Hawaii Poa Sales With No Experience

Description

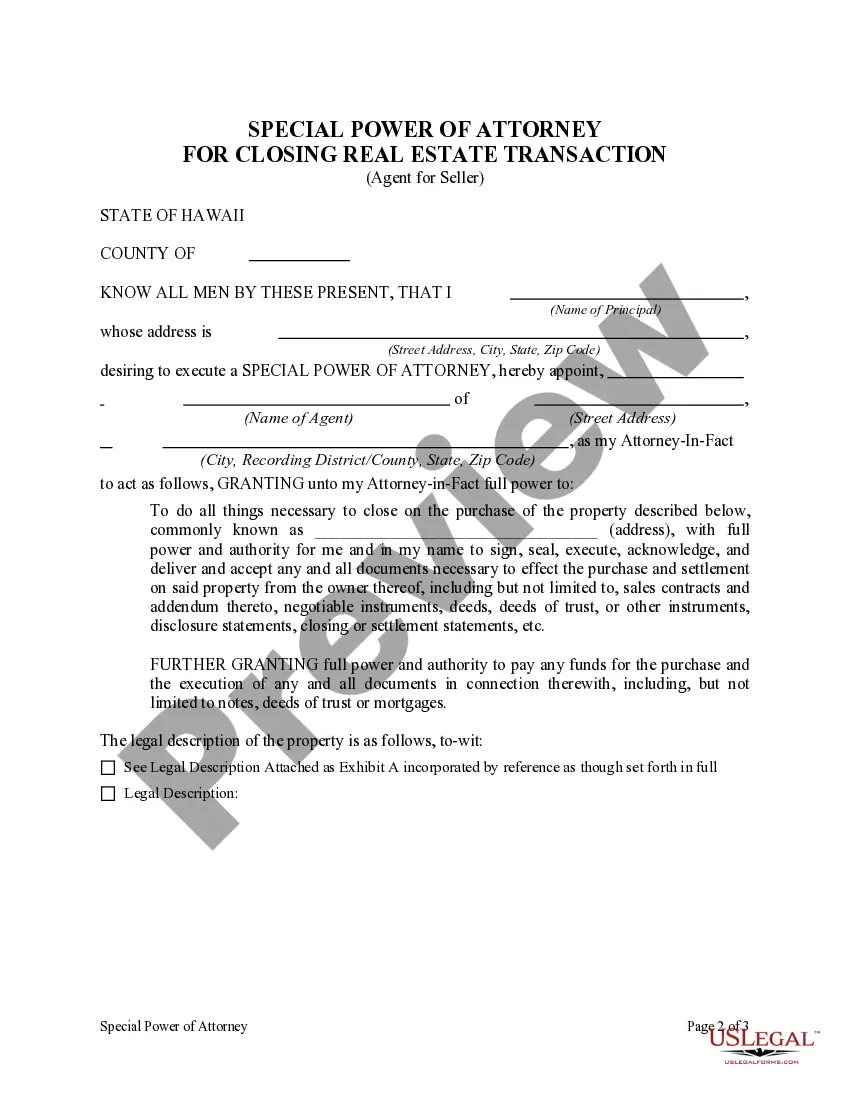

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- Log in to your US Legal Forms account if you're an existing user and select the Download button to get the required form. Confirm that your subscription is active or renew it if necessary.

- For new users, begin by reviewing the form description and Preview mode. Verify the document meets your requirements and complies with local jurisdiction.

- If the template isn't suitable, utilize the Search feature to find a better match that addresses your legal needs.

- Once you find the correct form, click on the Buy Now button, select your subscription plan, and create an account for full access to the form library.

- Complete your purchase by entering your payment information or using PayPal. Your subscription grants permission to download.

- Retrieve your form from the My Forms section of your profile and save it on your device for easy access.

In conclusion, US Legal Forms serves as a robust resource for anyone looking to navigate Hawaii POA sales with no experience. With over 85,000 legally compliant forms at your fingertips, you can easily produce documents with confidence.

Start your journey today and take advantage of US Legal Forms to simplify your legal document needs!

Form popularity

FAQ

You should file the Hawaii general excise tax on a monthly, quarterly, or annual basis, depending on your business's revenue. It's important to keep track of filing dates to avoid penalties. If you are new to Hawaii poa sales with no experience, using tools from UsLegalForms can simplify the filing process.

Generally, if you earn income in Hawaii, you are required to file a tax return. This includes individuals, businesses, and entities meeting specific income thresholds. As someone exploring Hawaii poa sales with no experience, it is essential to understand these requirements to stay compliant and avoid penalties.

Yes, if you operate a business in Hawaii, you typically need to file both G45 and G49 forms. The G45 is for estimated general excise tax, while the G49 summarizes your total yearly income. For those unfamiliar with Hawaii poa sales with no experience, consulting resources like UsLegalForms can clarify these filing requirements.

The 1099G form in Hawaii reports certain types of income, such as unemployment compensation and tax refunds. This form informs you and the IRS about these payments. For individuals involved in Hawaii poa sales with no experience, understanding the 1099G can help ensure compliance with tax obligations.

Filing the Hawaii G-49 form requires specific information about your business income. You can complete this form online or through traditional paper methods. If you are venturing into Hawaii poa sales with no experience, platforms like UsLegalForms can provide valuable insights into completing your G-49 accurately.

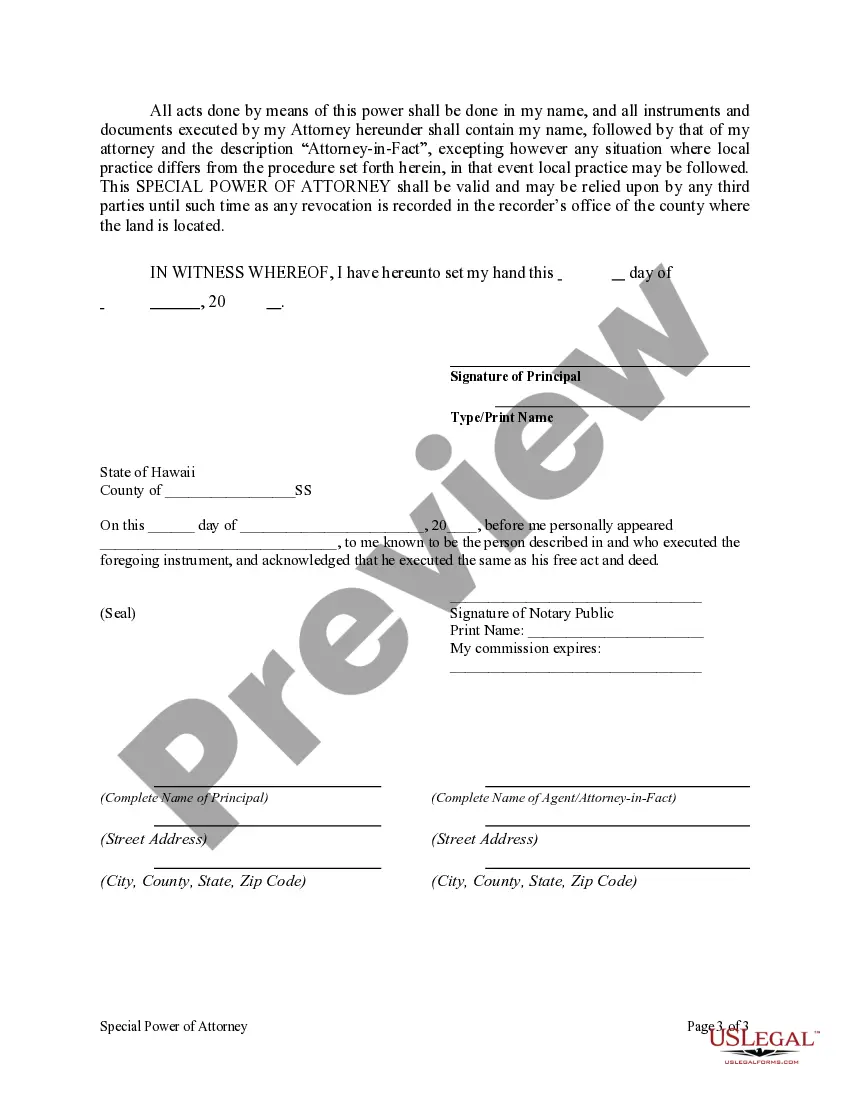

In Hawaii, a power of attorney does not need to be recorded, but it is often recommended. Recording can provide additional protection and ensure it is recognized by third parties. For those involved in Hawaii poa sales with no experience, understanding this process can help avoid potential complications.

Yes, you can file your Hawaii state tax online. Many residents find this method convenient and efficient. Various platforms, including UsLegalForms, offer resources and tools that guide you through the process, especially if you are new to Hawaii poa sales with no experience.

Yes, securing a sales job without prior experience is possible, especially in Hawaii poa sales with no experience. Focus on demonstrating your willingness to learn and grow. Network with industry professionals, and consider internships or entry-level positions that offer training. A proactive attitude can help you stand out and land the job you desire.

Beginners can successfully generate sales in Hawaii poa sales with no experience by starting with a solid understanding of their target market. Emphasize building relationships and trust with potential customers. Utilize social media and networking opportunities to connect with new leads. As you gain experience, adjust your strategy based on customer feedback to enhance your effectiveness.

Yes, you can definitely break into Hawaii poa sales with no experience. Many companies value enthusiasm and passion over a traditional track record. Focus on building your sales knowledge through online resources or courses. Consider platforms like US Legal Forms, which can help you understand the legal aspects of sales while building your confidence in the field.