Satisfaction, Release or Cancellation of Security Deed by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

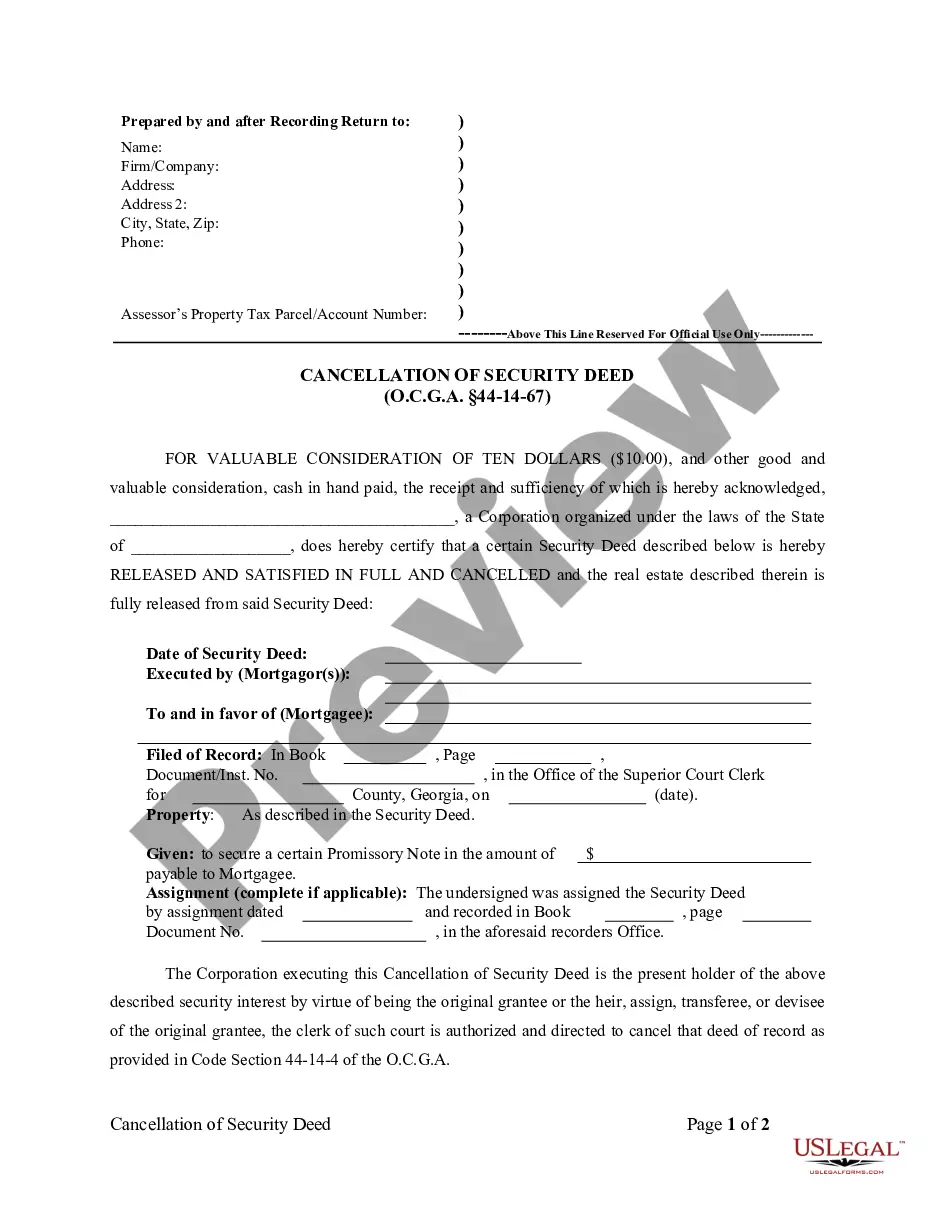

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Georgia Law

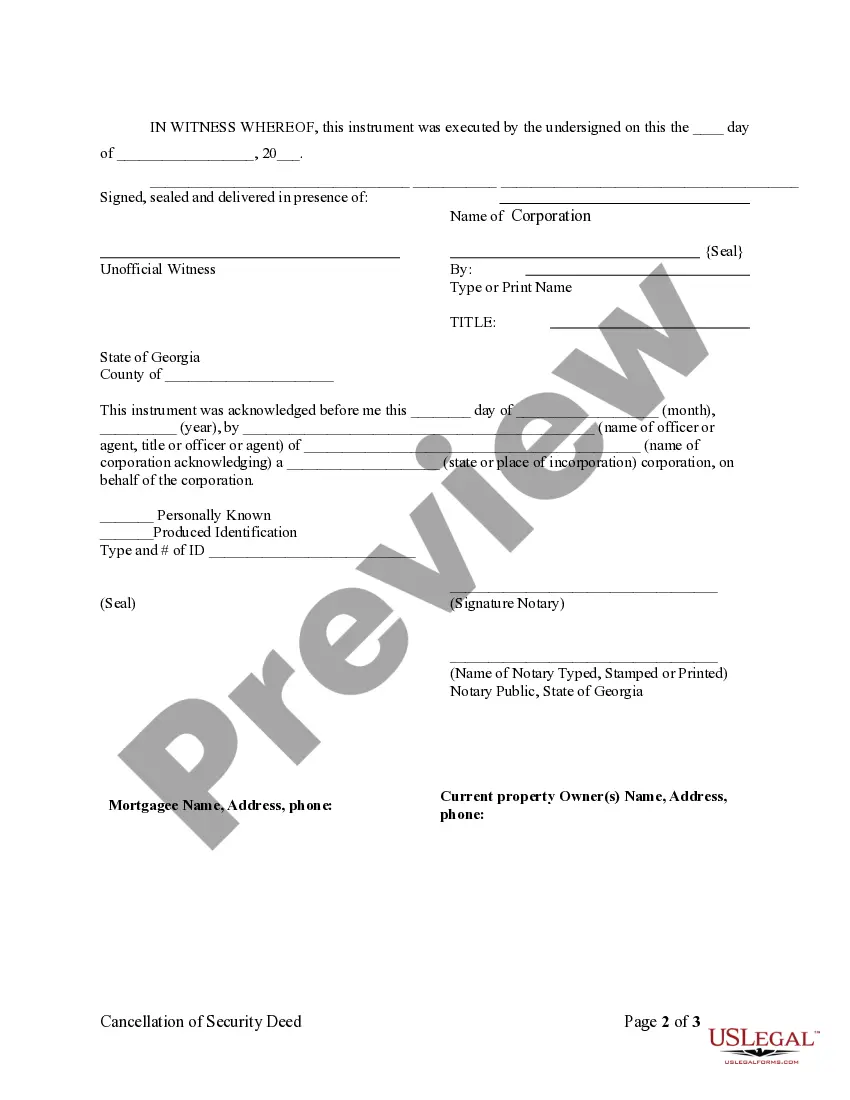

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Demand on behalf of the borrower is not required. Lender has 60 days to record satisfaction following payoff.

Recording Satisfaction: Whenever the indebtedness secured by any instrument is paid in full, the grantee or holder of the instrument, within 60 days of the date of the full payment, shall cause to be furnished to the clerk of the superior court of the county or counties in which the instrument is recorded a legally sufficient satisfaction or cancellation to authorize and direct the clerk or clerks to cancel the instrument of record.

Marginal Satisfaction: Not allowed. Satisfaction must be by separate instrument.

Penalty: Upon the failure of the grantee or holder to transmit properly a legally sufficient satisfaction or cancellation as provided in this Code section, the grantee or holder shall, upon written demand, be liable to the grantor for the sum of $500.00 as liquidated damages and, in addition thereto, for such additional sums for any loss caused to the grantor plus reasonable attorney's fees.

Acknowledgment: An assignment or satisfaction must contain a proper Georgia acknowledgment, or other acknowledgment approved by Statute.

Georgia Statutes

44-2-6. Recording bond for title, contracts, transfers, and assignments; priority as to subsequent deeds taken without notice from same vendor.

Every bond for title, bond to reconvey realty, contract to sell or convey realty or any interest therein, and any and all transfers or assignments of realty shall be filed and recorded in the office of the clerk of the superior court of the county where the land referred to in the instrument is located. The filing and recording shall, from the date of filing, be notice of the interest and equity of the holder of the instrument in the property described therein. The filing and recording may be made at any time; but such bond for title, bond to reconvey realty, contract to sell or convey realty or any interest therein, and any transfer or assignment of realty shall lose its priority over deeds, loan deeds, mortgages, bonds for titles, bonds to reconvey realty, contracts to sell or convey realty or any interest therein and any transfer or assignment of realty from the same vendor, obligor, transferor, or assignor which is executed subsequently but filed for record first and is taken without notice of the former instrument.

44-14-3.

(a) As used in this Code section, the term:

(1) Account means the loan, note, or other such agreement executed by the parties.

(2) Finance charge means interest and other charges agreed to by the parties.

(3) Grantee means heirs, devisees, executors, administrators, successors, transferees or assigns, and any servicing agent or any person or entity to whom indebtedness is paid on behalf of or by any grantor.

(4) Grantor means heirs, devisees, executors, administrators, successors, transferees, or assigns.

(5) Instrument means a deed to secure debt, a security instrument, a purchase money mortgage, a financing statement, a personalty mortgage, a loan contract, or other instrument executed in connection with any loan.

(6) Revolving loan account means an arrangement between a lender and a debtor for the creation of debt pursuant to an agreement secured by an instrument and under which:

(A) The lender may permit the debtor to create debt from time to time;

(B) The unpaid balances of principal of such debt and the loan finance and other appropriate charges are debited to an account;

(C) A loan finance charge is computed on the outstanding balances of the debtor's account from time to time;

(D) The debtor agrees to repay the debt and accrued finance charges in accordance with the written agreement with the lender; and

(E) The limitation on the maximum amount which the debtor is entitled to become indebted under said arrangement between the lender and debtor is stated on the face of the instrument, and said amount shall be deemed to be notice of the maximum amount secured by the instrument.

(b) (1) Whenever the indebtedness secured by any instrument is paid in full, the grantee or holder of the instrument, within 60 days of the date of the full payment, shall cause to be mailed to the grantor, at the grantor's last known address as shown on the records of the grantee or holder of the instrument, written notice of the grantee's or holder of the instrument's transmittal of notice of satisfaction or cancellation as required by this subsection and notice of the grantor's right to demand payment of $500.00 in liquidated damages from the grantee or holder of the instrument if such obligation is not timely met.

(2) Whenever the indebtedness secured by any instrument is paid in full, the grantee or holder of the instrument, within 60 days of the date of the full payment, shall cause to be furnished to the clerk of the superior court of the county or counties in which the instrument is recorded a legally sufficient satisfaction or cancellation to authorize and direct the clerk or clerks to cancel the instrument of record. The grantee or holder of the instrument shall further direct the clerk of the court to transmit to the grantor the original cancellation or satisfaction document at the grantor's last known address as shown on the records of the grantee or holder of the instrument. In the case of a revolving loan account, the debt shall be considered to be paid in full only when the entire indebtedness including accrued finance charges has been paid and the lender or debtor has notified the other party to the agreement in writing that he or she wishes to terminate the agreement pursuant to its terms.

(3) Notwithstanding paragraph (2) of this subsection, if an attorney at law remits the pay-off balance of an instrument to a grantee or holder of the instrument on behalf of a grantor, the grantee or holder of the instrument may direct the clerk of the court to transmit to such attorney the original cancellation or satisfaction document.

(4) A grantee or holder of the instrument shall be authorized to add to the pay-off amount the costs of recording a cancellation or satisfaction of an instrument.

(c) (1) Upon the failure of the grantee or holder of the instrument to transmit a legally sufficient satisfaction or cancellation as required by subsection (b) of this Code section, the grantee or holder of the instrument shall be liable to the grantor for the sum of $500.00 as liquidated damages and such additional sums for any loss caused to the grantor, plus reasonable attorney's fees if the grantor makes a written demand for liquidated damages to the grantee or holder of the instrument before transmittal, but not less than 61 days after the instrument is paid in full, and prior to filing a civil action.

(2) The grantee or holder of the instrument shall not be liable to the grantor if he or she demonstrates reasonable inability to comply with subsection (b) of this Code section; and the grantee or holder shall not be liable to the grantor unless and until a written demand for the liquidated damages as provided in subsection (b) of this Code section is made. No settlement agent or attorney may take an assignment of the right to the $500.00 in liquidated damages.

(3) Except as provided in paragraph (1) of subsection (b) and paragraph (2) of subsection (c) of this Code section, no other provision of this Code section shall be construed so as to affect the obligation of the grantee or holder of the instrument to pay the liquidated damages provided for in this subsection.

(4) At least 15 business days prior to filing a civil action to recover liquidated damages, the grantor shall provide notice in writing to the grantee or holder of the instrument at the address where the grantee or holder of the instrument directs payments to be mailed with respect to the indebtedness secured by the instrument or, if such address is not available, at the address of the grantee or holder of the instrument's registered agent for service of process in Georgia stating that the grantee or holder of the instrument:

(A) Has failed to comply with the obligation required by this Code section;

(B) Owes the grantor liquidated damages in the amount of $500.00; and

(C) May be sued by the grantor for the failure to comply with the provisions of this Code section.

(5) If the grantee or holder of the instrument fails to provide written notice to the grantor regarding the grantee's or holder of the instrument's obligation for transmittal as provided in paragraph (1) of subsection (b) of this Code section, the grantor may file a civil action at any time more than 60 days after the grantee's or holder of the instrument's receipt of full payment.

(c.1) In the event that a grantee or holder of record has failed to transmit properly a legally sufficient satisfaction or cancellation to authorize and direct the clerk or clerks to cancel the instrument of record within 60 days after a written notice mailed to such grantee or holder of record by registered or certified mail or statutory overnight delivery, return receipt requested, the clerk or clerks are authorized and directed to cancel the instrument upon recording an affidavit by an attorney who has caused the secured indebtedness to be paid in full or by an officer of a regulated or chartered financial institution whose deposits are federally insured if that financial institution has paid the secured indebtedness in full. The notice to be mailed to the grantee or holder of record shall identify the indebtedness and include a recital or explanation of this subsection. The affidavit shall include a recital of actions taken to comply with this subsection. Such affidavit shall include as attachments the following items:

(1) A written verification which was given at the time of payment by the grantee or holder of record of the amount necessary to pay off such loan; and

(2) (A) Copies of the front and back of a canceled check to the grantee or holder of record paying off such loan.

(B) Confirmation of a wire transfer to the grantee or holder of record paying off such loan.

(C) A bank receipt showing payment to the grantee or holder of record of such loan.

Any person who files an affidavit in accordance with this subsection which affidavit is fraudulent shall be guilty of a felony and shall be punished by imprisonment for not less than one year nor more than three years or by a fine of not less than $1,000.00 nor more than $5,000.00, or both.

(d) In all cases, any servicing agent or any person or entity to whom the indebtedness is paid on behalf of any grantee shall be responsible for notifying the holder thereof upon payment in full and for securing the satisfaction or cancellation as provided in this Code section; and, upon failure to do so, the servicing agent or payee shall be subject to the same liability as provided in this Code section.

44-14-4.

Any mortgagor who has paid off his or her mortgage may present the paid mortgage to the clerk of the superior court of the county or counties in which the mortgage instrument is recorded, together with the order of the mortgagee or transferee directing that the mortgage be canceled. After payment of the fee authorized by law, the clerk shall index and record, in the same manner as the original mortgage instrument is recorded, the canceled and satisfied mortgage instrument or such portion thereof as bears the order of the mortgagee or transferee directing that the mortgage be canceled, together with any order of the mortgagee or transferee directing that the mortgage be canceled. The clerk shall show on the index of the cancellation and on the cancellation document the deed book and page number where the original mortgage instrument is recorded. The clerk shall manually or through electronic means record across the face of the mortgage instrument the words satisfied and canceled and the date of the entry and shall sign his or her name thereto officially. The clerk shall also manually or electronically make a notation on the record of the mortgage to indicate where the order of the cancellation is recorded.