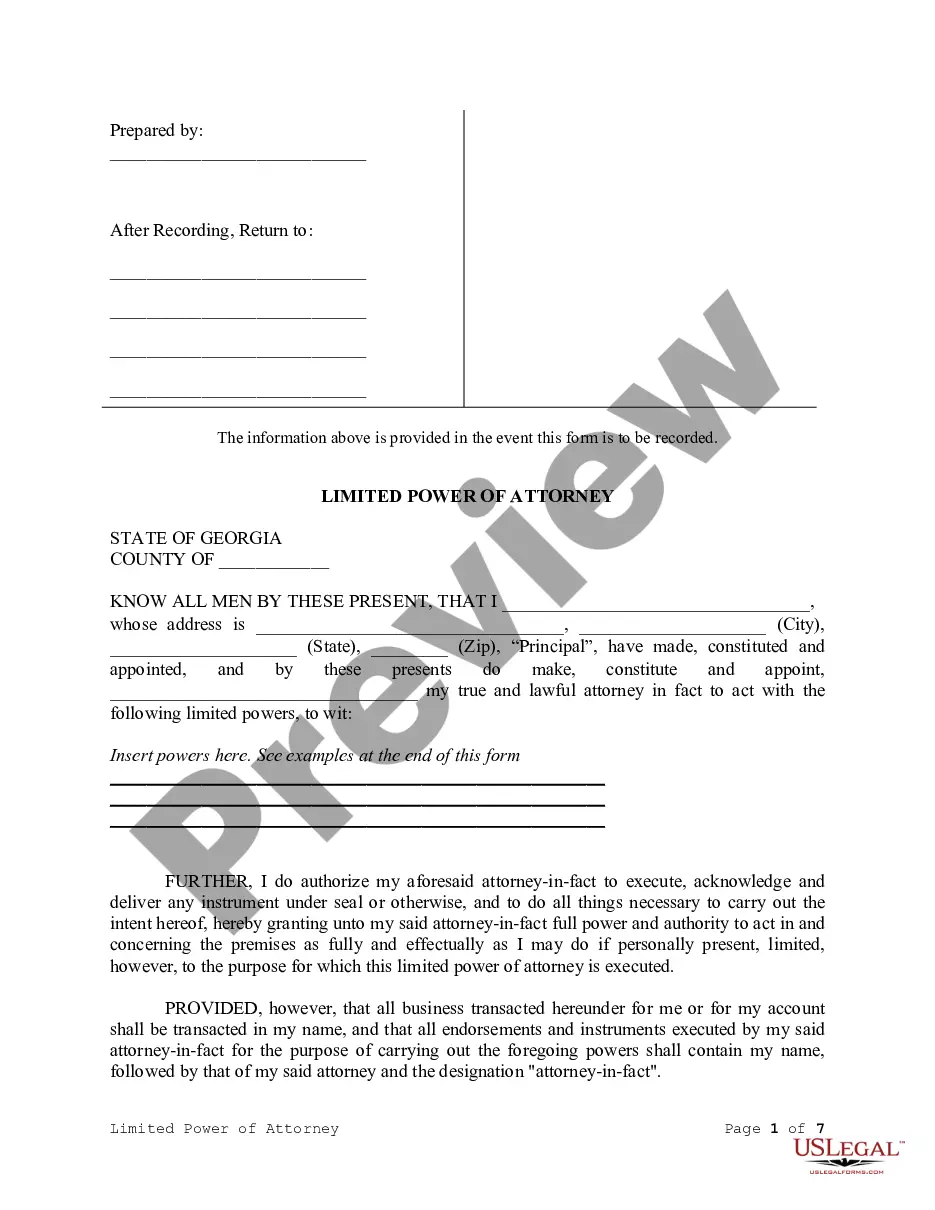

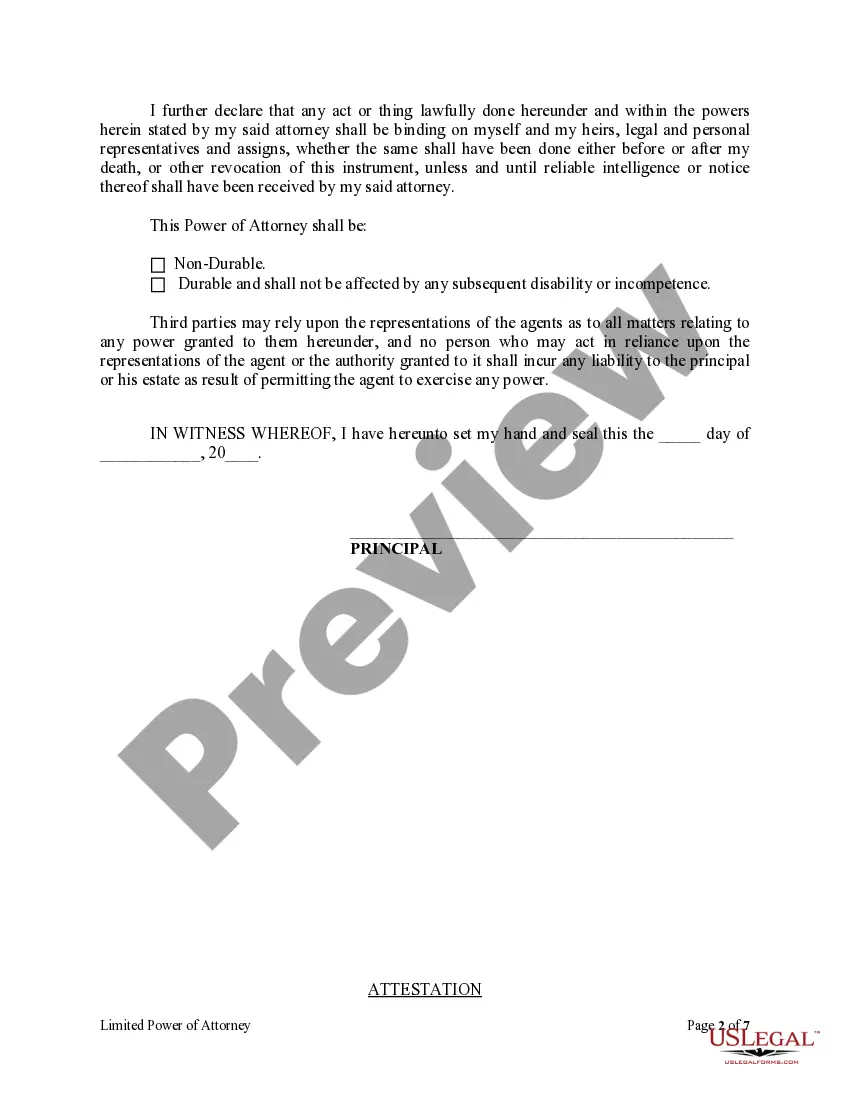

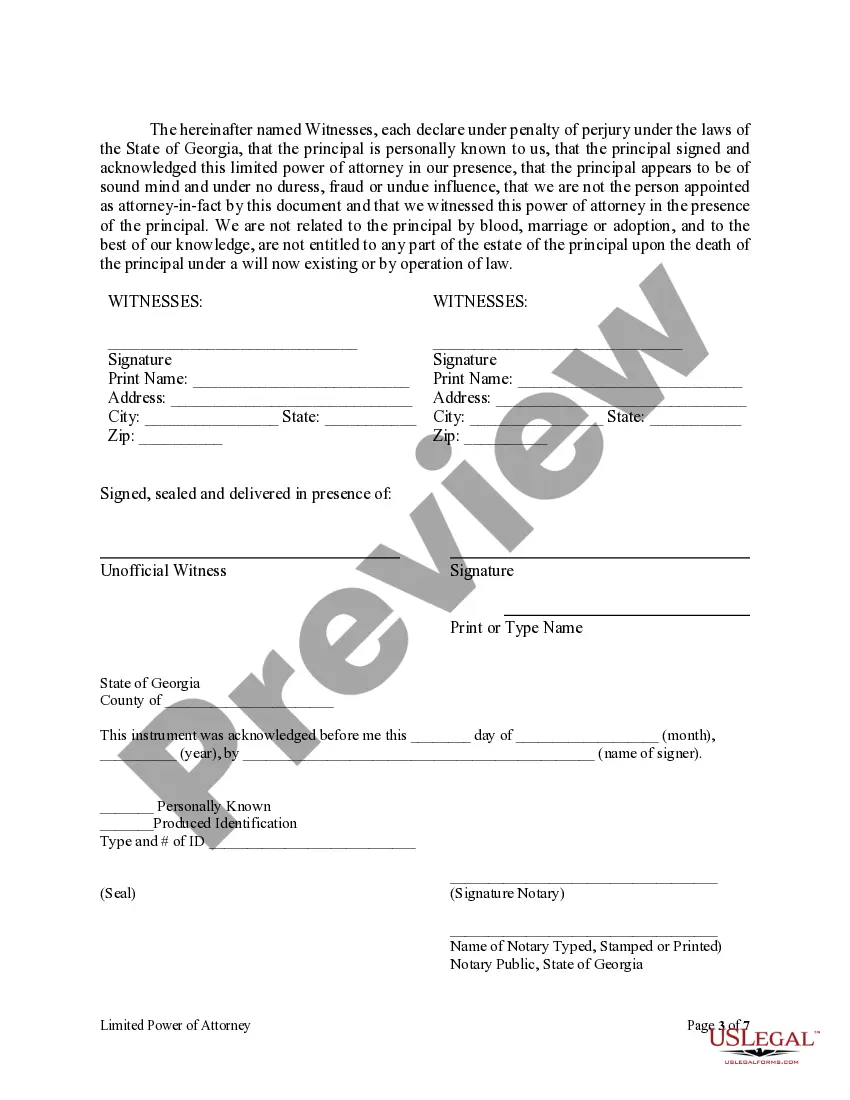

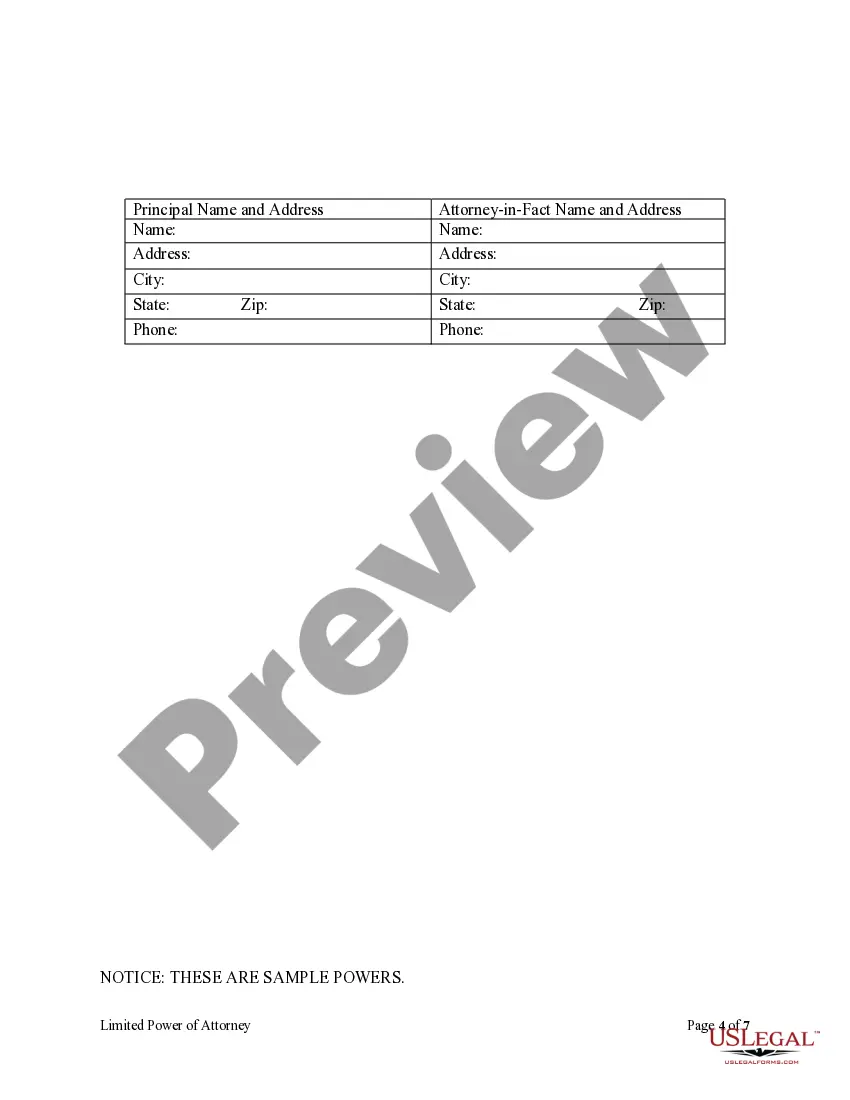

This is a limited power of attorney for Georgia. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Power Attorney For Bank Account

Description

How to fill out Georgia Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you're a returning user, log in to your account and download the necessary form template by clicking 'Download.' Don't forget to check your subscription's validity and renew it if necessary.

- For first-time users, start by previewing the desired form and reading its description carefully to ensure it meets your specific needs and complies with your local jurisdiction.

- If the form isn't quite right, utilize the Search tab to find alternative templates that match your requirements. Proceed only once you've selected the appropriate document.

- Purchase the document by clicking 'Buy Now' and choosing your preferred subscription plan. You'll need to create an account for access to the extensive library.

- Complete your purchase by entering your payment details, whether via credit card or PayPal, to finalize your subscription.

- Download the form to your device. You can complete it immediately or access it anytime from the My Forms section in your profile.

US Legal Forms is dedicated to empowering individuals and attorneys with a comprehensive library that includes over 85,000 legal documents. This vast collection not only offers more options than competitors but also guarantees precision and legal validity with expert assistance available for form completion.

Take control of your financial matters today with a power attorney for your bank account. Visit US Legal Forms to get started and simplify your legal documentation process!

Form popularity

FAQ

A power attorney for bank account management allows someone to make decisions regarding the account holder's finances when they cannot do so themselves. The individual designated in the POA can access, manage, and even close accounts as needed, ensuring the account holder's financial matters are taken care of. It's vital to establish clear guidelines within the POA document to ensure all parties understand the authority granted. Using platforms like USLegalForms can help you create a solid power attorney document tailored to your needs.

Yes, a Power of Attorney (POA) can add themselves to a checking account if the document explicitly grants that authority. It's essential to ensure that the bank accepts the power attorney for bank account transactions and understands the scope of the powers granted. This process usually involves presenting the POA document to the bank, which may have its forms or requirements. Once approved, the POA can manage the account according to the permissions outlined.

To get power of attorney for a bank account, you will need to fill out the appropriate legal forms, which outline the powers you wish to grant. You can easily access these forms through platforms like US Legal Forms, which provide templates tailored for your needs. Once completed, you'll need to sign the document in front of a notary to make it legally binding. After that, present the power attorney for bank account to your financial institution to ensure they recognize the agent's authority.

Yes, you can give someone permission to access your bank account by setting up a power attorney for bank account. This legal document allows you to designate an individual to manage your finances on your behalf. It ensures that the designated person can handle transactions, oversee payments, and make financial decisions in your best interest. Additionally, creating a power attorney for bank account offers you peace of mind knowing that your financial matters are in capable hands.

Yes, it is legal to give someone access to your bank account if you use a power attorney for bank account. This document ensures that your authorization is recognized by financial institutions. However, be cautious about whom you choose, as this person will have the ability to manage your finances. Using a trusted service like uslegalforms can help you draft this important document correctly.

Absolutely, you can authorize someone to access your bank account by using a power attorney for bank account. This document grants specific financial rights to the person you choose, enabling them to manage your banking activities on your behalf. It's crucial to specify the extent of their access, as this will safeguard your interests. Utilizing our platform can simplify the process of creating this legal document.

Yes, you can give someone permission to use your bank account through a power attorney for bank account. This legal document allows you to designate a trusted individual to handle your financial transactions. It's important to select someone reliable, as they will have access to your funds. Ensure that the power attorney clearly outlines the scope of their authority.

A Power of Attorney works with banks by granting an authorized person the right to manage financial transactions on behalf of the account holder. This includes capabilities such as making deposits, withdrawing funds, and handling account inquiries. It’s important to ensure that the POA is valid and correctly executed, as this will determine how effectively it can be used with the bank. USLegalForms can assist in creating a sound POA tailored specifically for banking needs.

Banks may deny a Power of Attorney for several reasons, including improper notarization, unclear language, or failure to meet their specific requirements. Additionally, if the agent’s authority is questioned or if the document is outdated, the bank might refuse to accept it. It is advisable to double-check the POA's details and ensure compliance with the institution’s guidelines to avoid denial.

Choosing between a Power of Attorney and a joint bank account depends on your specific needs. A POA allows one person to handle financial matters without sharing ownership, providing flexibility and control. On the other hand, a joint account can create shared ownership but may complicate matters if relationships change. Carefully consider your circumstances and perhaps consult with a legal professional for the best solution for handling financial responsibilities.