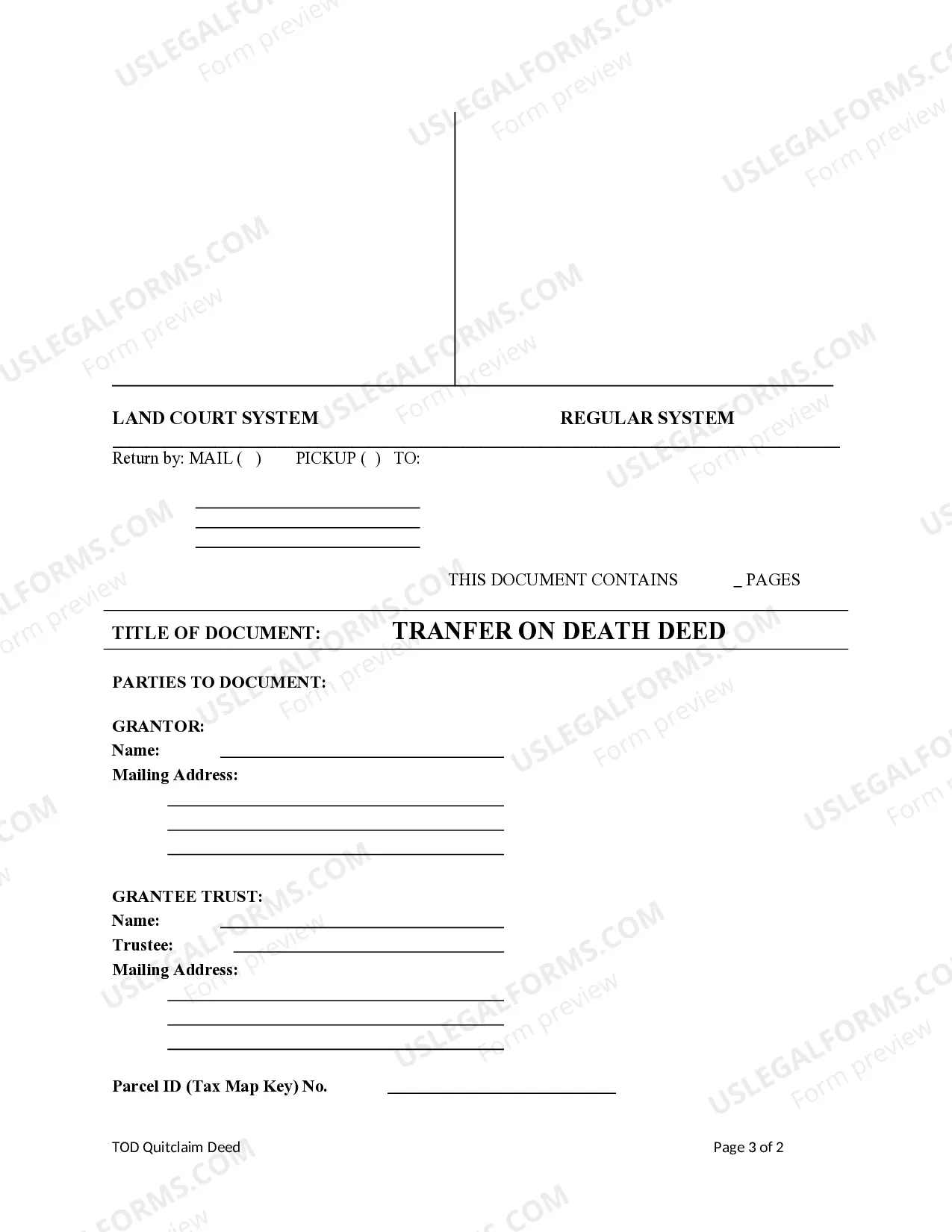

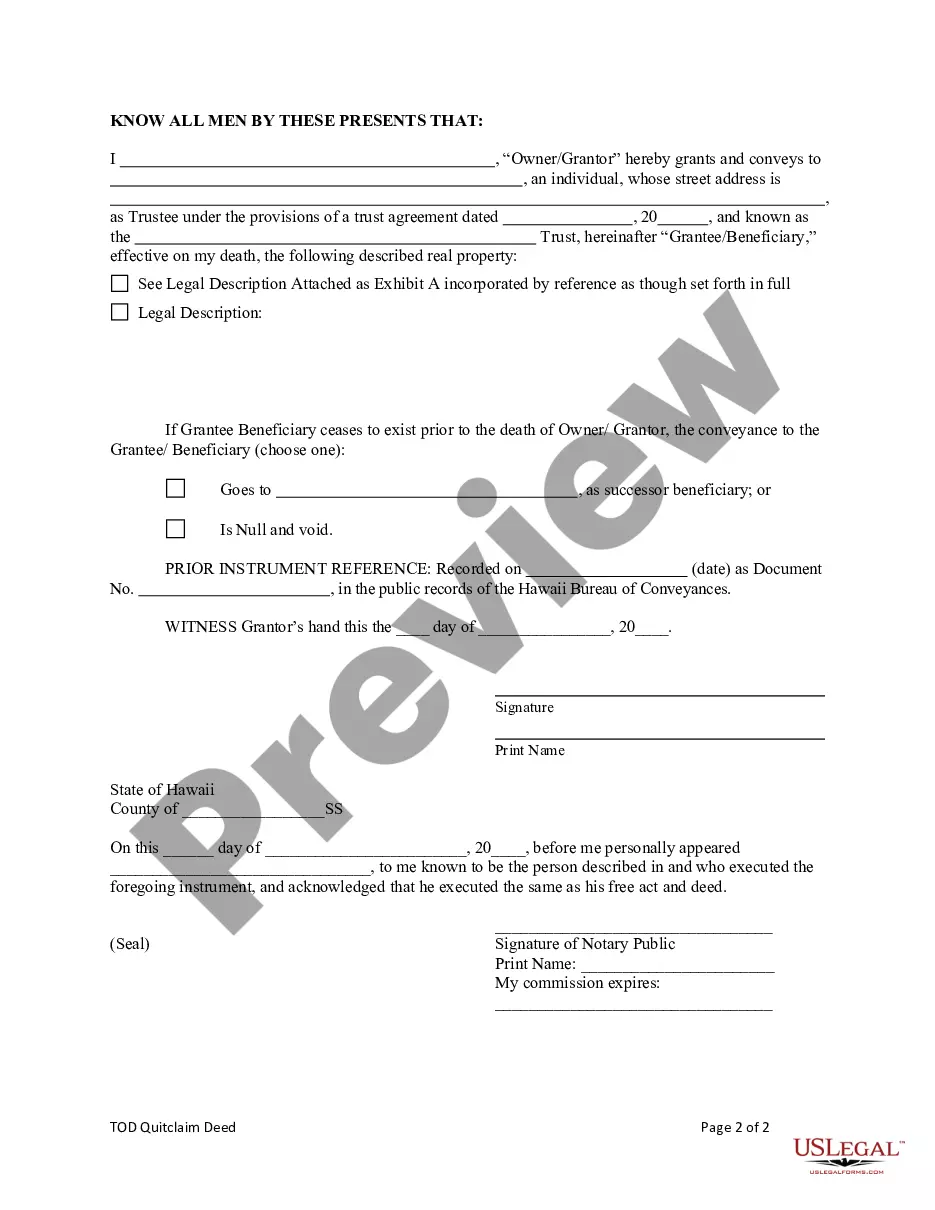

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is a Trust. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Transfer On Death Deed For Illinois

Description

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To A Trust?

- Log in to your US Legal Forms account if you’re a returning user. Ensure your subscription is active, or renew it as needed.

- For first-time users, start by checking the document preview and description. Ensure that the form aligns with your specific needs and state requirements.

- If the selected form doesn’t meet your requirements, utilize the search feature to find a more suitable template.

- Purchase the correct document by clicking the 'Buy Now' button. Choose your preferred subscription plan and create an account if necessary.

- Complete your payment using a credit card or PayPal and finalize your purchase.

- Download the form to your device, and access it later through the 'My Forms' section of your profile whenever needed.

US Legal Forms empowers both individuals and attorneys to quickly create legally binding documents with ease. Offering a robust selection of over 85,000 fillable forms, their service stands out in the legal documentation landscape.

Start simplifying your legal processes today. Visit US Legal Forms to obtain your transfer on death deed for Illinois and benefit from expert assistance whenever needed.

Form popularity

FAQ

To create a transfer on death deed for Illinois, you need specific information, such as the legal description of the property, the names of the beneficiaries, and the grantor's details. The deed must be signed by the grantor in the presence of a notary public to be valid. Additionally, you must record the executed deed with the local recorder's office to ensure it is enforceable during the owner's lifetime and after their passing. Platforms like US Legal Forms can provide the necessary templates and tips for preparation.

While it is not legally required to have a lawyer to create a transfer on death deed for Illinois, having legal assistance can be beneficial. An experienced lawyer can ensure that the deed is properly drafted and complies with Illinois laws, which can help prevent future disputes or complications. If you feel uncertain about the legal language or process, consider consulting a lawyer to provide you with peace of mind.

While a transfer on death deed for Illinois offers benefits, it also has some disadvantages. One key concern is that it does not provide any asset protection during the grantor's lifetime, meaning creditors can still access these assets. Additionally, if the property is sold before the owner's death, the deed becomes void, which may lead to complications if the owner intended to pass on the property. Understanding these drawbacks is crucial before making a decision.

To file a transfer on death deed for Illinois, you first need to prepare the deed according to Illinois state requirements, which include proper legal descriptions and signatures. Once completed, you must record this deed with the county recorder’s office in the county where the property is located. Make sure to check for any local regulations or specific forms that may be required. Utilizing platforms like US Legal Forms can simplify this process by providing templates and guidance.

You do not necessarily need a lawyer to create a transfer on death deed for Illinois, but it is highly recommended. Legal assistance can help ensure that the deed is properly drafted, executed, and recorded according to state laws. Additionally, using a platform like USLegalForms can guide you through the process, providing forms and information to facilitate creating an effective transfer on death deed.

A transfer on death deed for Illinois provides an alternative to a will but comes with some differences. Unlike a will, which goes through probate, a transfer on death deed directly transfers property to the beneficiary upon death, which can simplify the process. However, a will allows for more comprehensive estate planning, especially for complex situations. Therefore, evaluating your needs can help determine which option is better.

While the rules for a transfer on death deed for Illinois may differ from those in Texas, it's essential to understand local regulations. In Texas, the deed must be recorded during the owner’s lifetime to be valid. Beneficiaries must also meet certain criteria, which can vary from state to state. When considering a transfer on death deed, it's wise to consult local laws for specific guidelines.

One downside of a transfer on death deed for Illinois is that it does not provide for contingencies, such as if the beneficiary predeceases the property owner. Additionally, a transfer on death deed does not avoid creditor claims against the estate, which could affect the beneficiary's inheritance. Furthermore, it may not account for complexities in family dynamics, such as children from different marriages, requiring careful consideration.

Yes, a Transfer on Death (TOD) arrangement does avoid probate in Illinois. When you choose a TOD deed, your property transfers directly to your named beneficiary upon your death, bypassing the often lengthy probate process. This feature makes the transfer on death deed for Illinois an attractive choice for many individuals seeking to simplify estate management. By planning ahead, you can ensure your wishes are honored without unnecessary legal hurdles.

A transfer on death account in Illinois does not go through probate. This account type is specifically designed to bypass probate, allowing for a seamless transfer of assets directly to the beneficiary. By utilizing a transfer on death deed for Illinois, you eliminate delays and reduce costs associated with probate court. Properly setting up this account can relieve stress for your heirs at a challenging time.