60 Nights

Description

How to fill out Georgia 60 Day Notice To Terminate At-Will Lease From Landlord To Tenant?

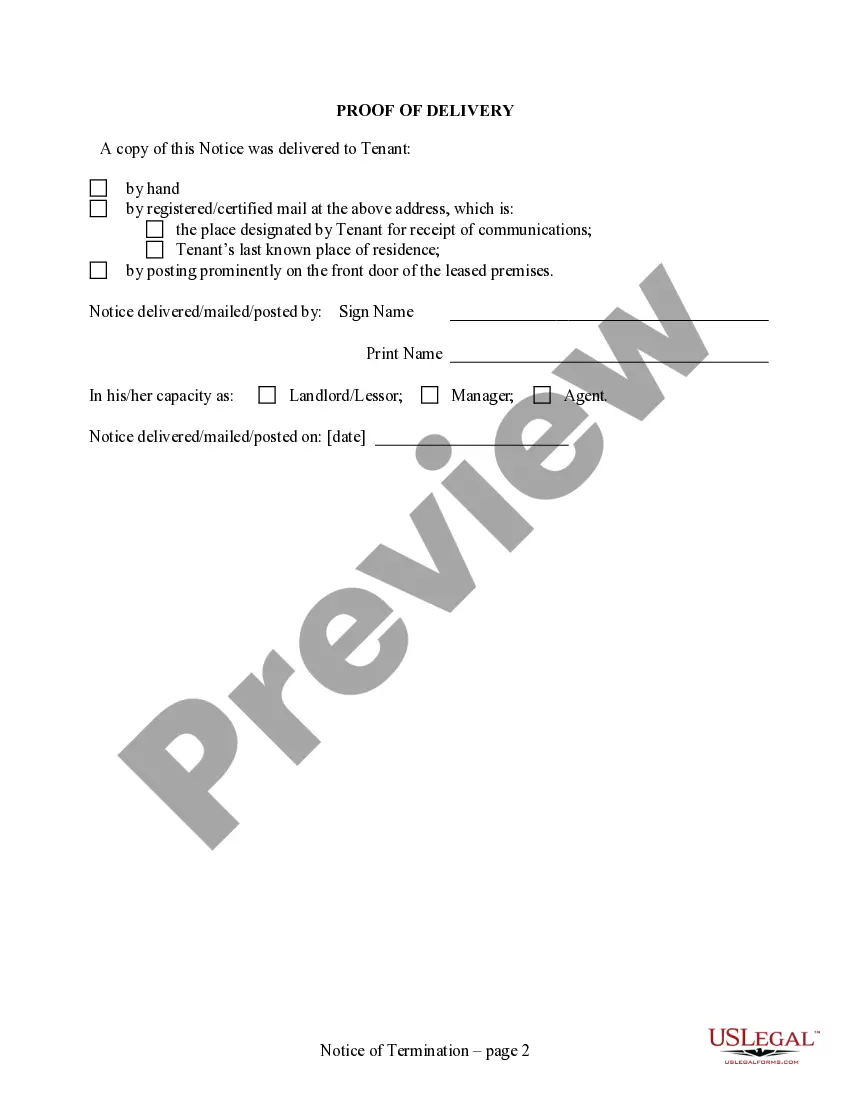

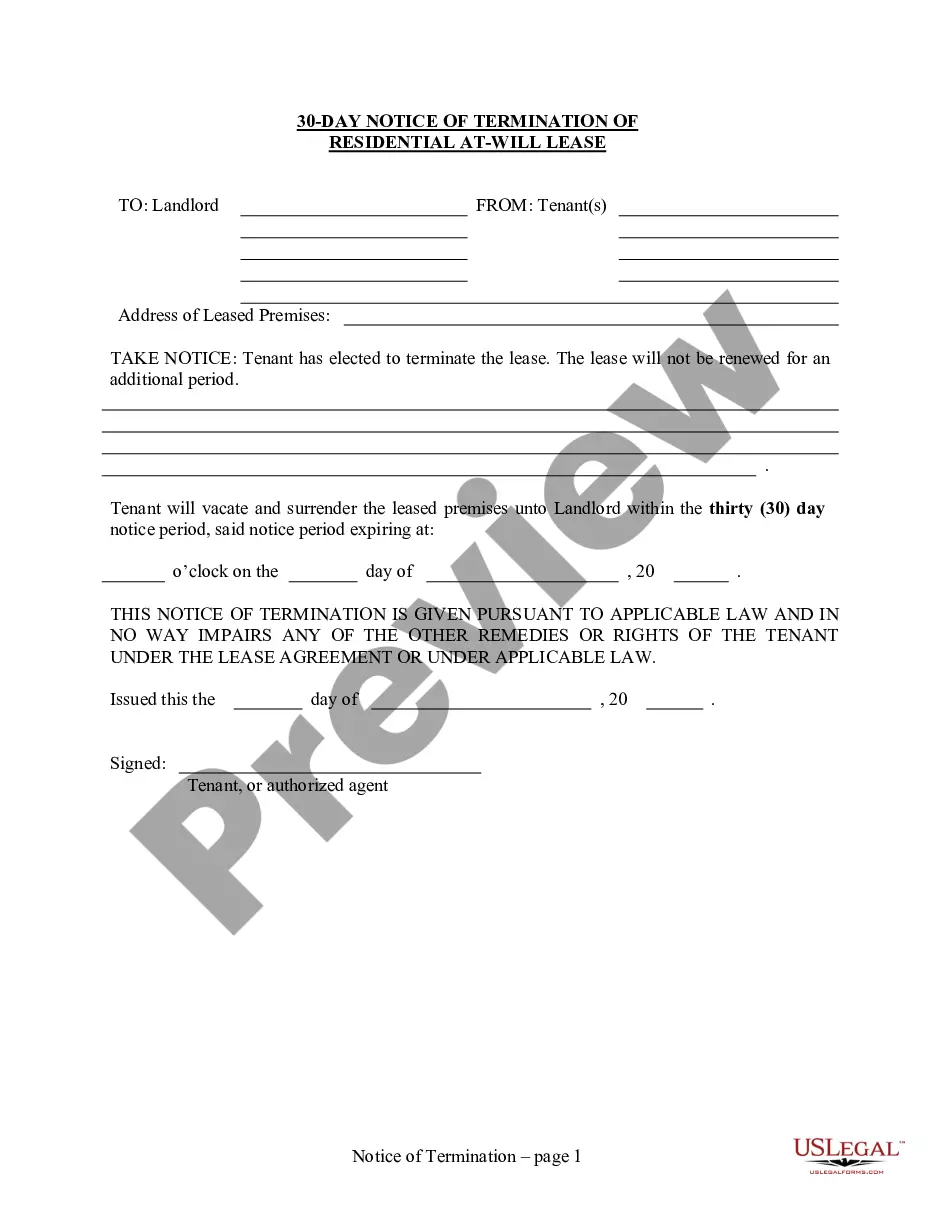

- Log in to your account if you're a returning user. Click on the Download button to retrieve your required form template. Ensure your subscription is active; if it's not, renew it according to your payment plan.

- If you're new to US Legal Forms, start by checking the preview mode and form descriptions. This ensures you select the correct template that fits your legal needs.

- Use the search bar if you need a different template. This will help you find the right document that meets your requirements.

- Proceed to purchase the document. Click the 'Buy Now' button and select your preferred subscription plan. Remember, you'll need to register to access the form library.

- Complete your purchase by entering your credit card information or using your PayPal account for the subscription payment.

- Download the form to your device. Once saved, you can fill it out and access it anytime later from the 'My Forms' menu in your profile.

By following these steps, you can easily access the legal forms you need, thanks to the extensive resources available through US Legal Forms. This service not only simplifies document acquisition but also ensures precision and legal soundness for your needs.

Start your journey with US Legal Forms today and experience the convenience of managing your legal documentation with ease.

Form popularity

FAQ

It is generally required to file taxes for every year you meet the income threshold set by the IRS. If you fail to file, the IRS may assess penalties, and they have a legal right to collect taxes owed for several years back. It's crucial to stay on top of your tax obligations to avoid complications down the line. US Legal Forms can help you understand your filing requirements and maintain good standing with the IRS.

To file your RMD on your tax return, simply report it as income on the designated line of your Form 1040. This means that any amount you withdrew as your RMD should be included in the taxable income section. If you have uncertainties about this process, seeking help from US Legal Forms can provide valuable support and clarity to ensure you file accurately.

Typically, your financial institution is responsible for notifying you about your Required Minimum Distribution when you reach the appropriate age. They should provide you with all necessary information regarding your withdrawals. Make sure to stay in contact with them to ensure compliance with RMD rules. For additional guidance, consider using US Legal Forms, which can offer insights into your RMD responsibilities.

You do not submit Form 5498 with your tax return, but it serves as an important record for your IRA contributions and RMDs. The form provides information about the fair market value and contributions, which is helpful for your records. Keep it on file for your reference, especially during tax time. Tools from US Legal Forms can aid you in understanding how to keep track of important documents like this.

You will report your Required Minimum Distribution (RMD) on Line 4 of Form 1040, where you list additional income. Make sure you include the total amount of the RMD to ensure accuracy in your tax return. Reporting it correctly is crucial because it impacts your taxable income. Utilizing resources from US Legal Forms can simplify the reporting process and help you avoid mistakes.

The IRS may send a letter regarding your RMDs if they have questions about your distributions. This letter typically communicates any concerns or requests for additional information. Receiving such a letter can feel daunting, but understanding it can help you respond effectively within the given 60-day timeframe. Engaging with platforms like US Legal Forms can provide clarity on how to handle these communications.

It typically takes up to 60 days for the IRS to complete a review after they receive your submitted documentation. However, this timeframe can vary based on your specific situation. Keep in mind that you should not delay your actions, especially if your case involves RMDs or other time-sensitive matters. Being proactive can certainly help you navigate these processes more smoothly.

One of the biggest mistakes regarding Required Minimum Distributions (RMD) is failing to withdraw the full amount by the deadline. The IRS imposes a penalty for not meeting this obligation. If you miss the RMD, you could face a hefty 50% tax on the amount you should have withdrawn. To avoid such issues, consider using resources like US Legal Forms, which helps you understand RMD requirements.

Making mosquito refill liquid at home requires a few simple ingredients. Combine water, a carrier oil, and essential oils like lavender or lemongrass for a natural repellent. This mixture can offer effective protection in your home for 60 nights. It serves as a practical and eco-friendly alternative to commercial products.

Mosquito repellent is best applied to both skin and clothes, as different methods provide varied levels of protection. By applying repellent directly on your skin, you create a barrier that keeps mosquitoes away. Additionally, treating your clothing can enhance your protection for up to 60 nights. Ensure coverage on both surfaces for maximum effectiveness.