Hawaii Assignment Trust For The Disabled

Description

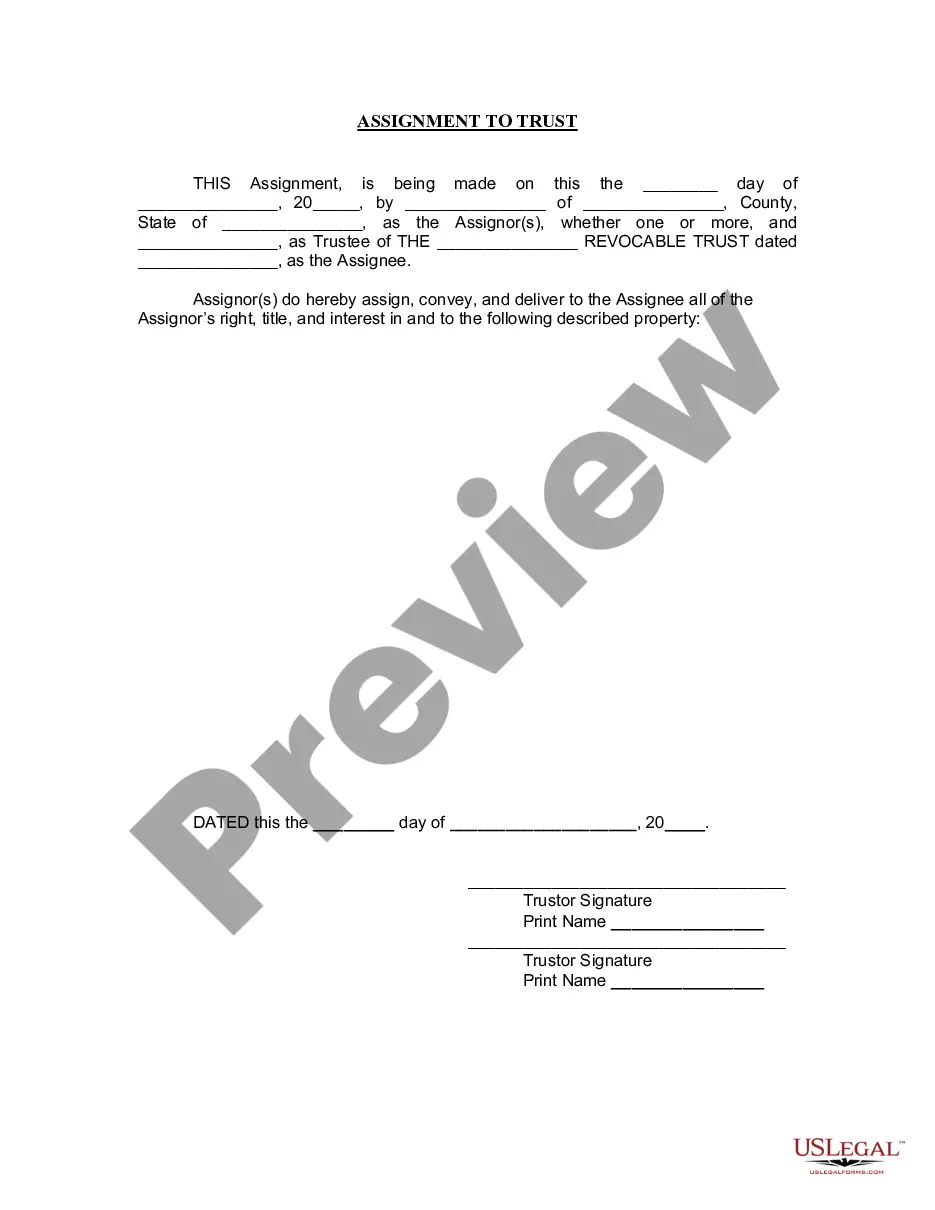

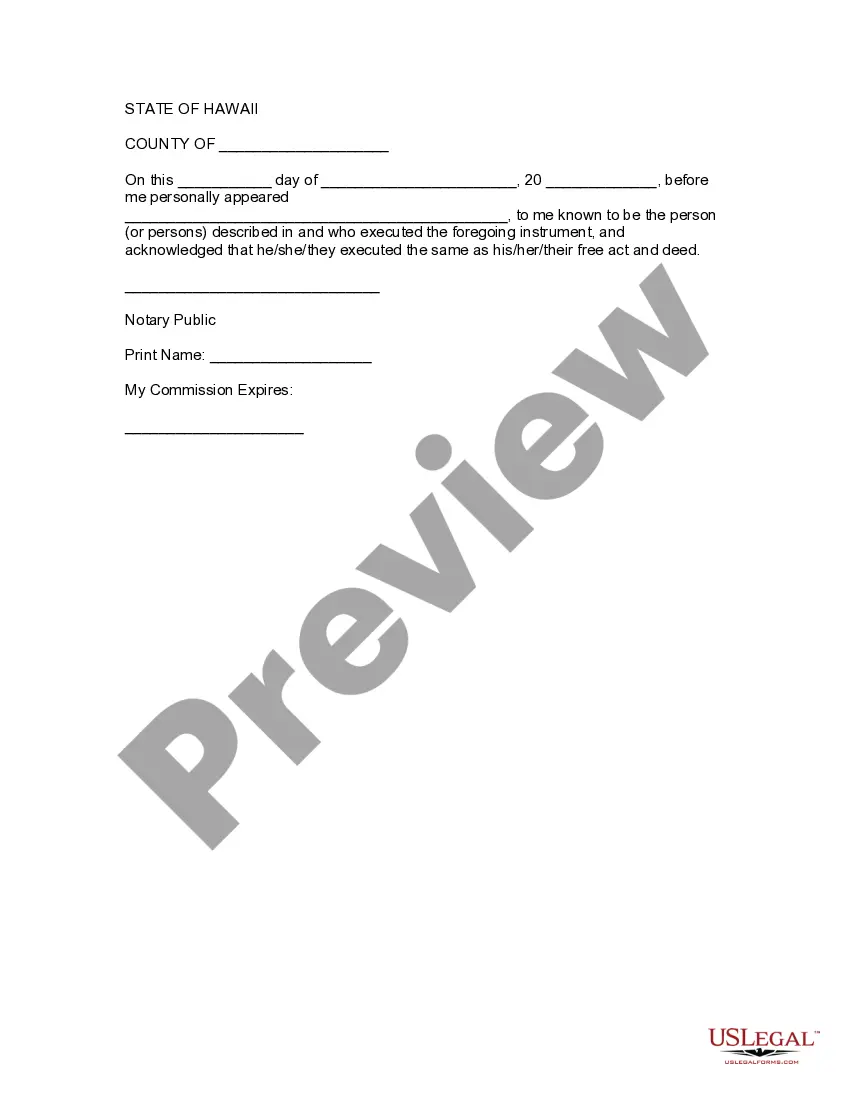

How to fill out Hawaii Assignment To Living Trust?

- Start by logging into your US Legal Forms account if you're a returning user. Make sure your subscription is active; renew if necessary.

- If you're new to US Legal Forms, begin by browsing the library. Use the search feature to find the Hawaii assignment trust for the disabled form that matches your needs.

- Review the form description and preview mode carefully to ensure it meets local jurisdiction requirements before you proceed.

- Select the form and initiate the purchase process by clicking on the Buy Now button. Choose the subscription plan that best suits you and create an account.

- Complete your purchase by entering your payment details through either credit card or PayPal.

- Once your payment is confirmed, download the form directly to your device for completion and access it anytime through the My Forms section in your profile.

In conclusion, US Legal Forms provides an unmatched collection of over 85,000 legal documents, making it easier for you to manage legal matters like the Hawaii assignment trust for the disabled. Their expert assistance ensures your forms are completed correctly.

Visit US Legal Forms today to expedite the process and ensure your loved ones are safeguarded.

Form popularity

FAQ

Although many people use the terms supplemental needs trust and special needs trust interchangeably, they are not the same. A supplemental needs trust is specifically designed to enhance the quality of life for individuals with disabilities without jeopardizing government aid. In contrast, a special needs trust has a broader scope and may include various protections for the beneficiary. Understanding these nuances is crucial when considering a Hawaii assignment trust for the disabled.

While a supplemental needs trust offers numerous advantages, there are also some drawbacks to consider. One notable disadvantage is the complexity involved in setting up and managing the trust, which may require professional guidance. Furthermore, if not properly established, there might be risks of benefiting the trust’s creator at the expense of the beneficiary's eligibility for essential government assistance. Engaging with resources such as the USLegalForms platform can help navigate these potential pitfalls.

The primary distinction between a special needs trust and a supplemental needs trust lies in their intended purposes. A special needs trust focuses on preserving eligibility for government benefits while providing funds for personal care and additional needs. On the other hand, a supplemental needs trust serves to supplement government benefits without reducing them. If you are considering options like the Hawaii assignment trust for the disabled, understanding these differences can guide your decision.

A qualified disability trust, such as the Hawaii assignment trust for the disabled, must meet specific criteria set by the IRS. It must be established for the benefit of an individual who is disabled, and it must provide the trustee with control over income distributions. Additionally, this type of trust must comply with federal and state laws to ensure it meets the required qualifications. Establishing such a trust can help safeguard your loved one's financial future.

The best trust for a disabled person often depends on their individual circumstances. Generally, a special needs trust or a Hawaii assignment trust for the disabled are excellent choices as they provide asset protection without affecting eligibility for government assistance. These trusts allow beneficiaries to maintain a better quality of life while ensuring essential resources are available. Seeking guidance from legal professionals can help tailor the right approach.

Setting up a trust for a disabled person involves several key steps. First, determine the type of trust that best suits the individual's needs, such as a Hawaii assignment trust for the disabled. Then, it’s crucial to work with a qualified attorney who understands the complexities involved, including legal and tax implications. This approach ensures the trust is established correctly and effectively supports the beneficiary.

While a special needs trust provides numerous benefits, there are some disadvantages to consider. For instance, funds within such trusts can only be used for specific expenses to avoid jeopardizing government benefits. Additionally, managing and establishing these trusts can come with administrative costs. However, utilizing a Hawaii assignment trust for the disabled may mitigate some issues by ensuring more straightforward management.

To qualify for a qualified disability trust, certain criteria must be met, including having a disability that has lasted or is expected to last for at least 12 months. Additionally, the trust must solely benefit individuals with disabilities and be created with specific tax regulations in mind. Using a Hawaii assignment trust for the disabled can help streamline this process by providing clarity in managing assets. This ensures disabled beneficiaries receive the necessary support.

In Hawaii, the main difference lies in how assets are managed and distributed after death. A will only takes effect upon death, requiring the probate process, while a trust, such as a Hawaii assignment trust for the disabled, can manage assets during a person's lifetime and beyond. Trusts provide greater privacy and quicker asset distribution. This can be particularly beneficial for those with disabilities, ensuring their needs are met without extensive delays.

For a person on disability, finding a supportive community is essential. Many individuals find quality living in Hawaii, known for its inclusive environments and available resources. Multiple local programs assist disabled residents, enhancing their quality of life. Thus, it's an ideal spot for anyone seeking a nurturing environment.