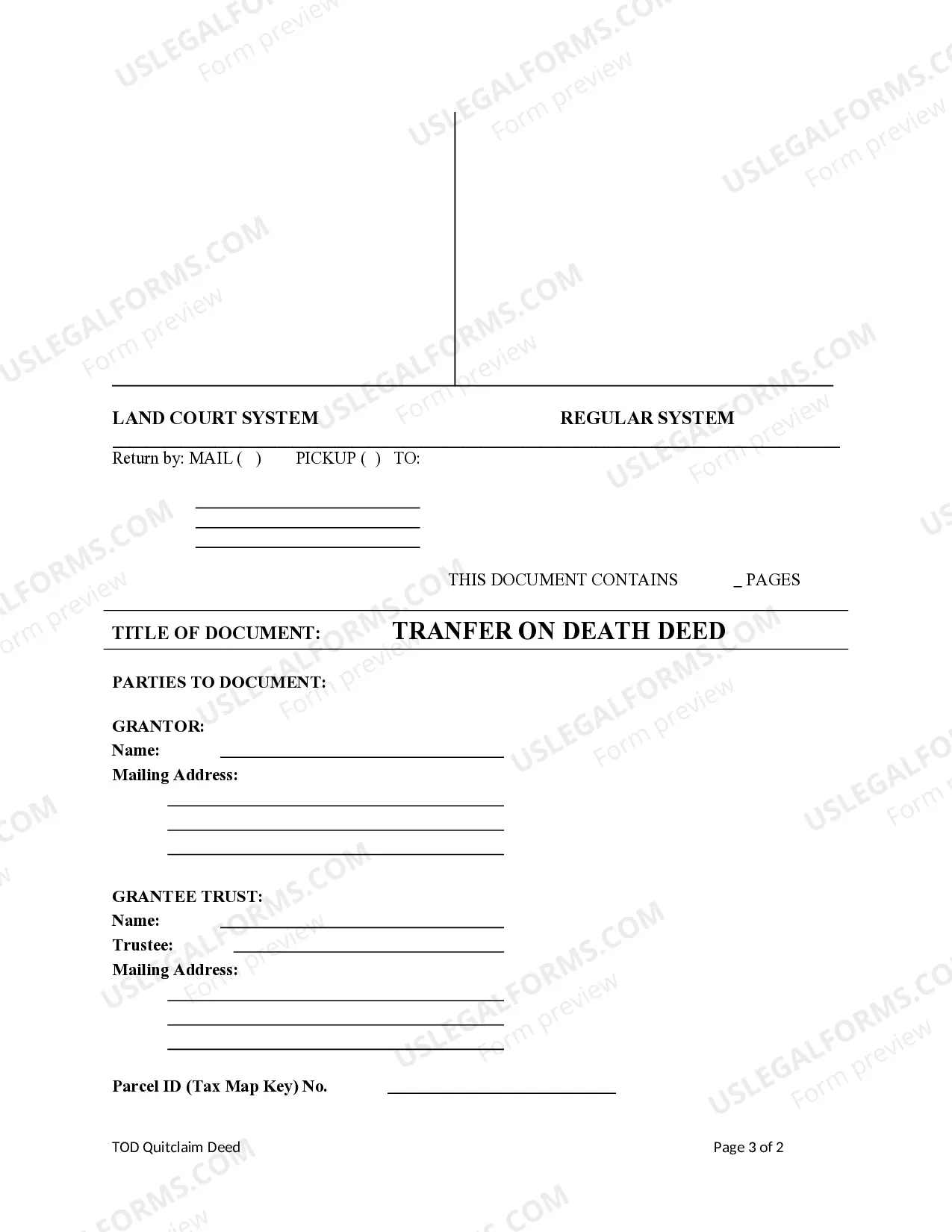

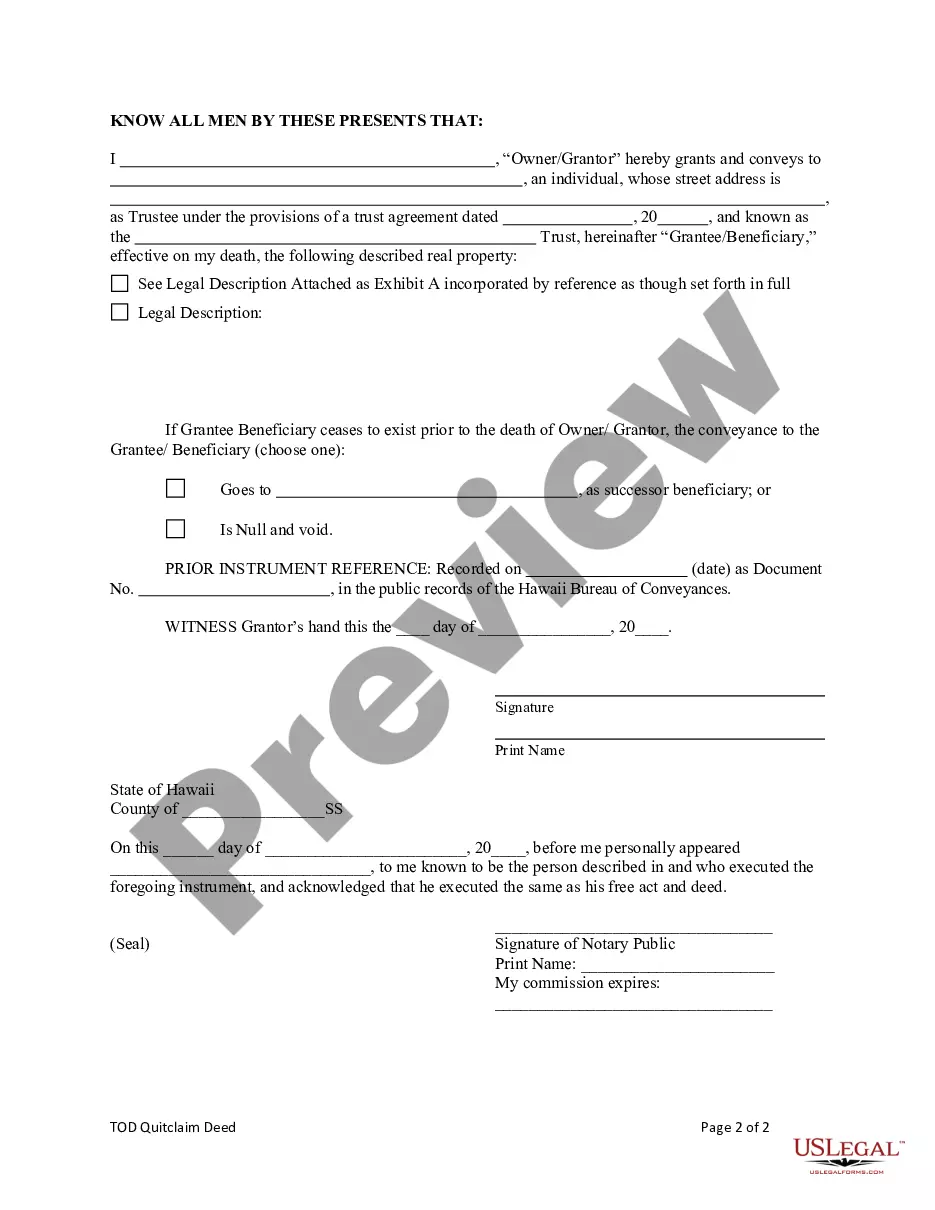

Hawaii Transfer On Death Deed Form

Description

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To A Trust?

Whether you handle documents frequently or occasionally need to submit a legal report, it is crucial to have a reliable resource where all samples are connected and current.

The initial step you should take with a Hawaii Transfer On Death Deed Form is to verify that it is the latest version, as this determines its eligibility for submission.

If you wish to simplify your search for the most recent document samples, look for them on US Legal Forms.

To acquire a form without creating an account, follow these steps: Use the search menu to locate the desired form. Review the Hawaii Transfer On Death Deed Form preview and description to confirm it is the specific one you are looking for. After verifying the form, just click Buy Now. Choose a suitable subscription plan. Create an account or Log In to your existing one. Utilize your credit card information or PayPal account to finalize the transaction. Select the download file format and confirm it. Eliminate confusion in dealing with legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms comprises a repository of legal forms that includes nearly every document example you might seek.

- Search for the templates you need, instantly check their relevance, and learn more about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Acquire the Hawaii Transfer On Death Deed Form examples in just a few clicks and save them anytime in your account.

- A US Legal Forms account will facilitate your access to all the samples you need with greater ease and less fuss.

- You merely need to click Log In in the website header and navigate to the My documents section where all the documents you require are readily available.

- You won’t need to spend time searching for the correct template or verifying its authenticity.

Form popularity

FAQ

Yes, Hawaii does have a transfer on death deed. This form allows property owners to designate a beneficiary who will receive the property automatically upon the owner’s death, avoiding probate. Utilizing this deed can streamline the transfer process and provide peace of mind for property owners. For ease and accuracy, consider using tools available on platforms like US Legal Forms to complete your Hawaii transfer on death deed form correctly.

To remove a deceased person from a deed in Hawaii, you typically need to record a notarized affidavit or an order from the court verifying the death. It is essential to gather necessary documents, like the death certificate and any relevant property deeds. Once completed, submit these documents to the county recorder's office. For those looking to simplify future property transfers, learning about the Hawaii transfer on death deed form can be beneficial.

A quitclaim deed in Hawaii allows one person to transfer their interest in a property to another individual without making any guarantees about the title. This means the recipient receives whatever interest the granter has, which can be helpful in informal property transfers. However, a quitclaim deed does not provide the same protections as a warranty deed. If you're considering this option, understanding the Hawaii transfer on death deed form can further assist in managing property transfer after death.

While a transfer on death deed in Illinois offers many benefits, it also has some drawbacks. One potential disadvantage includes the lack of control over the property after the owner’s death, as the designated beneficiaries receive the transfer directly. Additionally, creditors may still claim against the property even after the death. It's crucial to weigh these factors when considering the Hawaii transfer on death deed form as part of your estate planning.

In Illinois, you can transfer property after death using a transfer on death deed, which allows beneficiaries to inherit property directly. After the owner's death, you can present the Hawaii transfer on death deed form to establish the beneficiaries' rights. Make sure to properly record the deed to validate the transfer. This method can save time and minimize complications in the estate settlement process.

To complete a transfer on death deed in Illinois, you must ensure that the form is properly filled out and signed. You can use the Hawaii transfer on death deed form as a reference, but make sure it meets Illinois regulations. Additionally, you need to file the deed with the appropriate county recorder after the owner’s death. This transfer allows for a seamless passing of property, avoiding the probate process.

Transferring ownership of property in Hawaii typically involves preparing a new deed and submitting it to the local county office. Whether you are selling, gifting, or using a transfer on death deed, understanding the requirements is key. The Hawaii transfer on death deed form can streamline this process, especially if you want to pass your property to heirs without enduring the probate journey.

While transfer on death deeds offer many benefits, they also have some disadvantages. For instance, they do not provide protection from creditors and may not suit everyone’s financial situation. It's crucial to consider these aspects when utilizing the Hawaii transfer on death deed form as part of your estate planning.

Indeed, Hawaii recognizes transfer on death deeds as a valid estate planning option. This type of deed provides a straightforward method for transferring real estate to heirs outside of probate. By using the Hawaii transfer on death deed form, you can ensure a clear transfer of your property upon your passing.

Yes, Hawaii does allow for transfer on death deeds. This legal tool enables property owners to designate beneficiaries who will inherit the property upon their death, without going through probate. Utilizing the Hawaii transfer on death deed form can facilitate this process and ensure your property is transferred according to your wishes.