Hawaii Poa Sales With Bad Credit

Description

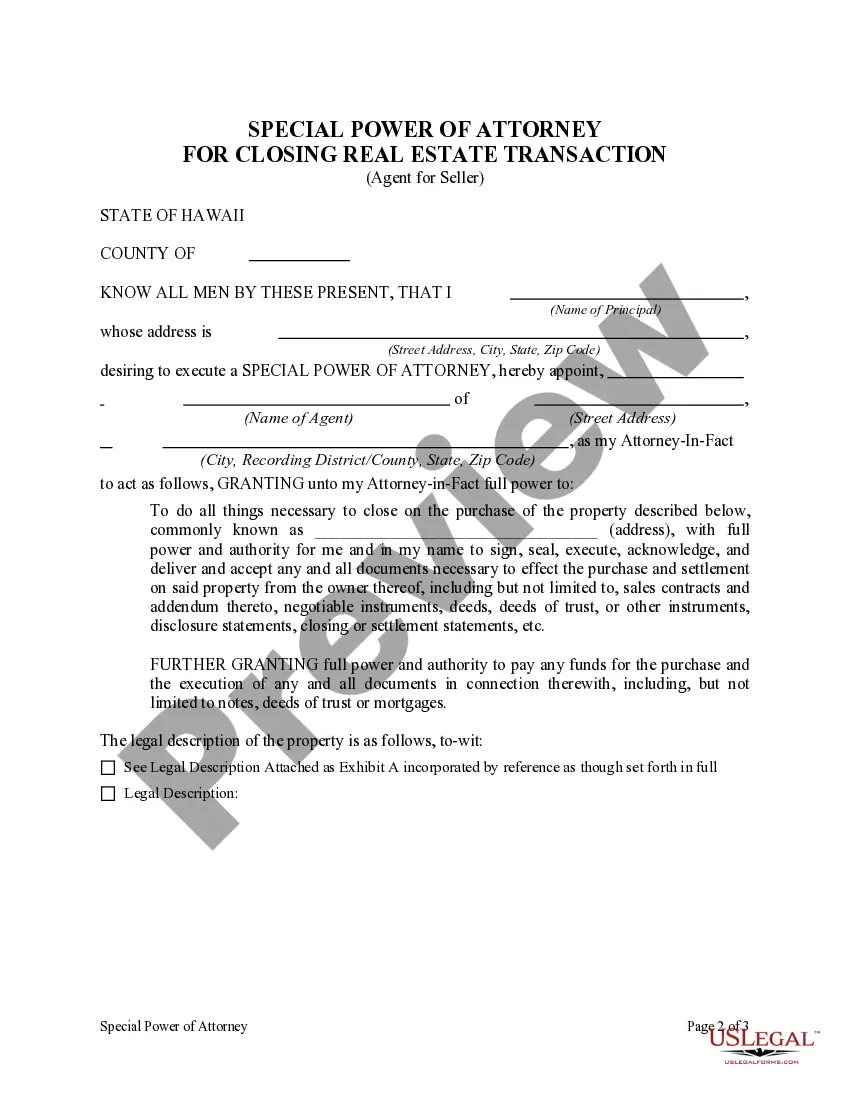

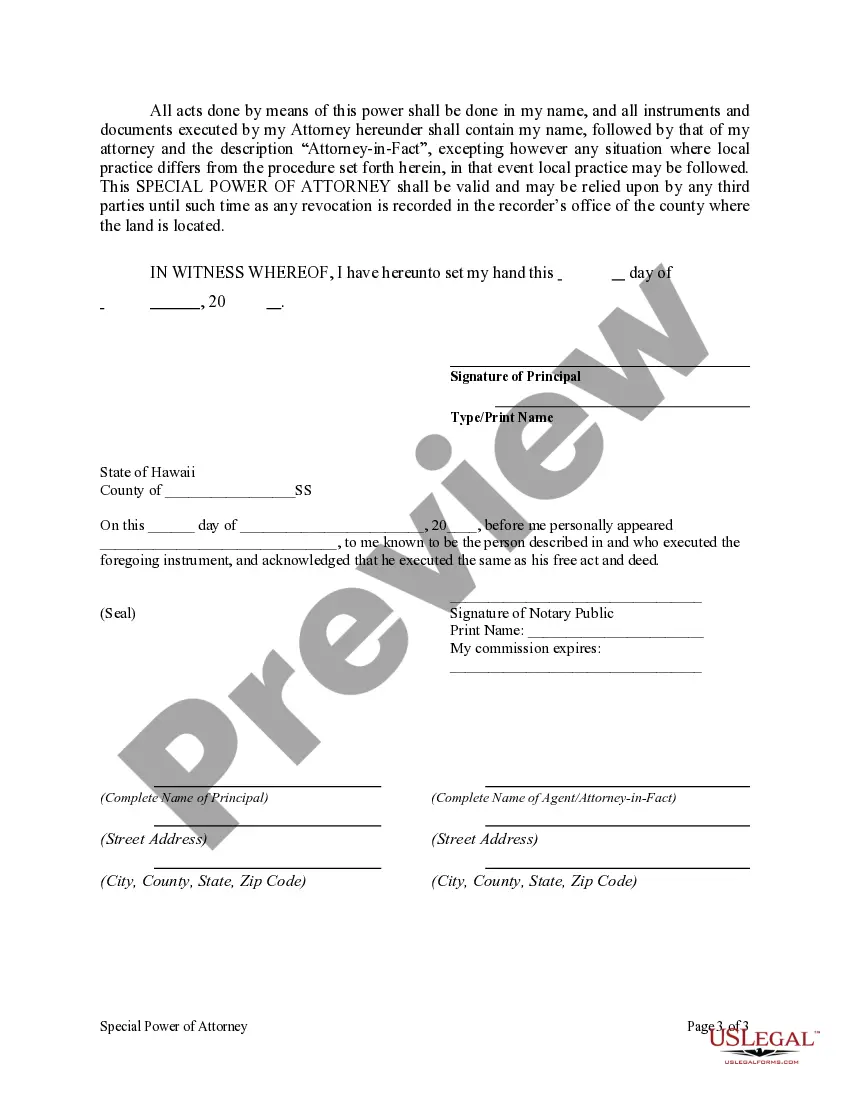

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- Log in to your US Legal Forms account if you are a returning user, ensuring your subscription is active.

- For new users, start by previewing the relevant form for Hawaii poa sales. Verify it fits your needs and complies with local regulations.

- If necessary, utilize the Search function to find other templates that may better match your requirements.

- Proceed to purchase the document by clicking the 'Buy Now' button and select your preferred subscription plan.

- Complete your payment using a credit card or PayPal to finalize your subscription.

- Download the finished form to your device, allowing for easy access in the 'My Forms' section of your profile.

Using US Legal Forms not only saves you time but also ensures you have access to a wider variety of legal templates than most competitors. With over 85,000 forms available, you can find precisely what you need.

Don't let bad credit hold you back from your real estate goals. Start using US Legal Forms today to simplify your legal processes and get the assistance you need.

Form popularity

FAQ

Yes, acquiring a condo with bad credit is possible. Various lending programs cater to buyers who may not have strong credit scores. By focusing on alternative financing options, such as those related to Hawaii poa sales with bad credit, you can improve your chances of home ownership. Consider resources like uslegalforms to find the right documentation and support to navigate this process.

You can live in Hawaii for up to one year without becoming a resident for tax purposes. Factors such as your intent to reside, employment status, and more can affect residency. Understanding this duration helps those involved in Hawaii poa sales with bad credit to make informed decisions regarding their residency status.

Nonresidents who earn income in Hawaii must file a Hawaii nonresident return. This applies if your income comes from Hawaii sources, even if you live elsewhere. If you are facing the complexities arising from Hawaii poa sales with bad credit, filing correctly can help you avoid unnecessary penalties.

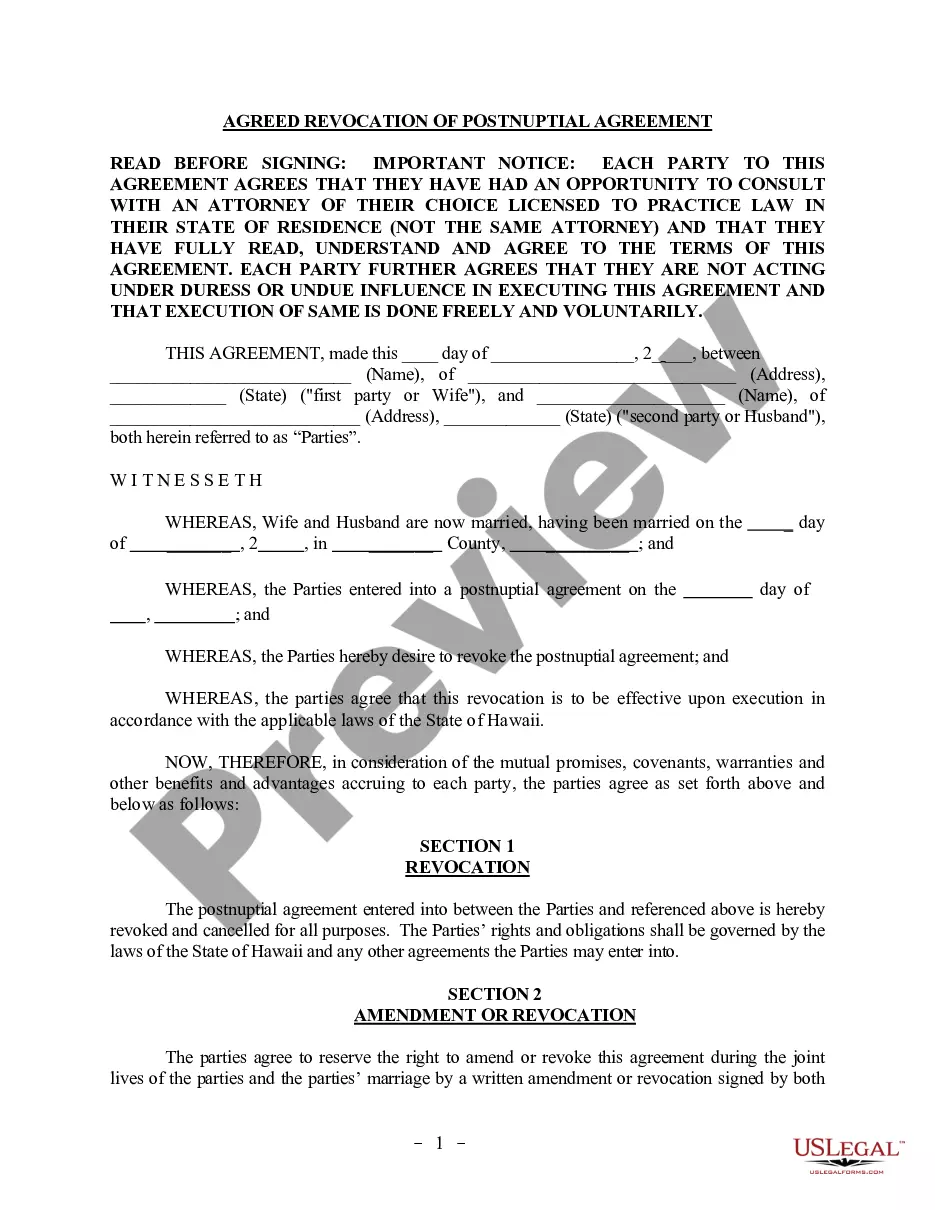

A power of attorney for Hawaii sales tax allows someone to represent you in tax matters. This agent can sign tax forms and make decisions on your behalf. If you are navigating Hawaii poa sales with bad credit, a power of attorney can provide peace of mind and help you manage your sales tax responsibilities.

An N11 form in Hawaii refers to the same standard income tax return used by residents. This form helps the state assess your tax obligations based on your financial situation. Understanding this aspect is crucial, especially if you are exploring Hawaii poa sales with bad credit, to stay compliant.

Hawaii tax form N-11 is the standard income tax return for residents. It collects information about your income, deductions, and tax liabilities. For those concerned about Hawaii poa sales with bad credit, being familiar with this form is essential to manage your finances and taxes effectively.

Filing the Hawaii G-49 form requires you to report your income and calculate your general excise tax. You can obtain the form from the Hawaii Department of Taxation website. If you face challenges because of Hawaii poa sales with bad credit, consider using our platform to simplify the process and ensure compliance.

To request penalty abatement in Hawaii, you need to submit a written request to the Hawaii Department of Taxation. Be sure to explain the reasons for your request and include any supporting documentation. If you are dealing with Hawaii poa sales with bad credit, having a power of attorney can help manage your tax obligations effectively.

The Toyota Fresh Start program is designed to assist individuals with challenging credit situations, like those looking into Hawaii POA sales with bad credit. This program offers flexible financing options and incentives to make car ownership more accessible. It aims to provide a second chance for people eager to get on the road despite their credit challenges. Discussing eligibility and benefits with your local Toyota dealer can clarify the advantages of this program.

To get a car with no down payment and bad credit, start by exploring local dealership options specializing in Hawaii POA sales. Being honest about your credit situation and showing proof of steady income can significantly improve your chances. Additionally, looking for special financing programs or grants can also be beneficial. You can utilize USLegalForms to find documentation and assistance for your financing process.