Letter Of Administration In Hawaii

Description

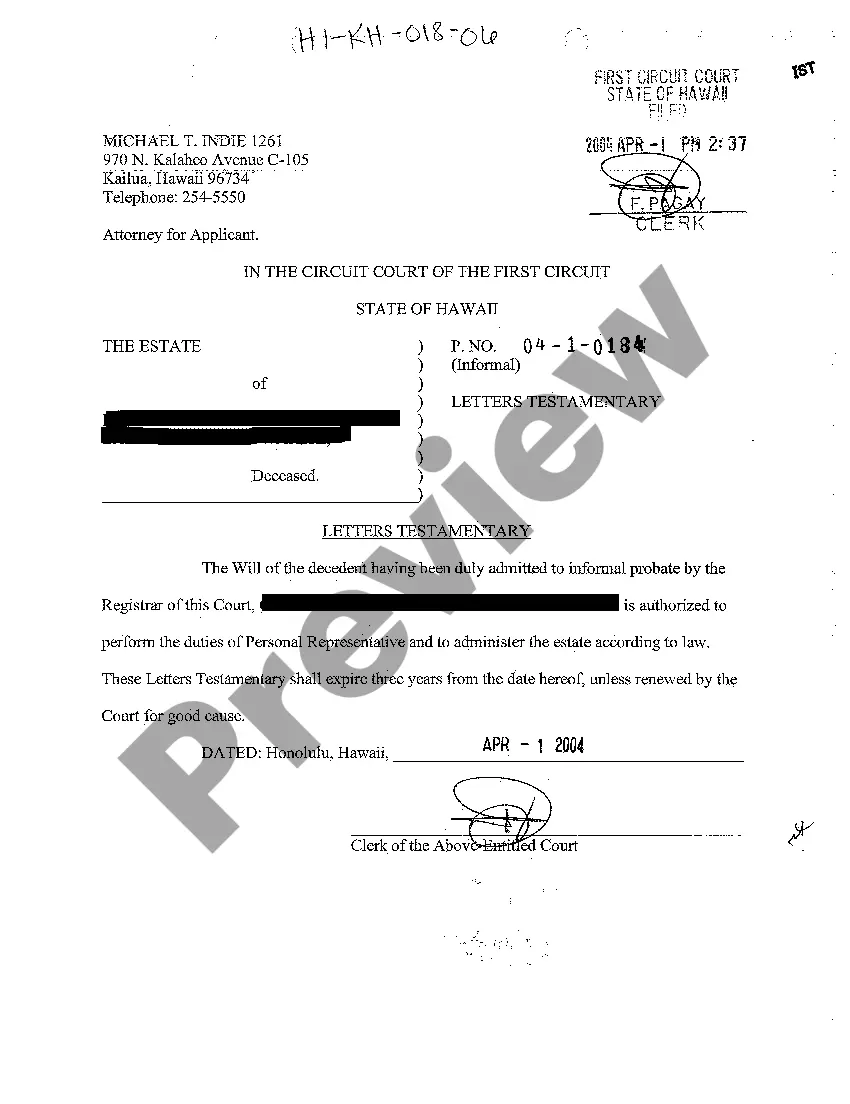

How to fill out Hawaii Letters Testamentary?

Whether for commercial reasons or personal matters, everyone must deal with legal issues at some point in their lives.

Completing legal documents necessitates meticulous care, starting with choosing the right form template.

With an extensive US Legal Forms catalog available, you don't have to waste time searching for the correct sample online. Utilize the library’s user-friendly navigation to find the appropriate form for any situation.

- Locate the required sample using the search box or catalog browsing.

- Examine the form’s description to confirm it aligns with your circumstances, state, and area.

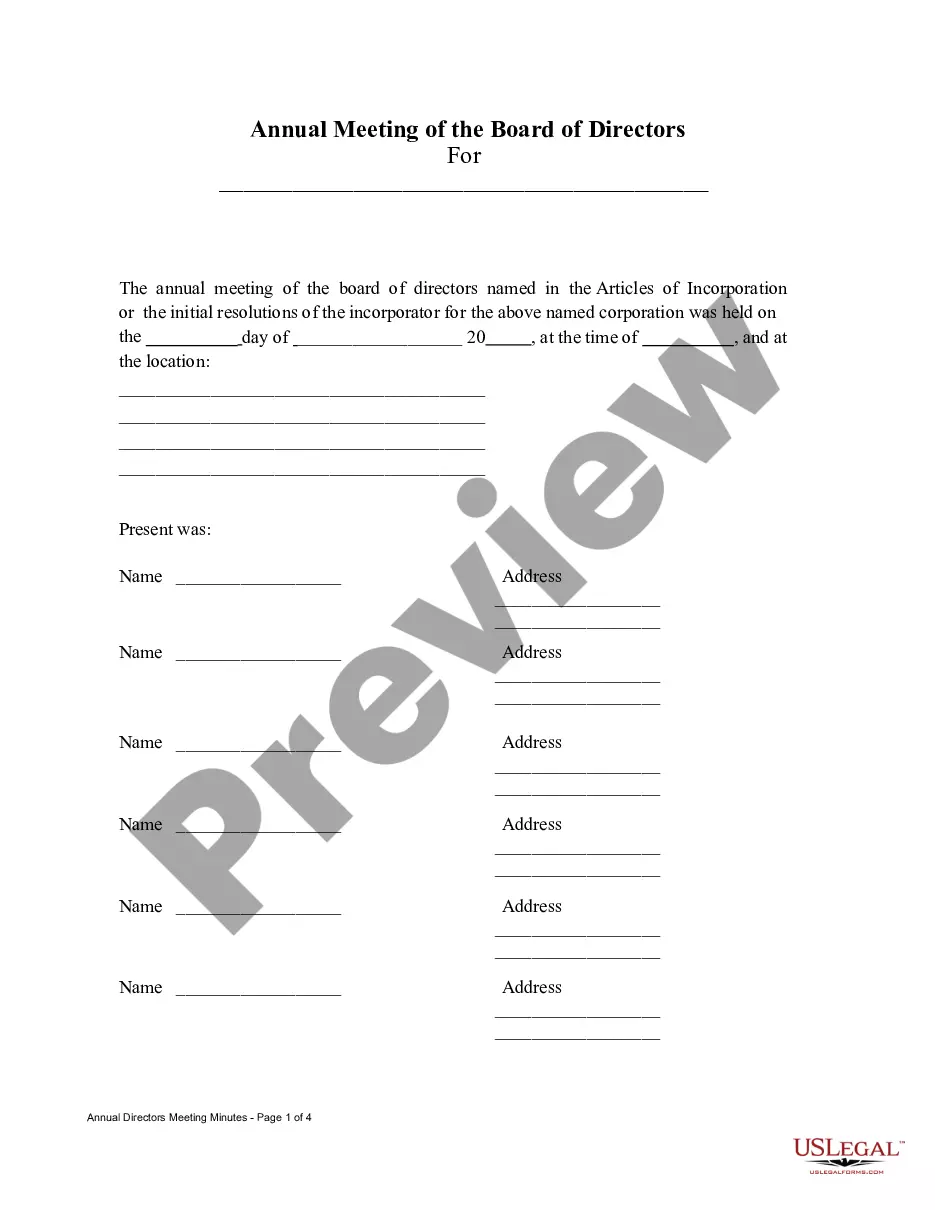

- Select the form’s preview to examine it.

- If it is not the correct document, return to the search function to find the Letter Of Administration In Hawaii sample you need.

- Download the template when it satisfies your needs.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing choice.

- Complete the account registration form.

- Choose your payment method: opt for a credit card or PayPal account.

- Select the desired file format and download the Letter Of Administration In Hawaii.

- Once it is saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

To obtain a letter of administration without a will in Hawaii, you must file a petition with the probate court demonstrating your eligibility as an administrator. This generally means you must show you are an heir or a person with a vested interest. Guidance from uslegalforms can simplify this process, ensuring you follow the necessary steps to get the letter you need.

Once a letter of administration is granted in Hawaii, the appointed administrator must start managing the estate promptly. This involves identifying and collecting the decedent's assets, notifying creditors, and settling any debts. Finally, the administrator will distribute the remaining assets to the beneficiaries as per Hawaii's intestacy laws or the will if one exists.

The purpose of a letter of administration in Hawaii is to grant authority to an administrator to manage a decedent's estate. This includes collecting assets, paying debts, and distributing the remaining assets to rightful heirs. Having this letter allows the administrator to perform these duties legally and efficiently, ensuring that the estate is settled according to state law.

Yes, you can write your own will in Hawaii, but there are specific guidelines you must follow for it to be legally valid. It needs to be signed and dated in front of two witnesses who are not beneficiaries. To ensure your intentions are clear and to avoid complications, using a professional service like uslegalforms can help you create a legally sound will.

When beginning a letter for administration in Hawaii, address the court with the appropriate title, such as 'Dear Honorable Judge.' Clearly identify the case by including the decedent's name and the case number, if available. Your introduction should state your relationship to the decedent and your request for the letter of administration, providing context for your petition.

To obtain a letter of administration in Hawaii, you generally need to provide a completed petition, the decedent's death certificate, and a list of their assets and liabilities. You may also need to show that you are a suitable administrator, which can include presenting an affidavit of heirship. Consulting uslegalforms can help you ensure you have all the necessary documents prepared correctly.

To avoid probate in Hawaii, you can consider several estate planning tools. Establishing a living trust allows your assets to pass directly to your beneficiaries without going through probate. Additionally, utilizing payable-on-death accounts and joint ownership can also help you sidestep probate. For more specific strategies, explore resources available on uslegalforms.

A letter of testamentary generally remains valid until the estate is fully settled or the court revokes it. In Hawaii, this typically means that the executor can exercise their authority for as long as it takes to complete the probate process. However, you should consider reviewing your situation with uslegalforms for tailored guidance and assistance.

No, letters of administration are not the same as letters of testamentary. While both documents allow a representative to administer an estate, letters of administration in Hawaii apply when there is no valid will, whereas letters testamentary are for estates with a will. Understanding this difference is crucial for navigating the probate process properly.

Another name for a letter of testamentary is a testamentary letter. This document grants the executor the legal authority to handle the deceased's estate according to the provisions of the will. It is important for the executor to obtain this letter in order to initiate the probate process efficiently.