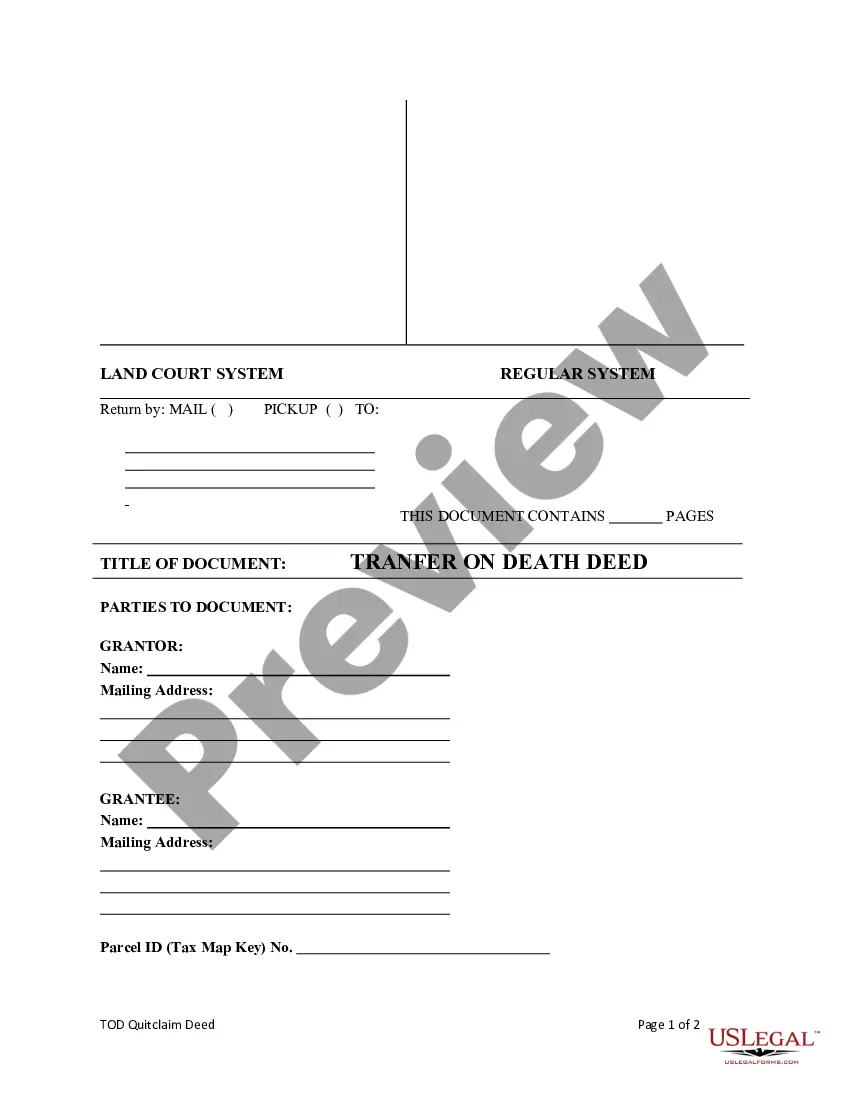

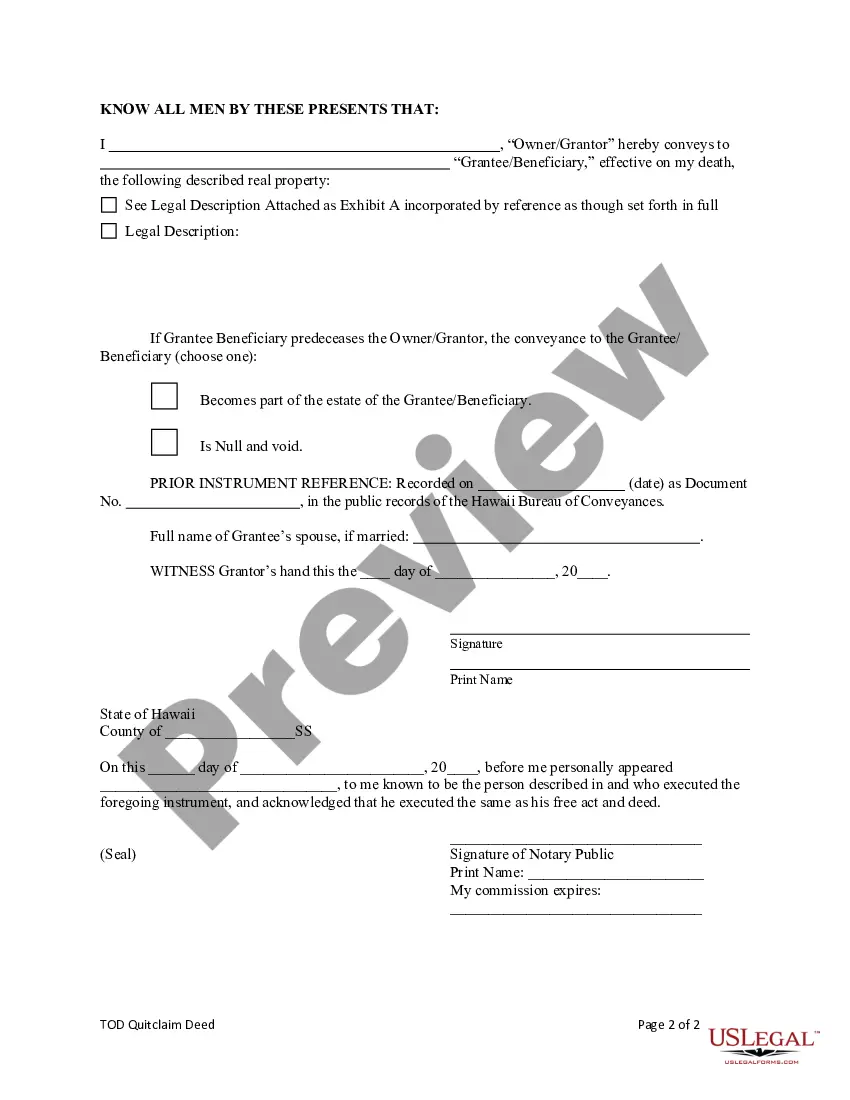

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is also an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer On Death Deed Form With Wisconsin

Description

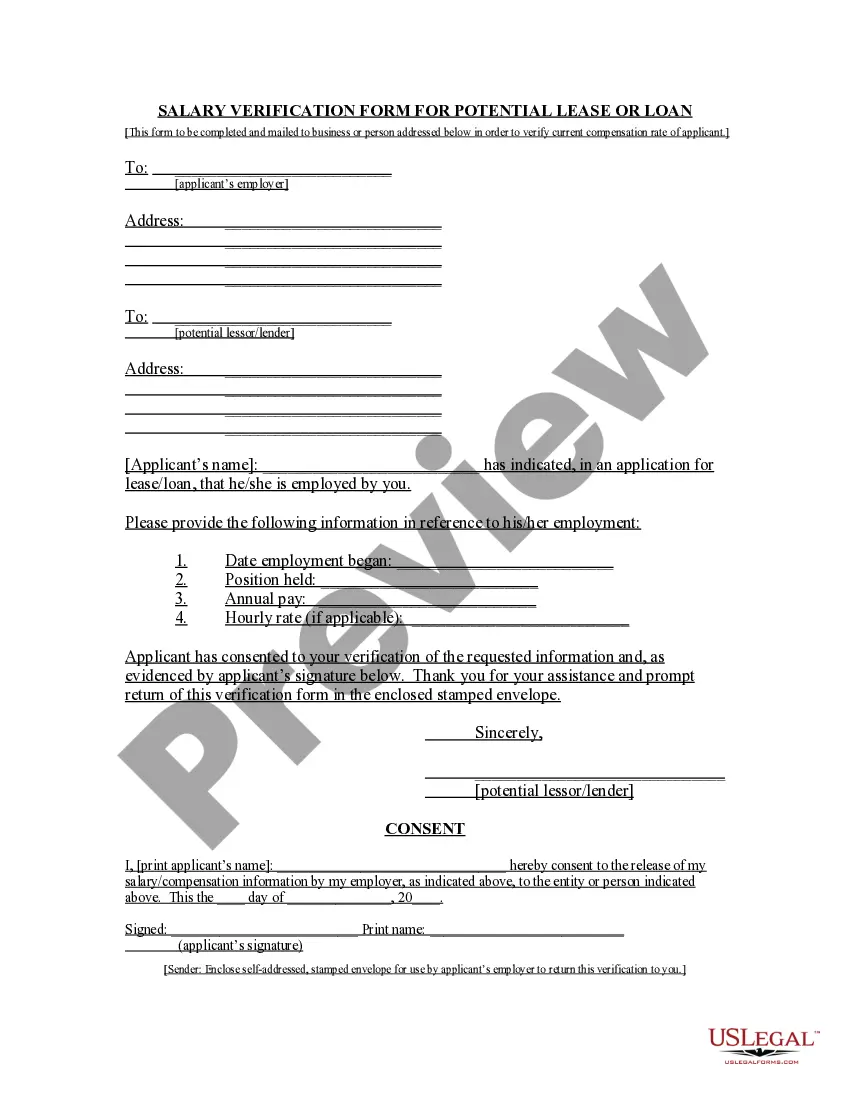

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

Identifying a reliable source to acquire the most up-to-date and suitable legal templates constitutes a significant part of dealing with bureaucratic processes.

Obtaining the correct legal documents requires accuracy and careful consideration, which highlights the necessity of obtaining samples of the Hawaii Transfer On Death Deed Form With Wisconsin exclusively from credible sources like US Legal Forms. An incorrect template could squander your time and delay the matter at hand.

Eliminate the hassle associated with your legal documentation. Explore the extensive collection at US Legal Forms to find legal templates, assess their relevance to your circumstances, and download them without delay.

- Utilize the catalog navigation or search feature to find your template.

- Examine the form’s description to confirm if it meets the necessities of your jurisdiction.

- Inspect the form preview, if available, to verify that the template is indeed the one you need.

- Continue searching and find the correct template if the Hawaii Transfer On Death Deed Form With Wisconsin does not align with your requirements.

- If you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected documents in My documents.

- If you don’t have an account, click Buy now to acquire the form.

- Select the payment plan that fits your needs.

- Proceed to register to finalize your transaction.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Select the file format for downloading the Hawaii Transfer On Death Deed Form With Wisconsin.

- Once the form is saved on your device, you can modify it using the editor or print it for manual completion.

Form popularity

FAQ

A ?Transfer on Death? (TOD) Deed can be a useful tool when creating an estate plan. This particular type of deed can streamline the process of conveying real property incident to your death.

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.

Hawaii Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with either the Bureau of Conveyances or the Office of the Assistant Registrar of the Land Court (see "Recording Your Deed" below to determine which) before your death. ... The beneficiary's rights.

The deed could get complicated, and its validity contested if it is not recorded correctly or if the legal criteria are not met. If there is no provision for a contingent beneficiary, the transfer on the death deed is rendered ineffective if the named beneficiary passes away before the property owner.

The Grantors (current owners) must sign the deed before a notary public. 2. Go to the Wisconsin Department of Revenue's E-Return website at and complete an E-Return (eRETR). Most of the information you need for the eRETR comes from your property tax statement and the new deed.