Estate Planning Checklist Form With 2 Points

Description

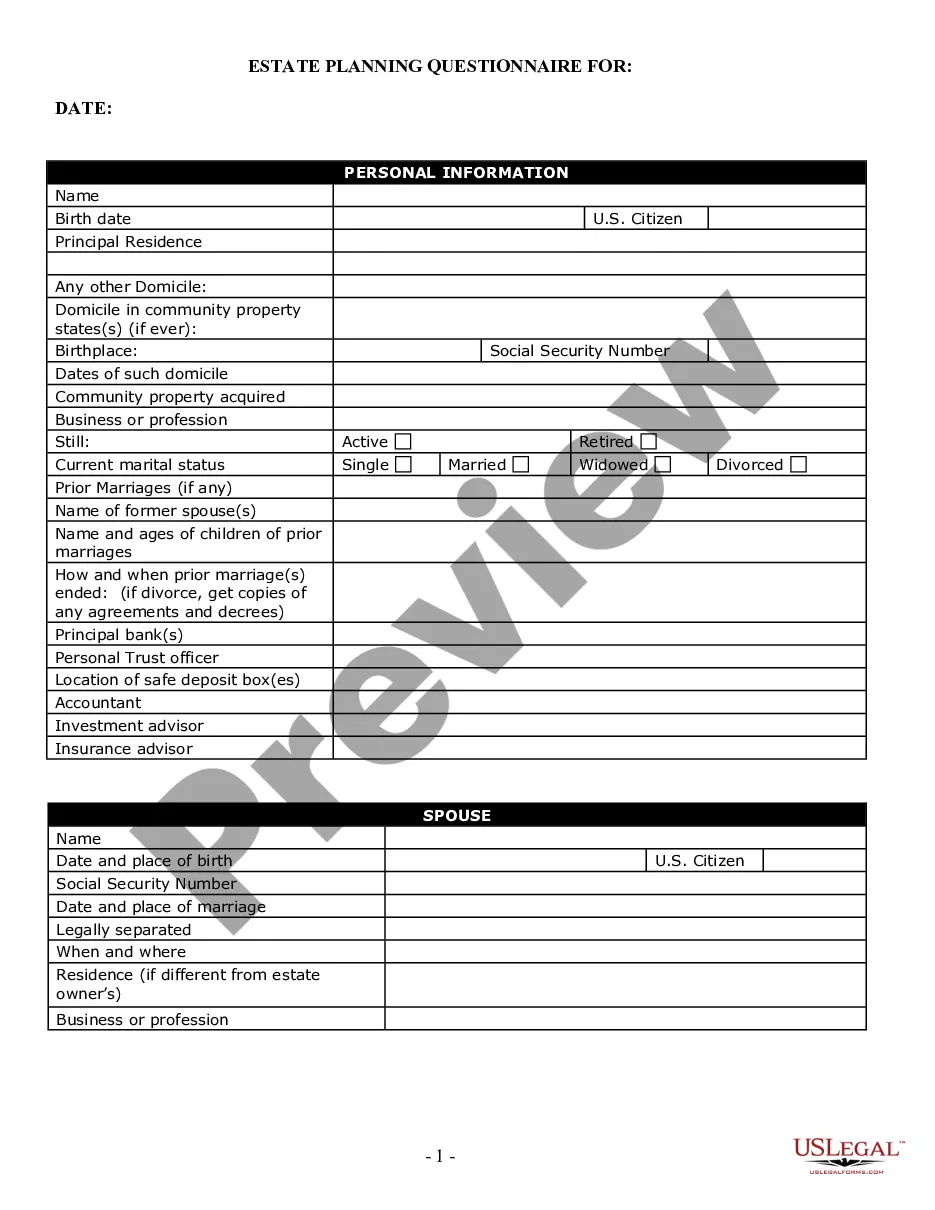

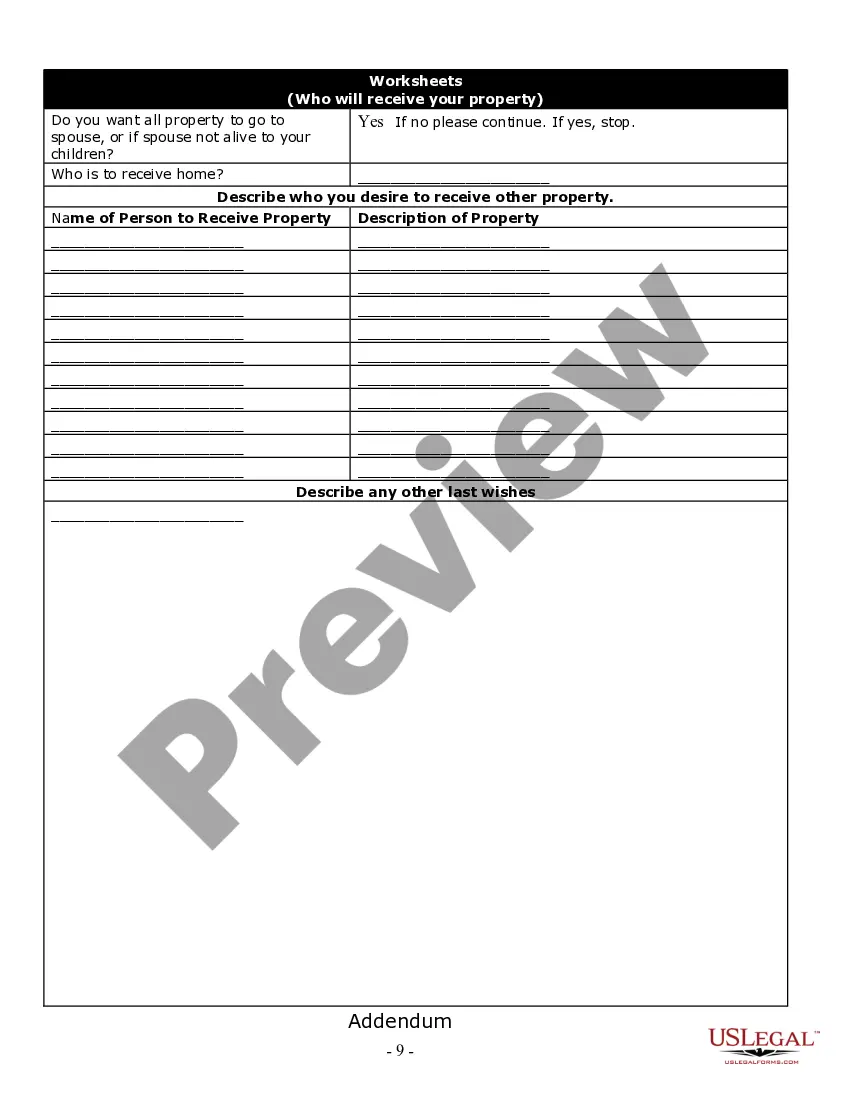

How to fill out Georgia Estate Planning Questionnaire And Worksheets?

How can you locate professional legal documents that adhere to your state's regulations and create the Estate Planning Checklist Form With 2 Points without consulting a lawyer.

Numerous online services offer templates to address various legal situations and requirements. However, pinpointing which available samples satisfy both your specific needs and legal standards may require some time.

US Legal Forms is a reliable platform that helps you discover official documents crafted in accordance with the most recent state law changes and economize on legal assistance.

If you do not have an account with US Legal Forms, follow these steps to proceed: Review the webpage you've opened to confirm that the form meets your requirements. Utilize the form description and preview options if available. Look for an alternative template in the header specifying your state if necessary. Click the Buy Now button once you locate the appropriate document. Select the most fitting pricing plan, then Log In or sign up for an account. Opt for the payment method (using a credit card or through PayPal). Choose the file format for your Estate Planning Checklist Form With 2 Points and click Download. The obtained templates will remain in your possession: you can always access them in the My documents section of your profile. Subscribe to our platform and create legal documents independently like a seasoned legal expert!

- US Legal Forms is not just an ordinary online directory.

- It consists of over 85k validated templates for various business and personal situations.

- All documents are categorized by field and state for a more efficient and user-friendly search process.

- Moreover, it provides robust tools for PDF editing and electronic signing, enabling users with a Premium subscription to swiftly complete their documentation online.

- It requires minimal time and effort to obtain the necessary forms.

- If you already possess an account, Log In and verify your subscription is active.

- Download the Estate Planning Checklist Form With 2 Points using the corresponding button next to the document name.

Form popularity

FAQ

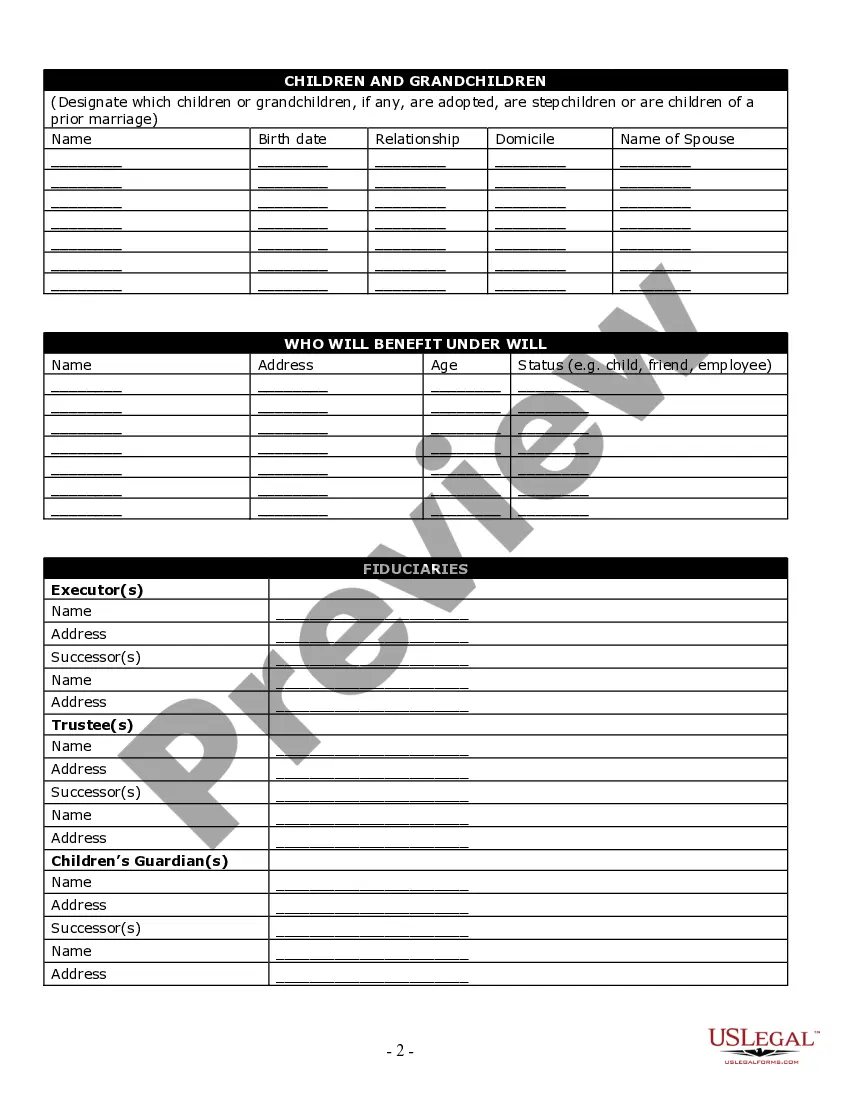

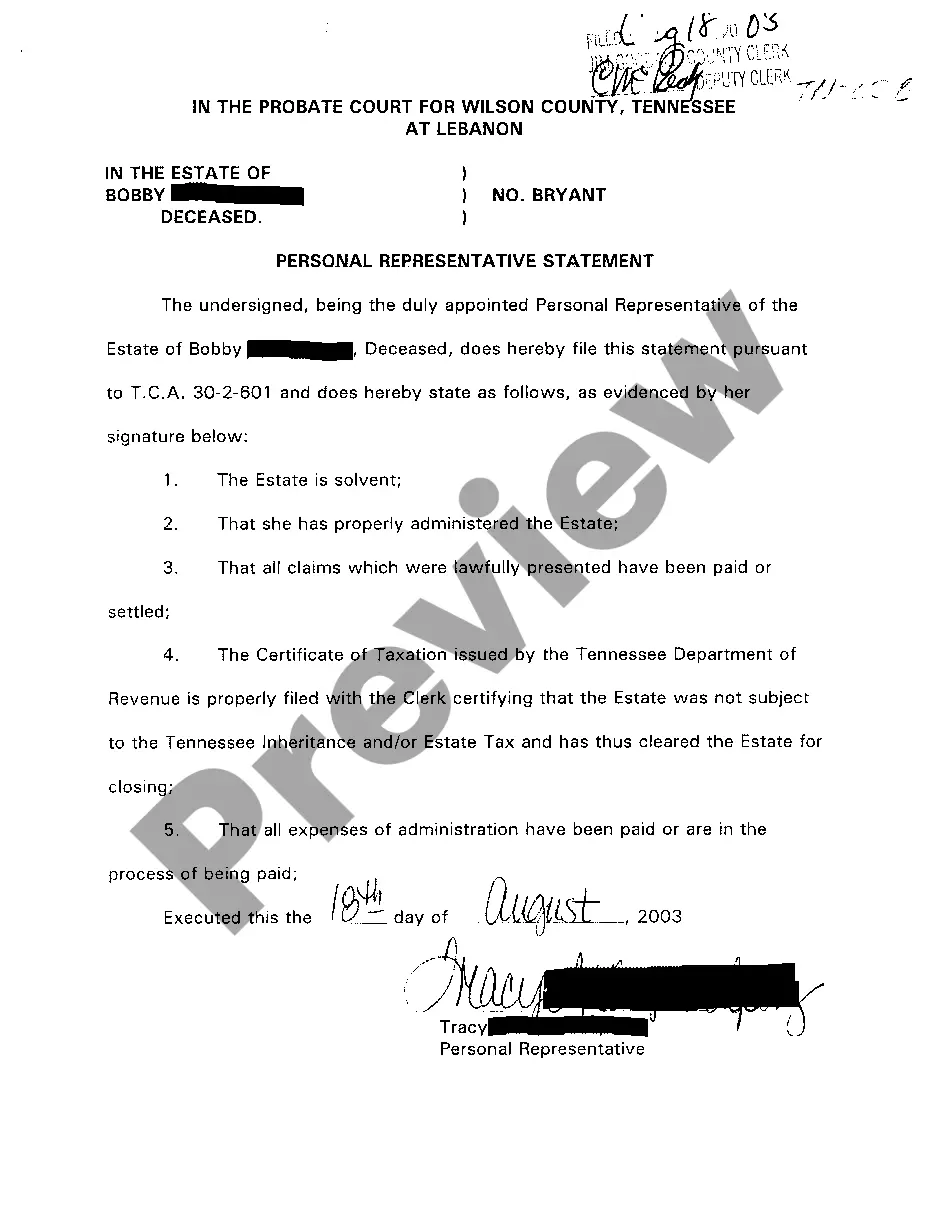

An important document needed for estate planning is a Last Will and Testament. This document outlines your wishes for the distribution of your assets after your passing. It can also nominate guardians for your minor children, ensuring their care according to your preferences. Utilizing an estate planning checklist form with 2 points can help simplify this process and ensure that you cover all necessary aspects.

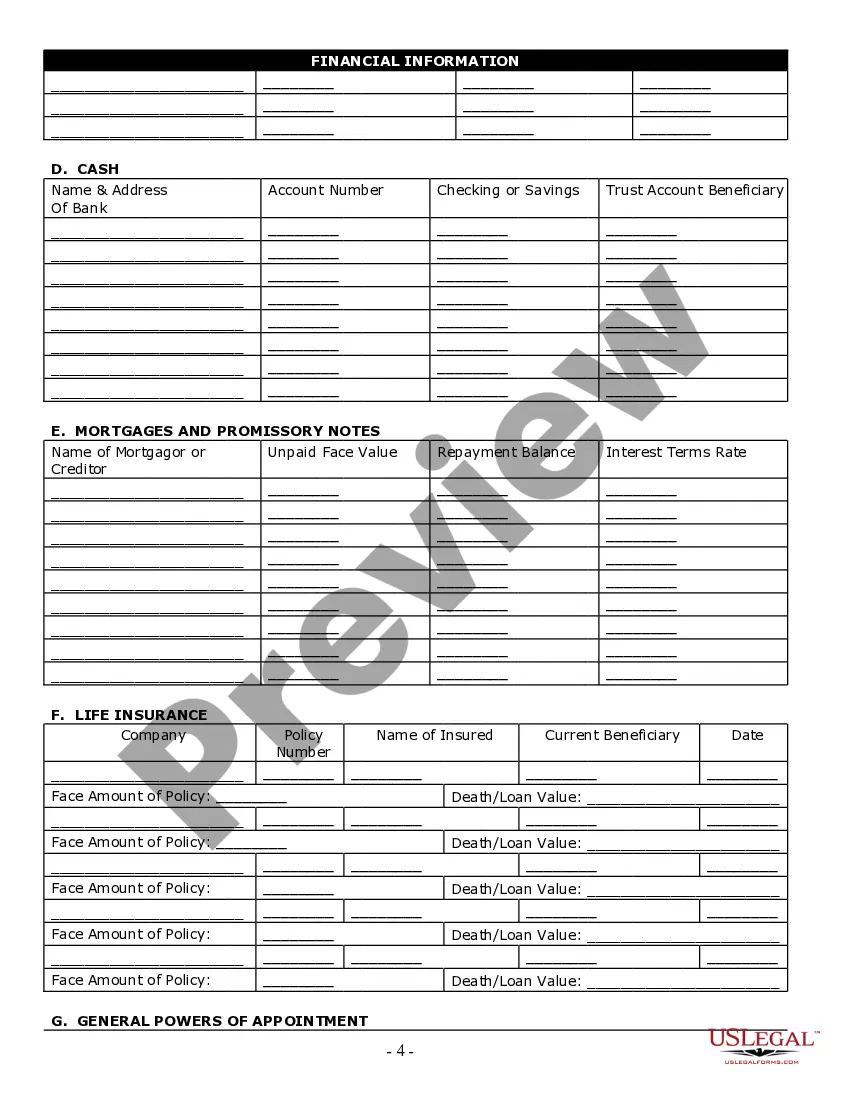

The 5 and 5 rule dictates that beneficiaries of an irrevocable trust can withdraw up to $5,000 or 5% of the trust's principal annually, without affecting the trust's overall structure. This balance meets the needs of beneficiaries while protecting the trust's purpose. When drafting your estate planning checklist form with 2 points, consider integrating this rule to help manage funds responsibly while ensuring compliance with legal standards.

The 5 or 5 rule refers to allowing beneficiaries the option to withdraw up to 5% of a trust's value each year or a sum of $5,000, thereby providing them with some liquidity. This rule supports both access to funds and preservation of the trust. Including the 5 or 5 rule in your estate planning checklist form with 2 points can greatly enhance financial flexibility for individuals involved.

Creating an essential checklist before death involves gathering important documents such as wills, insurance policies, and financial records. You should also ensure all beneficiaries and executors are properly informed of their roles. An estate planning checklist form with 2 points can serve as a practical guide. Additionally, consider consulting with a legal expert to address any unique aspects of your situation.

The 5 by 5 rule allows beneficiaries of a trust to withdraw up to $5,000 or 5% of the trust’s assets each year, whichever is greater. This flexibility enables beneficiaries to access funds without compromising the overall integrity of the estate plan. Including this rule in your estate planning checklist form with 2 points can enhance the benefits of the trust while still providing security.

While do-it-yourself estate planning can seem appealing, it often leads to critical oversights. Many people underestimate the complexities involved in setting up a legally sound estate plan. Using an estate planning checklist form with 2 points can help guide your process. However, consulting a professional can save you from potential legal issues in the future.

One of the biggest mistakes parents make is neglecting to clearly define how the funds in the trust should be used. Without specific guidelines, beneficiaries may mismanage the funds or use them in ways that do not align with your original intentions. It is crucial to include clear instructions in your estate planning checklist form with 2 points. Additionally, working with a legal professional can ensure that your trust fund operates as intended.

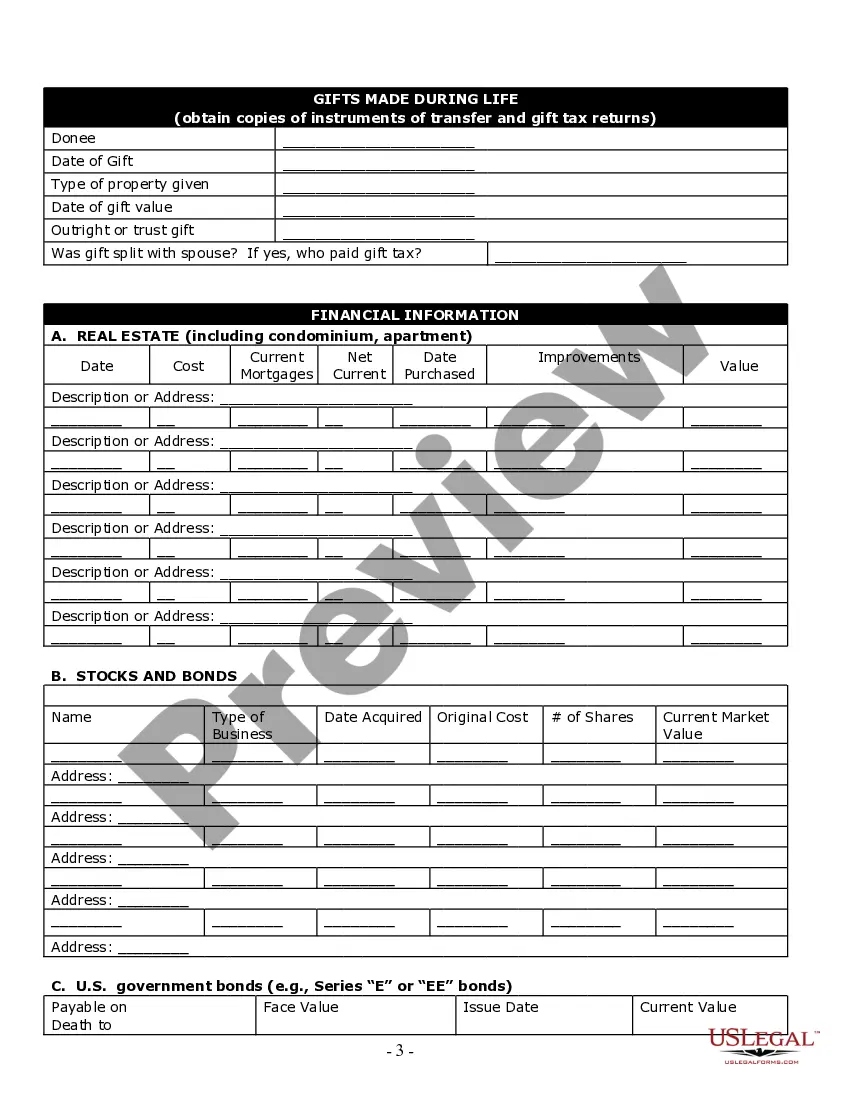

The 3 year look back rule for estate tax allows tax authorities to review any gifts made within three years before your death as part of your estate's tax calculations. This rule is crucial for understanding how prior gifts can affect your estate's overall value and tax implications. Using an estate planning checklist form can help you strategize your gifting approach to minimize estate tax liability.

In the U.S., the federal estate tax exemption allows individuals to inherit up to a certain amount without incurring taxes, which is periodically adjusted for inflation. As of recent updates, this amount is over several million dollars. To be well-prepared, consider using an estate planning checklist form to stay informed about exemption limits and better plan your estate.

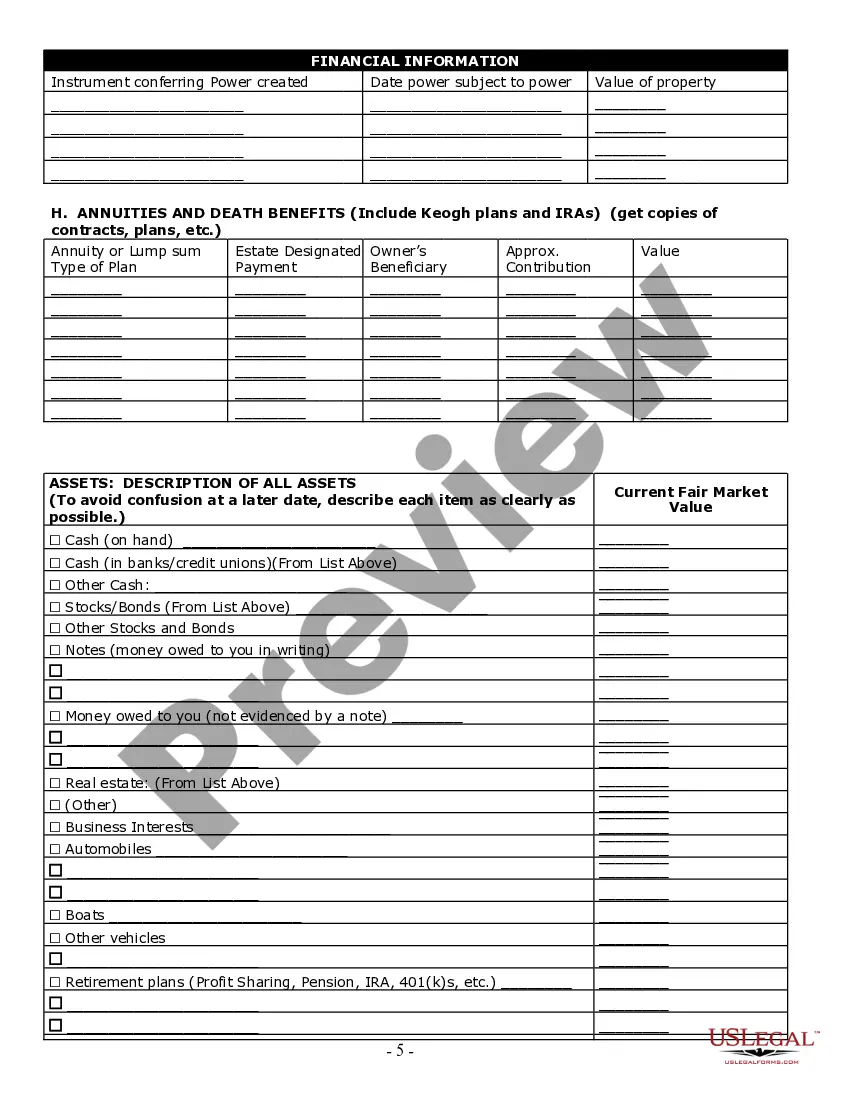

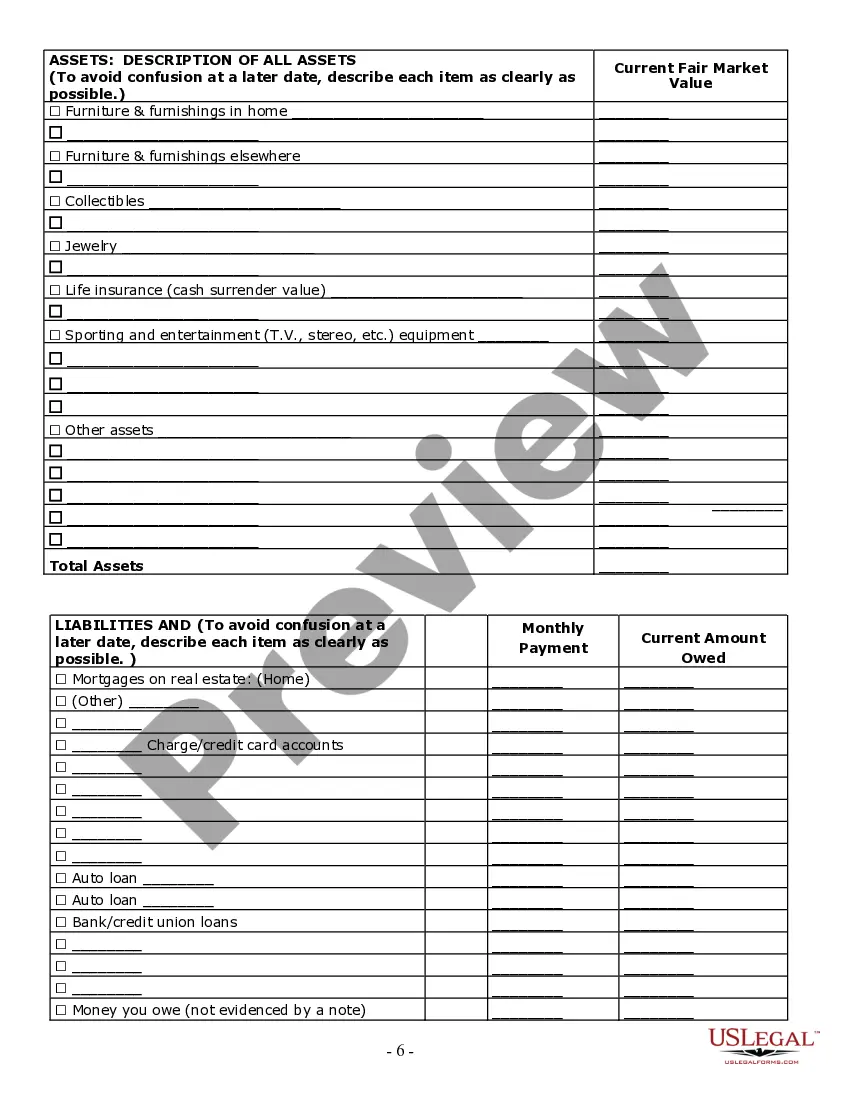

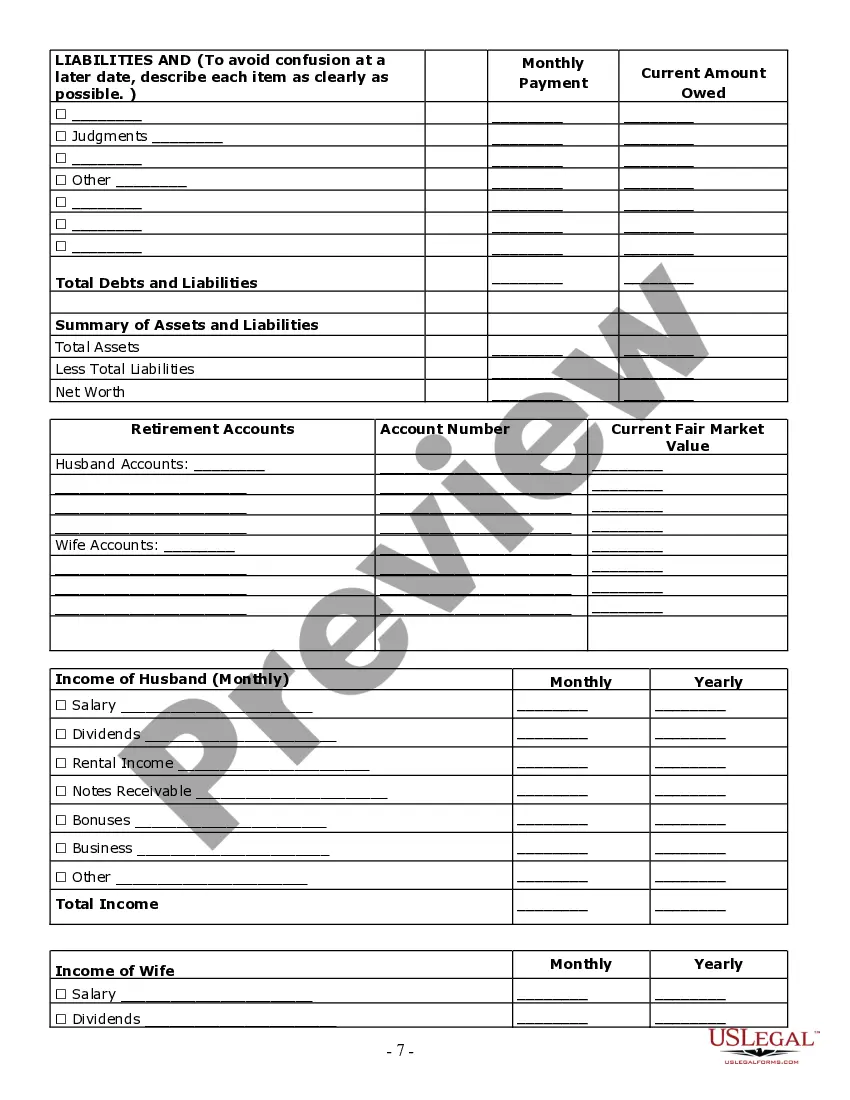

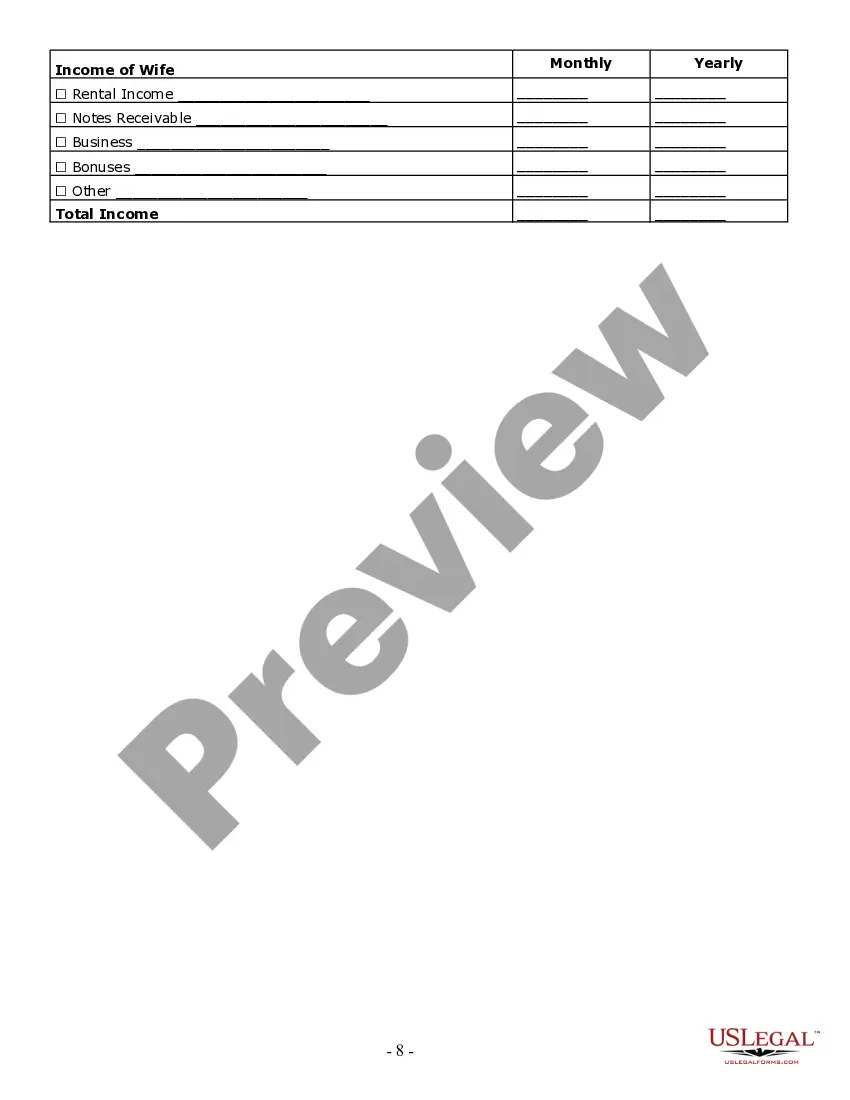

To create a list of assets for a will template, start by compiling all your financial accounts, real estate properties, vehicles, and personal belongings. Organize each asset, noting details such as location, value, and ownership. Using an estate planning checklist form during this process ensures you cover all necessary elements and simplifies the will drafting process.