by reviewing the preview mode and descriptions of the forms to find the one that suits your requirements.

- Use the search bar to look for additional templates if the initial option doesn’t align with your needs.

- After finding the appropriate form, click the 'Buy Now' button and choose your desired subscription plan. Registration will be necessary for full access.

- Proceed with the payment using your credit card or PayPal to finalize your subscription.

- Once purchased, download your form to your device and access it anytime from the 'My Forms' section in your profile.

US Legal Forms is an invaluable resource, boasting an extensive library with over 85,000 fillable legal documents at your fingertips. The platform not only offers a wide array of forms but also grants access to premium experts who can provide assistance, ensuring your documents are accurately completed and legally sound.

In conclusion, utilizing US Legal Forms simplifies the process of managing your Hawaii poa sales withholding tax documents. Don’t hesitate to explore the vast resources available—get started today and gain peace of mind for your legal needs!

Form popularity

FAQ

Exemptions from HARPTA apply to various individuals and situations, such as sellers who meet the primary residence requirements or certain corporations. Specific criteria must be adhered to in order to qualify for these exemptions. Therefore, understanding the Hawaii poa sales withholding tax and its exemptions can be beneficial when planning your sale.

Avoiding HARPTA tax can be achieved by utilizing exemptions related to primary residences or ensuring that the property qualifies under specific conditions. Additionally, seeking guidance from tax professionals can help identify the best practices and strategies tailored to your situation. By being informed about the Hawaii poa sales withholding tax, sellers can significantly reduce their liabilities.

The G45 form relates to the declaration of estimated income tax withholding, while the G49 form provides an annual reconciliation of that withholding. Both forms must be filed by real property sellers to comply with Hawaii's tax regulations. Understanding these forms is critical for effective management of the Hawaii poa sales withholding tax.

To avoid HARPTA, you need to meet specific exemptions outlined by the state. One option is to certify that the property sale qualifies as a primary residence if you lived in the property for at least two of the last five years. Also, consulting with a tax professional can guide you in navigating the Hawaii poa sales withholding tax regulations to find other legal strategies.

Yes, there are several strategies to legally minimize capital gains tax. One common approach is to reinvest profits into qualified opportunity zones or through a 1031 exchange. Another method involves holding onto an asset for over a year, which may qualify for lower tax rates. Understanding the Hawaii poa sales withholding tax can also help in making informed decisions.

You should file Hawaii general excise tax returns monthly, quarterly, or annually, depending on your business type and revenue. The filing frequency determines your deadlines, so it is crucial to stay informed. If you have Hawaii poa sales withholding tax involved, ensure that you file your returns on time to avoid penalties. Setting reminders can help you stay organized and compliant.

The power of attorney form for Hawaii sales tax allows an individual or entity to represent you in tax matters before the state. This is especially useful for handling complicated transactions or disputes. If you deal with Hawaii poa sales withholding tax, this form can help simplify communication with the tax authority. It grants legal authority to another person to act on your behalf smoothly.

Yes, you need to file both G45 and G49 forms if your business is subject to these requirements. The G45 is typically filed for interim periods while the G49 is your annual summary return. Both forms help you accurately report any Hawaii poa sales withholding tax obligations. This ensures you remain compliant with state tax laws.

Yes, you can file your Hawaii state tax online. The Hawaii Department of Taxation provides an e-filing platform that allows you to submit your returns conveniently. This includes options for filing forms related to Hawaii poa sales withholding tax. Utilizing the online system can streamline your filing process, ensuring that you meet all deadlines.

The 1099G form in Hawaii reports certain government payments, including tax refunds. This form is important when calculating your income for the year. If you have received a refund related to Hawaii poa sales withholding tax, it would appear on this form. Be sure to check the details carefully to ensure accurate tax reporting.