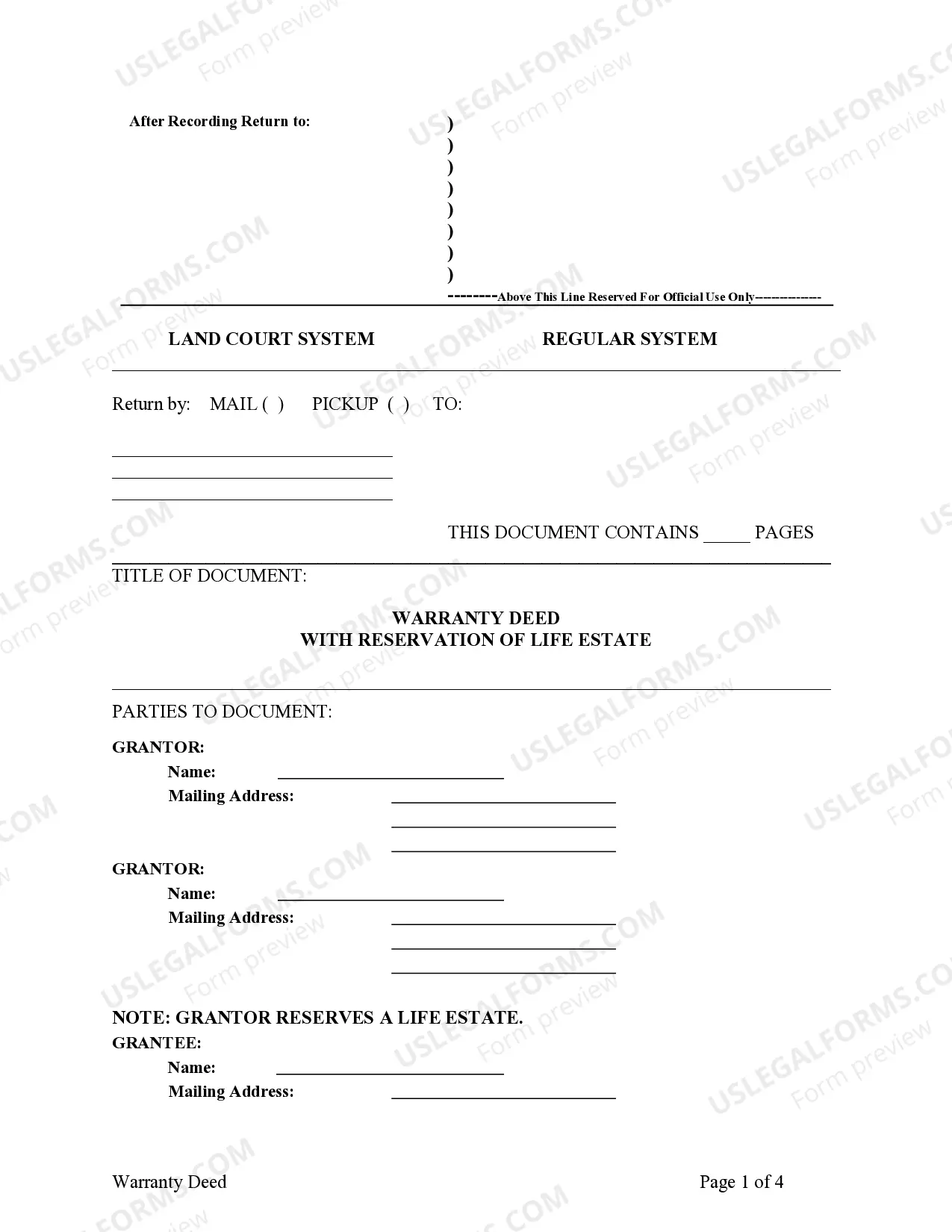

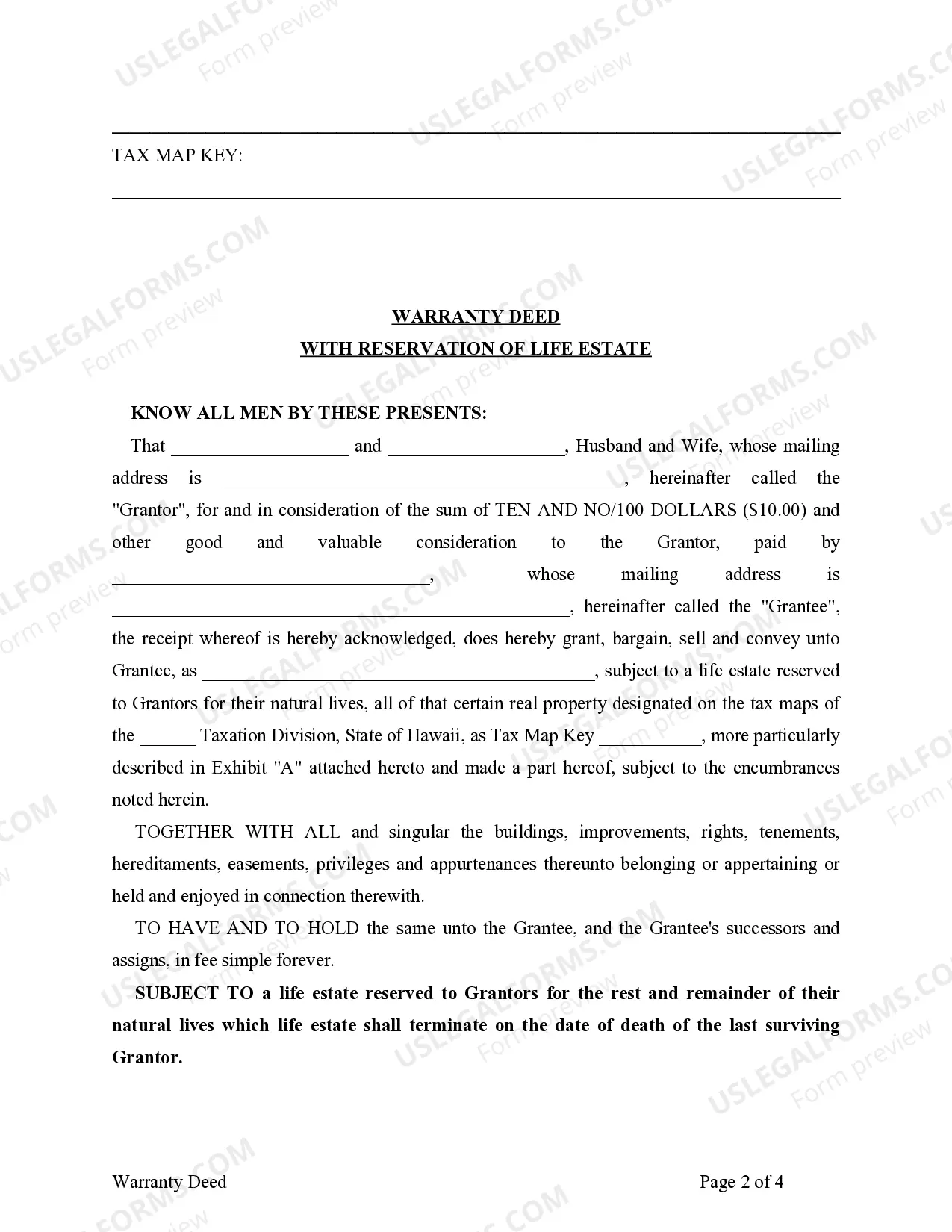

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Life Estate Hawaii With Condition Subsequent

Description

How to fill out Hawaii Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether for business purposes or for personal matters, everyone has to deal with legal situations sooner or later in their life. Filling out legal papers demands careful attention, starting with selecting the appropriate form sample. For example, when you choose a wrong edition of the Life Estate Hawaii With Condition Subsequent, it will be rejected when you send it. It is therefore crucial to have a reliable source of legal documents like US Legal Forms.

If you have to obtain a Life Estate Hawaii With Condition Subsequent sample, follow these simple steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Look through the form’s information to make sure it suits your case, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect form, go back to the search function to locate the Life Estate Hawaii With Condition Subsequent sample you need.

- Download the file if it meets your requirements.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Life Estate Hawaii With Condition Subsequent.

- Once it is downloaded, you are able to complete the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time searching for the appropriate template across the web. Make use of the library’s simple navigation to get the appropriate form for any situation.

Form popularity

FAQ

A remainderman is a third person other than the estate's creator, initial holder, or either's heirs. For example, if Blackacre is granted ?to Thelma for life, and then to Louise??Thelma has a life estate and Louise is a remainderman.

An example of a life estate with Jane Smith as the remainderman is "to John Smith for life, then to Jane Smith." Jane Smith is the remainderman in this example because she is the person inheriting title to the property following the death of John Smith.

What are the pros and cons of life estates? Avoid probate. Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

A life estate may limit the transferability of the property, as the life tenant can only sell or transfer their interest in the property for the duration of their life or the designated measuring life.

In the event of the death of a remainderman before the life tenant dies, the remainderman's interest may pass to the deceased remainderman's estate or possibly to the surviving joint remaindermen, depending upon how the joint remainder interests were set up in the will, trust, or deed.