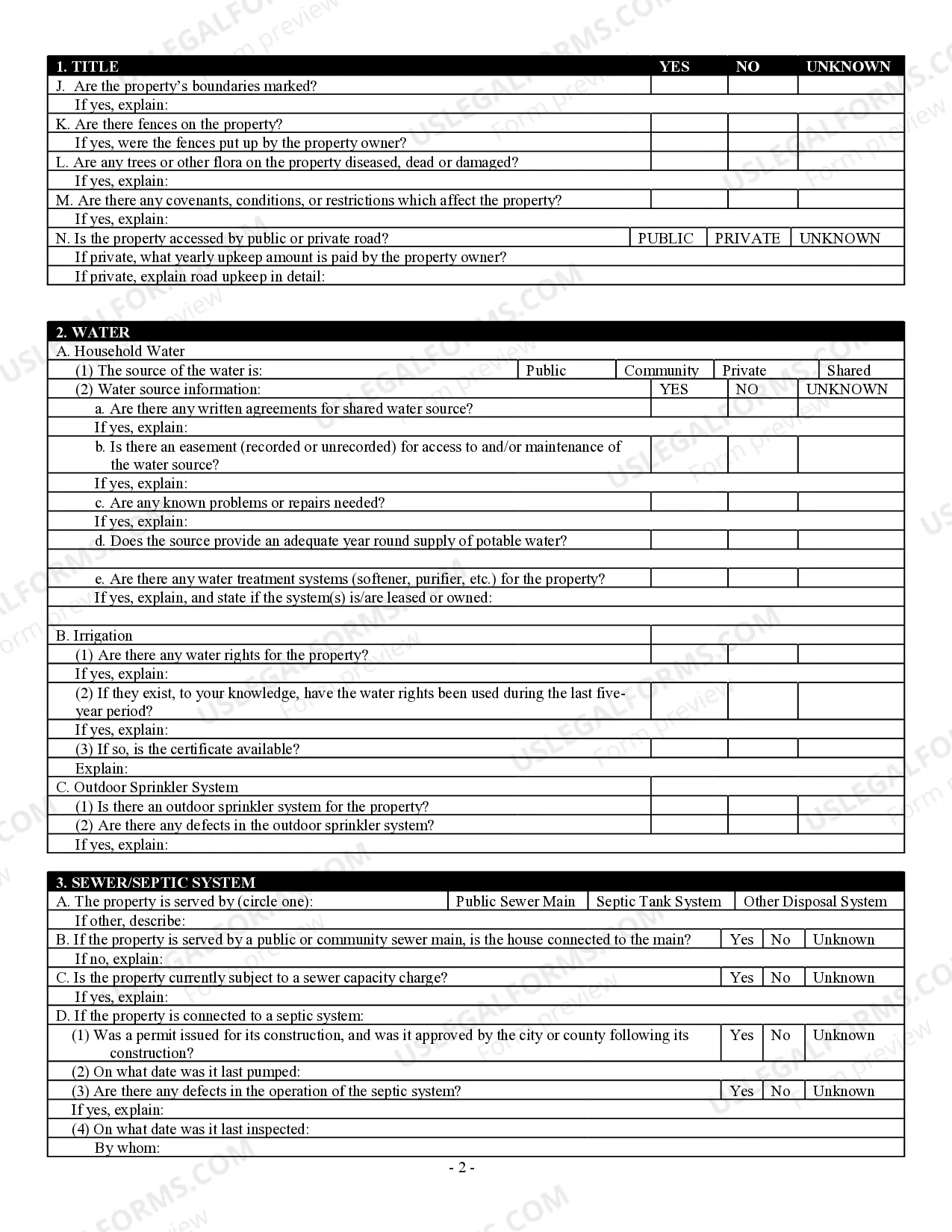

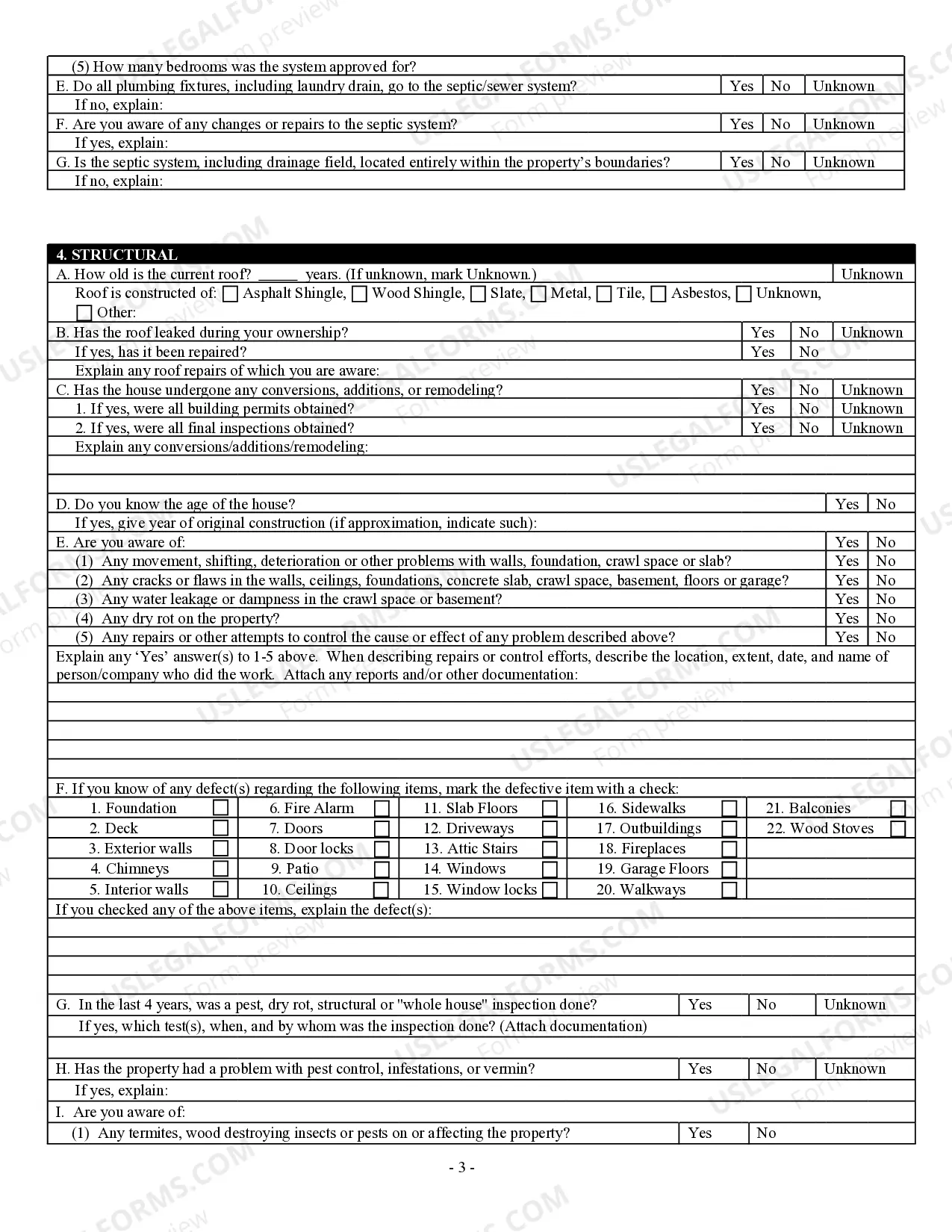

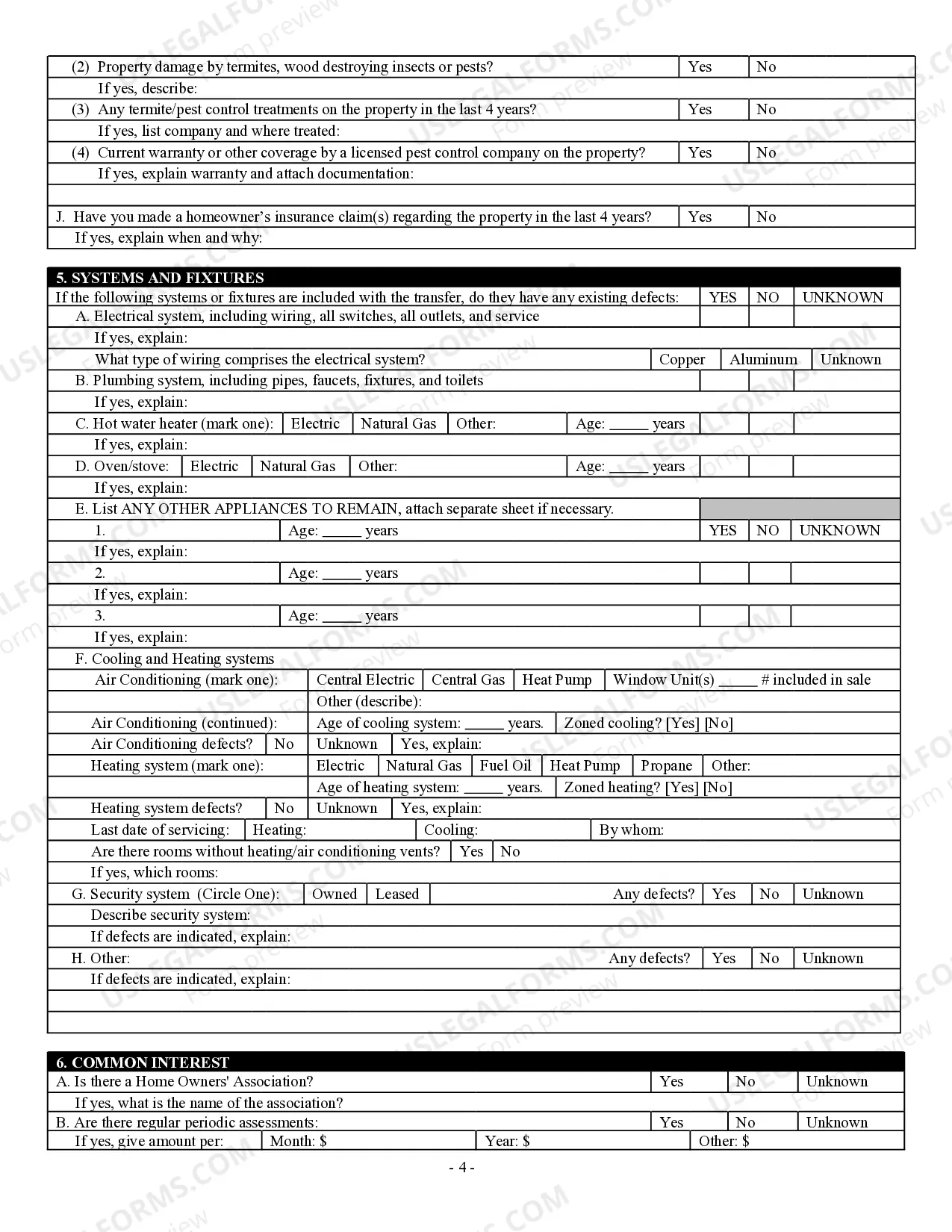

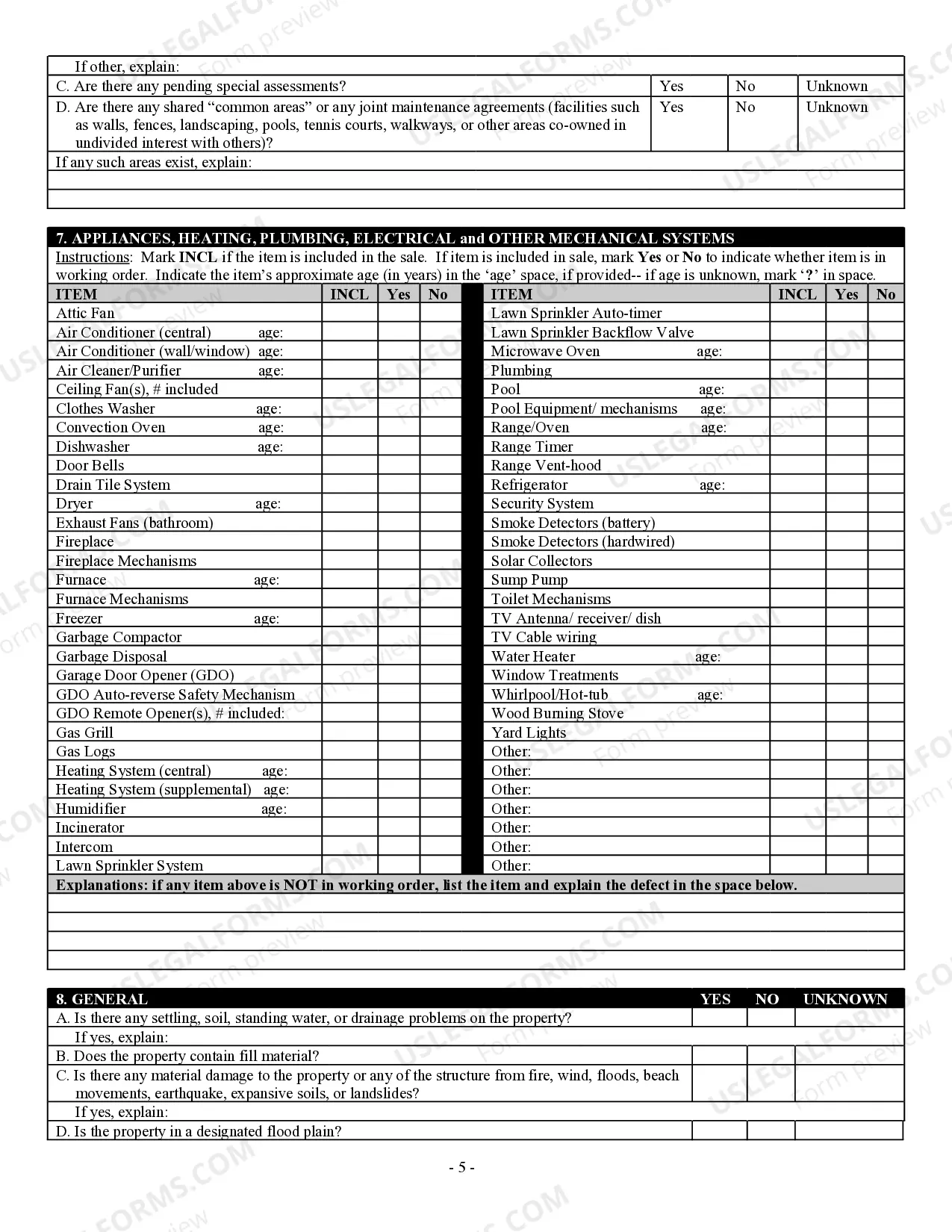

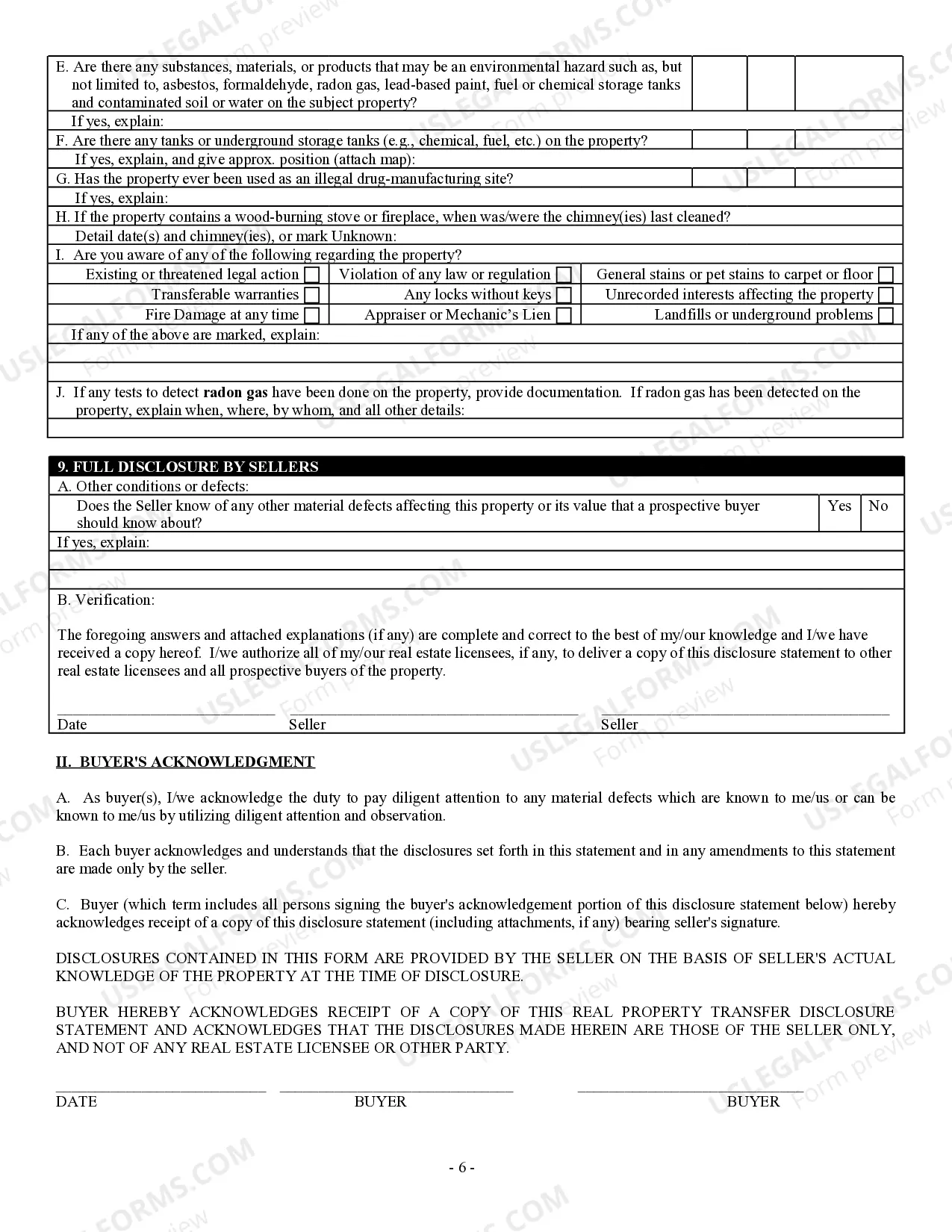

This form is a Seller's Disclosure Statement for use in a residential sales transaction in Georgia. This disclosure statement concerns the condition of property and is completed by the Seller.

Georgia Real Estate Disclosure Form For Sale

Description

How to fill out Georgia Residential Real Estate Sales Disclosure Statement?

Managing legal documents can be daunting, even for the most experienced experts.

If you are searching for a Georgia Real Estate Disclosure Form For Sale and are unable to spend time looking for the correct and updated version, the tasks can be anxiety-inducing.

With US Legal Forms, you are able to.

Access legal and business forms specific to your state or county. US Legal Forms encompasses all requirements you may have, from personal to corporate documents, in one location.

If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the advantages of the platform. Here are the steps to follow after accessing the form you require: Confirm that it is the correct form by previewing it and reading its description. Ensure the template is recognized in your state or county. Click Buy Now when you are ready. Select a monthly subscription plan. Choose the format you prefer and Download, complete, sign, print, and submit your document. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and reliability. Simplify your daily document management into a straightforward and user-friendly process today.

- Utilize advanced tools to fill out and manage your Georgia Real Estate Disclosure Form For Sale.

- Access a valuable resource repository of articles, guides, and handbooks related to your circumstances and requirements.

- Save time and effort searching for the necessary documents, and make use of US Legal Forms' sophisticated search and Review tool to locate Georgia Real Estate Disclosure Form For Sale and obtain it.

- For those with a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to view the documents you have previously saved and manage your folders at your discretion.

- A robust online form repository can be transformative for anyone aiming to navigate these challenges effectively.

- US Legal Forms is a leader in online legal paperwork, with more than 85,000 state-specific legal documents accessible at any time.

Form popularity

FAQ

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

FHA loans are backed by the Federal Housing Administration and offered by FHA-approved lenders. Unlike FHA loans, conventional loans are not insured or guaranteed by the government. Mortgage insurance is mandatory with FHA loans; you can avoid it on a conventional loan by putting down at least 20%.

Look at the paper that says ?Promissory Note? or ?Note.? If you have an adjustable rate mortgage, your note may have the words ?Adjustable Rate Note? and may include language similar to: ?The interest rate I will pay will change in ance with Section __ of this Note.?

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

Types of mortgages Conventional loan: Best for borrowers with good credit scores. Jumbo loan: Best for borrowers with excellent credit looking to buy a more expensive home. Government-backed loan: Best for borrowers who have lower credit scores and minimal cash for a down payment.

How to Write a Mortgage Deed Step 1 ? Fill In the Effective Date. ... Step 2 ? Enter Borrower and Lender Details. ... Step 3 ? Write Loan Information. ... Step 4 ? Fill In Property Details. ... Step 5 ? Identify Assigned Rents. ... Step 6 ? Enter Acceleration Upon Default. ... Step 7 ? Choose the Power of Sale Option.

Also, for all types of QMs, the points and fees may not exceed the rule's specified points-and-fees caps. What Are the Different Types of QMs? There are four types of QMs ? General, Temporary, Small Creditor, and Balloon-Payment.

Conventional mortgages are the most common type of mortgage. That said, conventional loans may have different requirements for a borrower's minimum credit score and debt-to-income (DTI) ratio than other loan options.