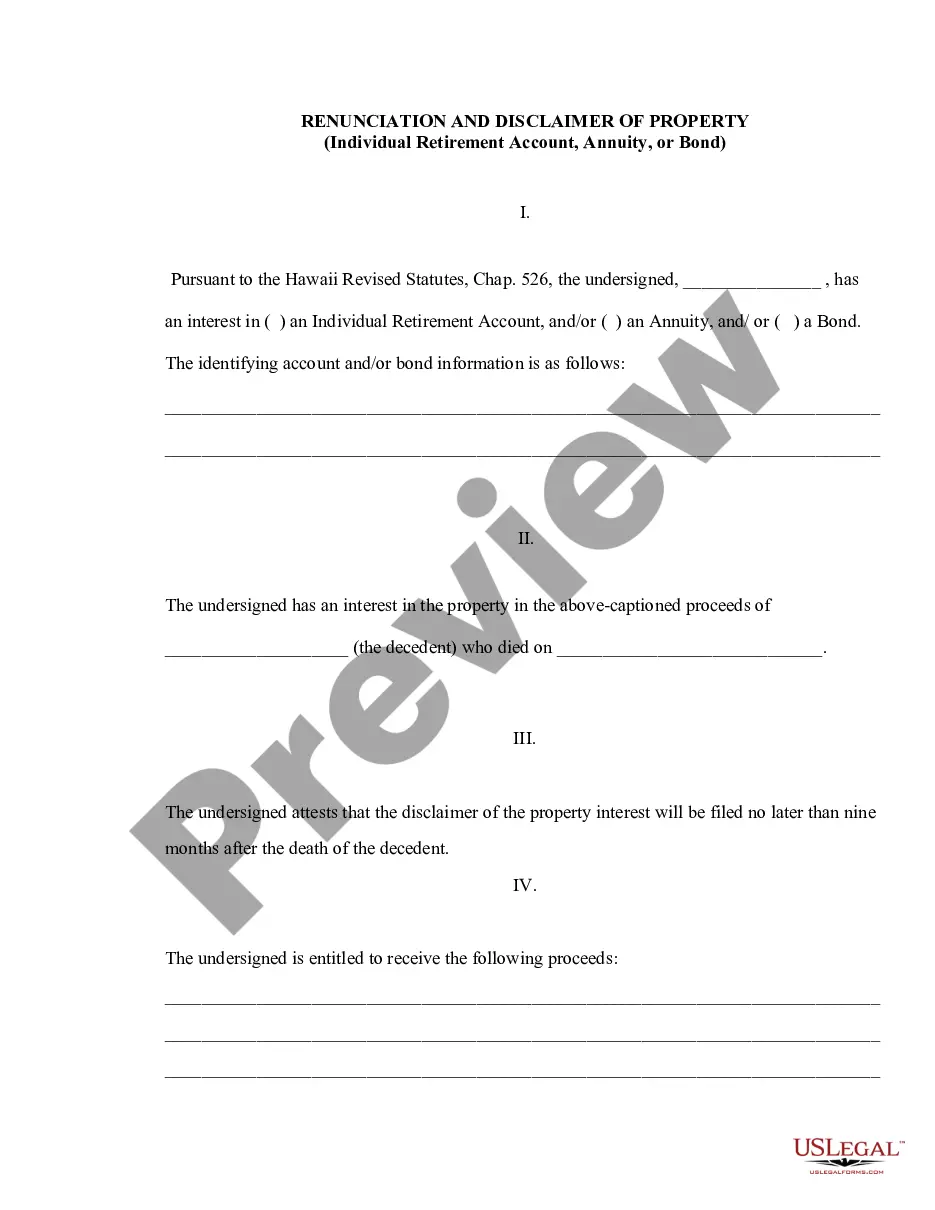

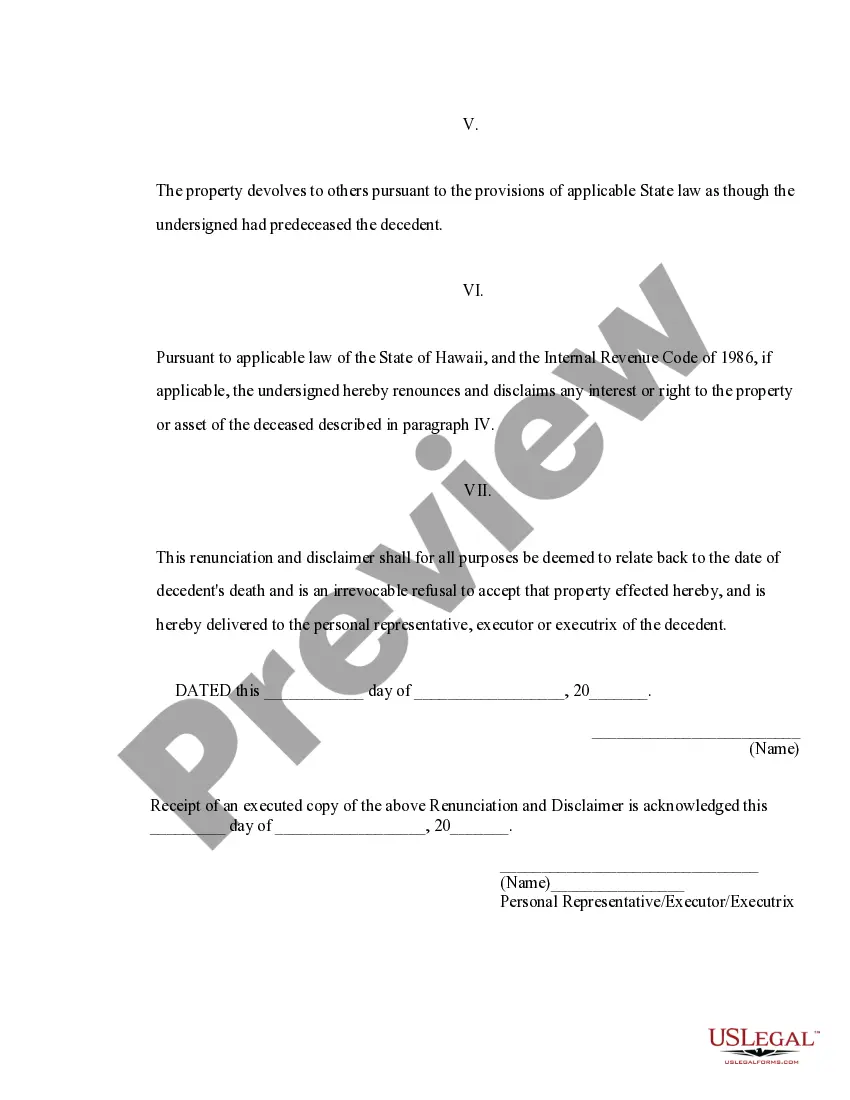

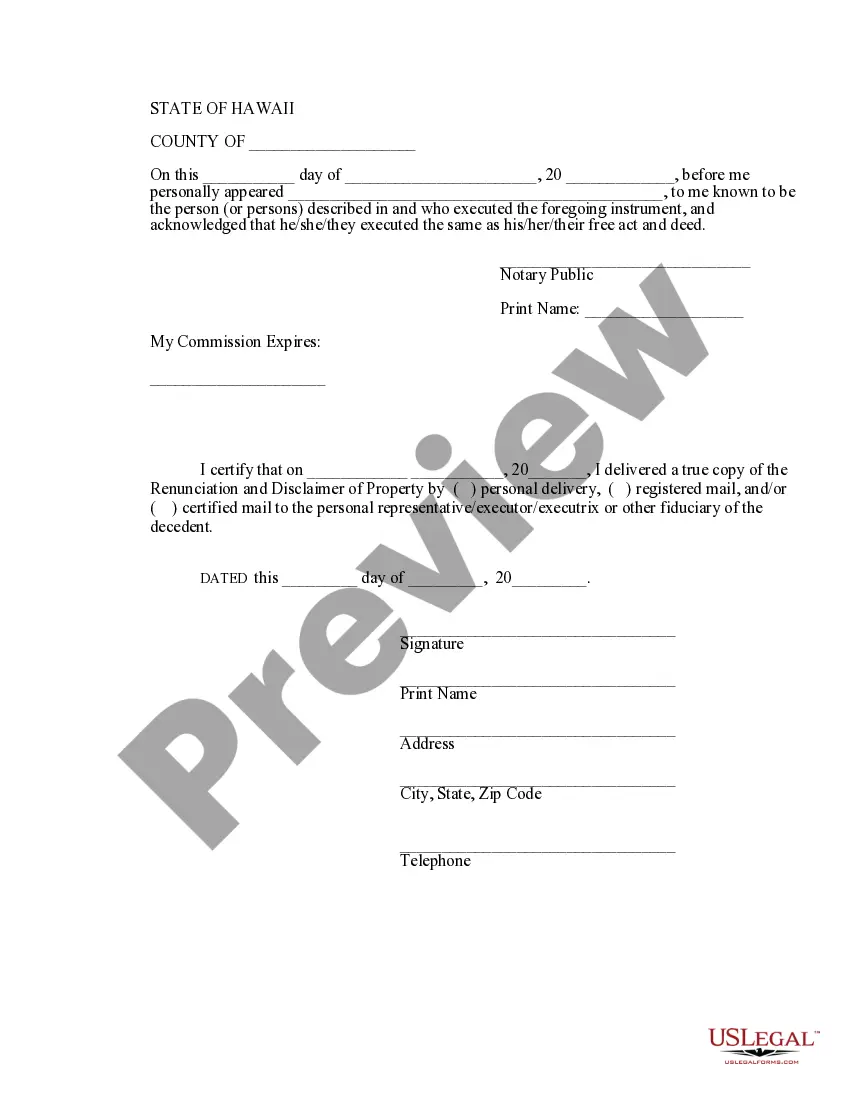

This form is a Renunciation and Disclaimer of an Individual Retirement Account (IRA), an Annuity, or Bond. The beneficiary has gained an interest in the proceeds of the account(s) due to the death of the decedent. However, the beneficiary has chosen to disclaim his/her rights to the proceeds pursuant to the Hawaii Revised Statutes, Chap. 526. The disclaimer will relate back to the death of the decedent and it will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Hawaii Individual Retirement Account Form

Description

Form popularity

FAQ

The Hawaii retirement savings plan is designed to help employees save for retirement through a variety of investment options. It allows participants to contribute a portion of their earnings to grow their retirement savings over time. Complete the Hawaii individual retirement account form to explore how this plan can fit into your retirement strategy.

Hawaii state retirement calculation involves considering your years of service, salary history, and the specific retirement plan regulations. The final pension amount can vary significantly based on these factors, making individual planning important. Using the Hawaii individual retirement account form can assist in this calculation by highlighting your service and potential benefits.

The only retirement system in Hawaii is the Employees' Retirement System (ERS), which offers benefits to state and county employees. This system is designed to provide financial security for retirees after they complete their service. To better understand your options, using the Hawaii individual retirement account form may help clarify your retirement planning.

To retire with benefits from the State of Hawaii, you generally need at least five years of credited service. This requirement helps ensure that employees are committed to their roles before receiving benefits. Make sure to complete the Hawaii individual retirement account form when preparing your retirement documents.

You can contact the Employees' Retirement System (ERS) of Hawaii through their official website, where you will find phone numbers and contact forms. Additionally, visiting their office can provide you direct assistance. If you have questions about retirement plans, consider having the Hawaii individual retirement account form ready for your discussion.

The pension amount from the state of Hawaii varies based on your salary, years of service, and the specific retirement plan. Generally, the formula used factors in your highest average salary over a set number of years. Therefore, using the Hawaii individual retirement account form can help you estimate your pension and prepare effectively for your retirement.

To retire from the State of Hawaii, you must complete at least five years of service to be eligible for benefits. However, the amount you receive will depend on your total years of service and the retirement plan you fall under. Filling out the Hawaii individual retirement account form can assist you in understanding your eligibility and planning for retirement.

Generally, you need to work for the state of Hawaii for a minimum of 10 years to qualify for a pension. This requirement ensures that employees have dedicated sufficient time to earn retirement benefits. Using the Hawaii individual retirement account form can help you review your service years and calculate your potential pension.

Kauai is often cited as the most affordable island for retirement in Hawaii. It offers lower housing costs and a laid-back lifestyle compared to other islands like Oahu and Maui. Before you decide, consider filling out the Hawaii individual retirement account form to organize your finances and retirement savings.

You can usually retire from the state of Hawaii when you reach your minimum retirement age, which varies based on your years of service. If you have at least five years of credited service, you can retire with benefits at age 62. To prepare your retirement paperwork effectively, consider using the Hawaii individual retirement account form for a seamless process.