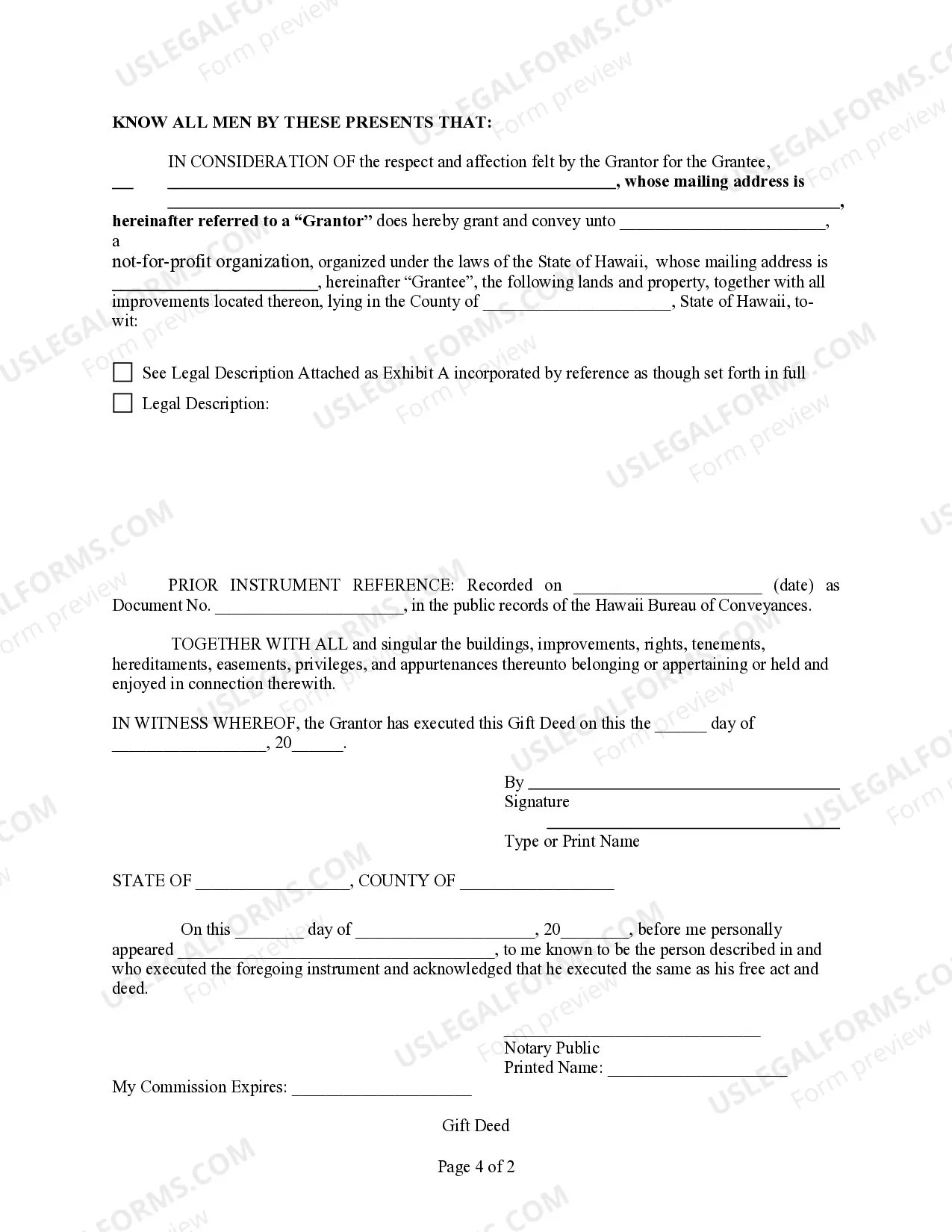

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Unincorporated Printable For Business

Description

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- If you’re a returning user, log in to access your account and download your required form easily by clicking the Download button. Ensure your subscription is active; renew it if necessary.

- For first-time users, begin by browsing our extensive collection. Utilize the Preview mode and read the form descriptions to choose the right legal document that aligns with your jurisdiction.

- Should you need to find an alternative template, use the Search feature to locate additional forms that meet your requirements.

- Select and purchase the document. Click the Buy Now button and select a subscription plan that fits your needs, creating an account to unlock the full library.

- Complete your purchase by entering your payment information, ensuring a secure transaction through credit card or PayPal.

- After purchase, download your form and save it for completion. You can revisit your downloaded documents anytime through the My Forms section of your profile.

By utilizing US Legal Forms, users gain access to a comprehensive collection of over 85,000 legal documents that are both easily fillable and editable. This service empowers individuals and attorneys to create precise and legally compliant forms with minimal effort.

Get started today and streamline your business documentation process with US Legal Forms. Visit us now to find the perfect form for your needs!

Form popularity

FAQ

Yes, a sole proprietor does need a business license in Hawaii. This requirement applies to nearly all businesses, including those operating under a personal name. You can simplify the application process by using the Hawaii unincorporated printable for business to ensure compliance with regulations. Acquiring the necessary licenses will help you operate legitimately and avoid potential fines.

To obtain a small business license in Hawaii, first identify the type of license applicable to your business sector. You can start by using the Hawaii unincorporated printable for business to understand what licenses you may need. After gathering the required documents, apply through the Hawaii Department of Commerce and Community Affairs. Ensuring all your paperwork is accurate will speed up the application process.

Registering a small business in Hawaii involves several steps. Begin by selecting the business structure you prefer; options include LLC, corporation, or sole proprietorship. Utilize the Hawaii unincorporated printable for business to navigate the registration process efficiently. Complete the necessary paperwork and submit it to the appropriate state agency, ensuring you adhere to all local laws and requirements.

To register as a small business, you'll need to choose a business name and format, such as a sole proprietorship or LLC. After finalizing your decision, you can use the Hawaii unincorporated printable for business to ensure compliance with local regulations. Furthermore, consider securing any necessary permits or licenses that fit your business needs. By following these steps, you'll set a solid foundation for your small business.

Yes, sole proprietors in Hawaii typically need a business license to operate legally. Depending on your business type and location, you may require additional permits or licenses as well. Utilizing a Hawaii unincorporated printable for business can simplify the process of identifying the necessary licenses for your venture. For a more efficient experience, you can rely on the US Legal Forms platform, which offers helpful resources for business compliance.

To file an annual report for your LLC in Hawaii, you need to visit the official state website and use their online filing system. You will need to provide essential information about your business, including your registered agent details and the principal office address. It's a straightforward process made easier with resources available for Hawaii unincorporated printable for business. If you prefer a more guided approach, consider using the US Legal Forms platform for assistance.

Starting a small business in Hawaii involves several key steps, including creating a business plan, choosing your business structure, and registering with the state. It's vital to review local regulations and acquire any necessary licenses or permits. By using the Hawaii unincorporated printable for business, you get access to comprehensive tools and resources that assist you in establishing your small business efficiently.

To incorporate in Hawaii, you need to file Articles of Incorporation with the Department of Commerce and Consumer Affairs. Ensure you choose an appropriate name for your corporation and appoint a registered agent. Utilizing resources like the Hawaii unincorporated printable for business can guide you through the necessary steps and paperwork to streamline your incorporation process.

Yes, Hawaii requires businesses operating under a name different from their legal name to register for a DBA, which stands for 'Doing Business As.' This registration process helps to establish your brand identity and ensures compliance with state regulations. When you use the Hawaii unincorporated printable for business, it simplifies the DBA registration process, making it easier for you to focus on your venture.

You do not need to formally register your sole proprietorship in Hawaii, but you should consider obtaining an appropriate business license. Additionally, if you plan to use a business name that differs from your legal name, you must register that name. This proactive approach can enhance transparency for your Hawaii unincorporated printable for business operations.