Articles Of Incorporation Georgia Template With Calculator

Description

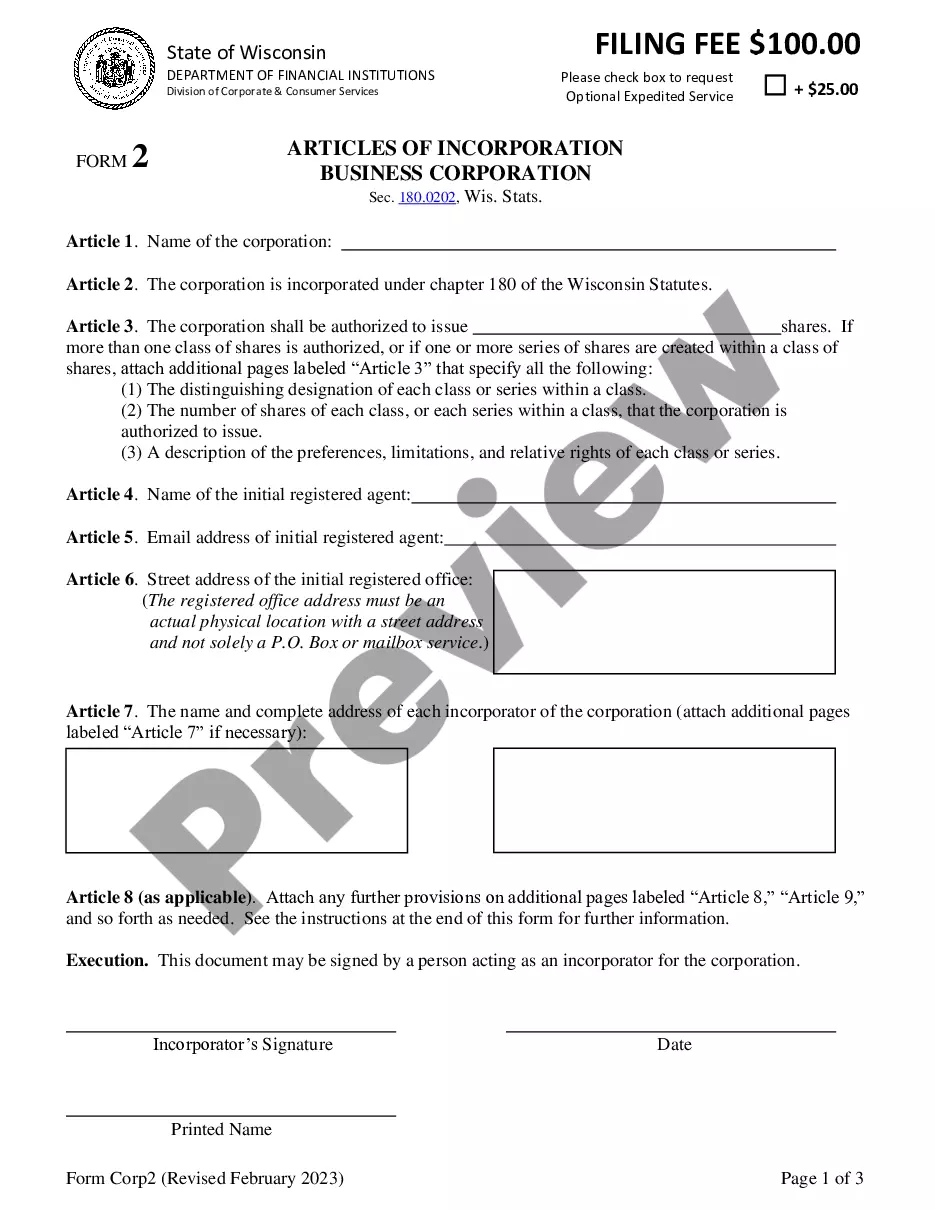

How to fill out Georgia Articles Of Incorporation For Domestic For-Profit Corporation?

The Articles Of Incorporation Georgia Template With Calculator displayed on this page is a reusable legal model created by expert attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 verified, state-specific documents for any commercial and personal situation. It’s the quickest, easiest, and most trustworthy method to acquire the paperwork you require, as the service ensures the utmost level of data safety and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you need and verify it.

- Browse through the example you searched for and preview it or examine the form description to ensure it meets your needs. If it does not, utilize the search feature to identify the correct one. Click Buy Now once you have located the template you need.

- Choose and Log In to your account.

- Select the pricing option that best fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and check your subscription to continue.

- Acquire the editable template.

- Select the format you prefer for your Articles Of Incorporation Georgia Template With Calculator (PDF, Word, RTF) and download the sample to your device.

- Fill out and sign the documents.

- Print the template to fill it out by hand. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with an eSignature.

- Download your documents again.

- Use the same document again whenever required. Access the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

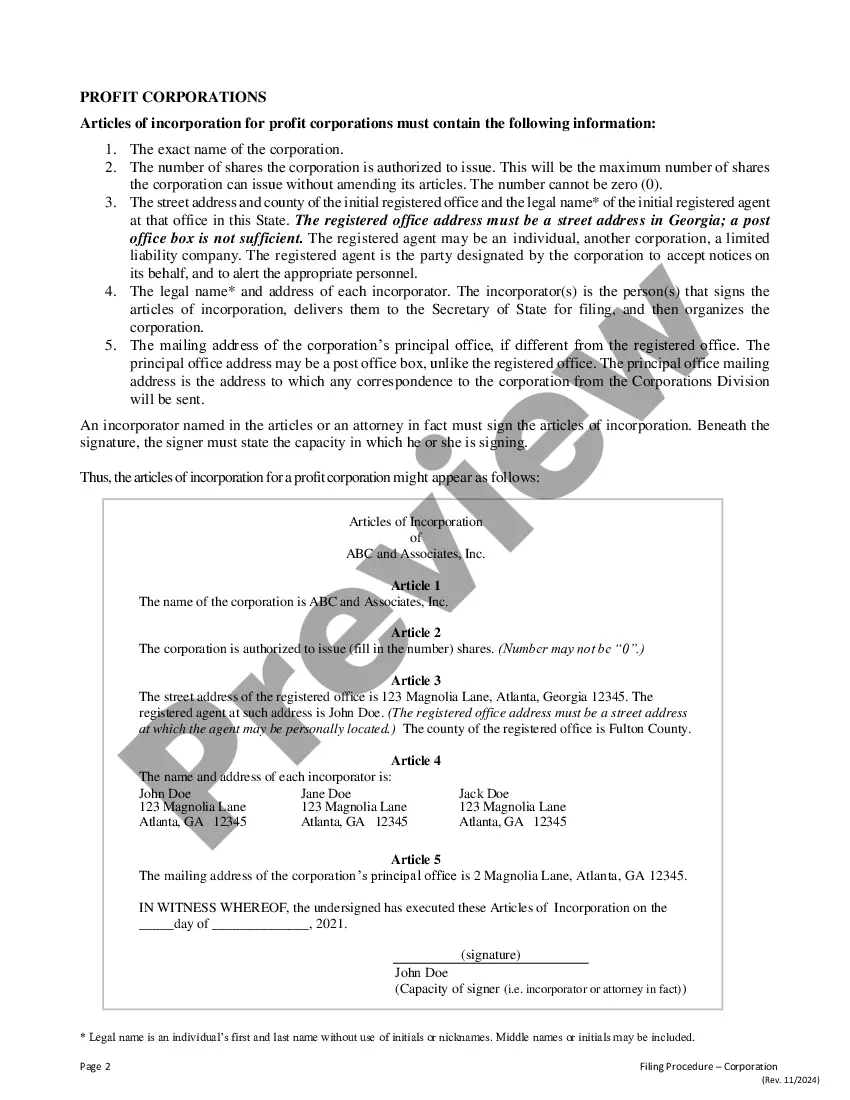

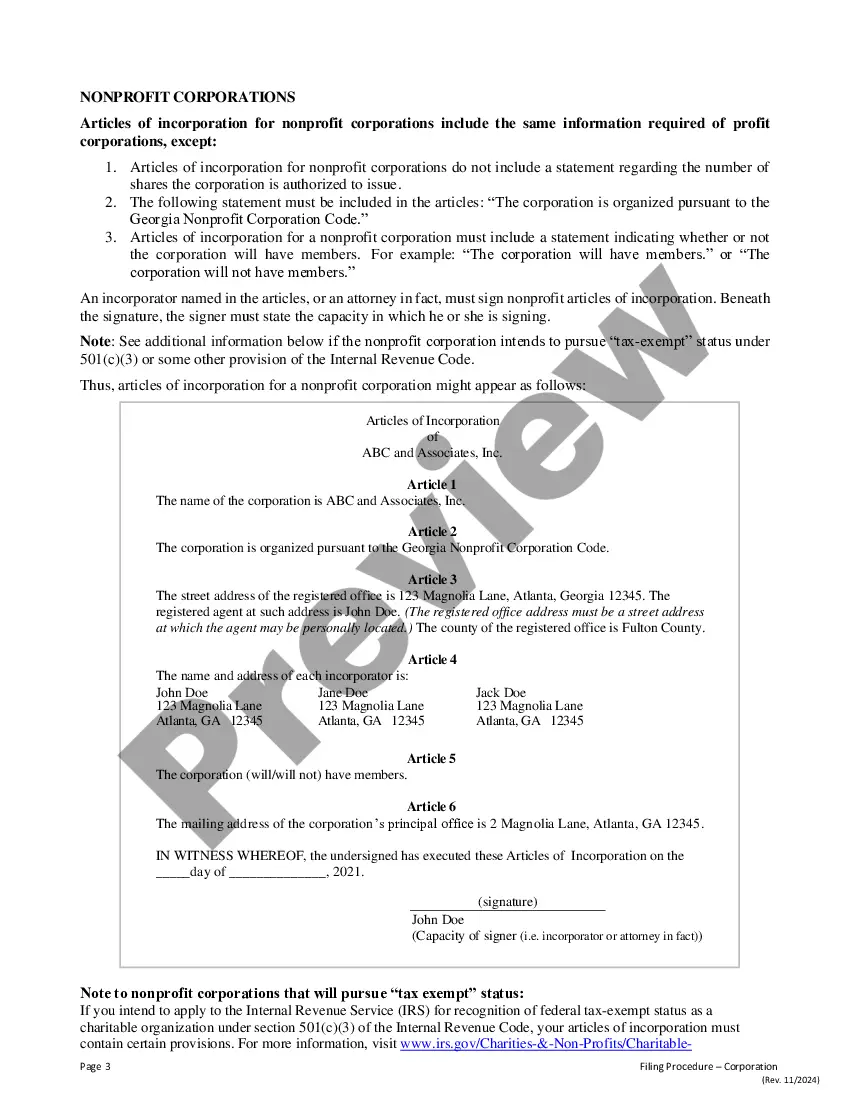

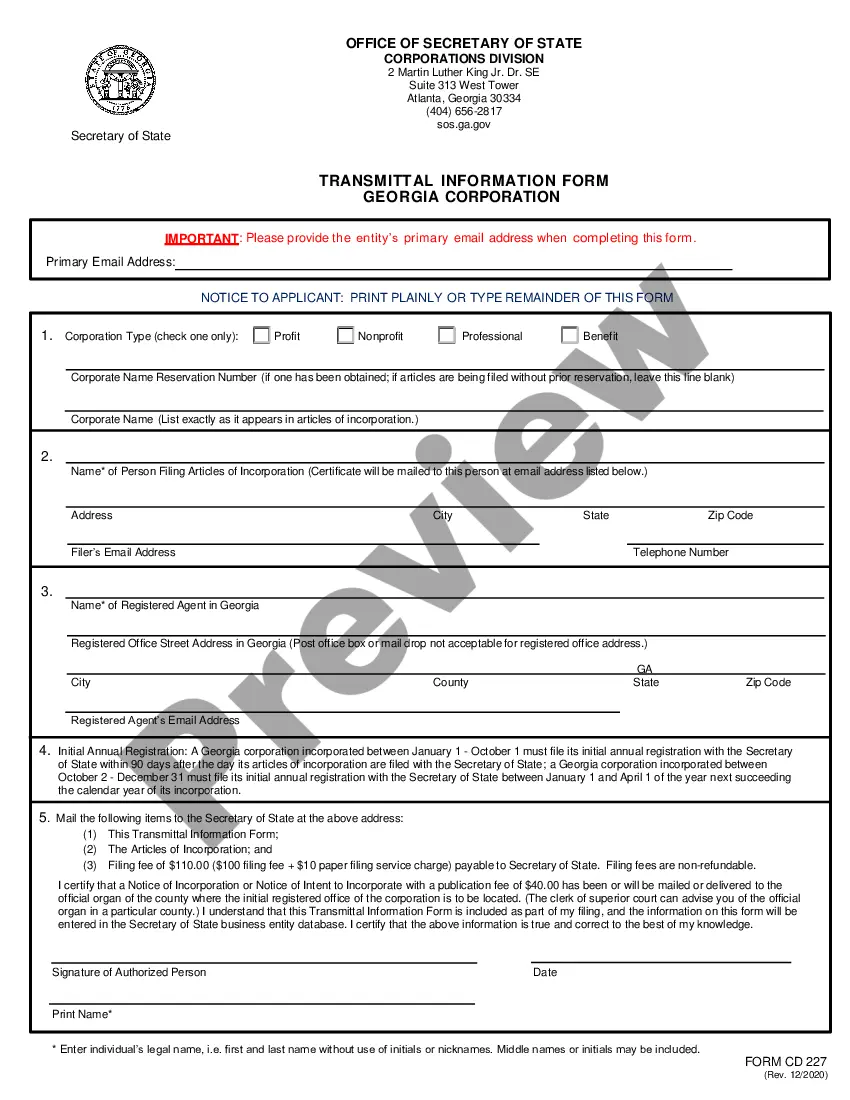

To form an LLC in Georgia, you must file Articles of Incorporation, select a unique business name, and designate a registered agent. You'll also need to create an operating agreement and obtain any necessary licenses or permits. An Articles of incorporation Georgia template with calculator can guide you through these steps, making the process easier and more efficient.

When filing Articles of Incorporation in Georgia, you must include the name of your LLC, its registered agent, the principal address, and the purpose of the business. Additionally, you should provide the duration of the LLC and the information of the organizers. Utilizing an Articles of incorporation Georgia template with calculator can help you ensure that you include everything necessary and avoid common pitfalls.

No, Articles of Incorporation and an LLC are not the same thing. Articles of Incorporation is a legal document that establishes your LLC as a formal business entity, while LLC stands for Limited Liability Company, which is the structure you are creating. By using an Articles of incorporation Georgia template with calculator, you can effectively create and manage your LLC.

You do not need Articles of Incorporation to obtain an Employer Identification Number (EIN). The EIN is primarily for tax purposes and can be obtained without registering your business structure. However, having an Articles of incorporation Georgia template with calculator will help you when you decide to formalize your business status later.

Yes, you need to file Articles of Incorporation to establish your LLC in Georgia. This document formally registers your business with the state and outlines its purpose and structure. Using an Articles of incorporation Georgia template with calculator can simplify this process and ensure you include all required information.

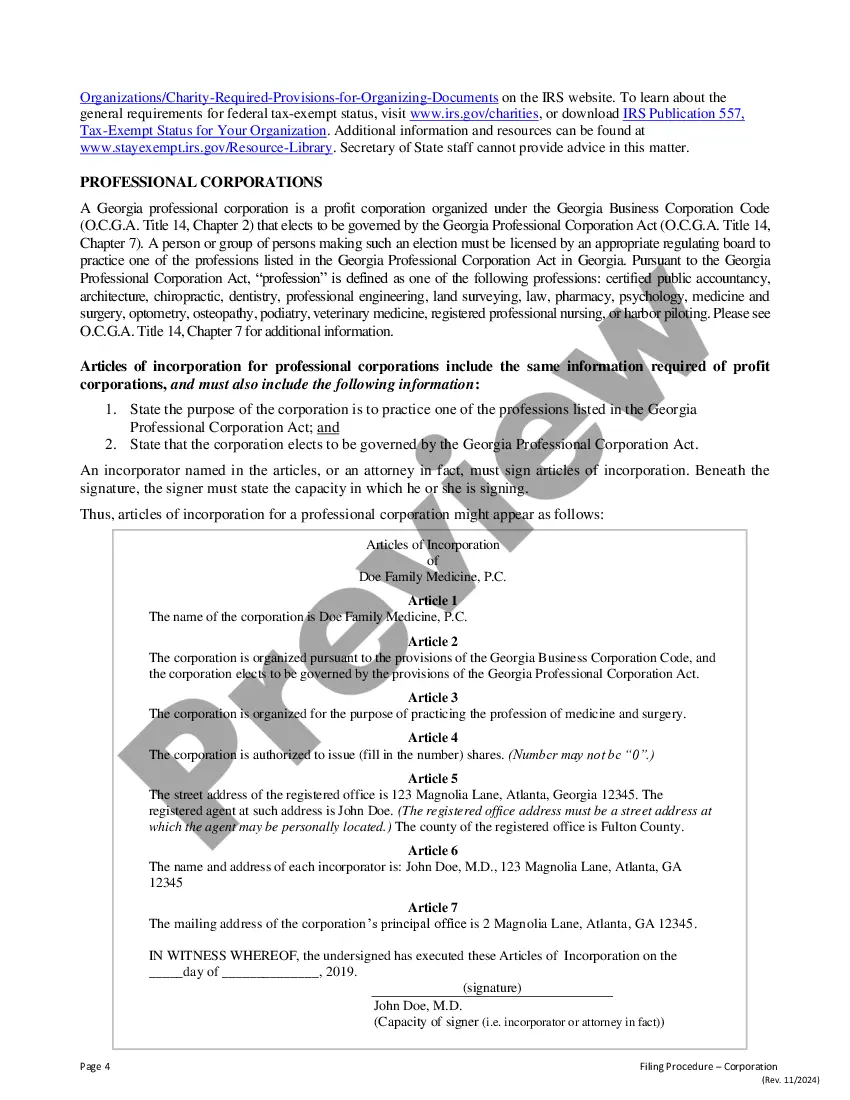

Yes, an AS Corporation must have a board of directors as required by Georgia law. This board is crucial for making key business decisions and guiding the corporation's direction. If you are in the process of setting up your AS Corp, using an Articles of Incorporation Georgia template with calculator can assist you in meeting legal obligations and creating a solid foundation for your business.

Most corporations in Georgia, especially those registered as C-corporations or S-corporations, are required to establish a board of directors. This requirement ensures that there is governance over corporate actions and compliance with laws. Therefore, whether you are starting a new business or reviewing your current structure, utilizing an Articles of Incorporation Georgia template with calculator can help outline these essential governance structures.

Yes, Georgia law requires all corporations to file Articles of Incorporation to legally establish the business. This document includes essential information such as the corporation's name and purpose. To streamline the process, consider using an Articles of Incorporation Georgia template with calculator available through uslegalforms, which can guide you through the filing requirements.

In Georgia, state law requires most corporations to have a board of directors. This board oversees major decisions and maintains compliance with state regulations. For those drafting their Articles of Incorporation, using an Articles of Incorporation Georgia template with calculator can help clarify requirements and ensure compliance.

Yes, it is possible to have a corporation without a board of directors in specific types of corporations. Some small businesses, especially single-member or closely-held corporations, may choose to operate without a traditional board. However, it's advisable to review the state requirements carefully before deciding, as having a board can provide multiple benefits for governance.