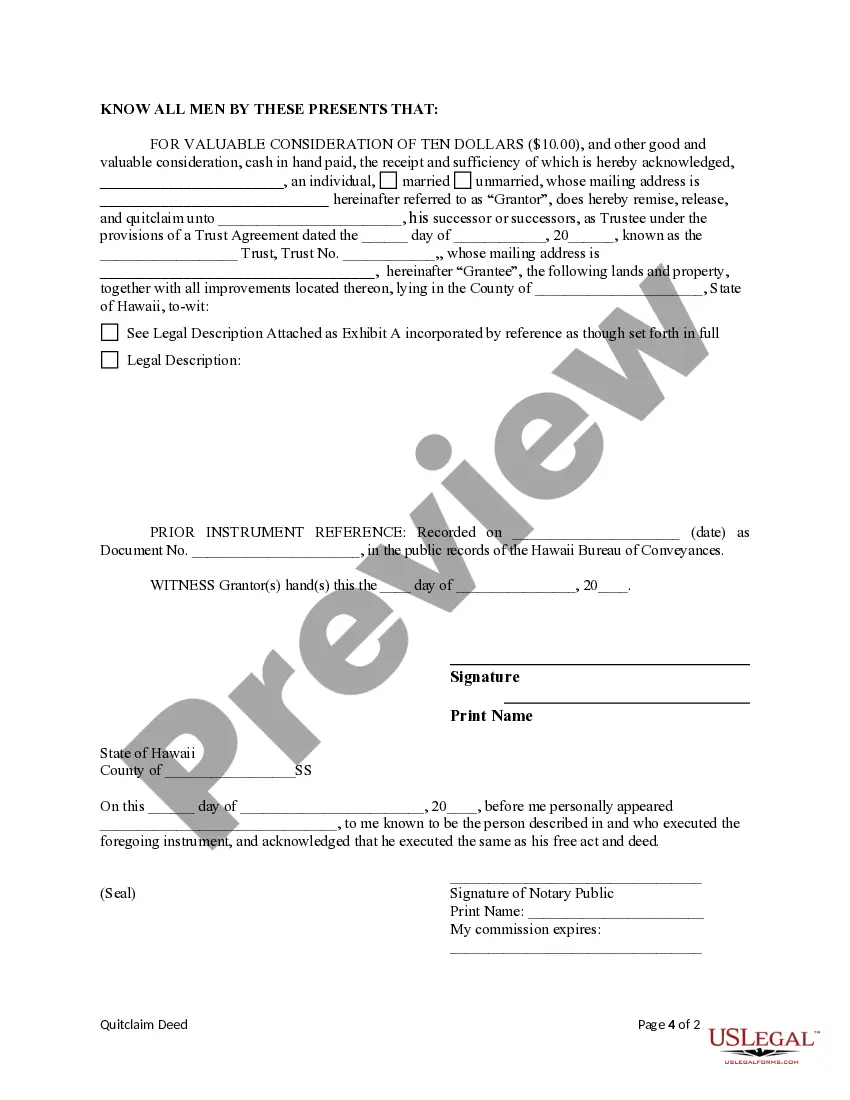

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

Trust Hawaii State Form N-848

Description

Form popularity

FAQ

Yes, you can file Hawaii state taxes online through authorized platforms. Utilizing the Trust Hawaii state form N-848 will make your electronic filing experience simpler and more efficient. It's a convenient way to ensure your tax obligations are met in a timely manner.

Yes, you can file your taxes electronically yourself. Platforms like US Legal Forms offer tools to help you navigate forms such as the Trust Hawaii state form N-848 independently. This option provides flexibility and control over your tax filing experience.

To file G49 Hawaii online, you can visit the official tax website or use services like US Legal Forms. When handling forms like the Trust Hawaii state form N-848, follow the online guidelines to ensure a smooth submission process. Always double-check your entries for accuracy.

Yes, Hawaii provides an eFile form option for taxpayers. You can find the Trust Hawaii state form N-848 online, making it easier to complete your filing requirements. E-filing saves time and offers a secure way to submit your tax documents.

The deadline for filing Hawaii state taxes is typically April 20. However, if you use the Trust Hawaii state form N-848, be sure to check for any updates or changes. Stay informed to avoid any penalties associated with late submissions.

Yes, Hawaii offers eFile forms for tax submission. The Trust Hawaii state form N-848 can be accessed online for your convenience. This digital format reduces paperwork and helps streamline your filing process.

Yes, Hawaii does tax trust income. It is important to understand how these taxes apply when filing forms like the Trust Hawaii state form N-848. Always consult a tax professional or utilize resources like US Legal Forms to navigate these compliance aspects effectively.

Yes, you can file Hawaii state tax online through various platforms, including US Legal Forms. Using the Trust Hawaii state form N-848 can simplify the process for you. It is user-friendly and ensures you meet all necessary requirements while filing your taxes electronically.

You can obtain Hawaii state tax forms online through the Hawaii Department of Taxation's official website or platforms like USLegalForms. They offer a simple way to access the Trust Hawaii state form N-848 and many other essential tax forms. This resource ensures you have the most up-to-date information and forms needed for fulfilling your tax obligations.

Exemptions from Hawaii's general excise tax include certain nonprofit organizations, government entities, and specific business transactions. Understanding these exemptions can be complex, but the Trust Hawaii state form N-848 can help clarify your status and obligations. Using USLegalForms can provide you with the right tools and forms to navigate these tax exemptions effectively.