Child Support Hawaii Withholding Limits

Description

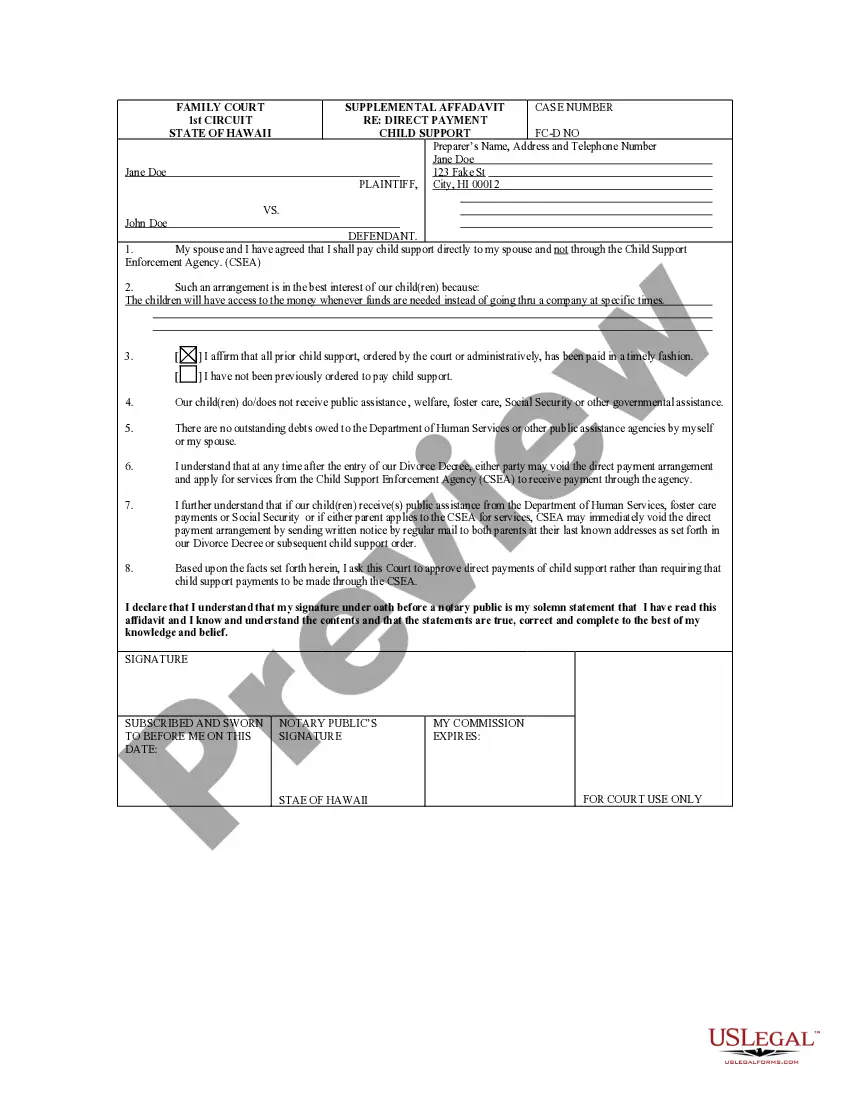

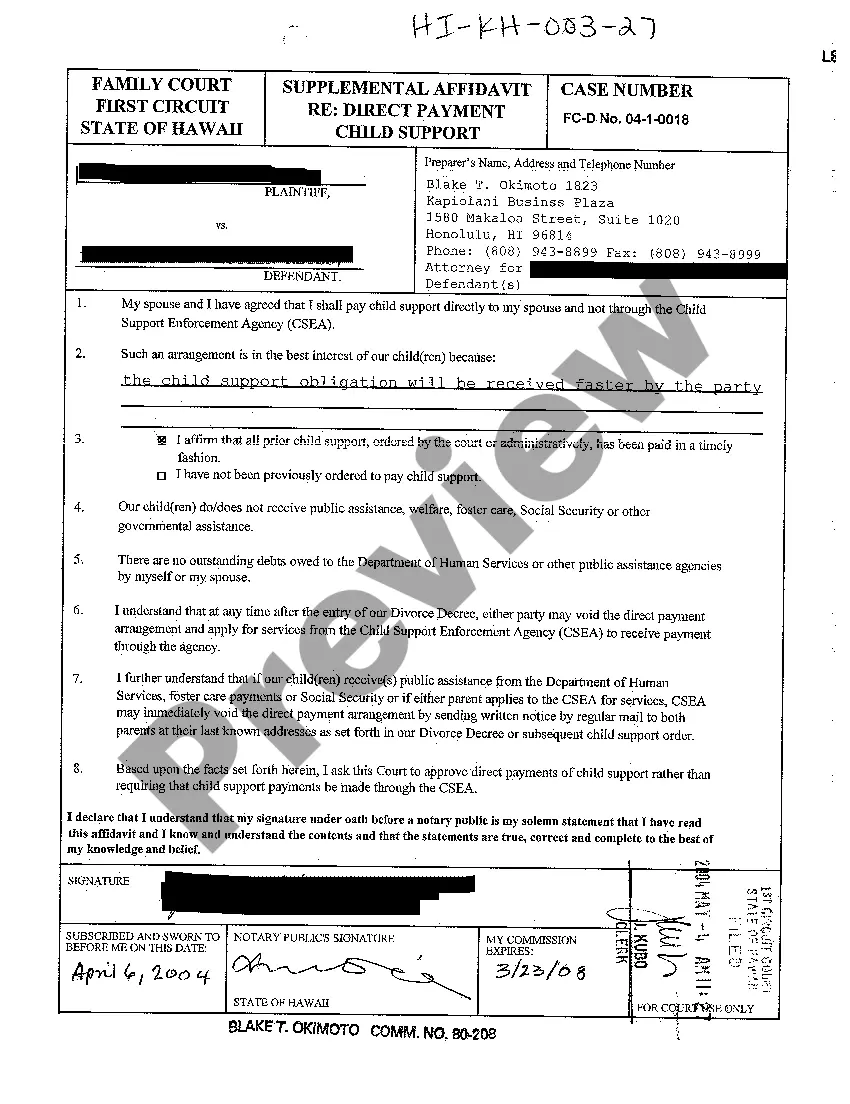

How to fill out Hawaii Supplemental Affidavit Regarding Direct Payment Child Support?

Individuals frequently link legal documentation with complexity that only an expert can manage.

In some respects, this is accurate, as crafting Child Support Hawaii Withholding Limits necessitates considerable expertise regarding subject criteria, encompassing state and county laws.

However, with US Legal Forms, matters have become simpler: pre-prepared legal templates for various life and business situations pertinent to state regulations are compiled in a single online directory and are now accessible to all.

Select a pricing plan that aligns with your needs and financial plan. Create an account or Log In to continue to the payment page. Pay for your subscription with PayPal or your credit card. Choose the format for your document and click Download. Print your file or import it to an online editor for faster completion. All templates in our catalog are reusable: once purchased, they remain stored in your profile. You can access them anytime via the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and area of application, making it easy to find Child Support Hawaii Withholding Limits or any other specific template in just minutes.

- Current registered users with an active membership must Log In to their account and click Download to retrieve the form.

- New users will need to create an account and subscribe before they can store any paperwork documentation.

- Here is a detailed guide on how to obtain the Child Support Hawaii Withholding Limits.

- Examine the page content thoroughly to make sure it satisfies your requirements.

- Review the form description or view it using the Preview feature.

- If the previous document doesn't meet your needs, find another sample using the Search field above.

- Click Buy Now when you discover the appropriate Child Support Hawaii Withholding Limits.

Form popularity

FAQ

In Hawaii, the maximum rate of child support is structured to align with the needs of the child while considering the parent's financial situation. Typically, this rate is calculated from the non-custodial parent's income, with limits to ensure it remains manageable. For those navigating these complex calculations, understanding child support Hawaii withholding limits can provide clarity and guidance in fulfilling your support obligations.

The maximum child support amount in Hawaii varies based on various factors, including the number of children and both parents’ incomes. The formula used by the state is designed to ensure fair and reasonable support. It's vital to stay informed about child support Hawaii withholding limits, as they directly impact the calculation and enforcement of these obligations.

Hawaii applies specific guidelines that determine the maximum withholding for child support from your income. The typical maximum amount is based on your total income, operating on a percentage basis, which cannot exceed set statutory limits. Being careful about understanding child support Hawaii withholding limits helps prevent financial strain while ensuring your obligations are met.

In Hawaii, waiving child support is generally not an option. The state prioritizes the welfare of the child, requiring that support obligations be fulfilled. If circumstances change, you may need to petition the court for a modification rather than simply waiving the obligation. Understanding child support Hawaii withholding limits is crucial for ensuring compliance.

Hawaii state law mandates that both parents contribute to a child's support based on their income and circumstances. The state uses a formula to determine the amount owed, ensuring fairness and consistency. Knowing the Hawaii child support guidelines can help you understand your obligations and rights. Utilizing US Legal Forms can provide resources to navigate child support agreements while keeping Hawaii withholding limits in mind.

Yes, child support can be retroactive in Hawaii. The court may order child support payments to start from the time of the filing if it determines that the obligor was aware of their responsibilities. This can greatly impact your finances if you face back support obligations. Keeping track of child support and understanding Hawaii withholding limits can help you manage any retroactive payments more effectively.

The statute of limitations in Hawaii varies depending on the type of claim. For contracts, it is six years. For personal injury claims, it is also two years. Being aware of these timeframes allows you to take action within legal limits, especially regarding financial matters such as child support, where understanding Hawaii withholding limits is essential.

In Hawaii, the statute of limitations for debt collection is generally six years. This means that creditors have six years from the date of the last payment or the missed payment to initiate legal action for collection. By understanding these timelines, you can manage your obligations more effectively. If child support obligations are involved, knowing these limits can provide clarity on your responsibilities and potential consequences.

In Hawaii, the statute of limitations on child support is generally 10 years from the date the payment was due. This means you can enforce a child support order for up to a decade after a payment is missed. Understanding child support Hawaii withholding limits helps you navigate your obligations and rights effectively. If you need assistance with enforcement or understanding your responsibilities, US Legal Forms offers helpful resources and documents tailored to your situation.

In Hawaii, the maximum amount that can be withheld for child support depends on the parent's disposable income and the guidelines set by state law. Typically, your withholding limits are capped at a percentage of your income, which may vary according to the number of children involved. Utilizing resources like USLegalForms can help clarify these limits and ensure compliance with child support Hawaii withholding limits.