Trust Deed For House

Description

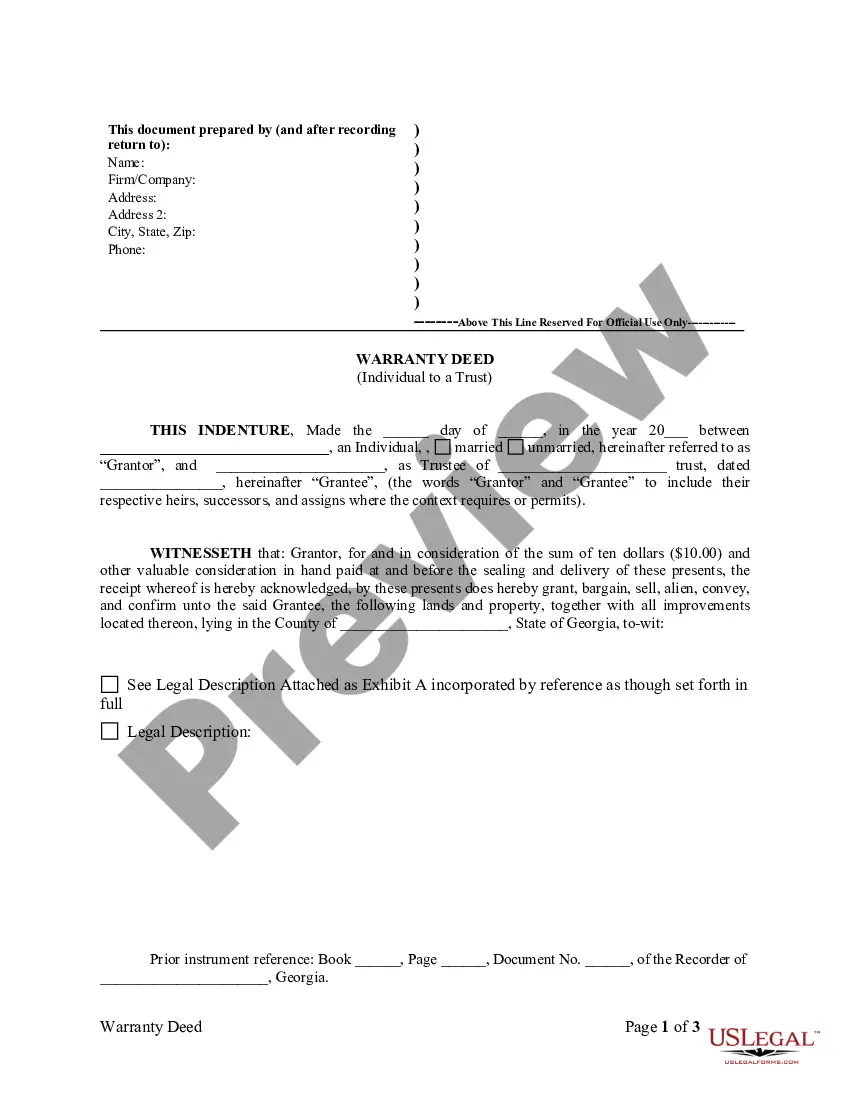

How to fill out Georgia Warranty Deed From Individual To A Trust?

- Log in to your US Legal Forms account if you are a returning user and ensure your subscription is active.

- If you're new, start by exploring the Preview mode and form description to find the right trust deed that fits your needs and local jurisdiction.

- If necessary, utilize the Search tab for more templates to ensure that you are choosing the correct form.

- Select your document by clicking the Buy Now button and choose your preferred subscription plan. Make sure to create an account for access.

- Complete your purchase by entering your payment details using a credit card or PayPal.

- Finally, download your trust deed template to your device and access it anytime in the My Forms section of your profile.

US Legal Forms offers users unrivaled access to over 85,000 fillable legal templates and packages, allowing expedient form completion while ensuring accuracy and legal compliance.

Don't hesitate to get started on your trust deed for house today. Visit US Legal Forms and experience the benefits for yourself!

Form popularity

FAQ

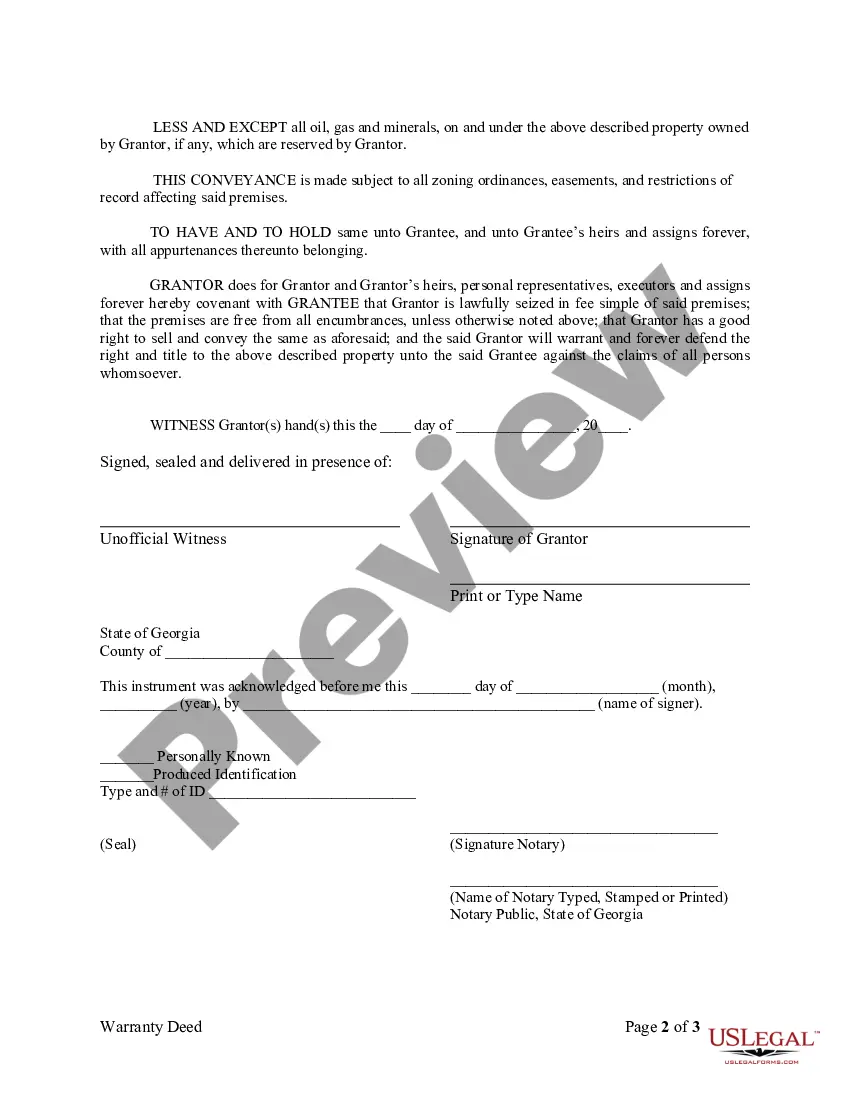

Someone might choose a trust deed for house due to its advantages in securing financing. This approach generally has quicker foreclosure proceedings and can lead to lower interest rates compared to standard mortgages. Additionally, the involvement of a neutral trustee adds another layer of security for both parties in the agreement.

One disadvantage of a trust deed for house is that it typically allows lenders to foreclose without going through the court system, which can be unsettling for borrowers. Additionally, if you default, the trustee may sell your property quickly, which can limit your time to address payment issues. This aspect requires careful consideration and understanding of your rights before entering a trust deed agreement.

A trust deed for house offers a streamlined process for securing financing compared to traditional mortgages. This arrangement provides flexibility, as it allows lenders to foreclose more quickly, which can result in lower interest rates for borrowers. Additionally, a deed of trust involves a third party, known as a trustee, who oversees the agreement, ensuring both parties are protected.

While a trust deed for a house can be beneficial, there are disadvantages to consider. Establishing a trust can lead to additional legal fees and ongoing management responsibilities. Moreover, transferring property into a trust may affect your ability to access home equity loans or lines of credit. Reviewing your options with a knowledgeable expert can help clarify the best course of action for your situation.

Holding property in a trust offers several advantages, including asset protection and streamlined transfer upon death. A trust deed for a house simplifies the process of passing property to heirs without the need for probate. On the downside, setting up and maintaining a trust may involve costs and administrative duties. It's essential to weigh these factors carefully based on your individual circumstances.

Deciding whether to gift a house or put it in a trust involves weighing the benefits of each option. Gifting a house can trigger tax consequences that impact both the giver and the recipient. Conversely, a trust deed for a house provides more control over how the property is managed and distributed over time. Evaluating your financial goals and priorities may guide you to the best choice.

One of the most significant mistakes parents make when establishing a trust fund is failing to appropriately name the beneficiaries. By not clearly defining who will benefit from the trust deed for the house, parents risk confusion or disputes later on. Additionally, not outlining the terms and conditions for asset distribution can lead to frustration among heirs. Consulting with a legal expert can help navigate these complexities.

In a deed of trust arrangement, the trustee holds the deed to your house legally, while you retain equitable title. This means that, even though the trustee has legal ownership, you have the right to live in and use the property. Once you fully repay the mortgage, the trustee will transfer full ownership back to you, providing a secure pathway to owning your home completely.