Llc Operating Agreement Hawaii For Llc

Description

How to fill out Hawaii Limited Liability Company LLC Operating Agreement?

Legal administration can be exasperating, even for the most seasoned experts. When you’re looking for an LLC Operating Agreement Hawaii for LLC and cannot find the time to locate the correct and updated version, the process can be overwhelming.

A robust online form directory could be a game-changer for anyone aiming to handle these situations efficiently. US Legal Forms is a leading provider in online legal documents, offering over 85,000 state-specific legal templates available for you at any time.

Access a resource hub of articles, guidelines, and materials relevant to your circumstances and requirements.

Save time and effort in finding the documents you need, and use US Legal Forms' advanced search and Preview feature to locate the LLC Operating Agreement Hawaii for LLC and obtain it.

Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your everyday document management into a seamless and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check My documents tab to view the documents you’ve previously saved and organize your folders as you prefer.

- If it’s your first time using US Legal Forms, create a free account and get unlimited access to all the platform's features.

- Once you’ve found the form you need, confirm this is the correct document by previewing it and reviewing its description.

- Make sure the template is valid in your state or county.

- Click Buy Now when you’re ready.

- Choose a subscription plan.

- Select the format you prefer, and Download, fill out, sign, print, and submit your document.

- Access state- or county-specific legal and business templates.

- US Legal Forms addresses any requirements you may have, from individual to corporate documents, in one location.

- Use innovative tools to complete and manage your LLC Operating Agreement Hawaii for LLC.

Form popularity

FAQ

Hawaii does not legally require an operating agreement for your LLC. However, it is advisable to have one, as it clearly defines the operational framework. By crafting an LLC operating agreement in Hawaii for LLC, you can ensure that your business runs smoothly and avoid potential disputes down the line.

Yes, you can write your own operating agreement for your LLC. It's essential to ensure it covers all necessary aspects like management structure and member responsibilities. If you need guidance, uslegalforms provides templates and resources to help you create a solid LLC operating agreement in Hawaii for LLC.

Not all LLCs have operating agreements, as they are not legally mandated in every state. However, creating one is beneficial for all LLCs, as it helps clarify member roles and operational procedures. An LLC operating agreement in Hawaii for LLC will strengthen your business's foundation and promote effective management.

In Hawaii, an operating agreement is not legally required for an LLC, but it is strongly recommended. This document aids in defining the roles and responsibilities of members, which provides a clear operational framework. Additionally, having an LLC operating agreement in Hawaii for LLC can protect you against potential conflicts.

Without an operating agreement, your LLC may face challenges in governance and management. In Hawaii, an LLC that lacks an operating agreement will rely on state laws, which may not reflect the members' wishes. This could lead to misunderstandings and complications, making an LLC operating agreement in Hawaii for LLC crucial for smooth operations.

Yes, an operating agreement (OA) is highly recommended for your LLC. It serves as a vital document that outlines the management structure and operational procedures. Having an LLC operating agreement in Hawaii for LLC ensures clarity among members and helps prevent disputes in the future.

Starting an LLC in Hawaii will include the following steps: #1: Choose a Name for Your Hawaii LLC. #2: Designate a Registered Agent. #3: File Your Articles of Organization. #4: Create an Operating Agreement. #5: Request Tax ID Numbers. #6: File Your Hawaii LLC Annual Report.

It will cost you $50 to register your LLC in Hawaii with the Hawaii Department of Commerce and Consumer Affairs Business Registration Division, plus an additional $1 State Archives fee. Filing online is the fastest way to complete the paperwork.

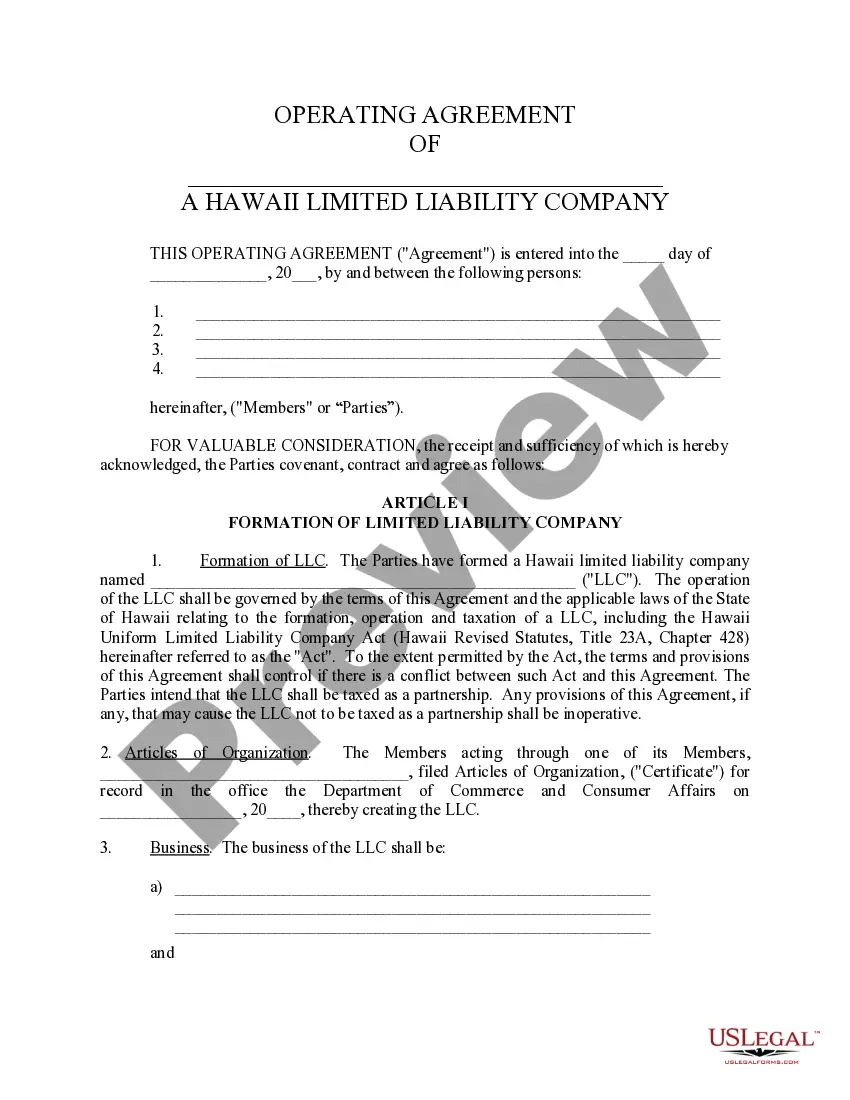

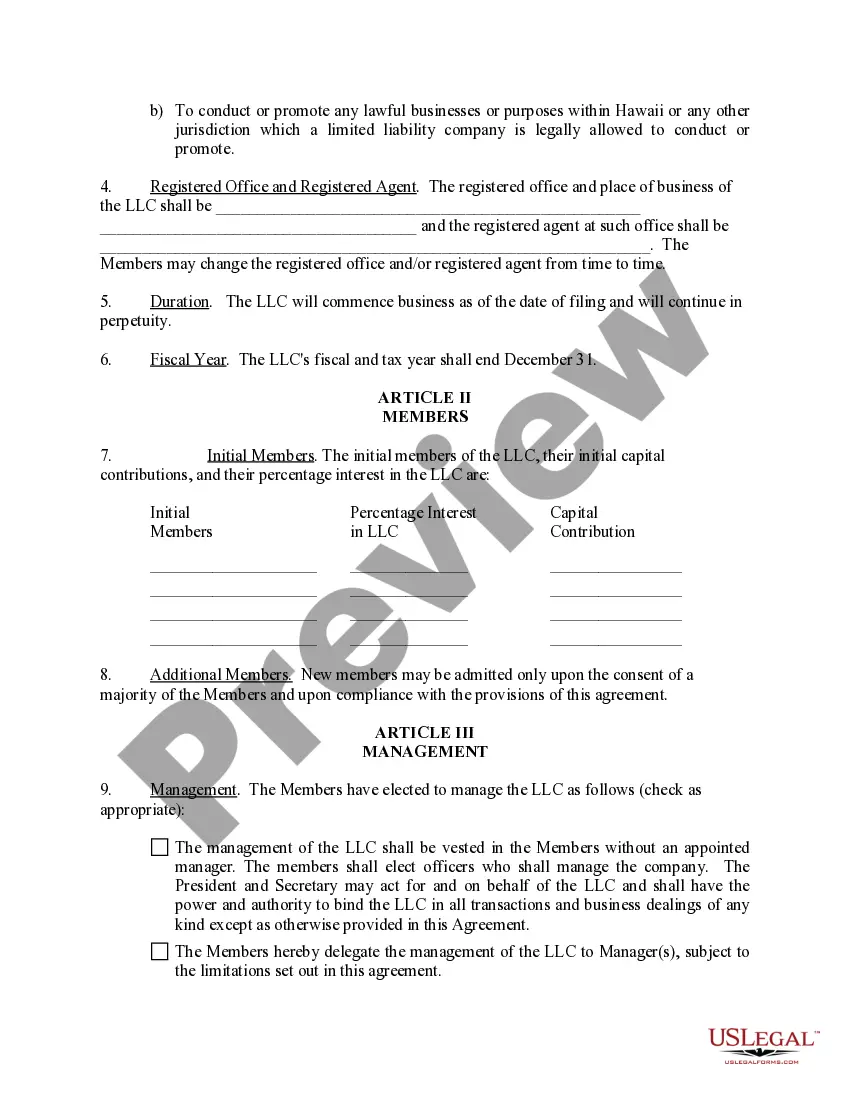

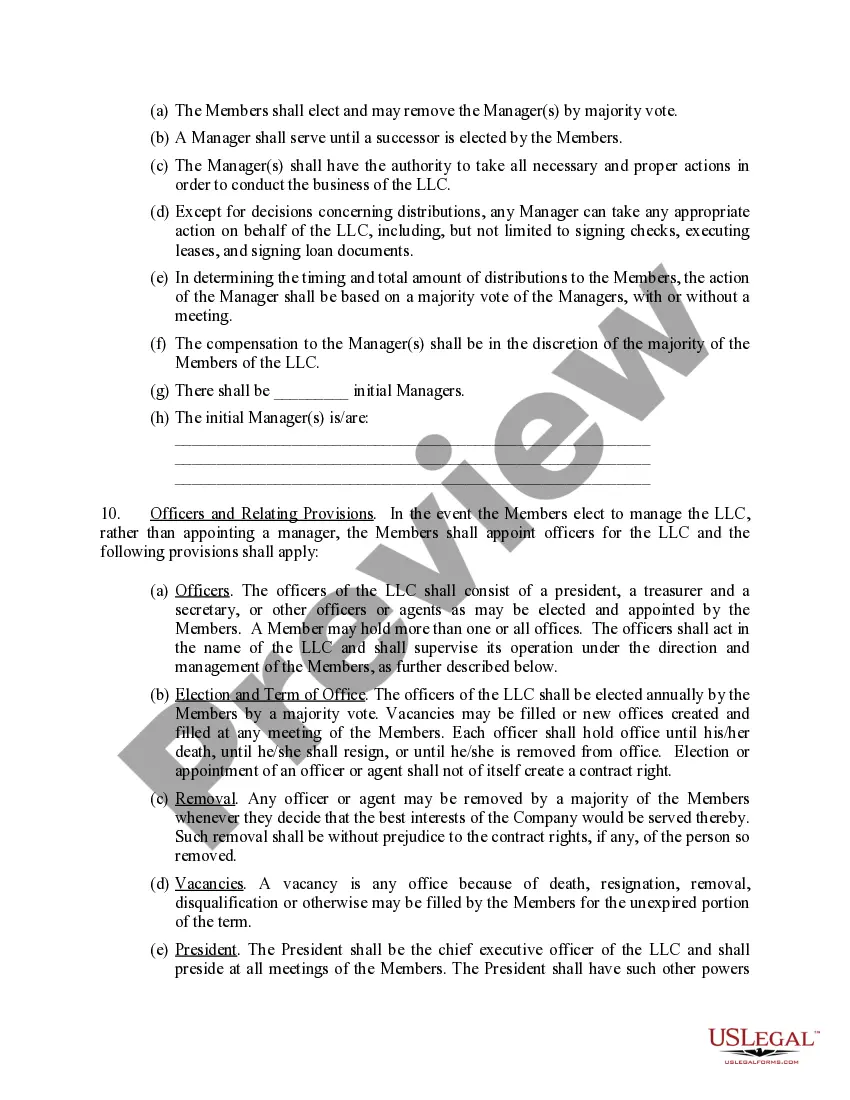

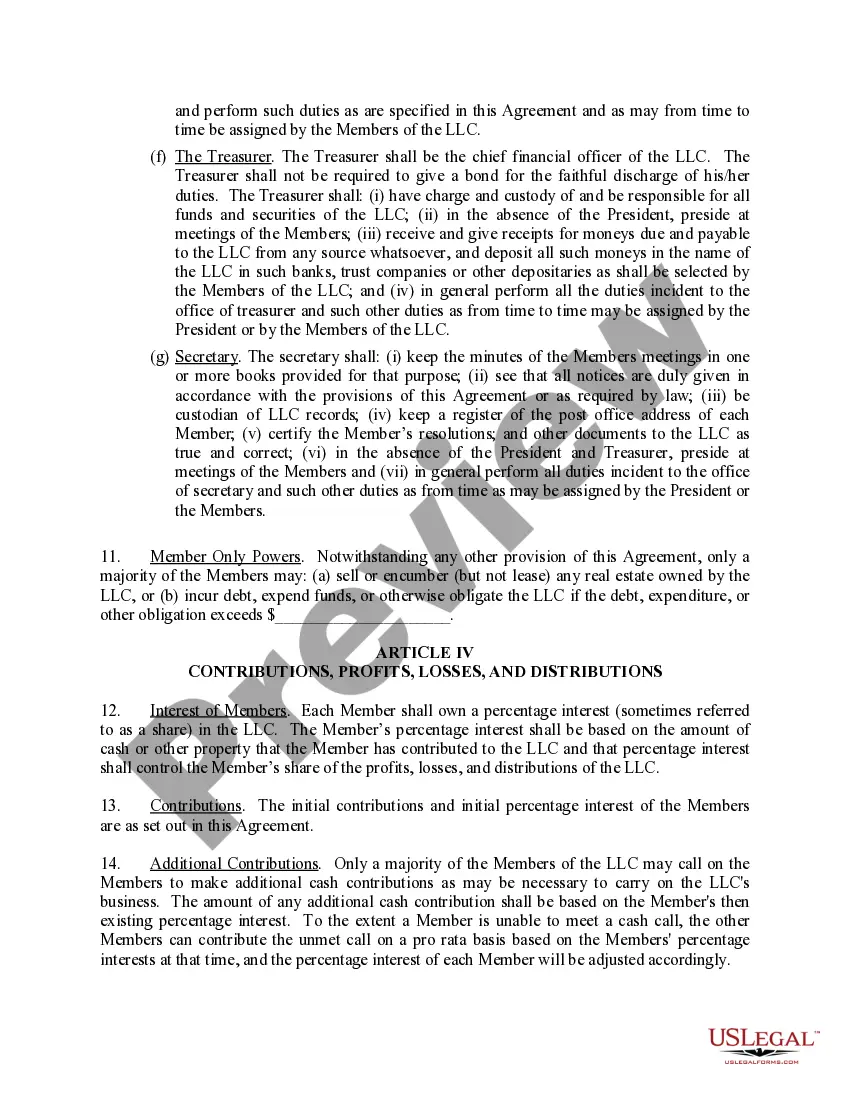

A Hawaii LLC Operating Agreement is a written contract between the LLC Members (LLC owners). This legal document includes detailed information about membership structure, who owns the company and how the LLC is managed.

Hawaii Annual Report Fee: $12.50 Hawaii LLCs are required by state law to file an annual report. The report costs $12.50 if filed online, or $15 if you file your report by mail.