Georgia Articles Of Incorporation Template With Calculator

Description

How to fill out Georgia Articles Of Incorporation For Domestic For-Profit Corporation?

Working with legal documents and operations can be a time-consuming addition to the day. Georgia Articles Of Incorporation Template With Calculator and forms like it typically require you to look for them and navigate the best way to complete them appropriately. Consequently, if you are taking care of economic, legal, or personal matters, using a extensive and hassle-free online library of forms at your fingertips will go a long way.

US Legal Forms is the top online platform of legal templates, offering more than 85,000 state-specific forms and numerous resources to assist you complete your documents effortlessly. Explore the library of relevant papers available with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Protect your papers management procedures by using a top-notch services that lets you put together any form in minutes without extra or hidden fees. Simply log in to your profile, find Georgia Articles Of Incorporation Template With Calculator and download it straight away in the My Forms tab. You may also access previously saved forms.

Could it be your first time using US Legal Forms? Sign up and set up a free account in a few minutes and you’ll have access to the form library and Georgia Articles Of Incorporation Template With Calculator. Then, follow the steps listed below to complete your form:

- Be sure you have the proper form by using the Review option and looking at the form information.

- Choose Buy Now when ready, and select the monthly subscription plan that suits you.

- Press Download then complete, sign, and print the form.

US Legal Forms has 25 years of experience assisting users deal with their legal documents. Get the form you need today and improve any process without having to break a sweat.

Form popularity

FAQ

To form a Georgia S corp, you'll need to ensure your company has a Georgia formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

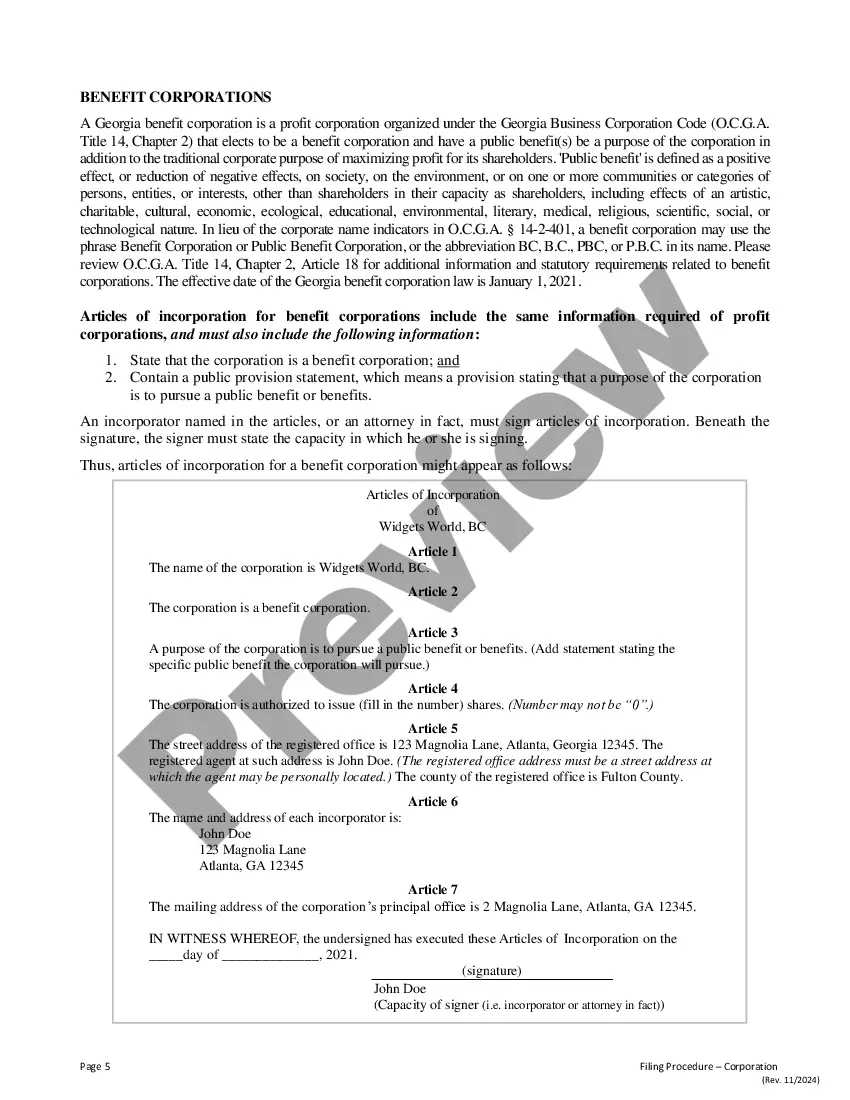

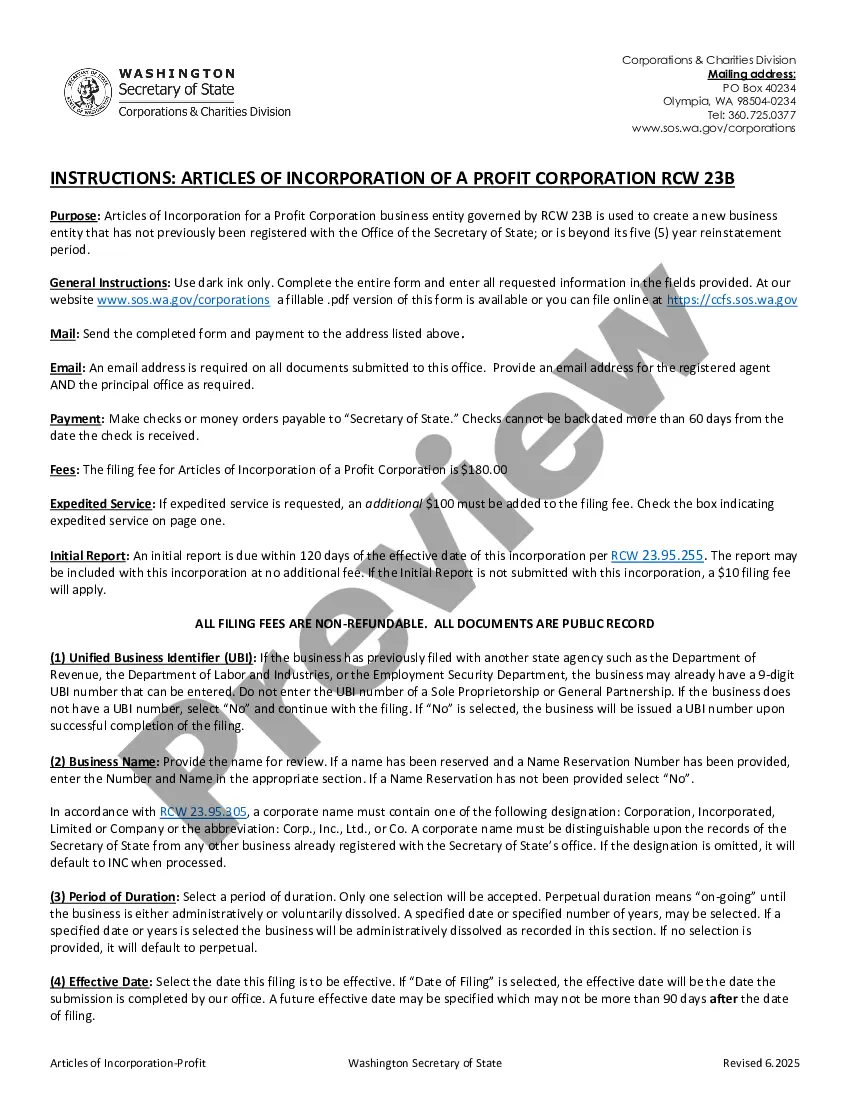

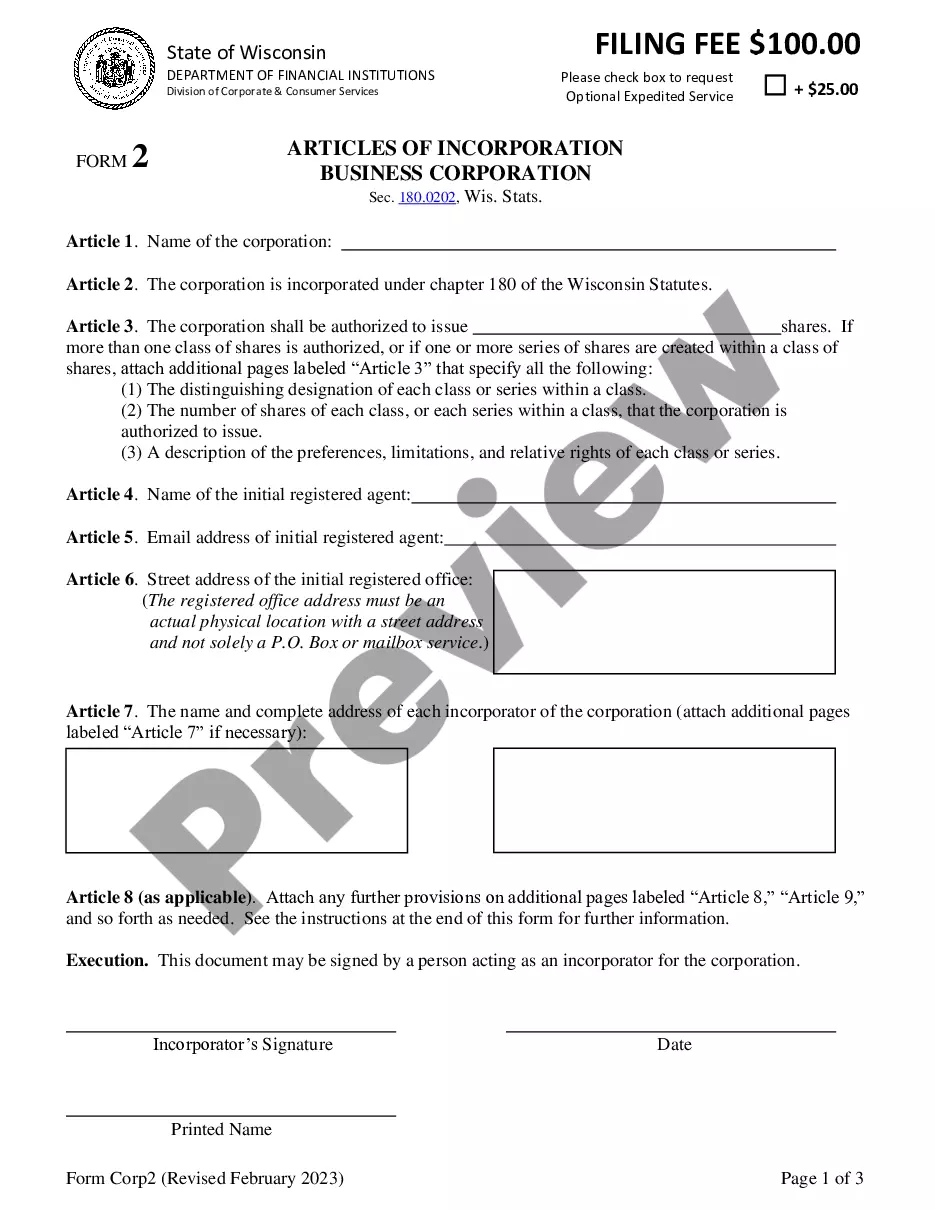

How do I create Articles of Incorporation? Step 1: State where the corporation is incorporating. ... Step 2: Provide details about the person filing the Articles of Incorporation. ... Step 3: State the corporation's name, purpose and duration. ... Step 4: Include details about the registered agent and office.

Filing for S corp election doesn't cost anything at the federal or state level in Georgia. However, if you haven't yet formed an LLC or a corporation, you'll need to pay a filing fee of $100 for an LLC and $100 for a corporation.

The articles of incorporation must include the following information: Name of the corporation. Type of entity. Corporate mailing and street address. Name, street, and mailing address of the registered agent. Incorporator's name, street, and mailing address. The names and mailing addresses of the corporate directors.

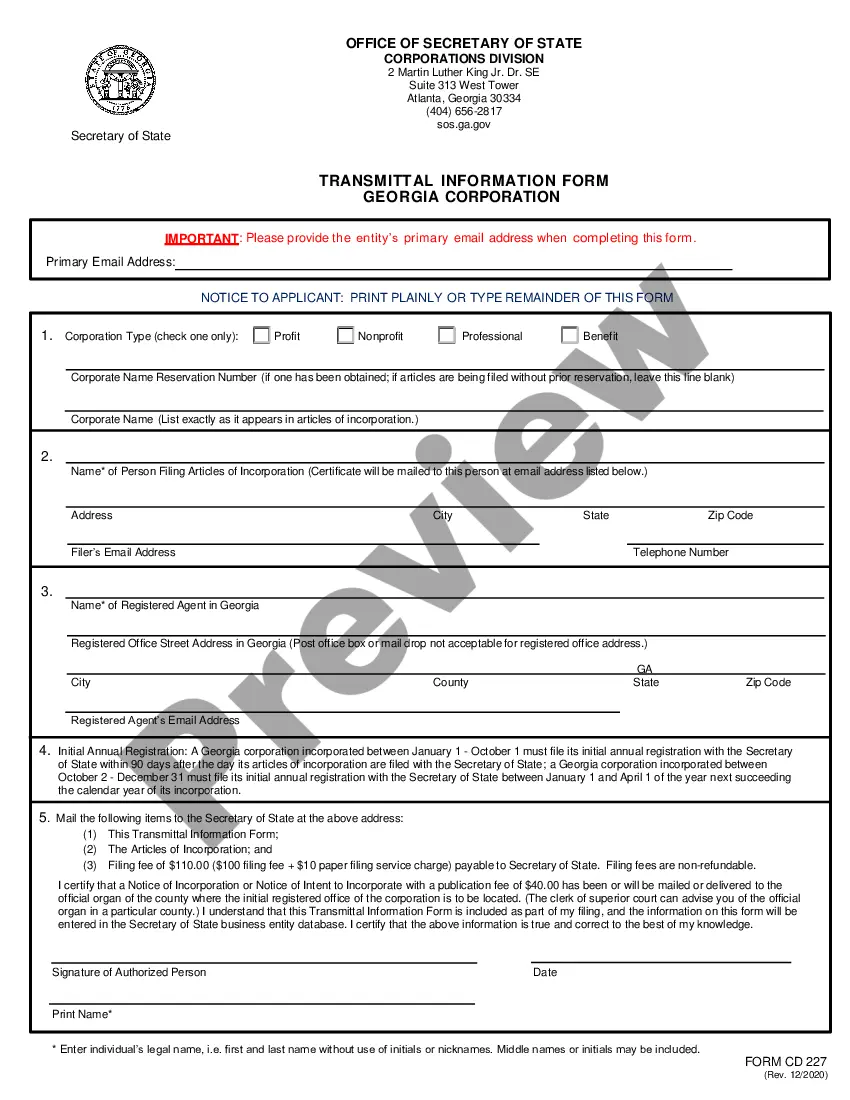

Create & File Registration Visit the Secretary of State's online services page. Create a user account. Select ?create or register a business?. ... Fill out the required information about your business entity (listed above). Pay the $100 filing fee by approved credit card: Visa, MasterCard, American Express, or Discover.