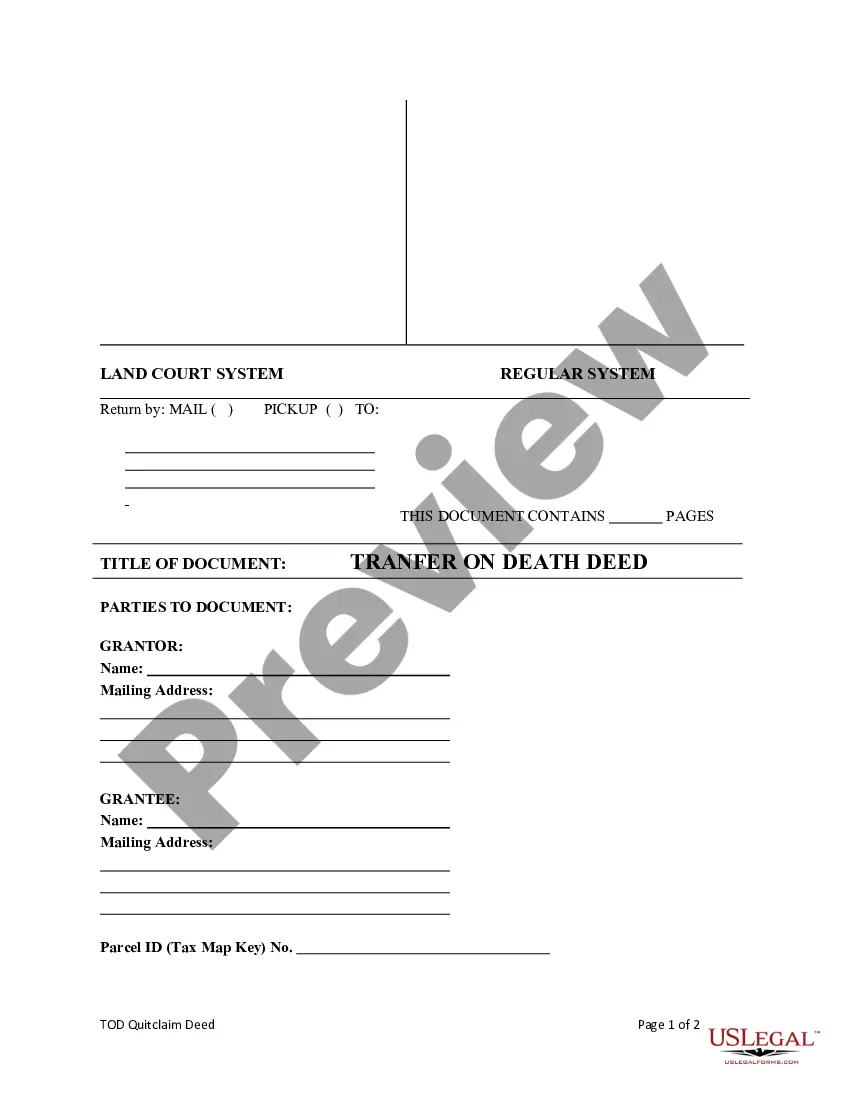

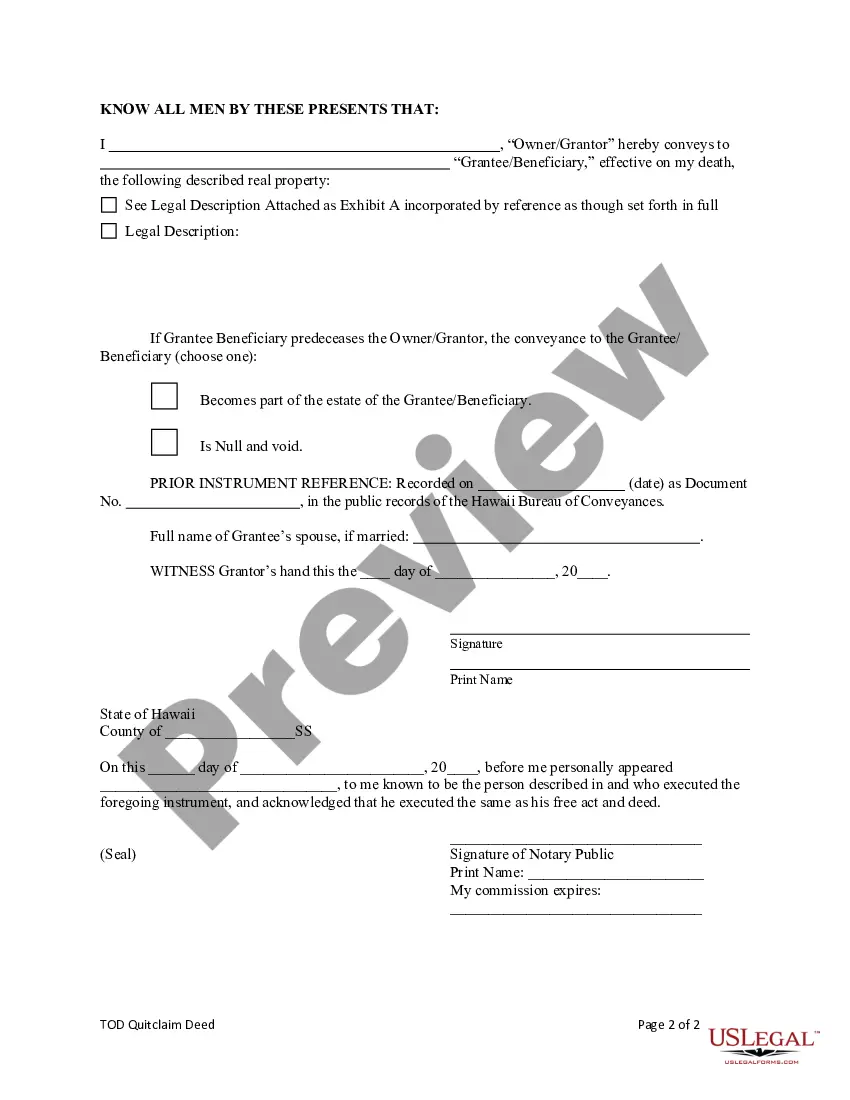

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is also an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Title: Understanding Hawaii Transfer on Death Deed Form with Beneficiaries: A Detailed Overview Introduction: In Hawaii, individuals seeking to transfer their real estate property upon their death have the option to utilize a Transfer on Death (TOD) Deed. This legal document allows property owners to name beneficiaries who will automatically inherit the property without the need for probate. This article explores the concept of Hawaii Transfer on Death Deed Form with Beneficiaries, explaining its purpose, advantages, and the different types available to residents. Types of Hawaii Transfer on Death Deed Form with Beneficiaries: 1. Hawaii Statutory Transfer on Death Deed: The Hawaii Statutory Transfer on Death Deed is a standard form that property owners can use to transfer their real estate upon death. It provides a straightforward and efficient process for transferring property to designated beneficiaries while bypassing probate. 2. Enhanced Life Estate Deed: Also known as the "Lady Bird Deed," this specific type of Transfer on Death Deed Form allows property owners to retain complete control over their property during their lifetime while designating beneficiaries who will inherit the property upon the owner's death. It differs from the standard TOD Deed as the property owner retains the ability to sell, mortgage, or otherwise alter the property's ownership rights during their lifetime. 3. Joint Tenancy with Right of Survivorship: Although not exclusively a Hawaii TOD Deed, Joint Tenancy with Right of Survivorship is a common form of property ownership where multiple owners have an equal share of the property. In this arrangement, when one owner passes away, the surviving joint tenants automatically inherit the deceased owner's share. Benefits and Considerations: 1. Avoidance of Probate: Utilizing a Hawaii Transfer on Death Deed Form with Beneficiaries provides property owners with the ability to transfer property directly to beneficiaries without the need for probate. This can save considerable time, expenses, and potential complications associated with the probate process. 2. Flexibility: Different types of TOD Deeds offer varying degrees of flexibility. For instance, while the standard Hawaii TOD Deed is relatively straightforward, the Enhanced Life Estate Deed grants property owners the freedom to maintain control over their property and make changes as desired during their lifetime. 3. Privacy: Unlike wills and probate proceedings, Transfer on Death Deed Forms with Beneficiaries offer a level of privacy as they do not become public records until the owner's death. This allows owners to keep their intentions confidential until the designated transfer occurs. 4. Beneficiary Designation: With a TOD Deed, property owners have the freedom to designate multiple beneficiaries, specify the share of property each will receive, and even name alternate beneficiaries in case the primary beneficiaries cannot inherit the property. Conclusion: Hawaii Transfer on Death Deed Form with Beneficiaries offers property owners a convenient and efficient method for transferring real estate upon their death. Whether utilizing the standard TOD Deed, Enhanced Life Estate Deed, or Joint Tenancy with Right of Survivorship, these legal instruments help avoid probate, provide flexibility, maintain privacy, and ensure a smooth property transfer to chosen beneficiaries.