Estate Planning Questionnaire And Worksheets With Examples

Description

How to fill out Florida Estate Planning Questionnaire And Worksheets?

Bureaucracy requires precision and exactness.

Unless you deal with completing paperwork like Estate Planning Questionnaire And Worksheets With Examples regularly, it might result in some misunderstanding.

Selecting the appropriate sample from the outset will ensure that your document submission goes smoothly and avert any hassles of re-sending a file or starting the same task entirely from scratch.

Finding the correct and current templates for your paperwork takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and enhance your efficiency with forms.

- US Legal Forms is the largest online repository of forms that contains over 85 thousand templates for various areas.

- You can discover the most current and most suitable version of the Estate Planning Questionnaire And Worksheets With Examples by simply searching for it on the website.

- Find, store, and download templates in your profile or verify with the description to ensure you have the correct one available.

- With a US Legal Forms account, you can conveniently procure, keep in one place, and navigate through the templates you save to access them in just a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, move to the My documents page, where your forms history is maintained.

- Review the description of the forms and download the ones you need at any time.

- If you're not a registered user, finding the needed sample will involve a few extra steps.

Form popularity

FAQ

The 5 or 5 rule in estate planning, often referred to similarly to the 5 by 5 rule, indicates that beneficiaries can withdraw a certain amount from a trust without incurring tax penalties. This policy aims to balance the beneficiaries' access to funds while preserving the trust's integrity. Incorporating an estate planning questionnaire and worksheets with examples will help you understand how to apply this rule in your estate plans. This knowledge empowers you to maximize the benefits for your heirs.

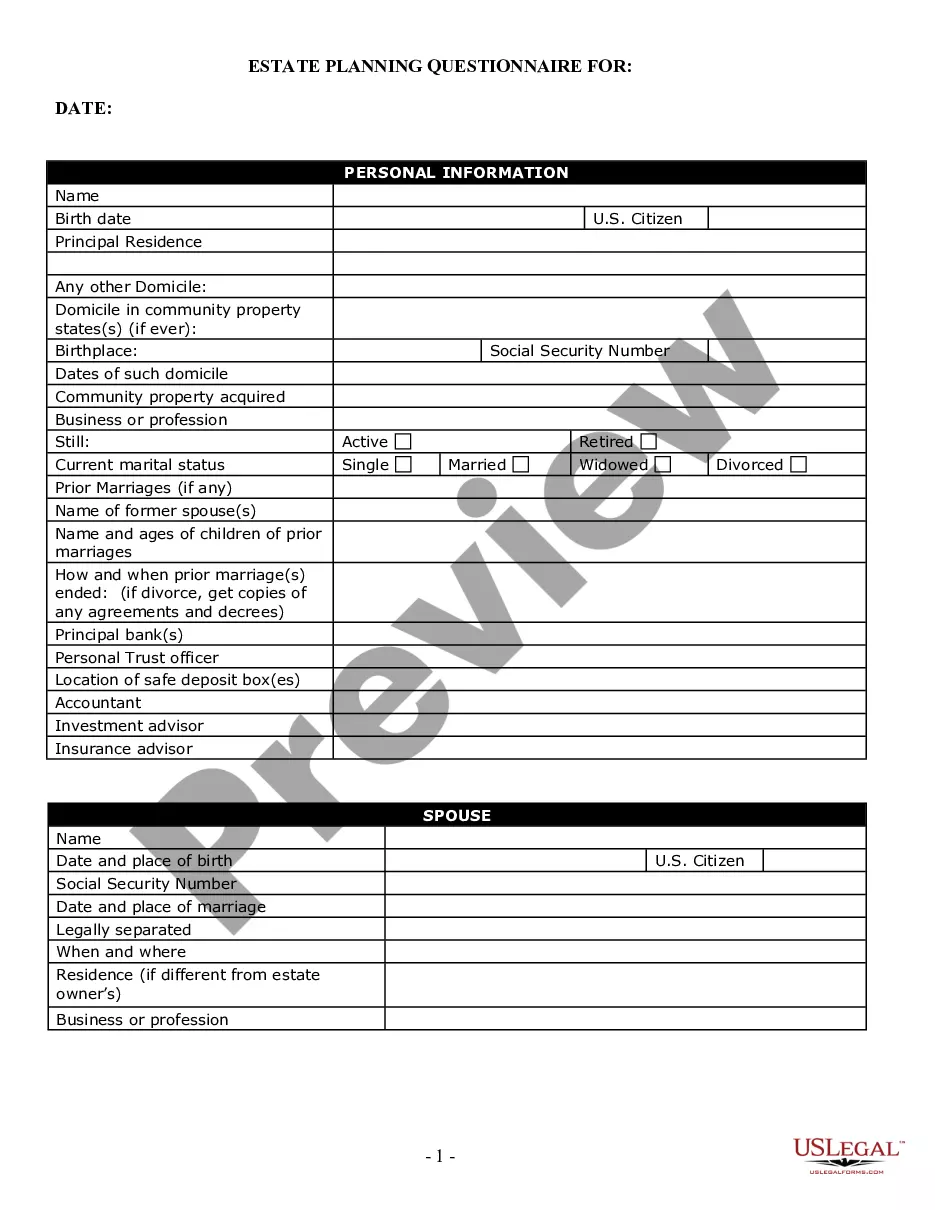

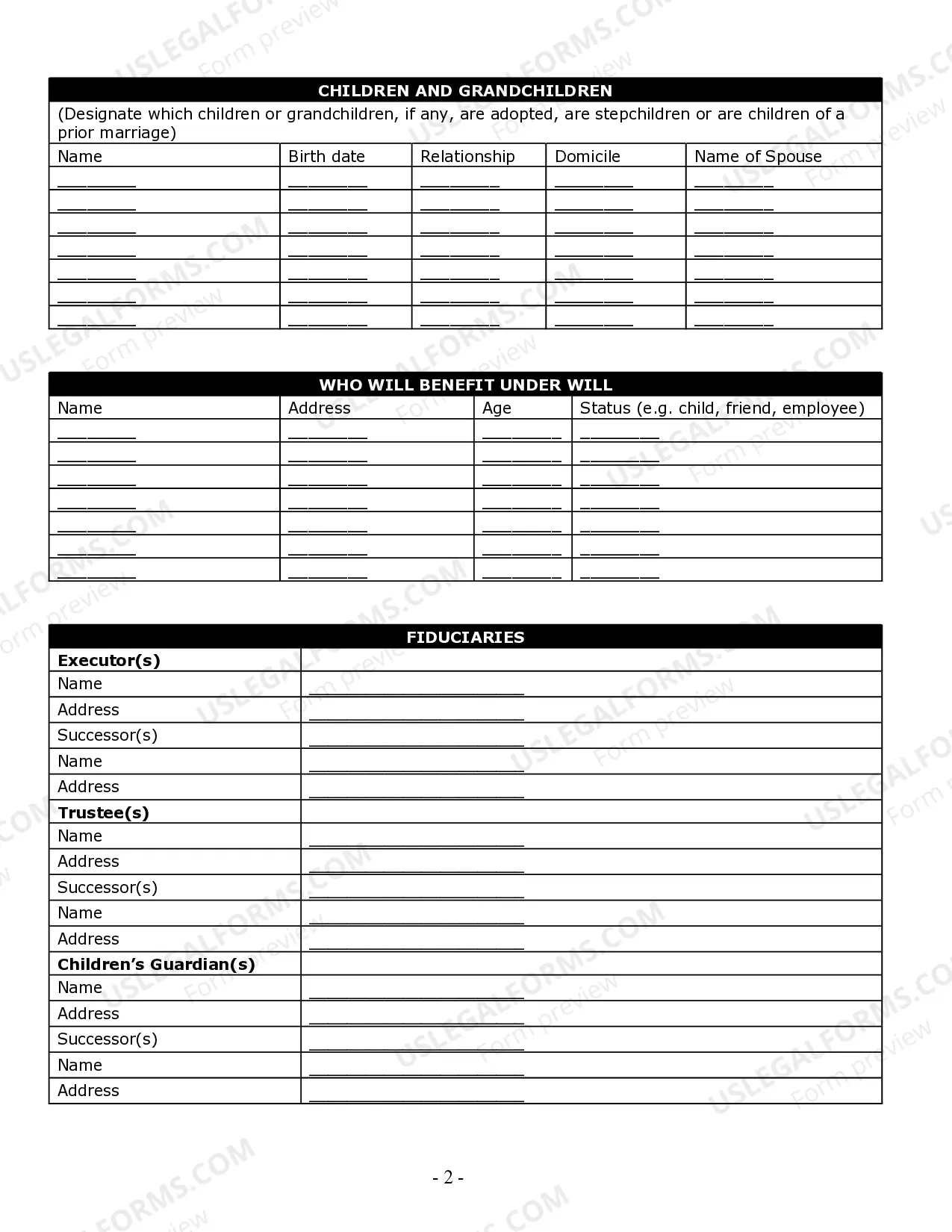

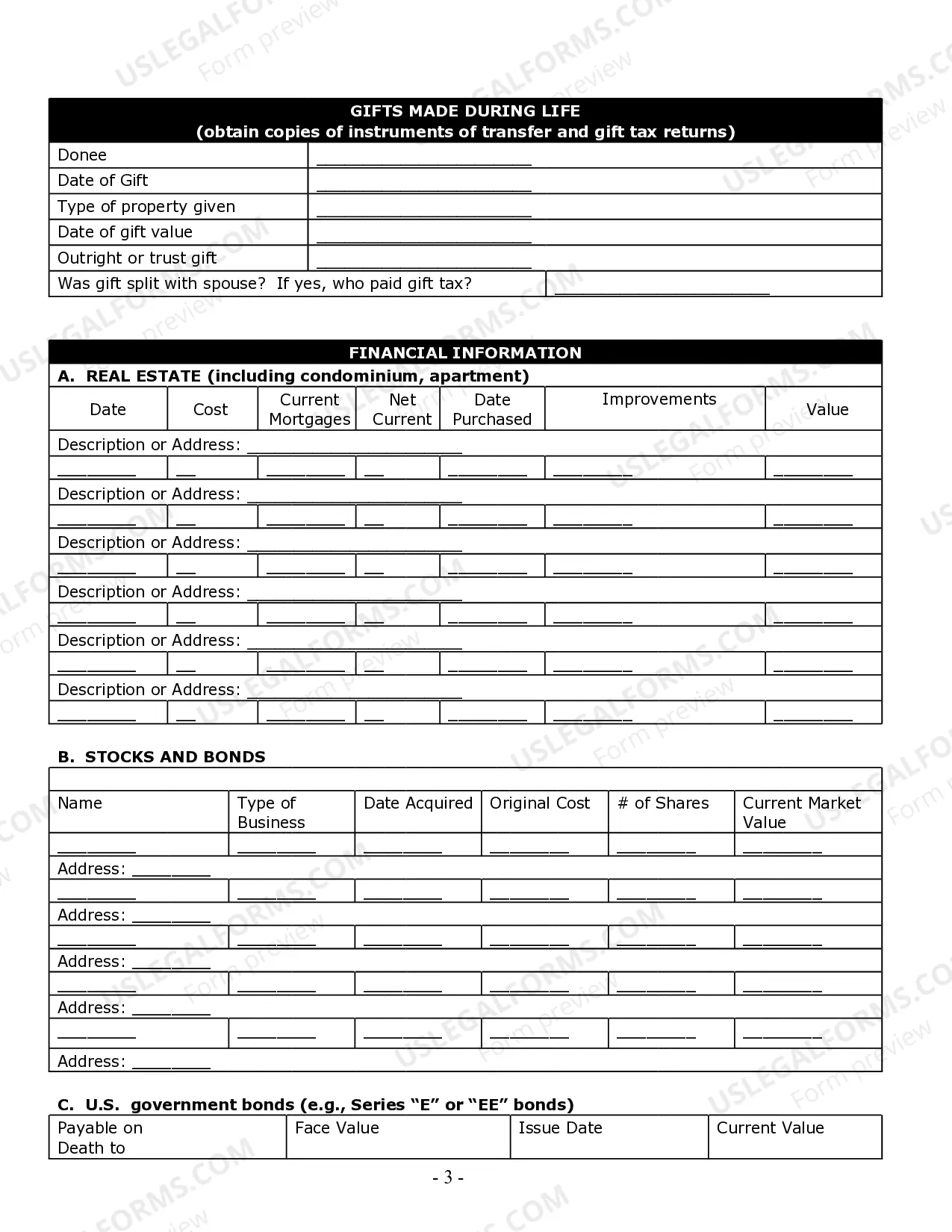

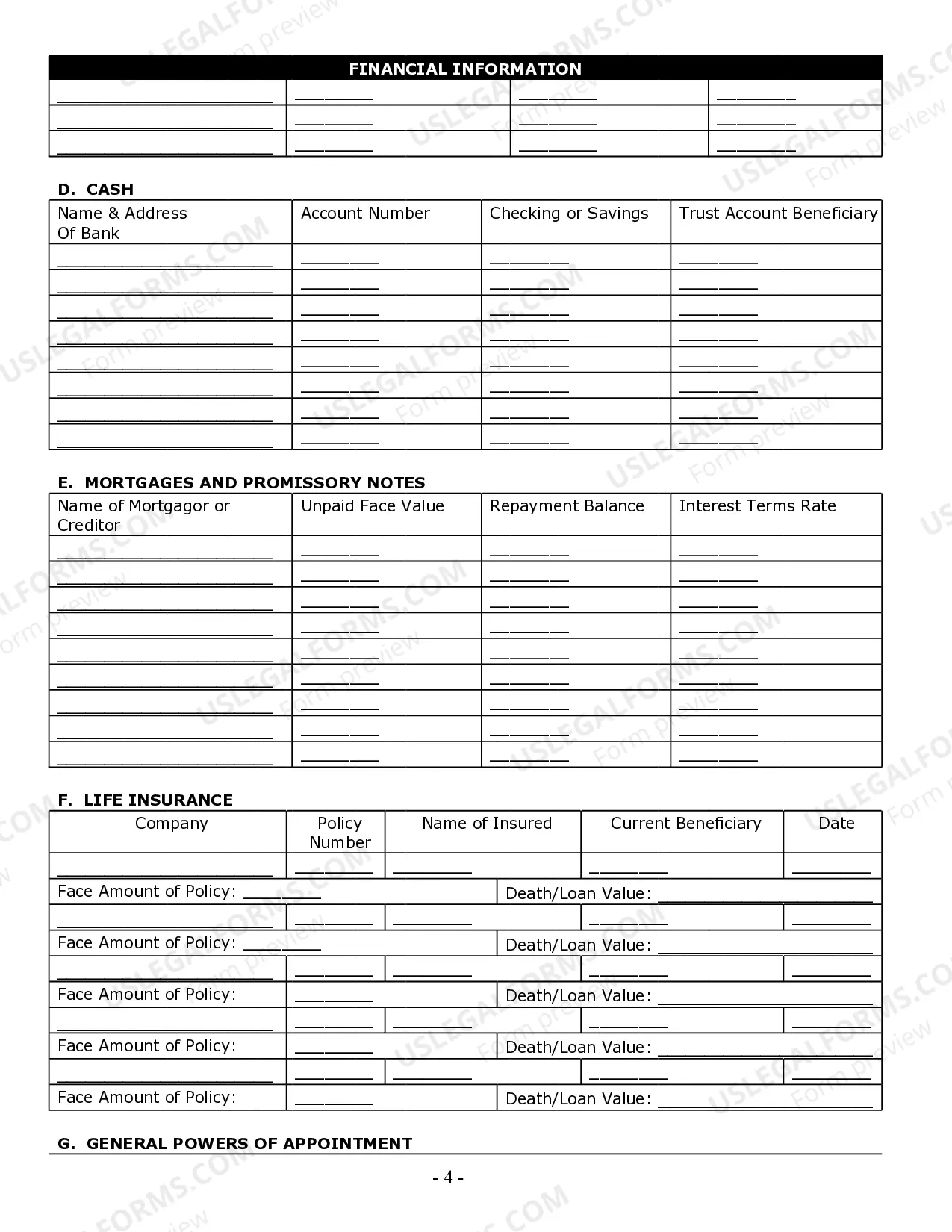

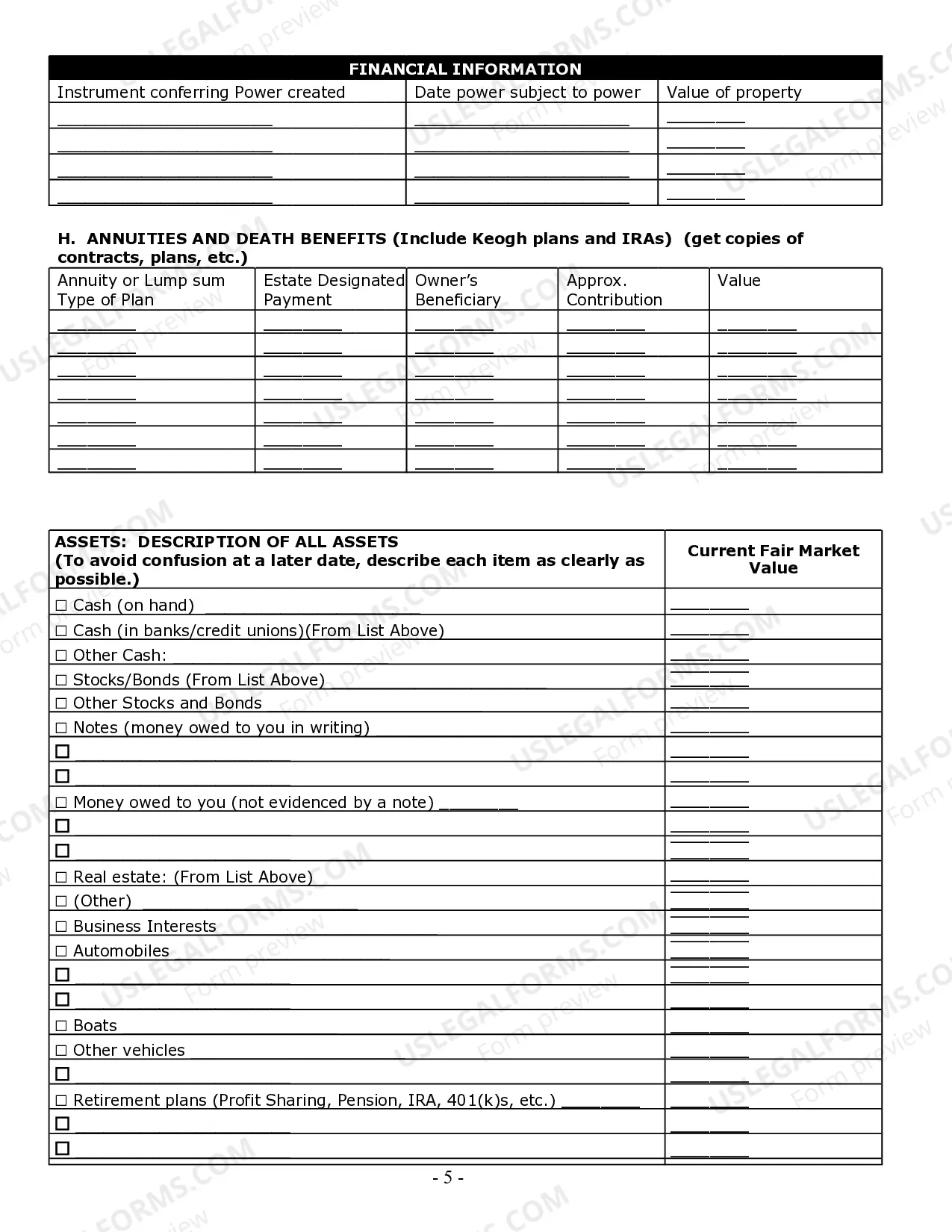

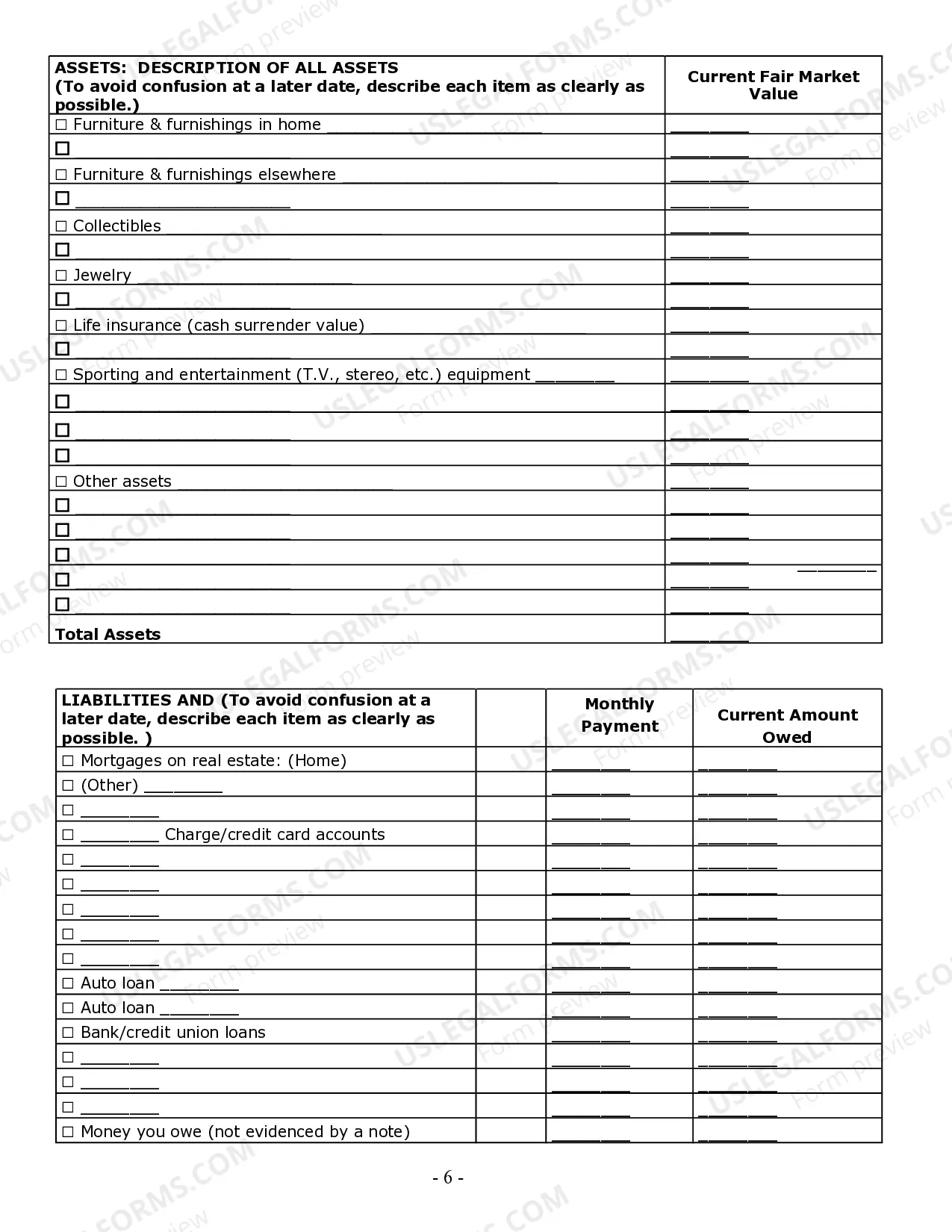

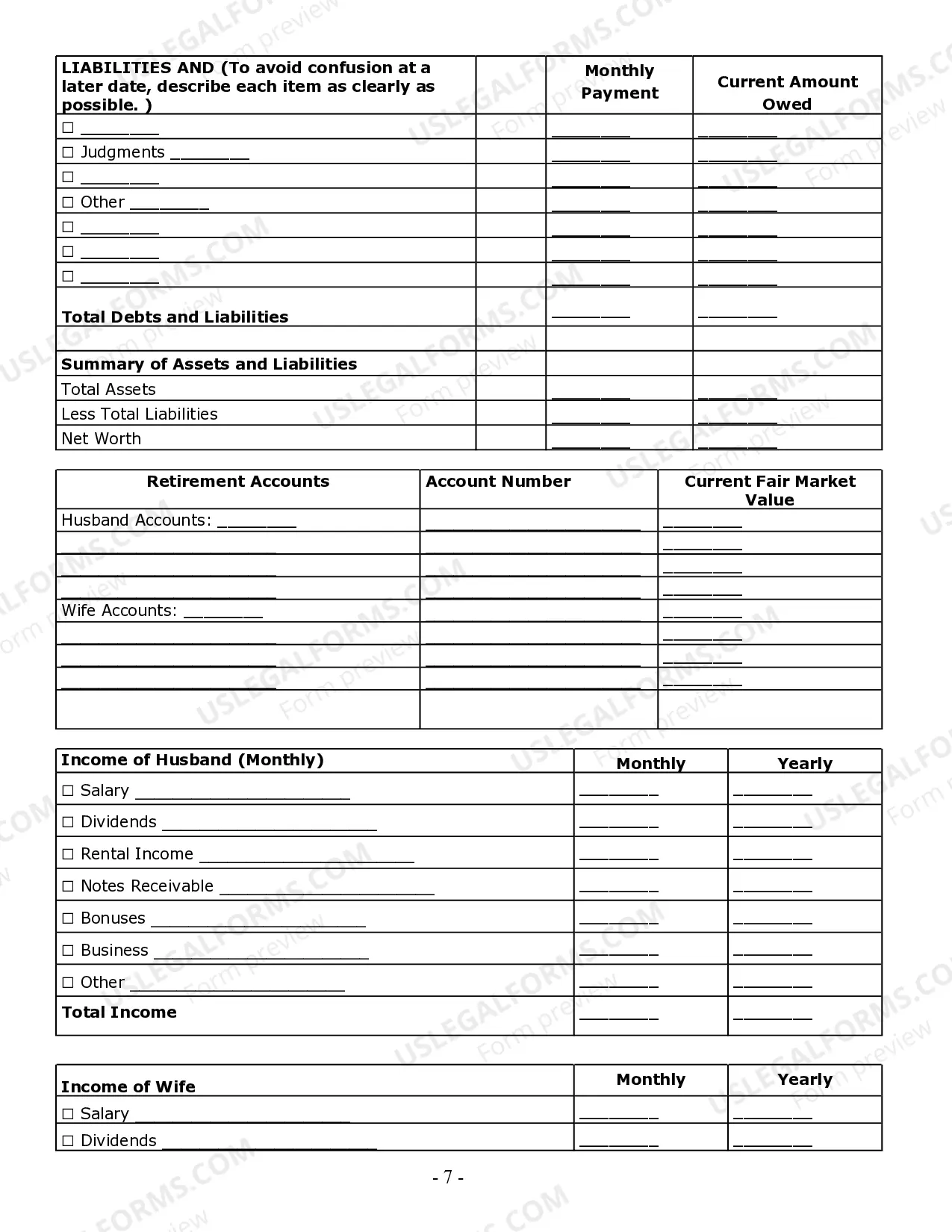

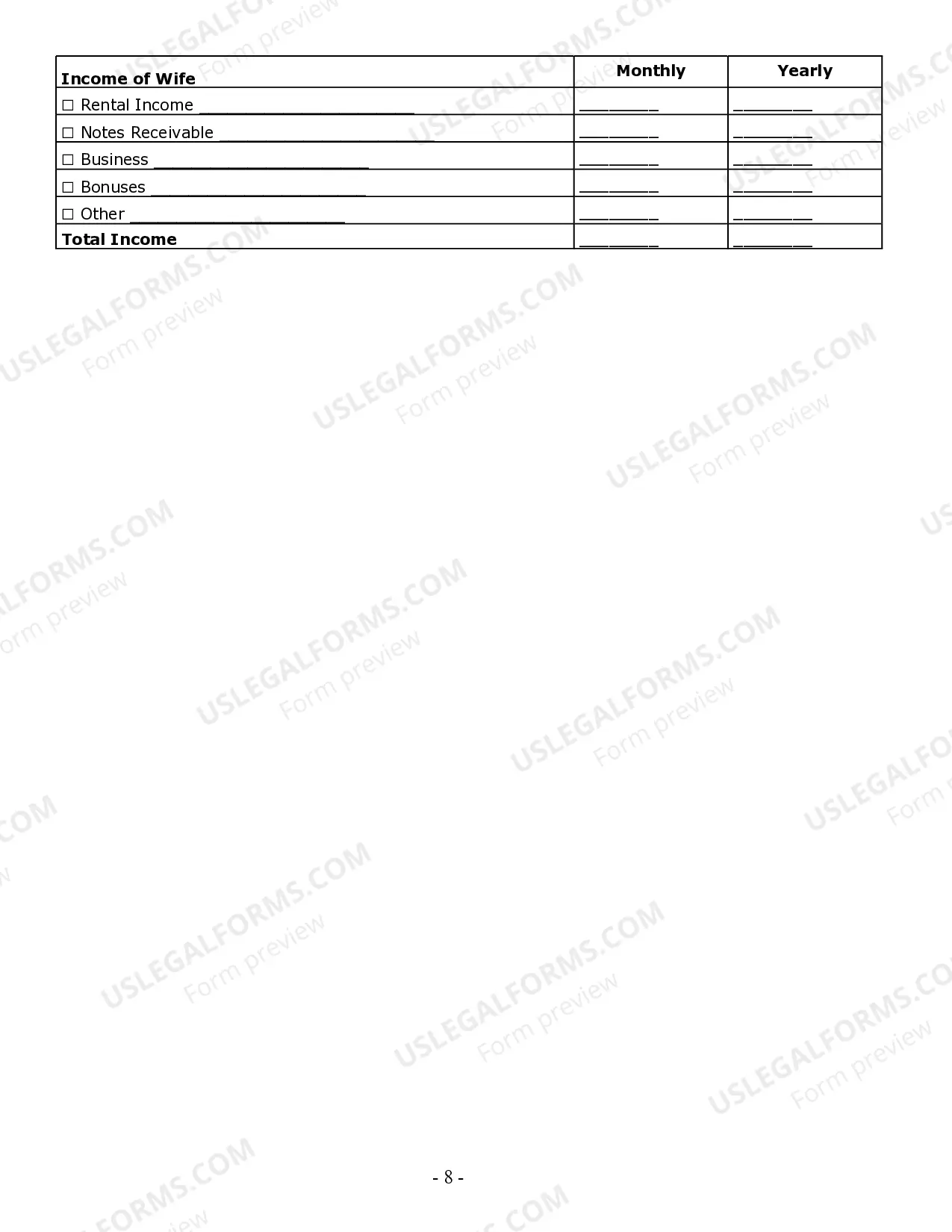

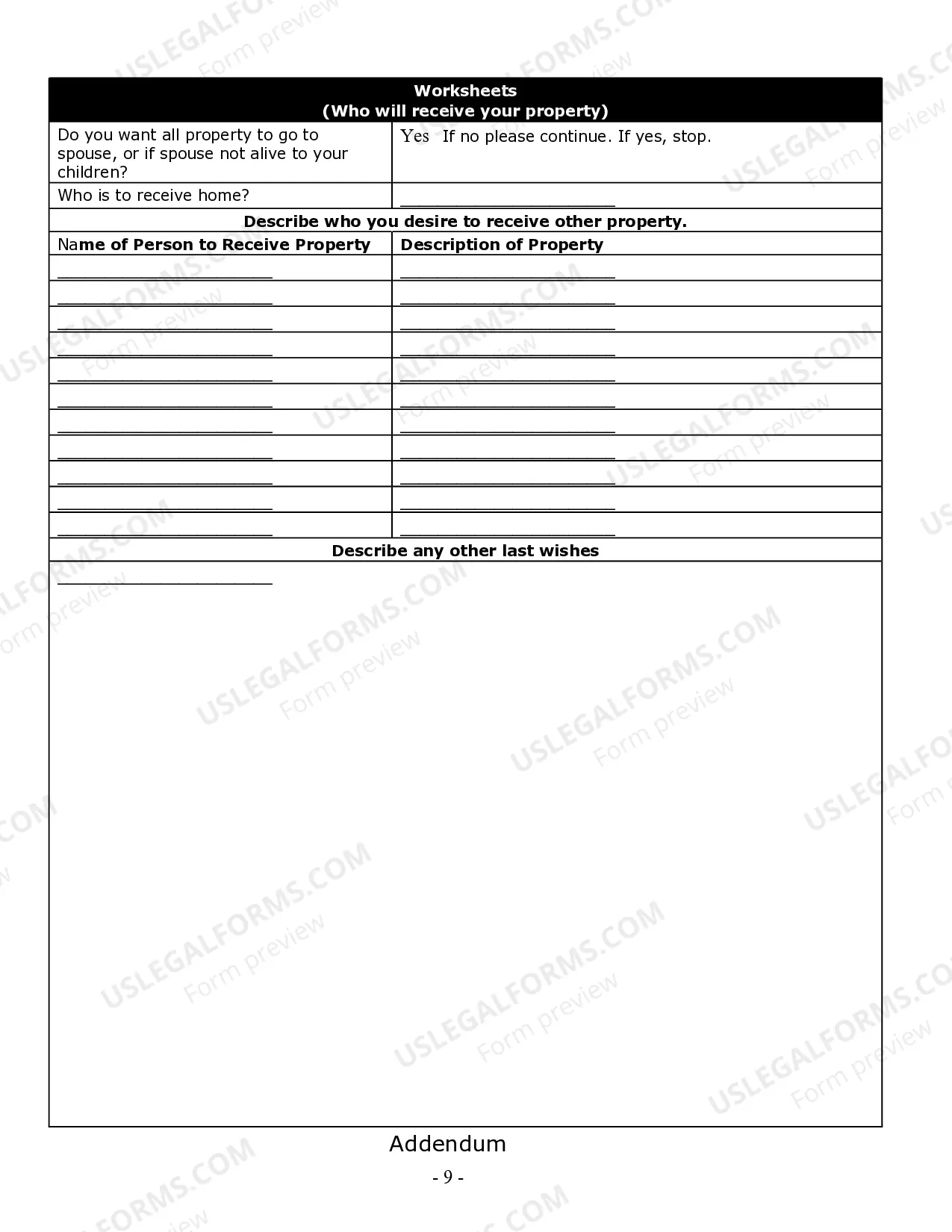

An estate questionnaire is a tool used to collect important information about your assets, liabilities, and wishes regarding distribution after death. This document helps streamline the estate planning process, making sure you don’t overlook any critical details. By using estate planning questionnaires and worksheets with examples, you can create a comprehensive assessment of your estate, facilitating clearer communication with your attorney and family. This preparation can significantly simplify the legal process later.

The 5 by 5 rule refers to a provision in estate planning trusts that allows beneficiaries to withdraw up to five percent of the trust’s value or $5,000, whichever is greater, each year. This rule provides flexibility for beneficiaries while still keeping trust assets protected. Utilizing an estate planning questionnaire and worksheets with examples will assist you in understanding how to incorporate this rule effectively. It ensures you make informed decisions regarding trust distributions.

One common mistake parents often make when setting up a trust fund is failing to clearly define the terms and conditions of the trust. Without detailed instructions, trustees may face confusion regarding how to manage the funds. Using an estate planning questionnaire and worksheets with examples can help parents outline their wishes clearly, ensuring that the trust serves its intended purpose. By addressing these aspects upfront, parents can avoid potential disputes later.

Preparing for an estate planning appointment involves gathering relevant documents and reflecting on your goals. Start by completing any estate planning questionnaires and worksheets with examples that you might find helpful. These tools will help you clarify your intentions regarding asset distribution and guardianship for dependents. Additionally, organizing your financial documents, such as property deeds and investment statements, can streamline your conversation with your estate planner.

An estate planning questionnaire is a tool that collects vital information about your assets, family, and wishes for the future. This questionnaire guides you through the estate planning process, ensuring you cover essential aspects like wills, trusts, and beneficiaries. By using estate planning questionnaires and worksheets with examples, you can organize your thoughts and make informed decisions about your estate. This resource empowers you to create a comprehensive estate plan tailored to your needs.

Filling out an estate planning questionnaire involves several important steps. Start by gathering personal information about your assets, debts, and beneficiaries. Be thorough in responding to each section, as this information will help shape your estate plan. Utilizing estate planning questionnaires and worksheets with examples can simplify this task and ensure you don’t overlook essential details.

The seven steps in the estate planning process encompass a holistic approach: assessing your assets, identifying your goals, choosing beneficiaries, selecting executors, creating legal documents, reviewing and updating your plans regularly, and conducting a final review. This structured plan is essential for ensuring your estate is distributed as you desire. Consider using estate planning questionnaires and worksheets with examples to help you work through each step effectively.

The 5 and 5 rule is a similar concept to the 5 by 5 rule, and it plays a significant role in the gift tax exclusion. Specifically, this rule states that you can give a total of $5,000 in gifts each year to up to five individuals without taxable consequences. This rule facilitates tax-efficient estate planning and helps you resourcefully distribute your wealth among your heirs.

To organize documents for estate planning, begin by gathering all necessary legal and financial documents, including wills, trusts, and property deeds. Clearly label each document and store them in a secure location, such as a fireproof safe. Additionally, create a master list detailing where each document is stored for easy access. Utilizing estate planning questionnaires and worksheets with examples can help you identify what documents you need.