Deed Form Real Estate Withholding Tax Exemption (form)

Description

How to fill out Georgia Administrator's Deed?

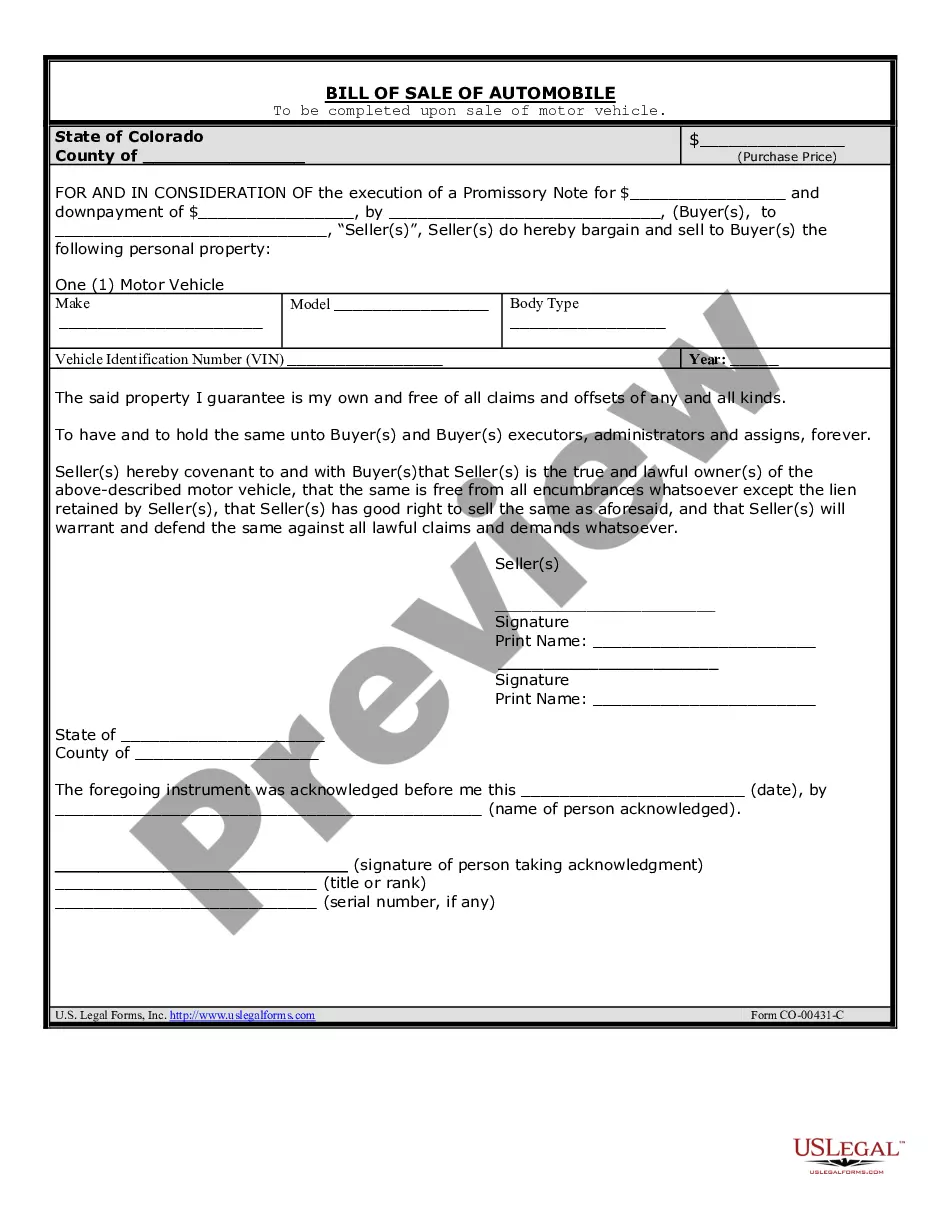

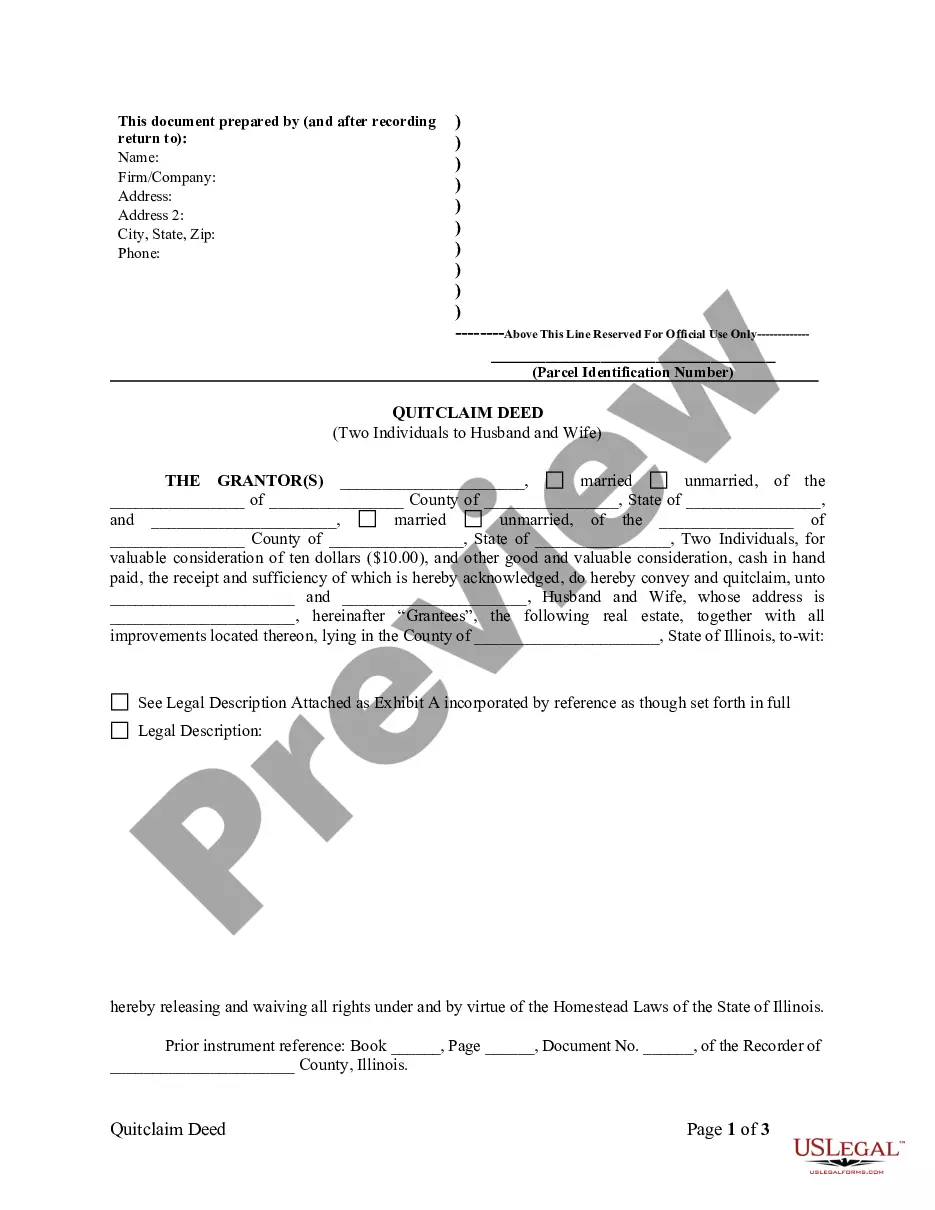

It’s obvious that you can’t become a legal expert immediately, nor can you figure out how to quickly prepare Deed Form Real Estate Withholding Tax Exemption (form) without the need of a specialized background. Creating legal forms is a time-consuming process requiring a particular education and skills. So why not leave the preparation of the Deed Form Real Estate Withholding Tax Exemption (form) to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court papers to templates for internal corporate communication. We understand how important compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our website and get the form you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Deed Form Real Estate Withholding Tax Exemption (form) is what you’re searching for.

- Start your search over if you need a different form.

- Register for a free account and choose a subscription option to purchase the form.

- Choose Buy now. Once the transaction is complete, you can download the Deed Form Real Estate Withholding Tax Exemption (form), fill it out, print it, and send or send it by post to the necessary people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

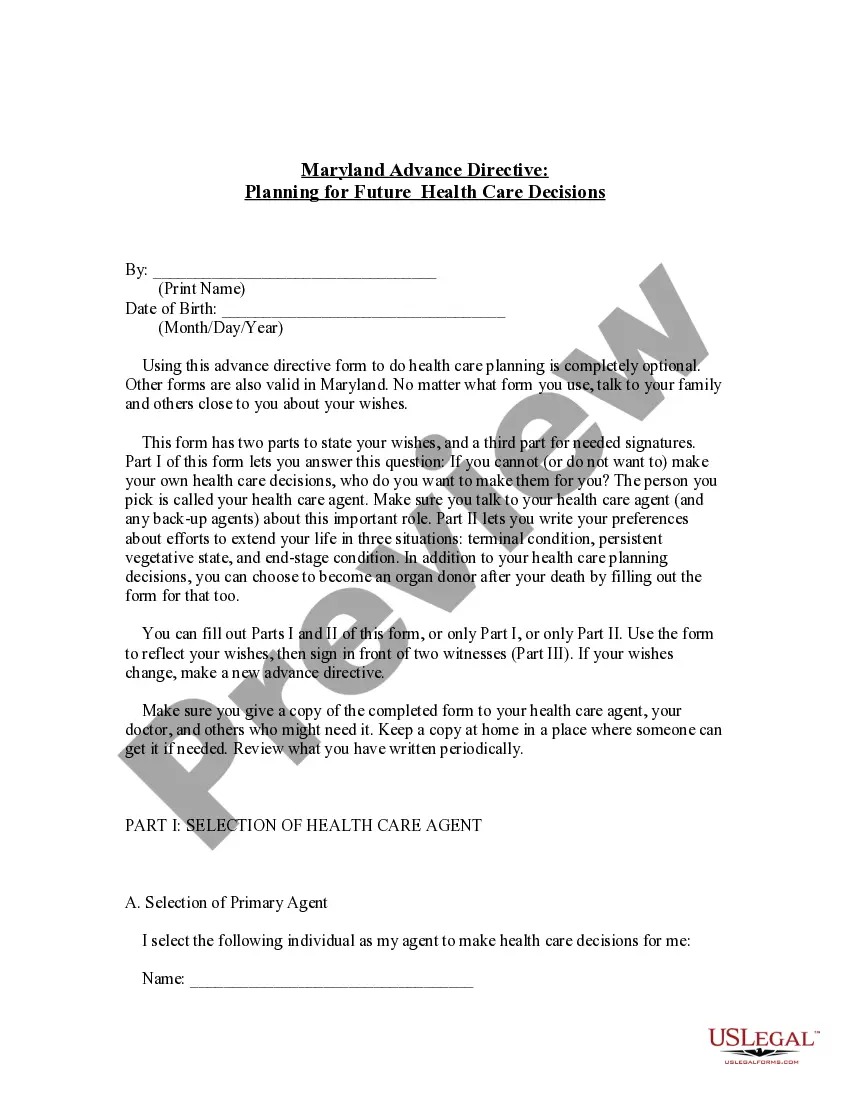

Exemptions: Here are the most common ones that the Seller should be made aware of: If the sales price is $100,000.00 or less, the exemption is automatic, no form needs to be completed. The Seller has owned and used the property as his principal residence at least 2 out of the 5 year period right before the sale.

Form 593, also known as the ?Real Estate Withholding Certificate,? is a document used in California real estate transactions. It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property.

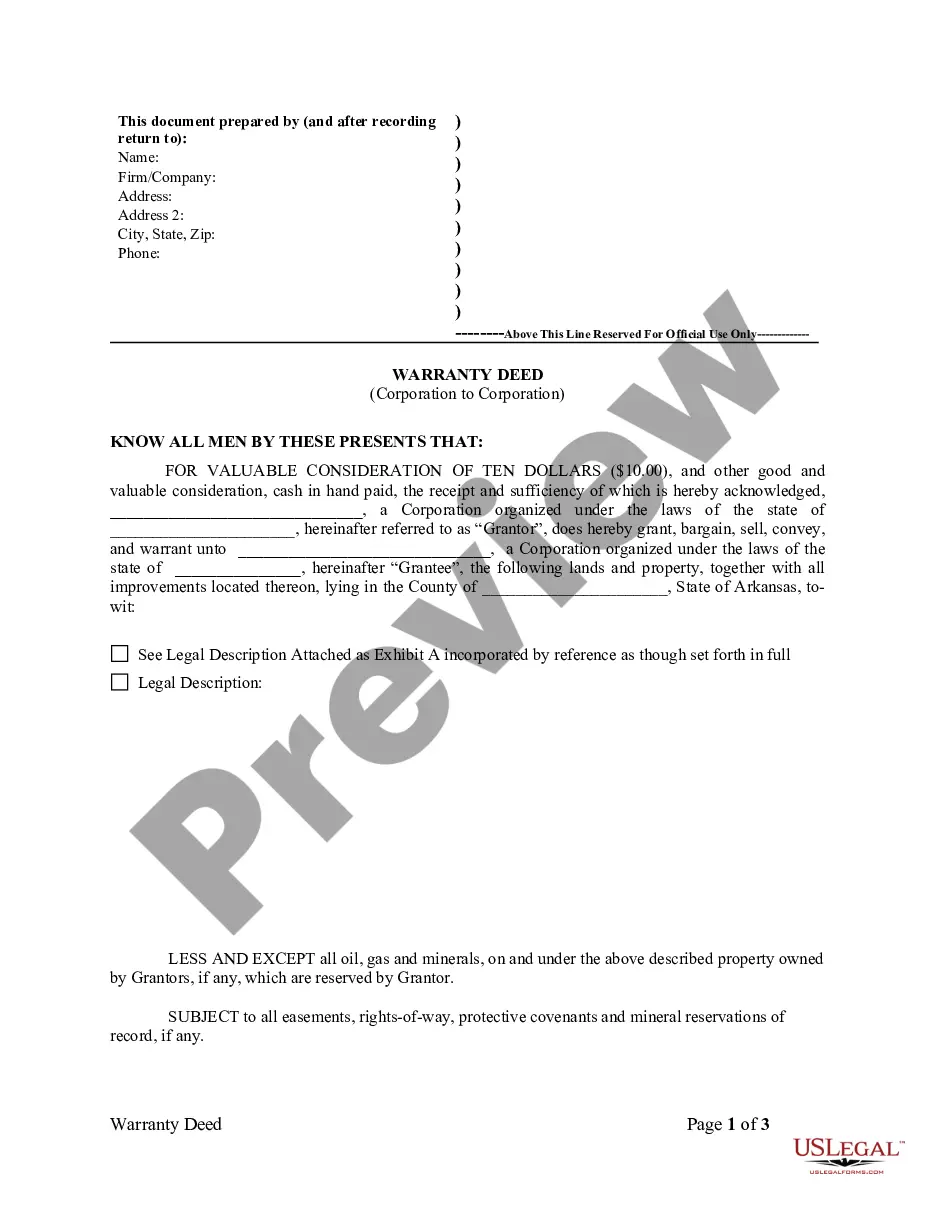

Wages paid to nonresidents of California for services performed inside the state are subject to withholding for state income tax; only wages paid to nonresidents of California for services performed outside the state are exempt from withholding. California does not distinguish between U.S. citizens, U.S. residents, and ...

When real estate is sold in Vermont, state income tax is due on the gain from the sale, whether the seller is a resident, part-year resident, or nonresident. If the seller is a nonresident, the buyer is required to withhold 2.5% of the sale price and remit it to the Vermont Department of Taxes.

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.