Hawaii Poa Sales For The Month

Description

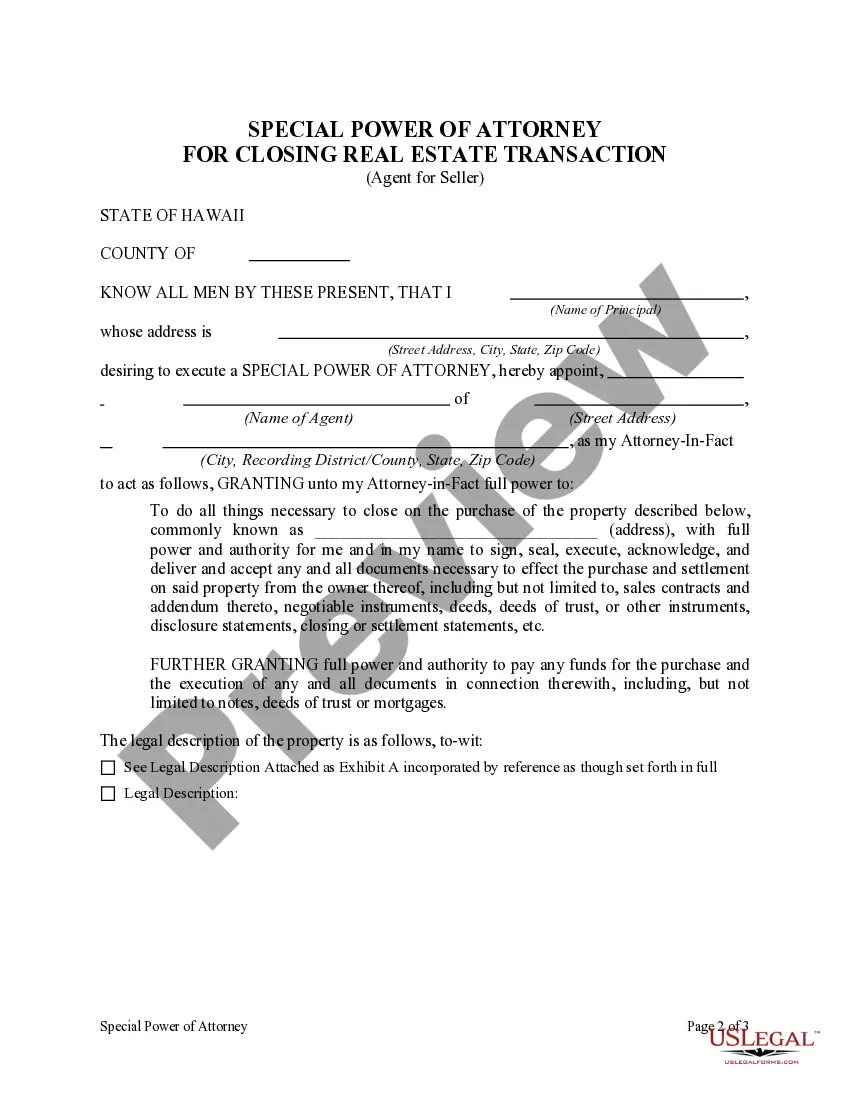

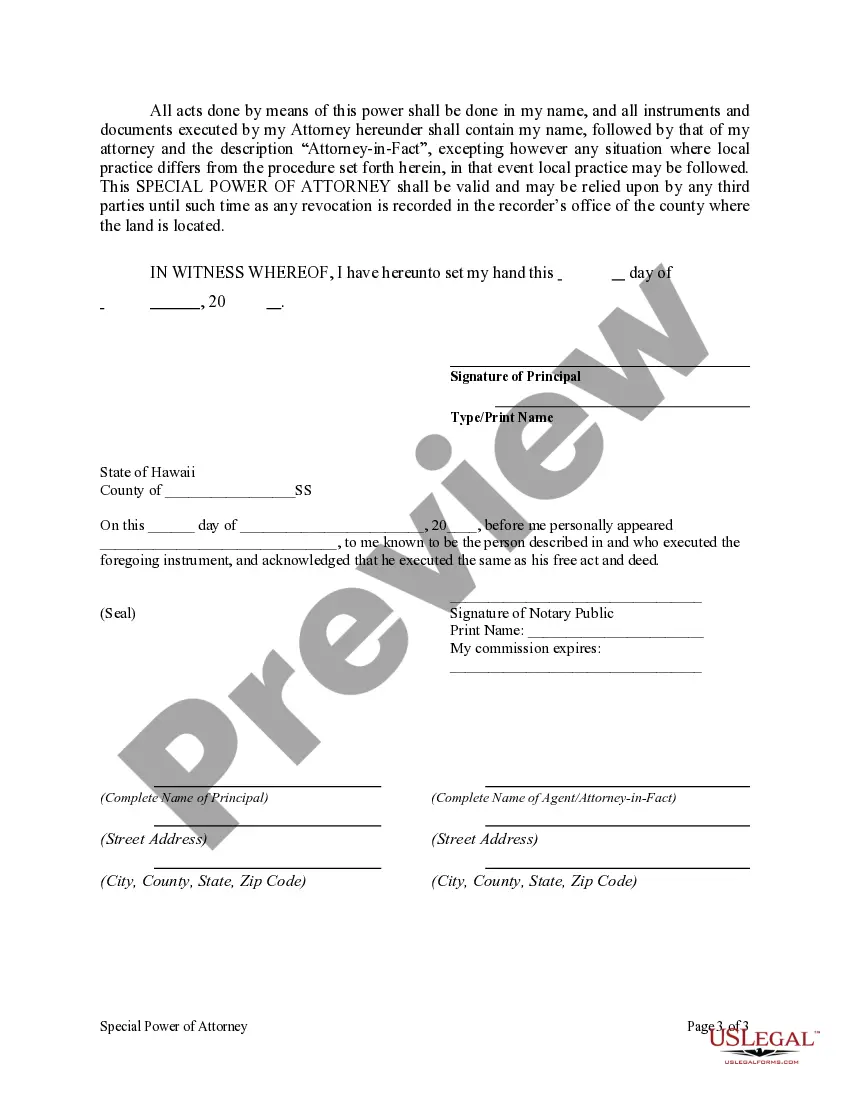

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- If you're a returning user, log in to your account and download your desired form template directly by clicking the Download button. Ensure that your subscription is still active; renew if necessary.

- For first-time users, start by browsing the available forms. Use the Preview mode to review the description and ensure it fits your jurisdiction's requirements.

- If you don’t find an appropriate form, use the Search tab to locate another template that meets your needs.

- Once you've chosen the right form, purchase your document by clicking the Buy Now button. Select your preferred subscription plan and create an account to access the library.

- Finalize your purchase by entering your payment details, either through credit card or PayPal.

- Finally, download the form to your device. Access the completed document anytime from the My Forms section of your profile.

US Legal Forms enables both individuals and attorneys to easily draft legal documents from an extensive library at a competitive price. With over 85,000 fillable forms and the option to consult premium experts, you can ensure your documents are accurate and legally sound.

Start your journey with US Legal Forms today and experience the convenience of quick and reliable legal documentation. Don't hesitate—sign up now!

Form popularity

FAQ

Yes, if you are required to, you must file both G45 and G49 forms. The G45 is for reporting estimated taxes, while the G49 reconciles actual earnings. If your business involves Hawaii poa sales for the month, ensuring that you file both forms accurately is vital to avoid discrepancies and to manage your financial health.

To file the Hawaii G-49 form, you'll need to gather your general excise tax information and complete the form accurately, detailing your taxable sales. Submitting the G-49 is mandatory for certain taxpayers and ensures compliance with state tax regulations. If you are involved in Hawaii poa sales for the month, managing your G-49 filing effectively is essential to maintain good standing with tax authorities.

Yes, you can file Hawaii state tax online through the Hawaii Department of Taxation's e-filing services. This method is convenient and allows you to submit your taxes securely from anywhere. For those focusing on Hawaii poa sales for the month, online filing can streamline your tax obligations and enhance efficiency.

You should file Hawaii general excise tax returns based on your business's reporting frequency, which can be monthly, quarterly, or annually. It’s crucial to keep track of your sales activities to ensure timely filings. This is particularly important if you engage in Hawaii poa sales for the month, as proper reporting helps you stay compliant and avoid penalties.

The 1099G Hawaii form is used to report certain government payments, such as tax refunds or unemployment benefits. If you received a refund in a previous year, you might receive this form. Understanding 1099G is essential for managing your taxes effectively, especially if you're looking to maximize your Hawaii poa sales for the month.

In Hawaii, property taxes can go unpaid for up to three years before the county can start foreclosure proceedings. This timeline emphasizes the importance of timely payments to avoid losing your property. If you are involved in Hawaii poa sales for the month, understanding property tax obligations can be essential for maintaining your financial standing.

Hawaii does not have a uniform sales tax rate of 4.712%. The basic state rate is 4%, while counties can impose additional taxes, bringing rates to a range of 4% to over 4.5%. When you are looking into Hawaii poa sales for the month, make sure to confirm the specific rate for your location to avoid any confusion.

The power of attorney form for Hawaii sales tax allows a designated person to act on your behalf regarding tax matters, including sales tax filings and payments. This form can simplify processes for busy individuals and business owners who want to ensure their sales tax obligations are met correctly. If you are involved in Hawaii poa sales for the month, having this form can help you manage transactions more smoothly.

In Hawaii, the sales tax rate is generally 4% on purchases, though some counties may apply an additional 0.5% to 1% surcharge, making it potentially higher in certain areas. It's important to understand that this sales tax applies to most retail purchases, so knowing the correct amount can save you from surprise charges. When considering Hawaii poa sales for the month, ensure you calculate the tax to avoid any unexpected expenses.

The difference between G45 and G49 in Hawaii lies in their respective tax forms. G45 is used for general excise tax and includes filing for all forms of business income. In contrast, G49 is a more specialized form, often related to annual returns and for businesses claiming certain exemptions. Understanding these differences can be critical during Hawaii poa sales for the month as it affects tax preparation.