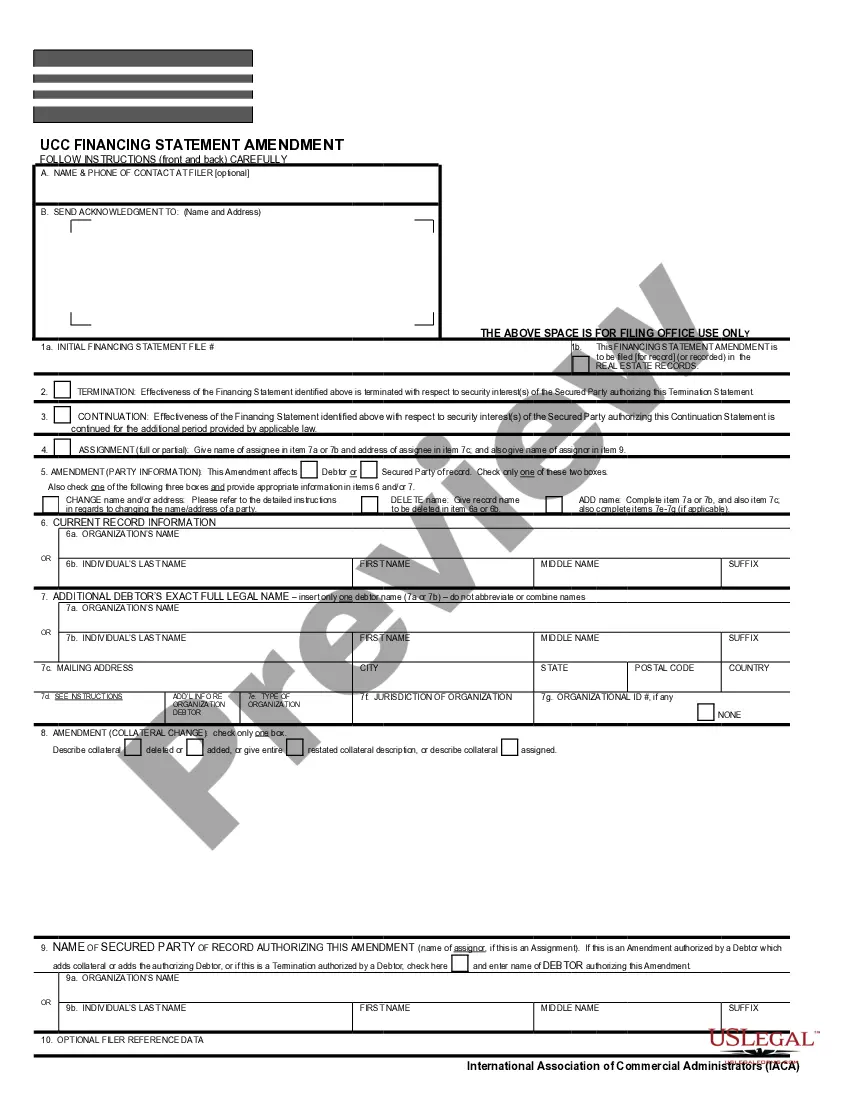

UCC1 - Financing Statement - Georgia - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Title: Ga UCC Forms for Filing — Simplifying the Uniform Commercial Code Process Introduction: Ga UCC forms for filing refer to the various documents required in Georgia to initiate and maintain a Uniform Commercial Code (UCC) filing. The UCC is a set of laws governing commercial transactions and securing creditors' interests in personal property. Properly filing UCC forms provides legal protection for parties involved in these transactions. This article will provide a detailed overview of Ga UCC forms for filing and highlight the different types available. 1. Georgia UCC-1 Financing Statement: The Georgia UCC-1 Financing Statement is the primary form used to file a UCC lien against personal property offered as collateral in a loan transaction. It is a crucial document to let potential creditors know about existing liens or encumbrances on the property, ensuring transparency in commercial transactions. 2. Georgia UCC-3 Amendment Statement: The Georgia UCC-3 Amendment Statement is used to amend, continue, assign, or terminate an existing UCC-1 financing statement. It allows the parties involved to modify or update the initial filing based on changes in the transaction terms, collateral, or other relevant details. 3. Georgia UCC-5 Information Statement: The Georgia UCC-5 Information Statement serves to record additional information that does not directly modify any previous filings. It can be used to provide publicly available information regarding the debtor, secured party, or collateral without impacting the validity or priority of any existing filings. 4. Georgia UCC-11 Information Request: The Georgia UCC-11 Information Request form is used to gather information about existing UCC filings. It allows interested parties to request a search report, verifying the status of UCC filings, recorded liens, or other relevant details related to specific debtors or secured parties. Conclusion: Understanding the necessary Ga UCC forms for filing is essential for engaging in secure and transparent commercial transactions in Georgia. Whether filing a financing statement, making amendments, providing additional information, or conducting due diligence, these forms ensure the proper documentation and management of personal property liens. By utilizing the correct Ga UCC forms effectively, parties involved can protect their interests, establish priority, and facilitate smooth and legally sound transactions.