Hawaii Limited Real With You

Description

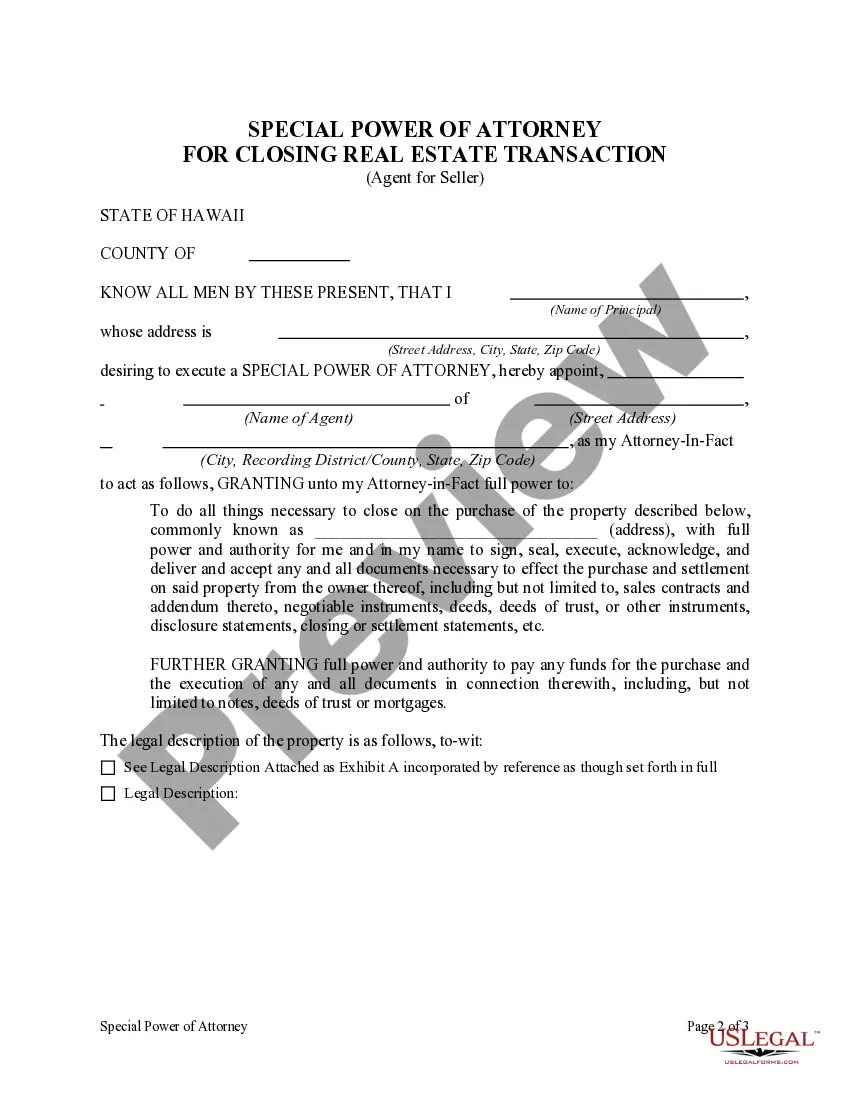

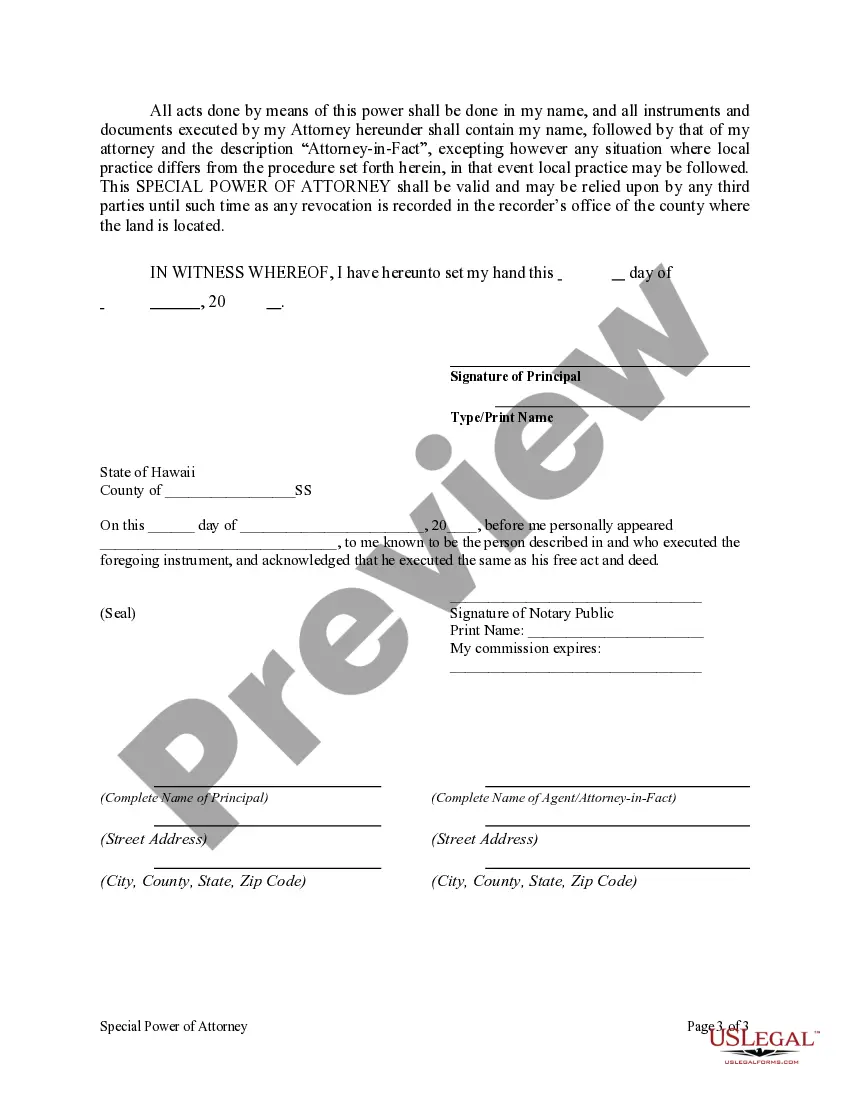

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- If you're a returning user, log in to your account, ensuring your subscription is active. Then, simply download the required form template by clicking the Download button.

- For first-time users, start by previewing the form descriptions and checking their compatibility with your local laws. Ensure you find the right template that meets your specific requirements.

- If the desired form isn’t suitable, utilize the Search feature at the top to find a more appropriate document.

- After confirming the right fit, click the Buy Now button and choose your preferred subscription plan to gain access to the extensive library.

- Complete your purchase by entering your credit card or PayPal details for subscription payment.

- Once the payment is processed, download the form and save it on your device. You can also access it anytime through the My Forms section in your profile.

In conclusion, US Legal Forms provides a robust selection of over 85,000 legal forms crafted to meet your needs, whether for personal or professional use in Hawaii. Their commitment to accuracy and user support enhances your experience, making legal processes smoother.

Don't miss out on the ease of managing your legal documents—explore US Legal Forms today!

Form popularity

FAQ

When you complete your Hawaii tax return, you will need to send it to the address specified for your type of filing. Generally, this differs for state residents and non-residents, as well as based on the nature of your income, including earnings from Hawaii limited real estate. Always verify the correct mailing address on the Department of Taxation's website or through official guidelines to ensure proper delivery.

To file Form G-49, Hawaii's annual return of income tax for partnerships, you will need specific documentation and details about your income. If your partnership handles income from Hawaii limited real estate, ensure accurate records of earnings and expenses are prepared. Consider using USLegalForms to easily navigate the filing process and ensure compliance with state requirements.

A Hawaii tax ID number is essential for businesses operating within the state. If you are managing a business involving Hawaii limited real estate, this identifier allows you to report taxes accurately and handle financial transactions smoothly. It is advisable to obtain a tax ID number before engaging in any business activities in Hawaii to comply with state regulations.

Anyone who has taxable income above the minimum thresholds set by the Hawaii Department of Taxation must file a tax return. This includes individuals, partnerships, and businesses earning income through various means, including rental income from Hawaii limited real estate. Ensure you assess your situation yearly to avoid overlooking your filing responsibilities.

Residents of Hawaii who earn income are generally required to file a state tax return. This applies to individuals holding jobs, freelancer roles, or owning businesses, such as those dealing with Hawaii limited real estate. If you earn income in the state, it is critical to understand your filing obligations to avoid any potential penalties.

The income threshold for filing taxes varies based on your filing status, age, and whether someone can claim you as a dependent. For most taxpayers, if your income exceeds a specific level, you must file. For those engaged in activities like managing Hawaii limited real estate, tracking your income accurately is essential to determine your filing requirement.

In the United States, individuals are generally required to file a tax return if their income exceeds a certain threshold. This includes residents and non-residents who earn income in the U.S., including those who own a Hawaii limited real estate property. If you fit into these categories, it is important to assess your income and obligations to ensure compliance with tax laws.

A restricted license in Hawaii allows individuals to drive under specific conditions, such as for work or medical reasons. This type of license is typically issued to those who have had their full driving privileges suspended. For assistance in navigating the requirements and obtaining a restricted license, uslegalforms offers helpful resources and forms tailored to your needs.

Unfortunately, a limited purpose driver's license is not valid for air travel within the United States. Airlines require a REAL ID or other accepted forms of identification, such as a passport. If you're planning to fly, it’s essential to upgrade to a Hawaii limited real ID to ensure you can board your flight without any issues.

A limited purpose driver's license in Hawaii allows individuals to legally drive while having restricted privileges. This license typically caters to residents who may not qualify for a full license due to certain legal situations. If you need assistance in obtaining your limited purpose license, consider using the resources available at uslegalforms, which can guide you through the process.