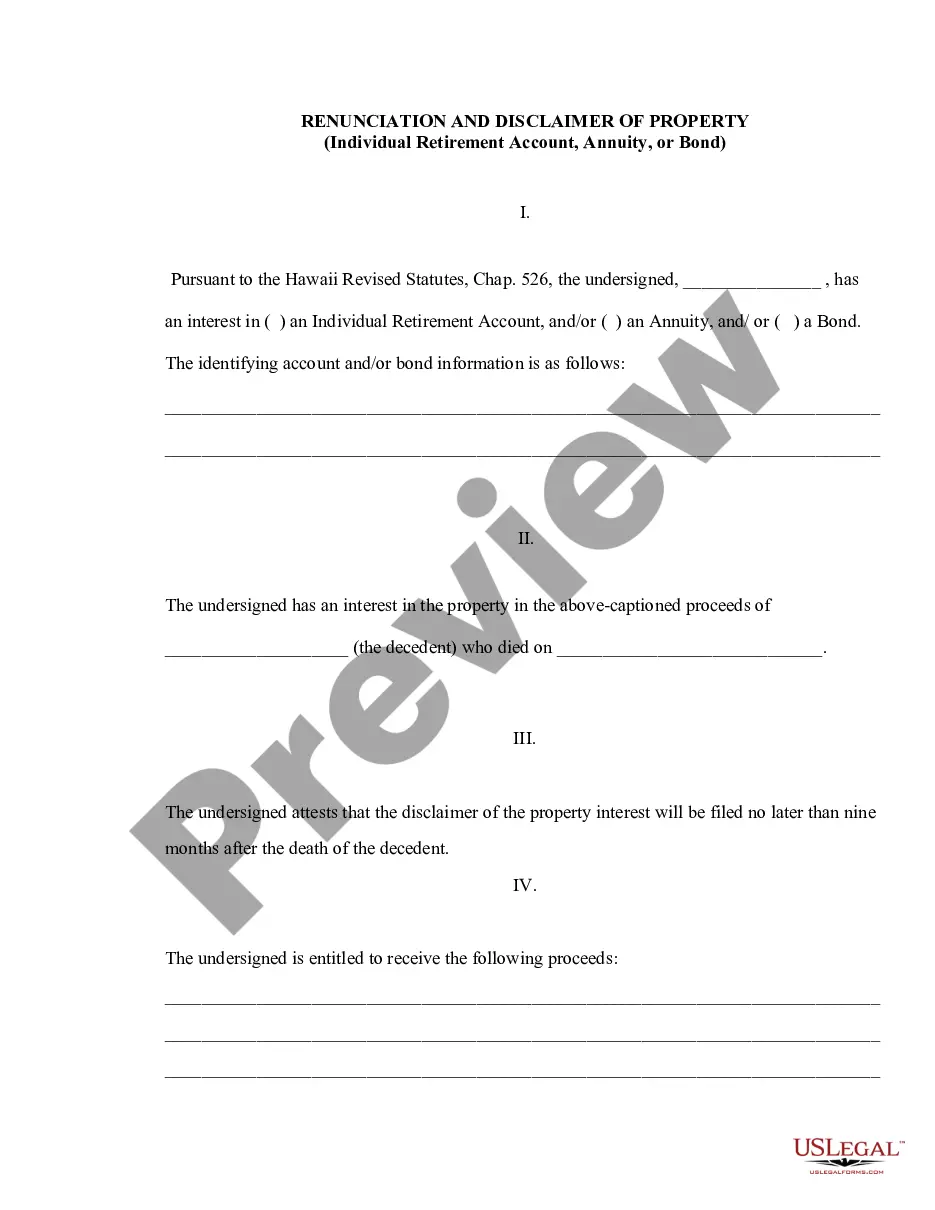

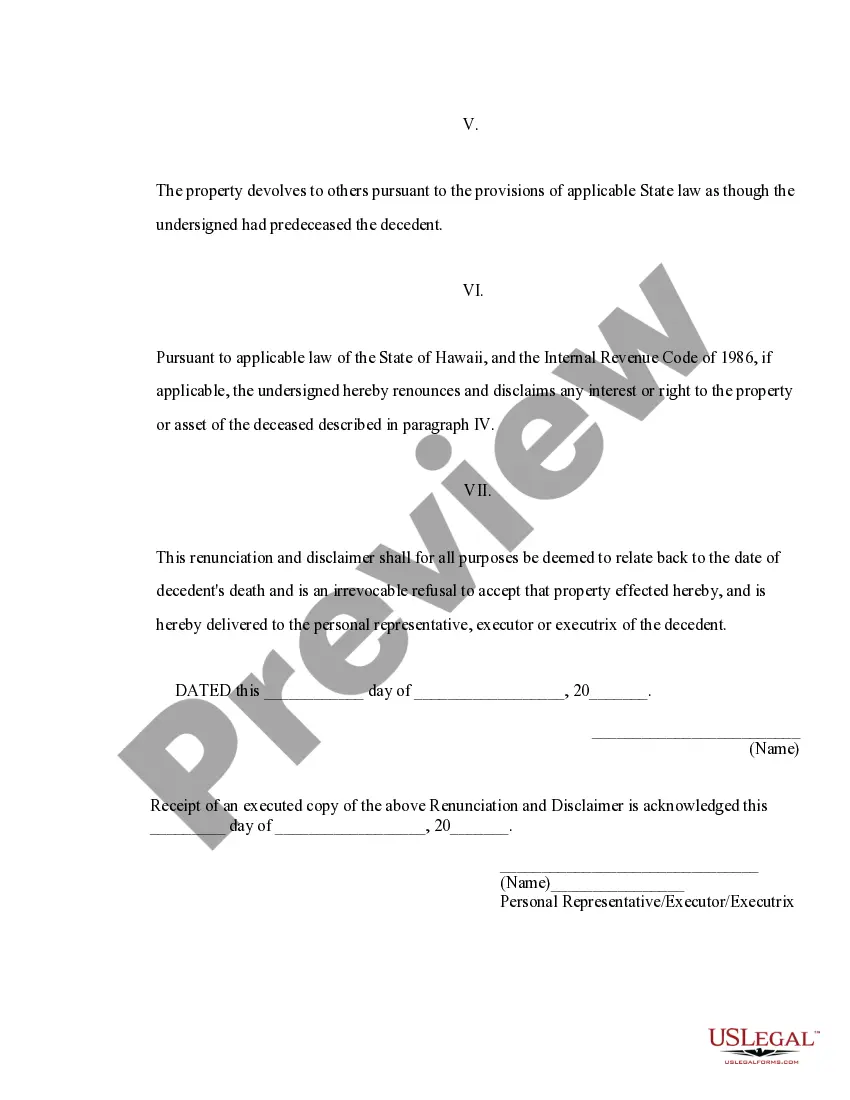

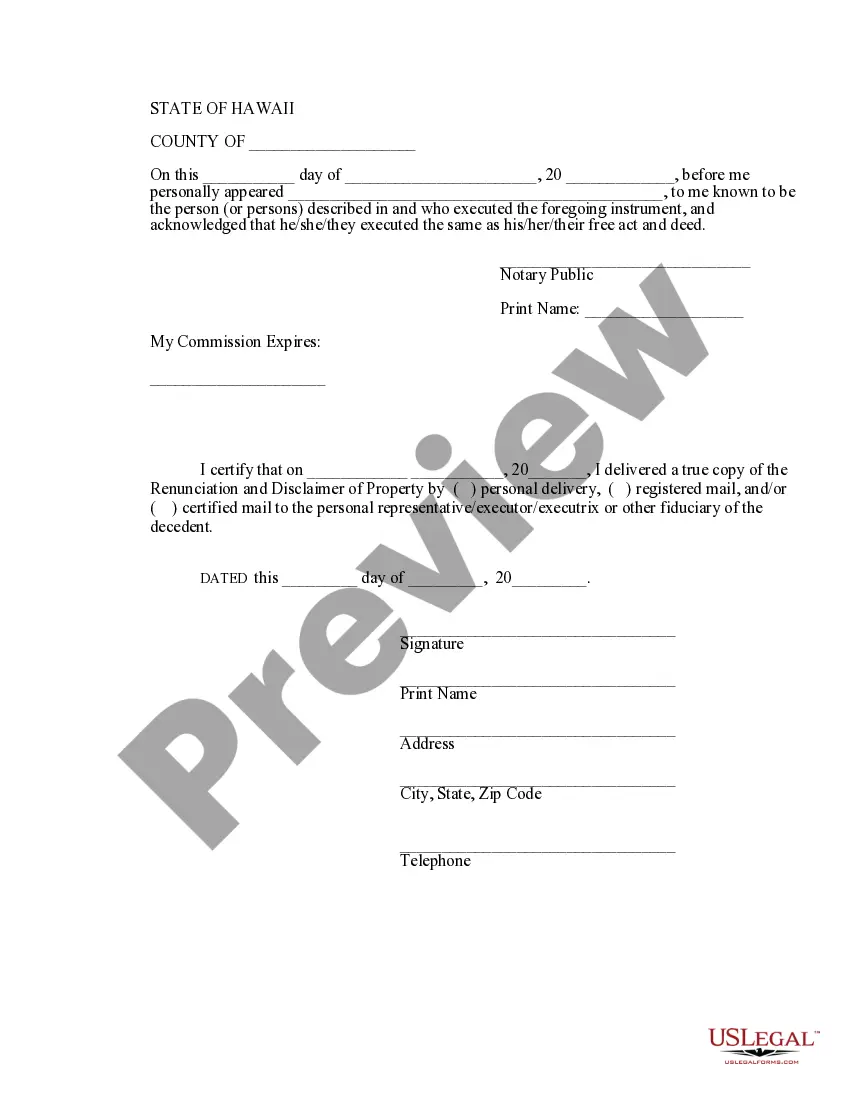

This form is a Renunciation and Disclaimer of an Individual Retirement Account (IRA), an Annuity, or Bond. The beneficiary has gained an interest in the proceeds of the account(s) due to the death of the decedent. However, the beneficiary has chosen to disclaim his/her rights to the proceeds pursuant to the Hawaii Revised Statutes, Chap. 526. The disclaimer will relate back to the death of the decedent and it will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Hawaii Individual Retirement Account Withholding

Description

Form popularity

FAQ

Determining how much to withhold for retirement, particularly in relation to Hawaii individual retirement account withholding, depends on several factors like your age, income, and retirement goals. Many financial experts recommend aiming for at least 10-15% of your salary, but this can vary based on personal circumstances. Evaluating your current expenses and future needs is critical in deciding on an appropriate withholding amount. Tools provided by services like uslegalforms can help simplify your planning process.

To fill out a withholding exemption, start by acquiring the correct form used for this purpose. Provide your personal information and indicate your exemptions correctly, including any pertinent details regarding the Hawaii individual retirement account withholding. It’s crucial that you double-check your entries for accuracy before submission to avoid future issues. If you need help, uslegalforms offers a simple platform to ensure you fill the form correctly.

Filling out a tax exemption requires you to provide specific information on the designated form. You must include your personal details, like your name and Social Security number, along with your reasons for the exemption related to Hawaii individual retirement account withholding. Once completed, submit it to your employer before the deadlines to ensure adjustments take effect in your payroll. It's best to consult professional advice if you're unsure.

To fill out your tax withholding accurately, start by gathering your financial information, including your salary and any additional income sources. Use the IRS guidelines along with the Hawaii individual retirement account withholding requirements to complete your form correctly. Ensure that you check the right boxes for exemptions and additional withholdings if needed. If you find yourself confused, consider using platforms like uslegalforms for guidance.

When you consider the Hawaii individual retirement account withholding, the exemption from withholding allows you to retain more of your earnings in your pocket. You should indicate any specific exemptions that apply to your situation on your withholding form. If your income falls below a certain threshold, you may claim this exemption. Always ensure to review your financial situation regularly, as changes can affect your withholding status.

The taxable amount of your retirement depends on several factors, including the type of account and your overall income during retirement. Generally, distributions from traditional IRAs are fully taxable, while qualified withdrawals from Roth IRAs are not. To maximize your retirement savings, it is beneficial to understand Hawaii individual retirement account withholding and tax implications thoroughly.

Tax withholding for retirement accounts generally depends on your total tax situation, the type of account, and your state’s laws. While federal withholding can start at 10% for early distributions, Hawaii individual retirement account withholding may differ based on local tax laws. It's wise to consult a tax professional to determine the best withholding strategy for your situation.

Several states have mandatory withholding requirements for 401k distributions. These states include California, New Jersey, and Massachusetts, among others. If you are considering a 401k withdrawal, it is crucial to check your state’s rules on withholding and consult about Hawaii individual retirement account withholding to avoid any surprises.

The 20% withholding rule applies to federal income tax on IRA distributions, but it is not mandatory for everyone. You can opt for a different withholding rate, but you need to request it specifically. For residents in Hawaii, understanding Hawaii individual retirement account withholding is essential to ensure compliance with local regulations.

In Hawaii, retirement income is subject to state income tax, but the rates can vary. Specifically, Hawaii individual retirement account withholding is applicable for most retirement benefits, including pensions and distributions from IRAs. Additionally, some exemptions may apply based on your income level and type of retirement plan. It's crucial to understand these regulations to effectively manage your retirement finances.