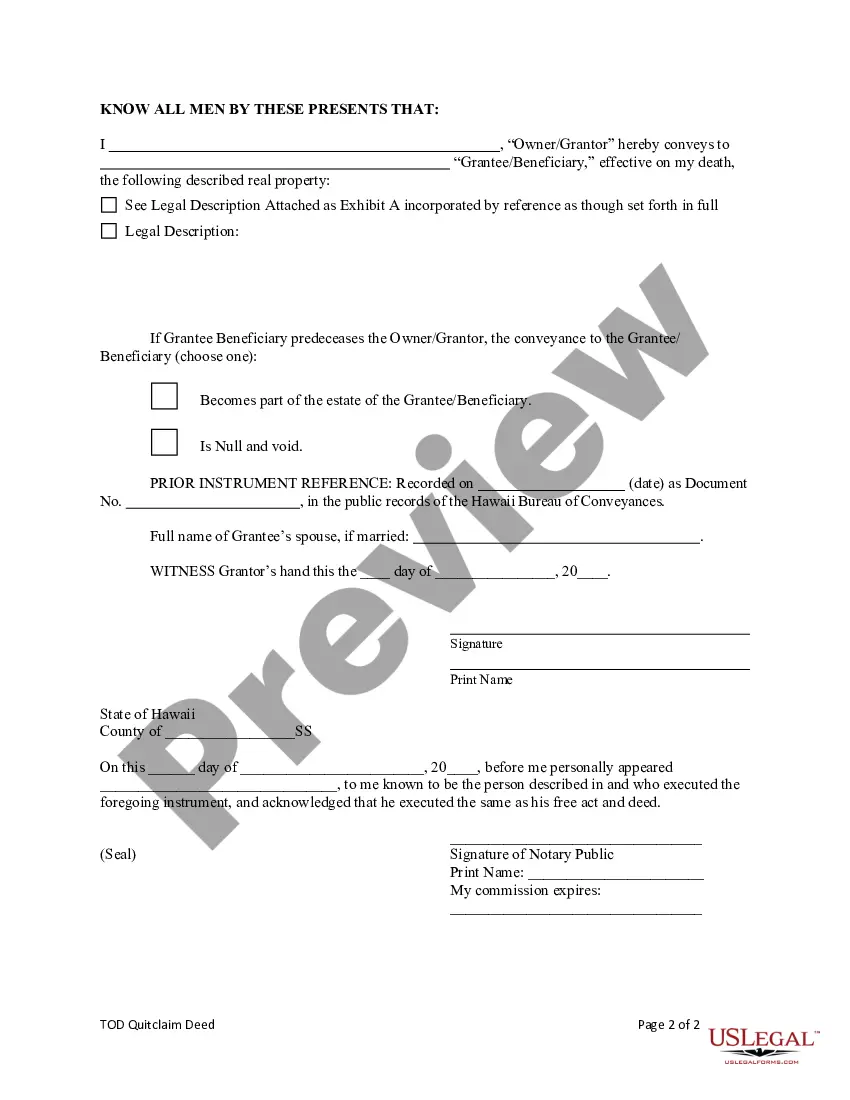

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is also an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer On Death Deed Form For California

Description

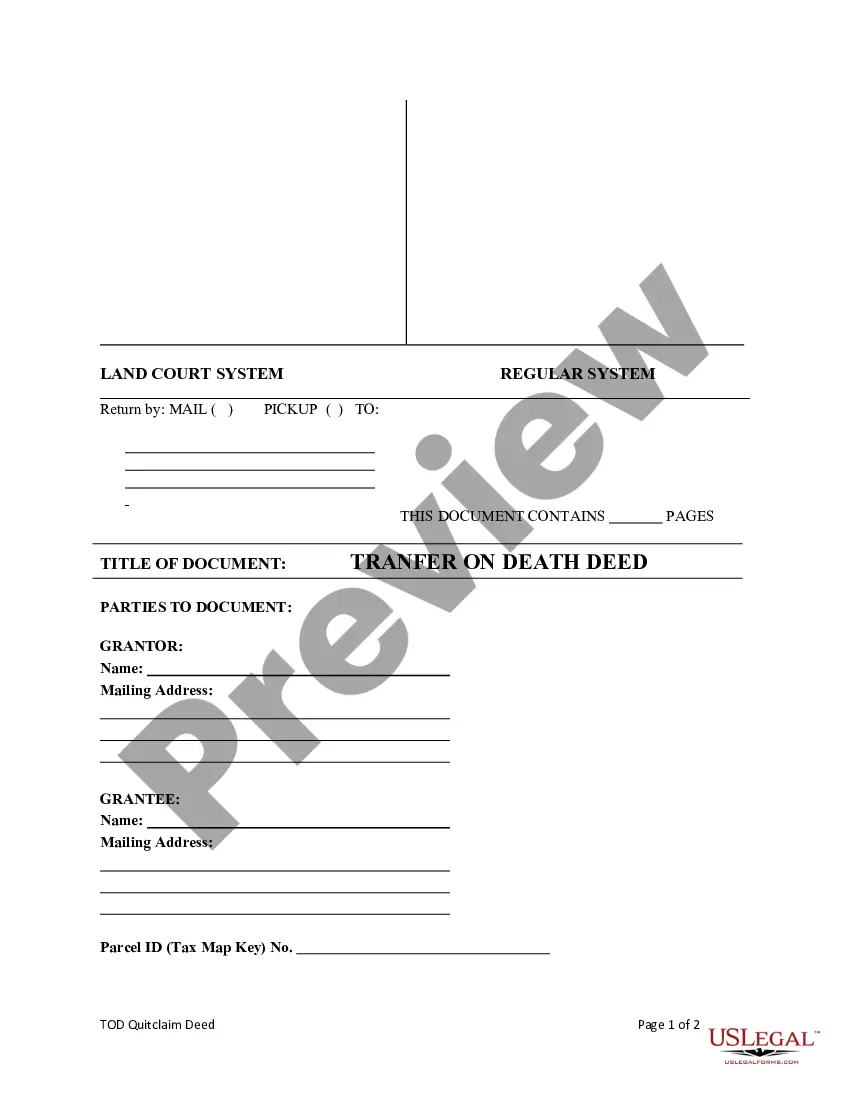

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

Drafting legal documents from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a a more straightforward and more cost-effective way of preparing Hawaii Transfer On Death Deed Form For California or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of over 85,000 up-to-date legal documents addresses virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms diligently prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the Hawaii Transfer On Death Deed Form For California. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and navigate the library. But before jumping straight to downloading Hawaii Transfer On Death Deed Form For California, follow these tips:

- Review the document preview and descriptions to make sure you are on the the document you are looking for.

- Check if form you select conforms with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Hawaii Transfer On Death Deed Form For California.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms boasts a good reputation and over 25 years of experience. Join us today and turn document execution into something easy and streamlined!

Form popularity

FAQ

To file a transfer on death deed in Hawaii, you must complete the appropriate form, ensuring all required details are correct. After completing the Hawaii transfer on death deed form for California, you should sign the form in front of a notary and then file it with the Bureau of Conveyances. This process formally records your intent and protects your property from probate, offering peace of mind to you and your beneficiaries.

Transfer on Death (TOD) deeds are indeed available in California, offering a smooth way to transfer property upon your passing. However, it's important to remember that California has its own specific regulations and requirements for these deeds. If you are considering a Hawaii transfer on death deed form for California, ensure that you understand the legal implications and processes involved. Utilizing a reliable platform like US Legal Forms can guide you through the creation and filing of the necessary documents seamlessly.

Hawaii Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with either the Bureau of Conveyances or the Office of the Assistant Registrar of the Land Court (see "Recording Your Deed" below to determine which) before your death. ... The beneficiary's rights.

When a beneficiary inherits assets from a deceased owner, the beneficiary receives what is known as the "step up" in basis; essentially, the date of death value becomes the applicable value for purposes of calculating capital gains tax. This significant benefit is lost when a loved one is simply added to title.

A Revocable Living Trust A trust can be a great mechanism to avoid probate and is the recommended method. While there are some upfront fees for creating a trust, the fees are typically much less than probate costs. Generally, you, as trustee, retain control of the assets held within the trust during your lifetime.

Step 1: Locate the Current Deed for the Property. ... Step 2: Read the ?Common Questions? Listed on Page 2 of the TOD Deed. ... Step 3: Fill Out the TOD Deed (Do Not Sign) ... Step 4: Sign in Front of a Notary; Have Two Witnesses Sign. ... Step 5: Record the Deed at the Recorder's Office within 60 Days of Signing It.

In 2016, the laws in California were updated to allow people with a home, condo, farm of 40 acres or less, or a multi-unit building with no more than four units to be designated on a property deed known as a Transfer-on-Death deed which the beneficiary of the property would be at the owner's death.