Ga Deed Online Withholding

Description

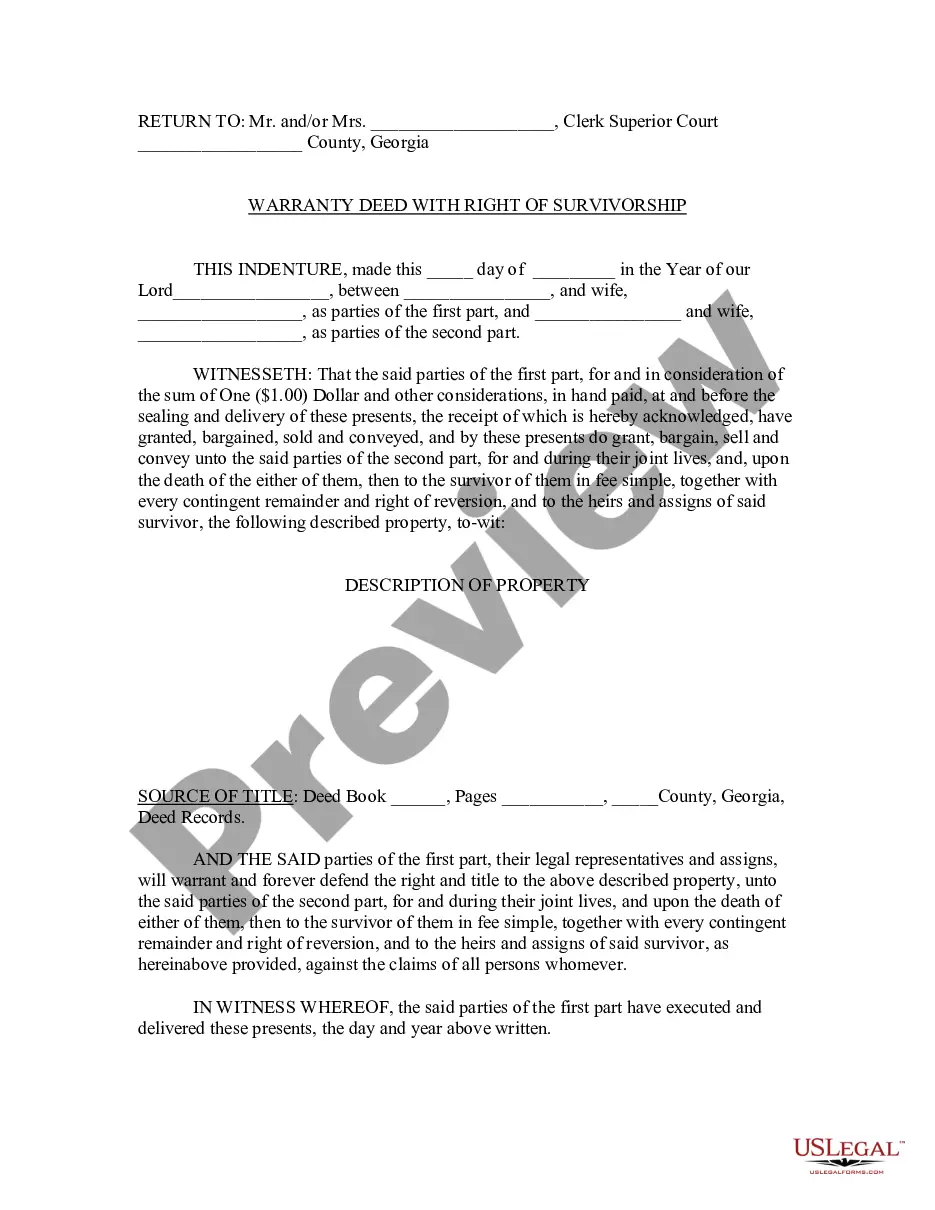

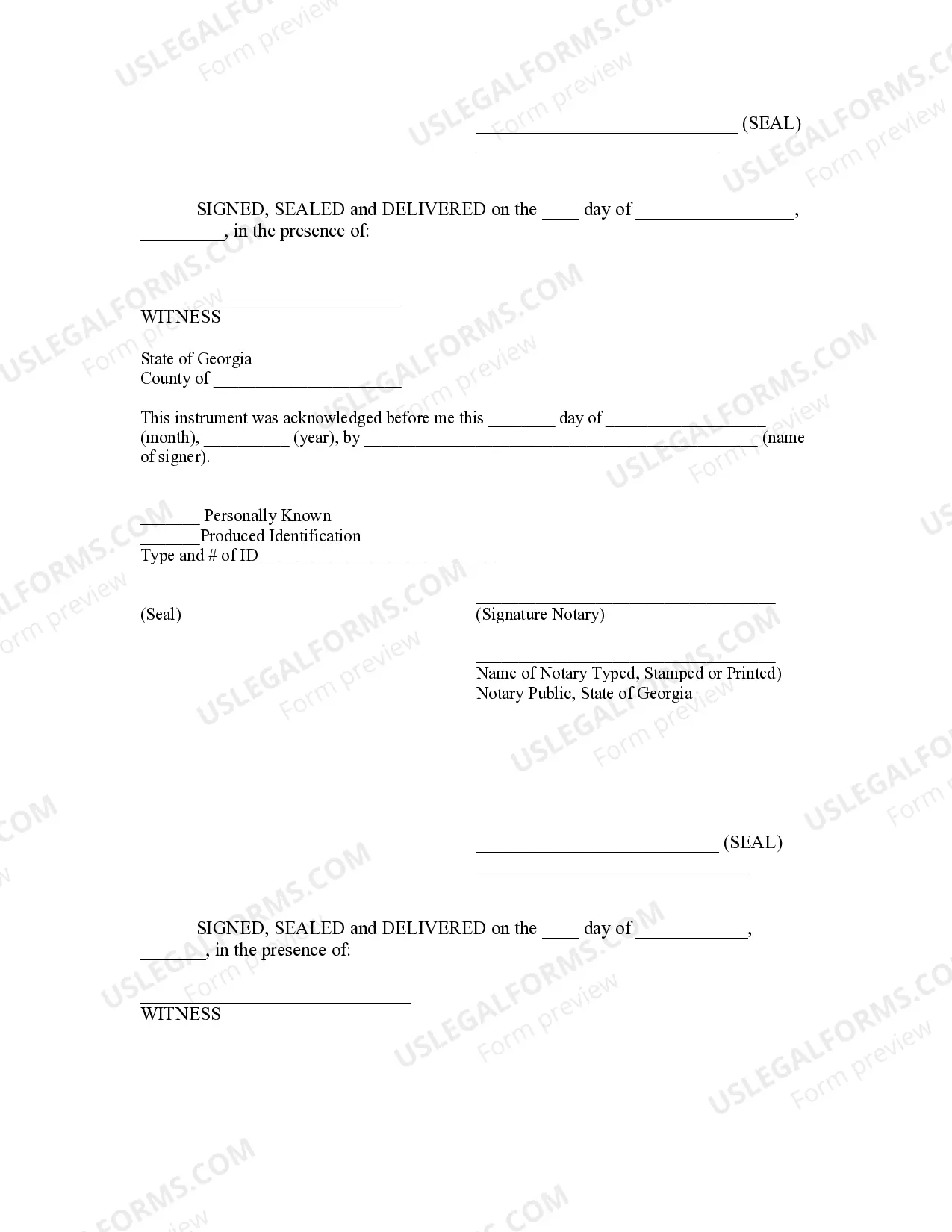

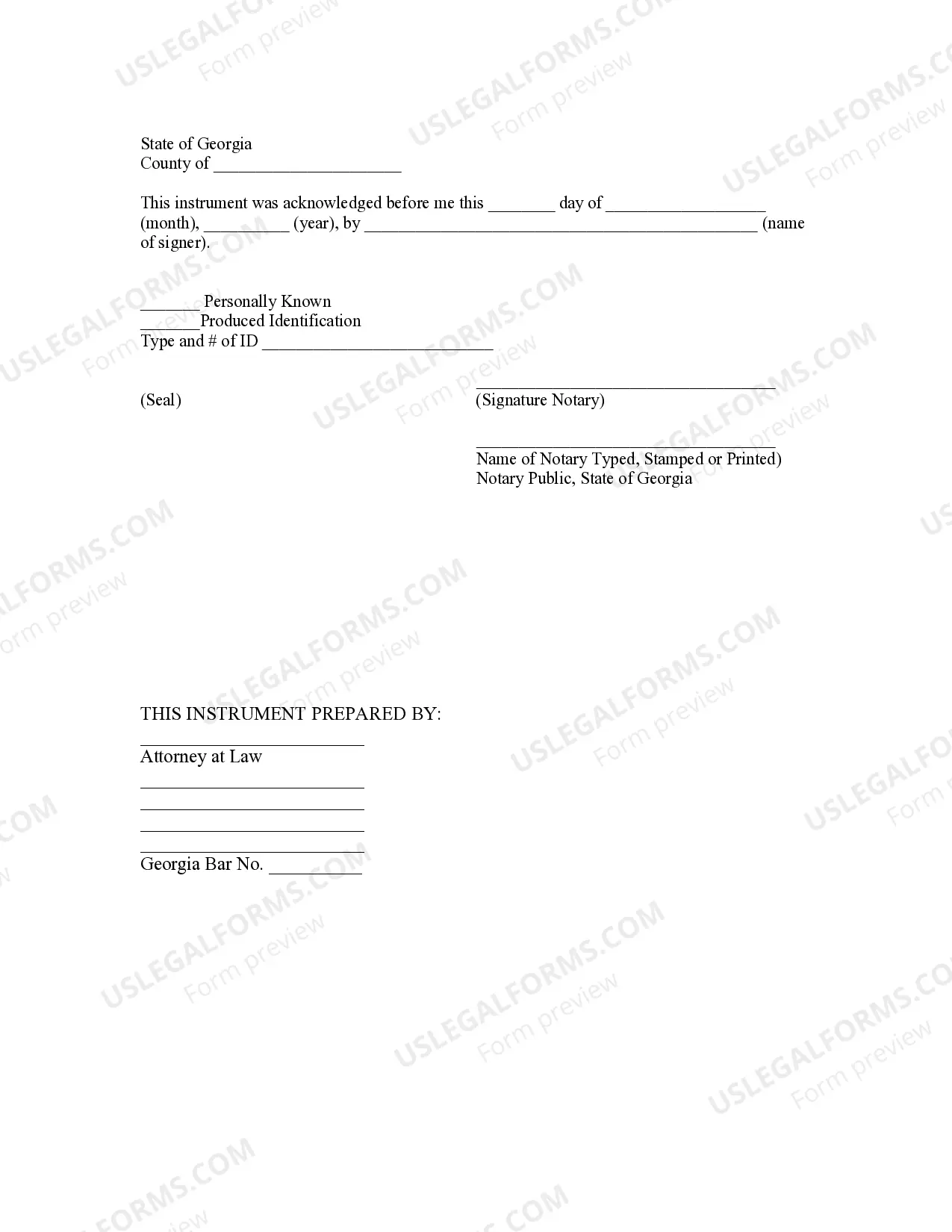

How to fill out Georgia Warranty Deed With Right Of Survivorship?

Legal administration may be daunting, even for experienced professionals.

When you are searching for a Ga Deed Online Withholding and do not have the opportunity to invest time finding the correct and current version, the procedures can be taxing.

US Legal Forms meets all the requirements you may have, from personal to business paperwork, all in one place.

Employ sophisticated tools to fill out and manage your Ga Deed Online Withholding.

Here are the steps to follow after downloading the form you need: Confirm this is the correct document by previewing it and reviewing its details. Ensure that the sample is recognized in your state or county. Click Buy Now when you are ready. Choose a subscription plan. Select the format you prefer, and Download, fill out, eSign, print, and deliver your documents. Enjoy the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Streamline your routine document management in a straightforward and user-friendly manner today.

- Access a repository of articles, guides, and manuals that are pertinent to your situation and needs.

- Save time and energy searching for the documents you require, and use US Legal Forms’ advanced search and Review feature to locate Ga Deed Online Withholding and obtain it.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to see the documents you have previously saved and manage your folders as you wish.

- If this is your initial experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- A robust online form repository can be a transformative tool for anyone who wishes to navigate these circumstances effectively.

- US Legal Forms stands as a frontrunner in digital legal documents, with over 85,000 state-specific legal forms accessible at any moment.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

Filling out a withholding certificate requires careful attention to detail. Start by obtaining the correct form, typically the W-4, depending on your situation. Provide accurate information about your income, deductions, and filing status to ensure proper withholding. For comprehensive assistance, consider using US Legal Forms to navigate the intricacies of Ga deed online withholding and ensure you complete the form correctly.

Making withholding tax online involves a few simple steps, ensuring you meet your obligations smoothly. Begin by accessing a reliable site, such as US Legal Forms, which provides helpful tools for Ga deed online withholding. You'll need to input your income details and calculate the appropriate amount to withhold. Once you have all the information, submit your payment electronically for convenience.

Filing withholding tax online is a straightforward process that can save you time. Start by gathering your financial documents, such as W-2 forms and other income records. Then, visit the official tax website or a trusted platform like US Legal Forms, where you can find resources and guidance tailored to Ga deed online withholding. Follow the prompts to complete your filing securely and efficiently.

Creating a withholding account requires you to register with the appropriate tax authority. For Georgia, you can do this online through the Georgia Department of Revenue. For further assistance, consider using uslegalforms, where you can find detailed guidance and templates for setting up your Ga deed online withholding account effectively.

To obtain a Georgia tax account number, you must register with the Georgia Department of Revenue. This process usually involves completing an online application or submitting a paper form. Once your application is processed, you will receive your account number, which you will need for any Ga deed online withholding tasks.

Yes, you can file Georgia taxes electronically. The Georgia Department of Revenue allows electronic filing for both individual and business taxes. Utilizing e-filing can streamline your process, especially for Ga deed online withholding, making it easier to meet deadlines and manage your tax obligations.

To register for a withholding tax account in Georgia, visit the Georgia Department of Revenue website. Fill out the necessary registration forms and provide required information about your business or employment. Once registered, you can easily manage your Ga deed online withholding obligations through their online portal.

Setting up your tax withholding involves determining the correct amount to withhold from your paychecks. You should fill out the Employee's Withholding Allowance Certificate, also known as Form W-4. For more guidance on Ga deed online withholding, consider using online platforms like uslegalforms, which provide resources and templates to simplify the process.

To set up a Georgia withholding account, you need to complete the Georgia Withholding Account Application. You can find this application on the Georgia Department of Revenue's website. After submitting the application, you will receive your withholding account number, which is essential for managing your Ga deed online withholding responsibilities.