Trust Deed For Mortgage

Description

How to fill out Georgia Warranty Deed From Individual To A Trust?

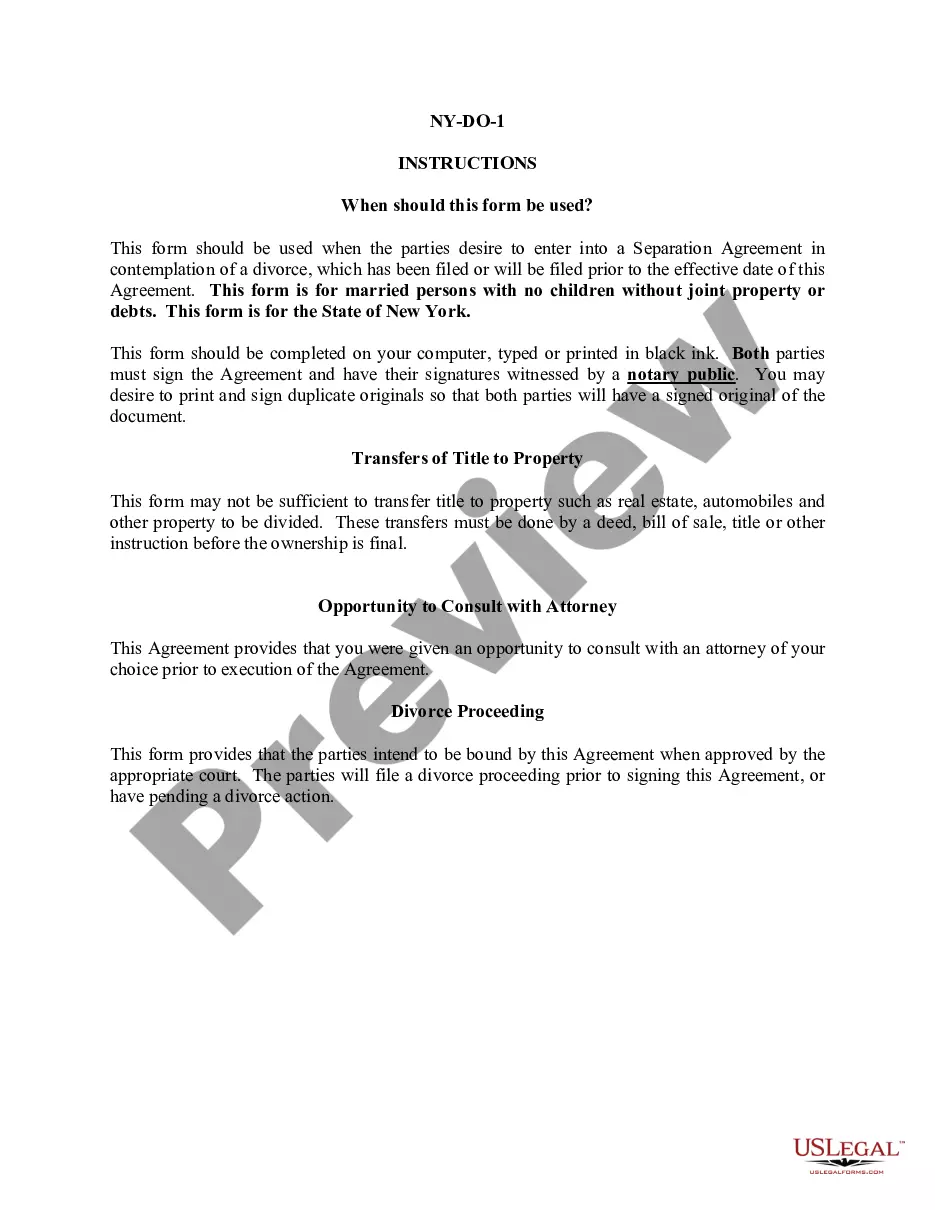

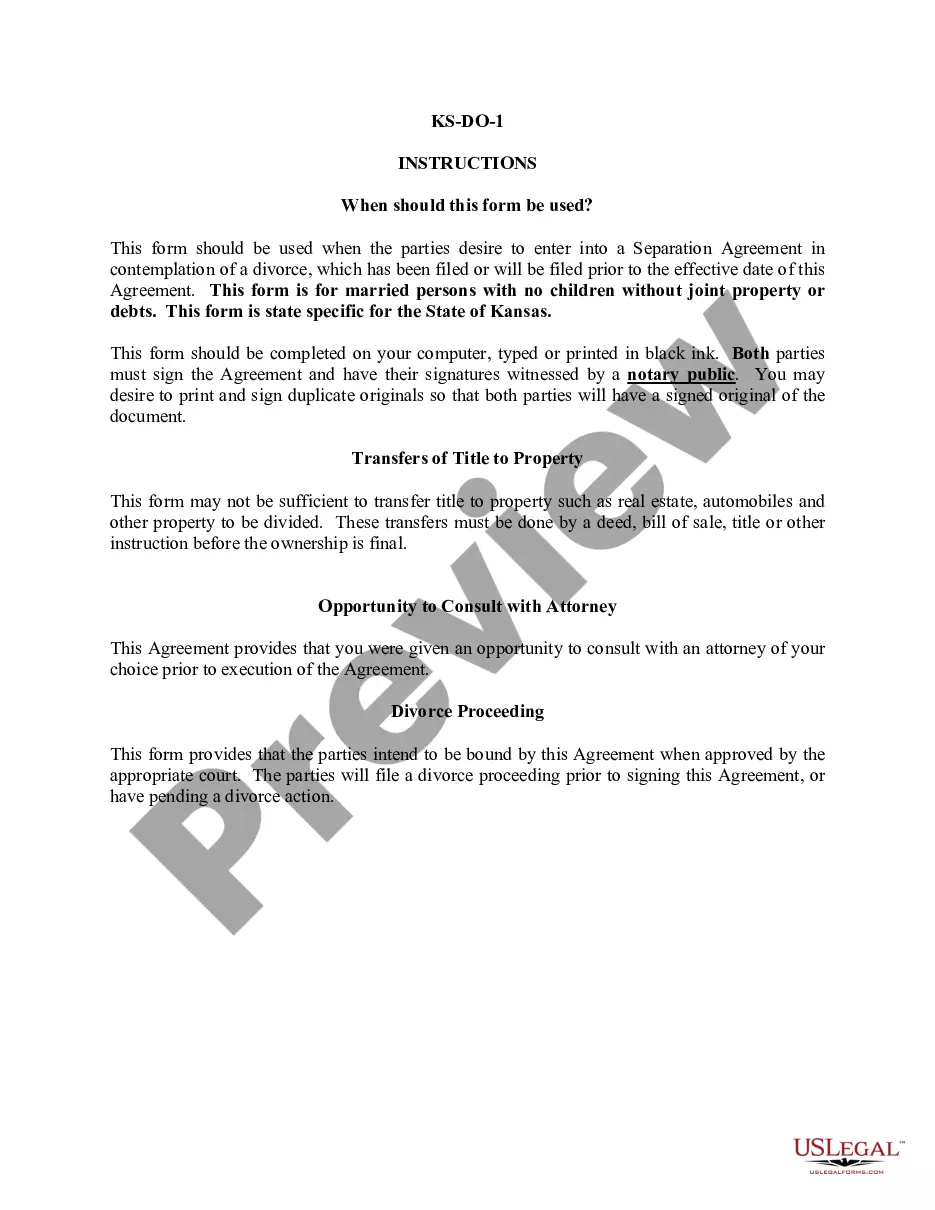

- If you are a returning user, simply log in to your account and select the desired trust deed template for download. Verify your subscription is active, or proceed to renew if necessary.

- For first-time users, start by browsing the extensive library of templates available. Ensure you thoroughly review the description and preview mode for the trust deed that aligns with your local requirements.

- If you need to find a different document, utilize the Search tab at the top of the page. This can help you locate any other required forms quickly.

- To purchase the selected trust deed, click on the 'Buy Now' button and choose your preferred subscription plan. You'll need to create an account for access to the legal forms library.

- Complete your transaction by entering your payment details either via credit card or PayPal to finalize the subscription.

- After your purchase, download your form and save it to your device. You can always access it later through the My Forms section of your account.

US Legal Forms offers not only a vast collection of legal documents—over 85,000 all easily fillable and editable—but it also connects you with premium experts for assistance, ensuring your trust deed is completed with accuracy and confidence.

In conclusion, downloading a trust deed for mortgage is streamlined with US Legal Forms. With our user-friendly platform, you can easily access necessary documents, so take the first step today and secure your financial future!

Form popularity

FAQ

Drafting a trust deed for mortgage involves several key steps. First, gather all relevant information about the borrower, lender, and property in question. Then, structure your document to include all necessary terms, ensuring clarity in the repayment plan and default conditions. For ease and accuracy, consider using drafting tools available on platforms like USLegalForms.

Yes, you generally need to declare a trust deed to protect your rights and inform others about the secured interest in your property. Declaring it through public records enhances its validity and legal enforceability. Platforms like US Legal Forms can help you navigate these requirements effectively, ensuring compliance with local laws.

To put your house in a trust while having a mortgage, you first need to review your mortgage terms. Some lenders allow this, but others may require you to get their consent. It's advisable to consult legal resources or use services like US Legal Forms to draft a trust deed for mortgage that correctly transfers ownership.

Yes, you can write your own trust deed for mortgage, but it's crucial to ensure it meets state laws. A properly drafted trust deed outlines the agreement between you and your lender, helping to protect both parties in the transaction. Using templates from platforms like US Legal Forms can provide structure and guidance, making the process simpler.

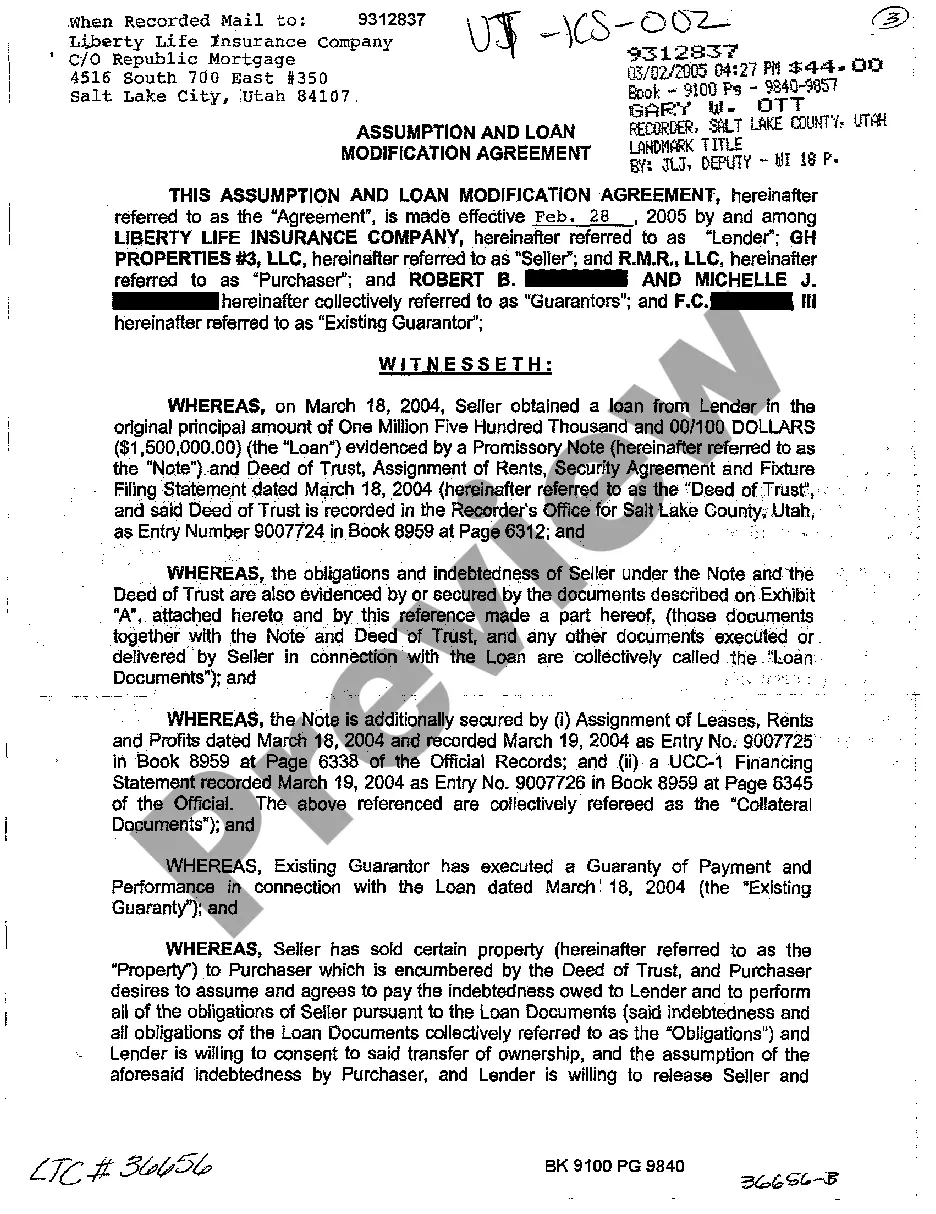

A mortgage trust deed is a specific type of trust deed used primarily for securing mortgage loans. It involves a trustee holding the property title, providing a layer of protection for the lender while allowing the borrower to live in and use the property. In essence, a mortgage trust deed for mortgage is a foundational document that supports secure lending practices.

The function of a trust deed for mortgage is to detail the obligations of the borrower while also outlining the rights of the lender. Essentially, it creates a legal framework that defines how the property may be held and what happens if the borrower defaults. This clarity helps protect both parties and facilitates smoother transactions.

Individuals may use a deed of trust for various reasons, primarily to simplify the mortgage process. This legal document provides a streamlined method for securing loans, making it easier to manage the relationship between the borrower, lender, and trustee. By using a trust deed for mortgage, borrowers can often enjoy quicker closings and clearer terms.

One potential disadvantage of a trust deed for mortgage is the lack of judicial oversight during foreclosure. This process can occur more swiftly but might limit your options for negotiation and appeal. It's important to weigh these factors and consider how they align with your financial situation and long-term goals.

Lenders often prefer a deed of trust for its streamlined foreclosure process compared to a traditional mortgage. With a deed of trust, they can initiate a non-judicial foreclosure, which is generally quicker and less costly. This efficiency benefits both lenders and borrowers by resolving issues around default more effectively.

A mortgage is not technically a form of deed of trust; they are distinct legal instruments used for securing loans. A deed of trust involves three parties—the borrower, the lender, and a trustee—while a mortgage generally involves only two parties. Understanding the specific distinctions can help you navigate your financing options effectively.