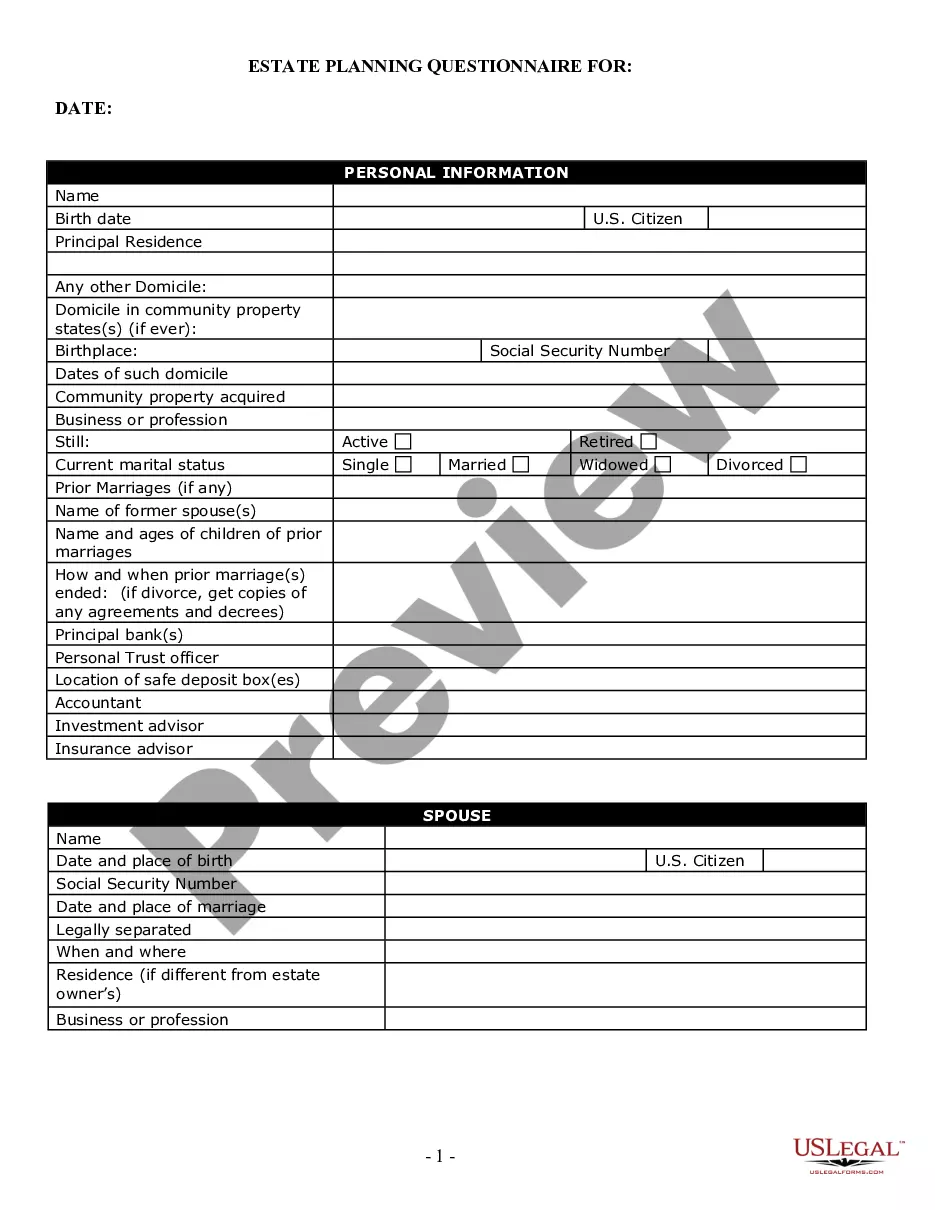

Estate Planning Questionnaire And Worksheets With Answers Pdf

Description

How to fill out Estate Planning Questionnaire And Worksheets With Answers Pdf?

How to acquire professional legal documents that adhere to your state laws and complete the Estate Planning Questionnaire and Worksheets With Answers Pdf without consulting an attorney.

Numerous online services offer templates to address various legal scenarios and formal requirements. However, it may require some time to determine which of the current examples satisfy both your intended use and legal obligations.

US Legal Forms is a reliable service that aids you in locating official documents crafted according to the most recent state law revisions and helps you save on legal costs.

Download the Estate Planning Questionnaire and Worksheets With Answers Pdf by using the corresponding button next to the document title. If you do not have an account with US Legal Forms, adhere to the steps below.

- US Legal Forms is not an ordinary online repository.

- It comprises over 85,000 validated templates for different business and personal situations.

- All documents are categorized by region and state to expedite your search process.

- Additionally, it incorporates robust tools for PDF editing and eSignature.

- Users with a Premium subscription can efficiently finish their paperwork online.

- Acquiring the necessary documents takes minimal time and effort.

- If you already have an account, Log In and verify that your subscription is active.

Form popularity

FAQ

One of the most significant mistakes parents make is failing to communicate their intentions regarding the trust fund. Clear communication is essential to avoid misunderstandings among beneficiaries. Furthermore, using an estate planning questionnaire and worksheets with answers in PDF can help you outline your wishes clearly and avoid common pitfalls. It's critical to involve all relevant parties in this process, ensuring everyone understands the purpose and structure of the trust.

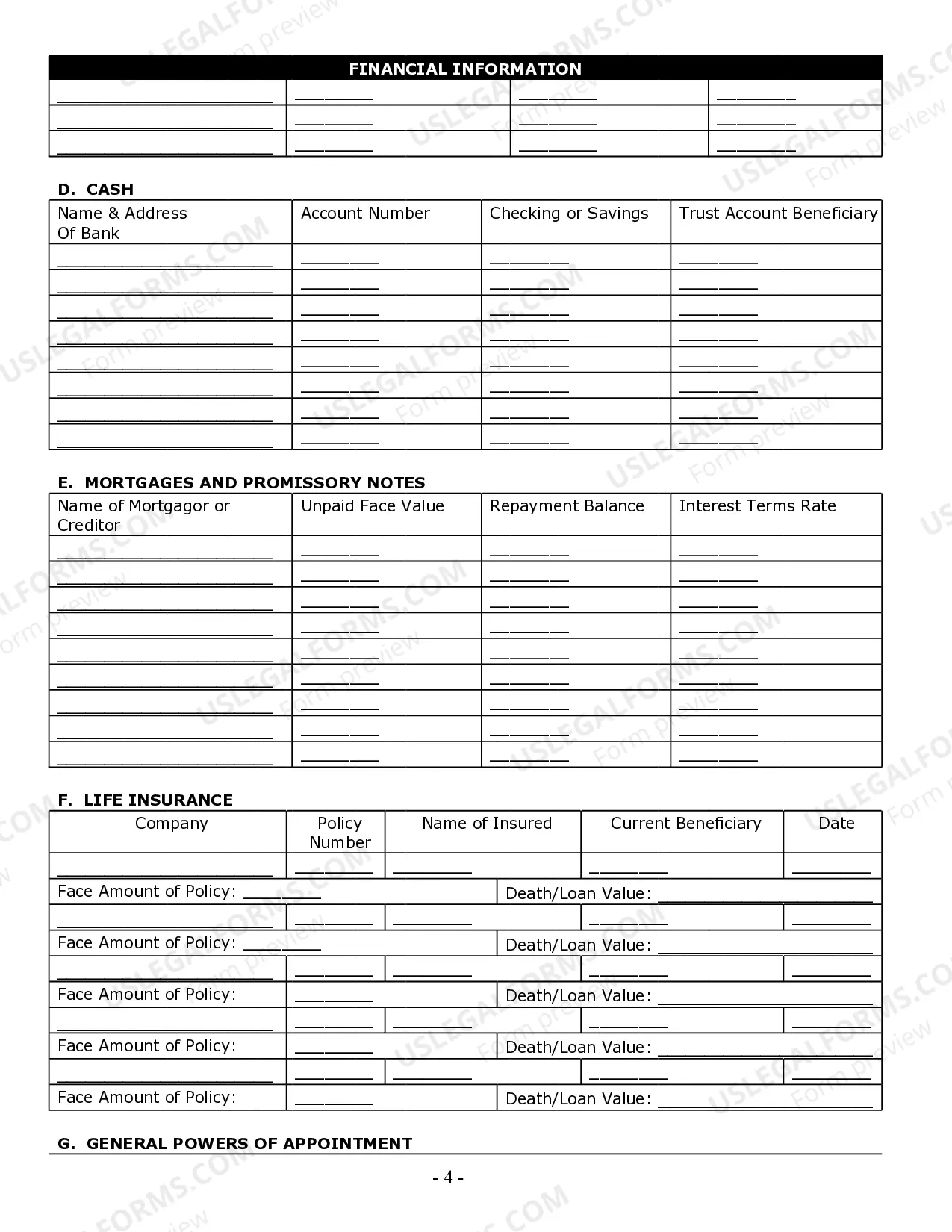

The 5 by 5 rule is a guideline to help you manage withdrawals from a trust. Specifically, it allows beneficiaries to withdraw up to 5% of the trust's value each year, giving them some control over the assets. This concept is particularly relevant when considering estate planning questionnaires and worksheets with answers in PDF format, as it assists you in strategizing financial distributions. Utilizing these tools can simplify the process and ensure compliance with tax regulations.

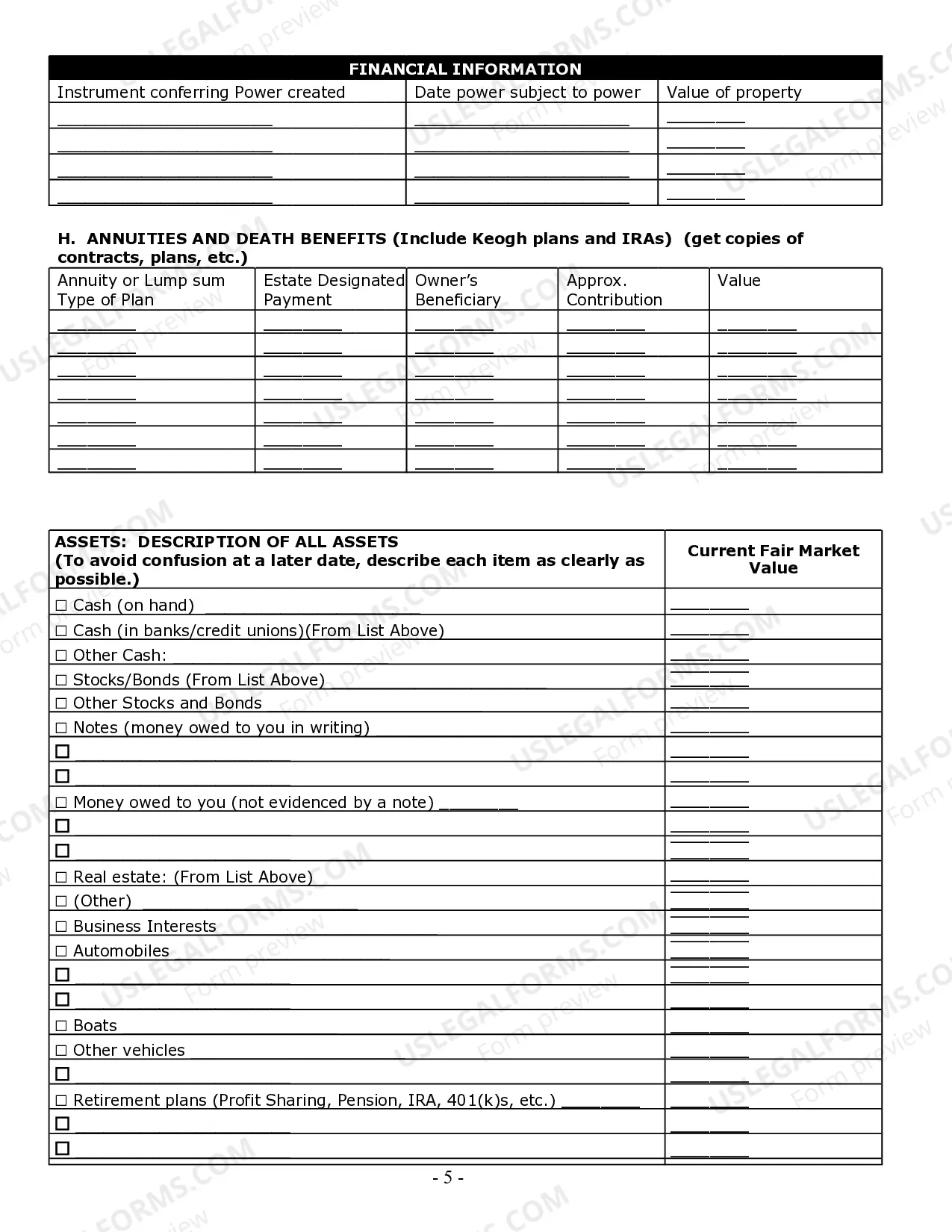

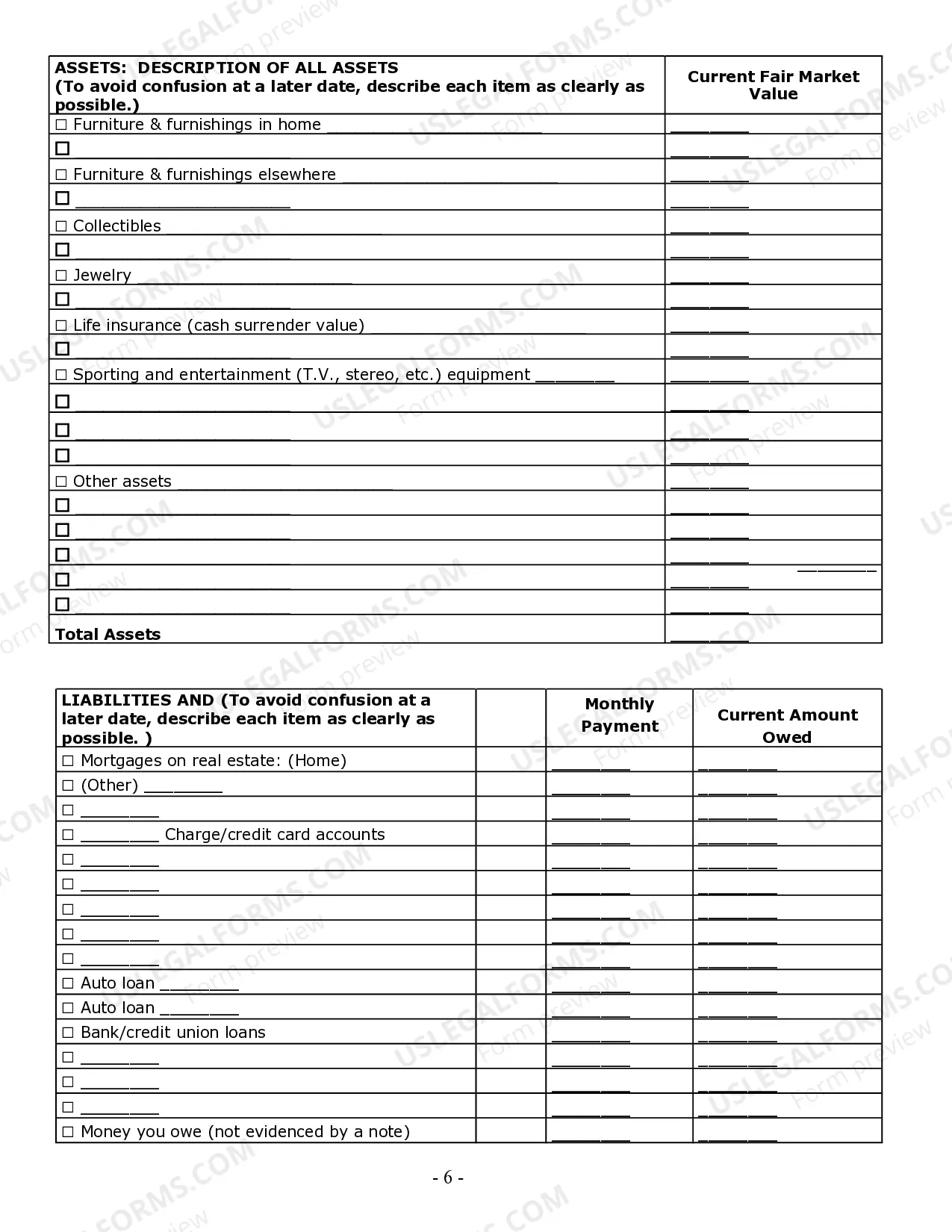

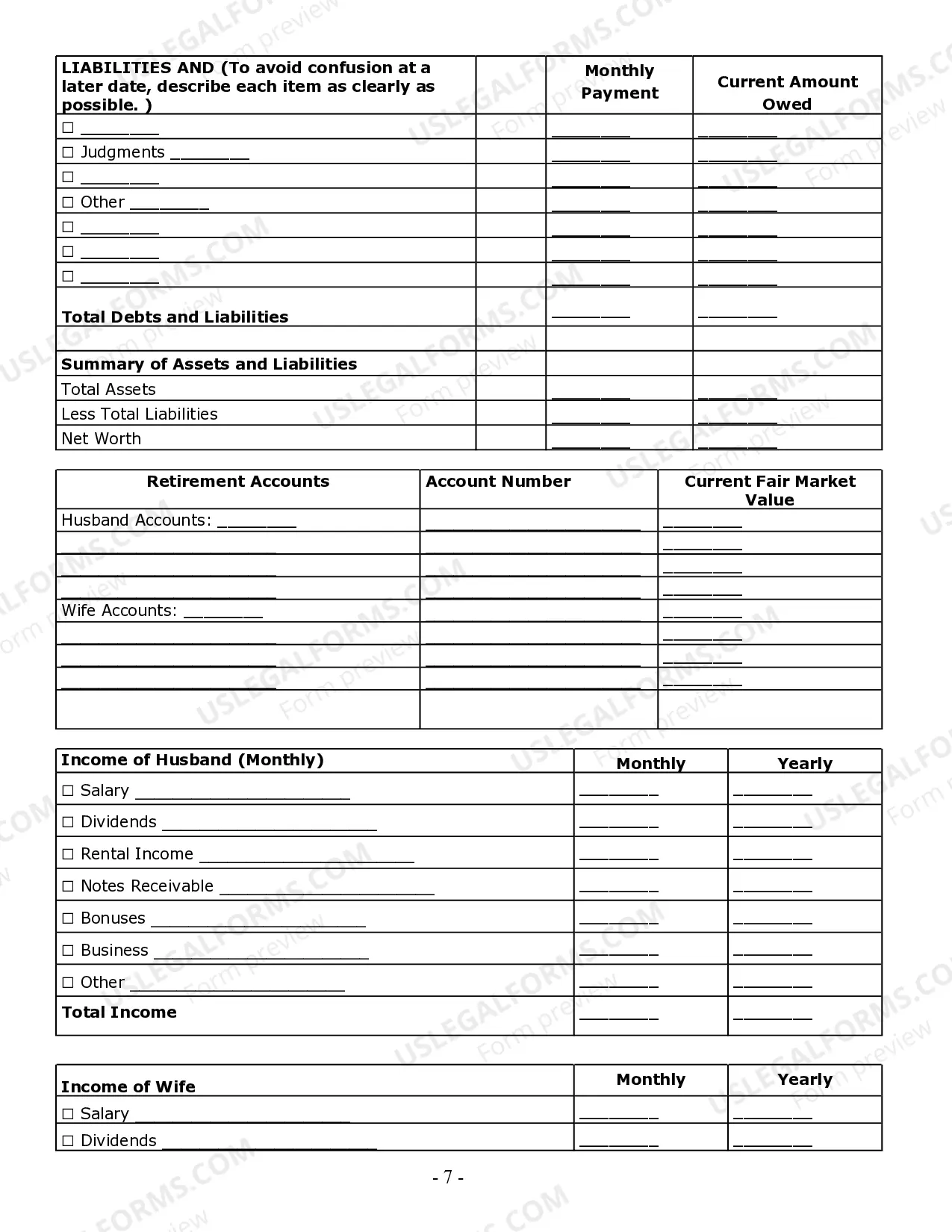

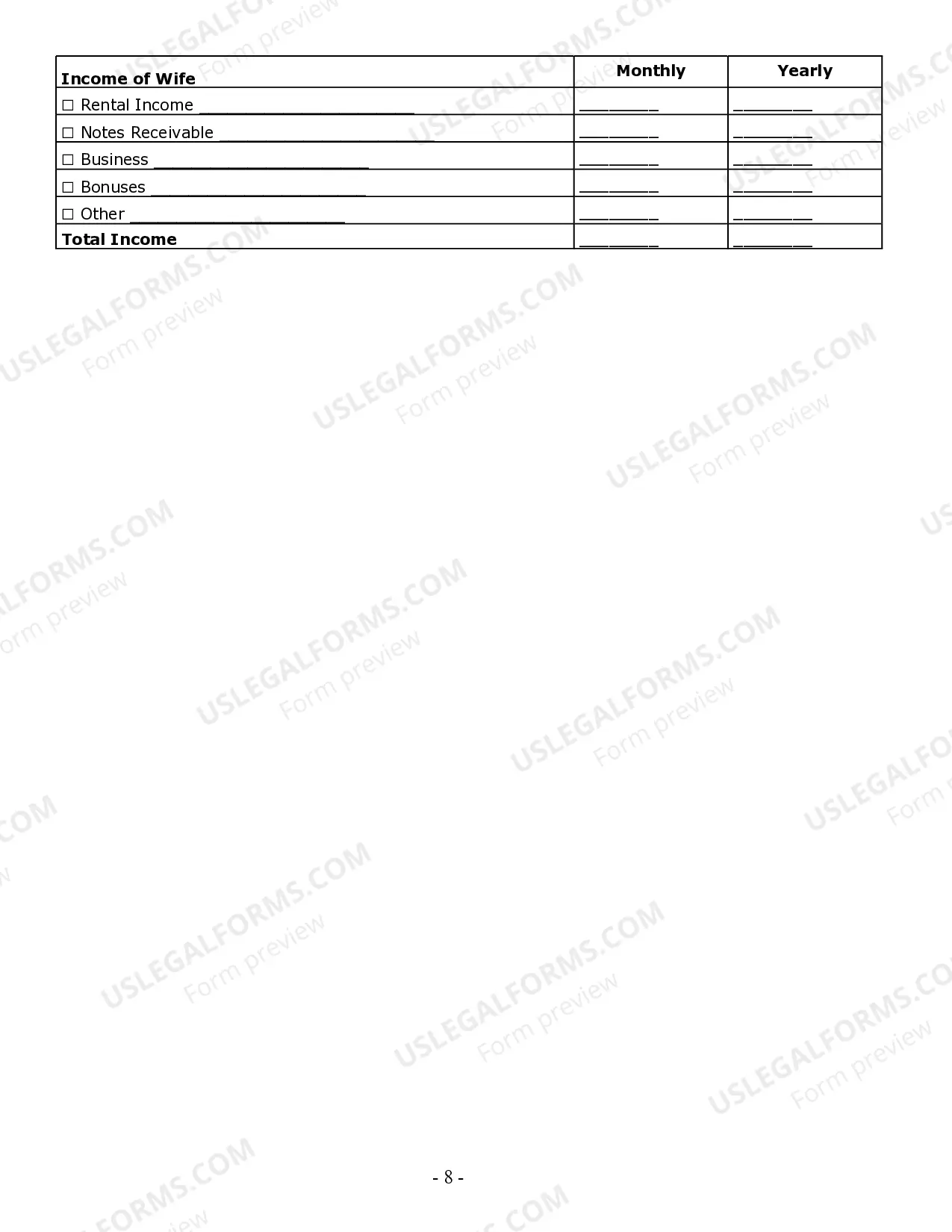

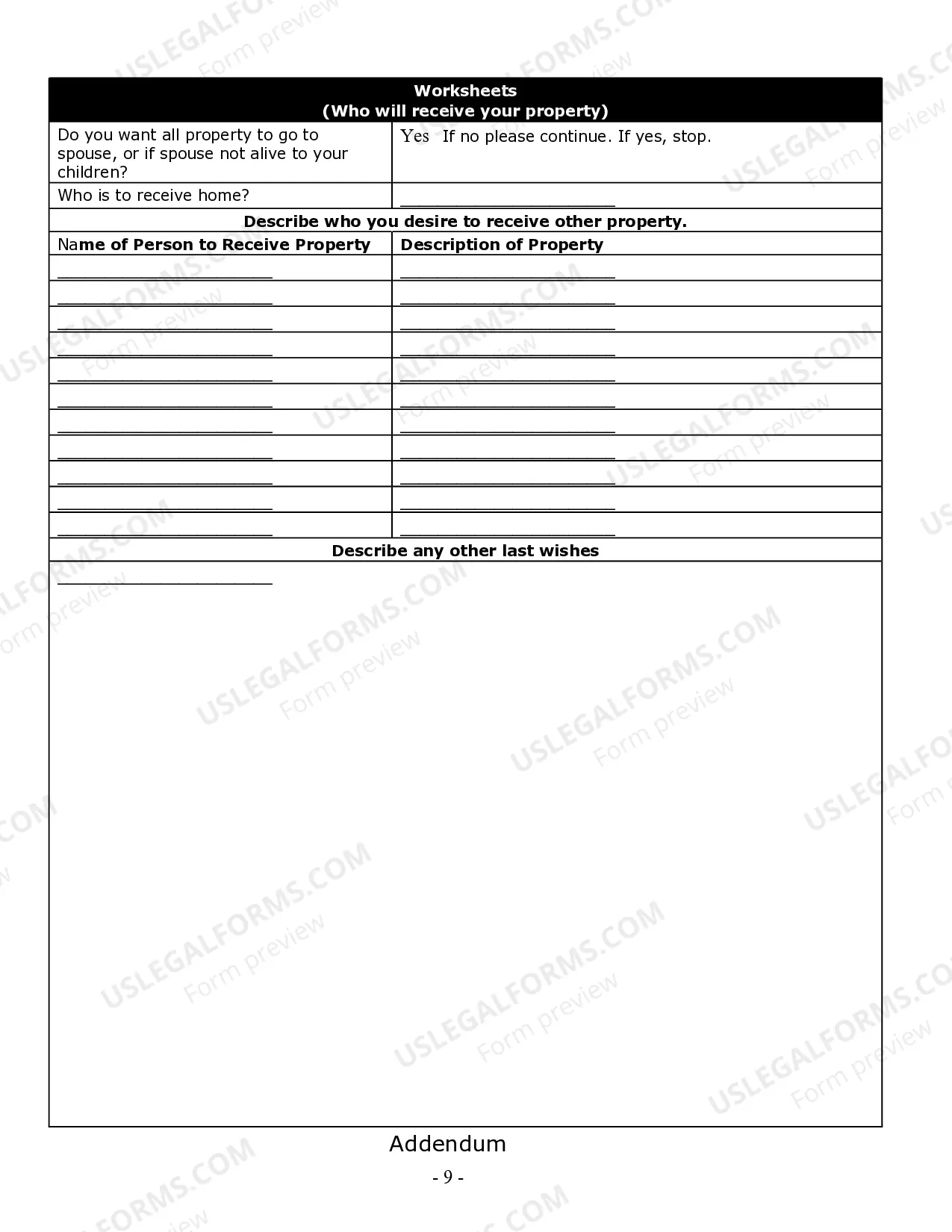

An estate planning questionnaire is a tool designed to gather essential information about your assets, wishes, and beneficiaries. It helps streamline the estate planning process by ensuring all critical components are addressed. Using an estate planning questionnaire and worksheets with answers pdf can facilitate meaningful discussions with your estate planner and ensure a thorough approach to your estate planning needs.

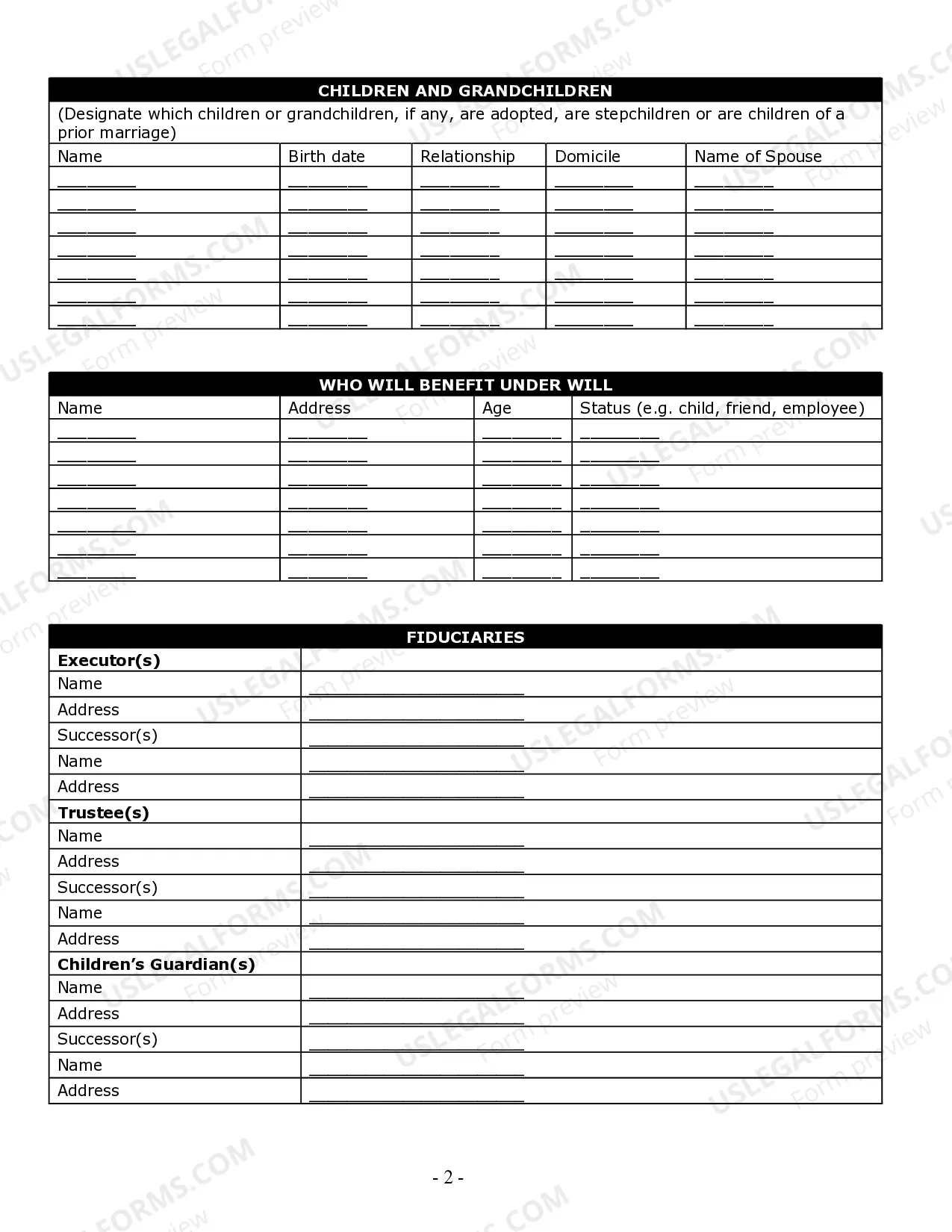

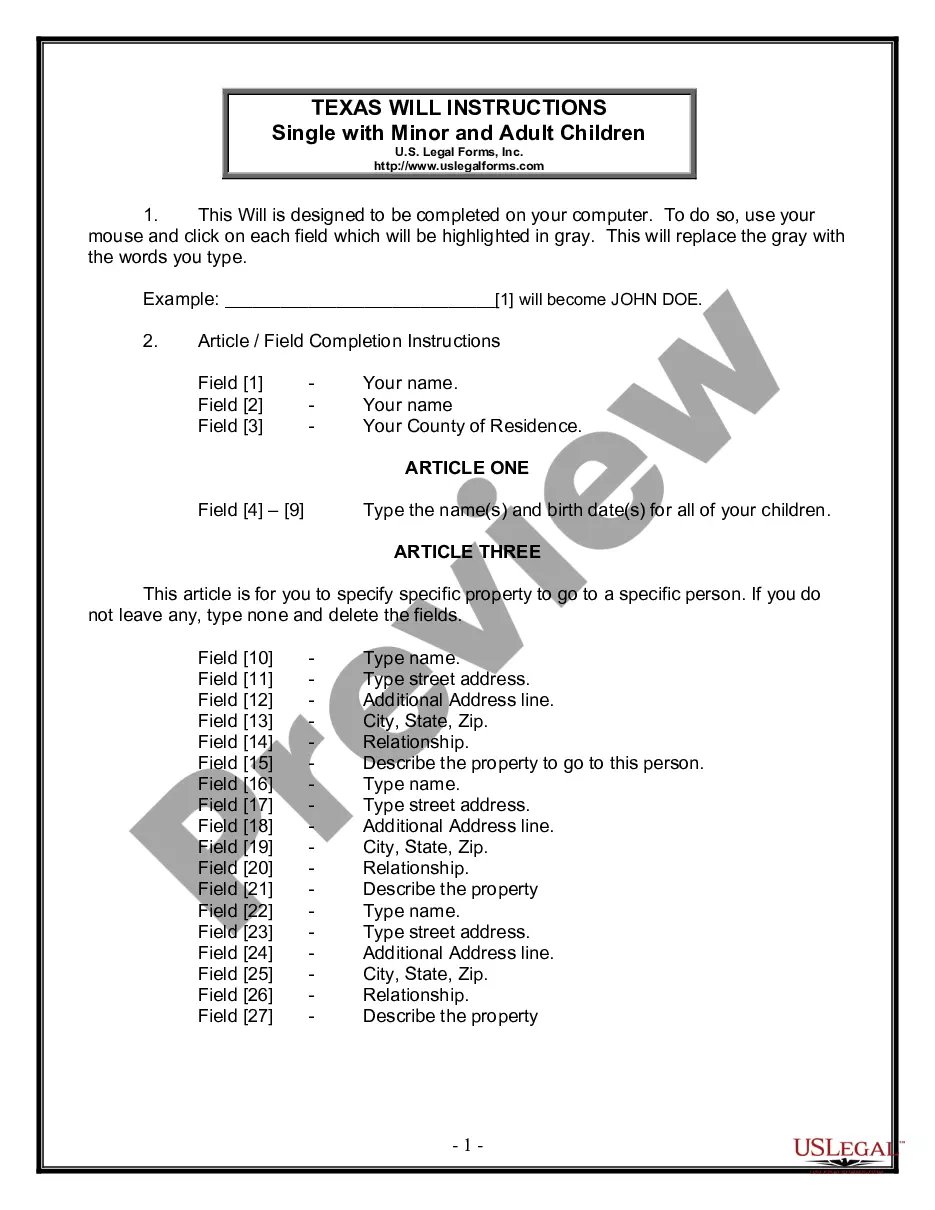

The estate planning process typically involves seven key steps: assessing your assets, outlining your goals, choosing your beneficiaries, selecting an executor, creating necessary documents, reviewing your plan regularly, and communicating your wishes to loved ones. Each step builds on the previous one to ensure a comprehensive plan. For a clearer understanding, refer to our estate planning questionnaire and worksheets with answers pdf, which can assist you in navigating these steps.

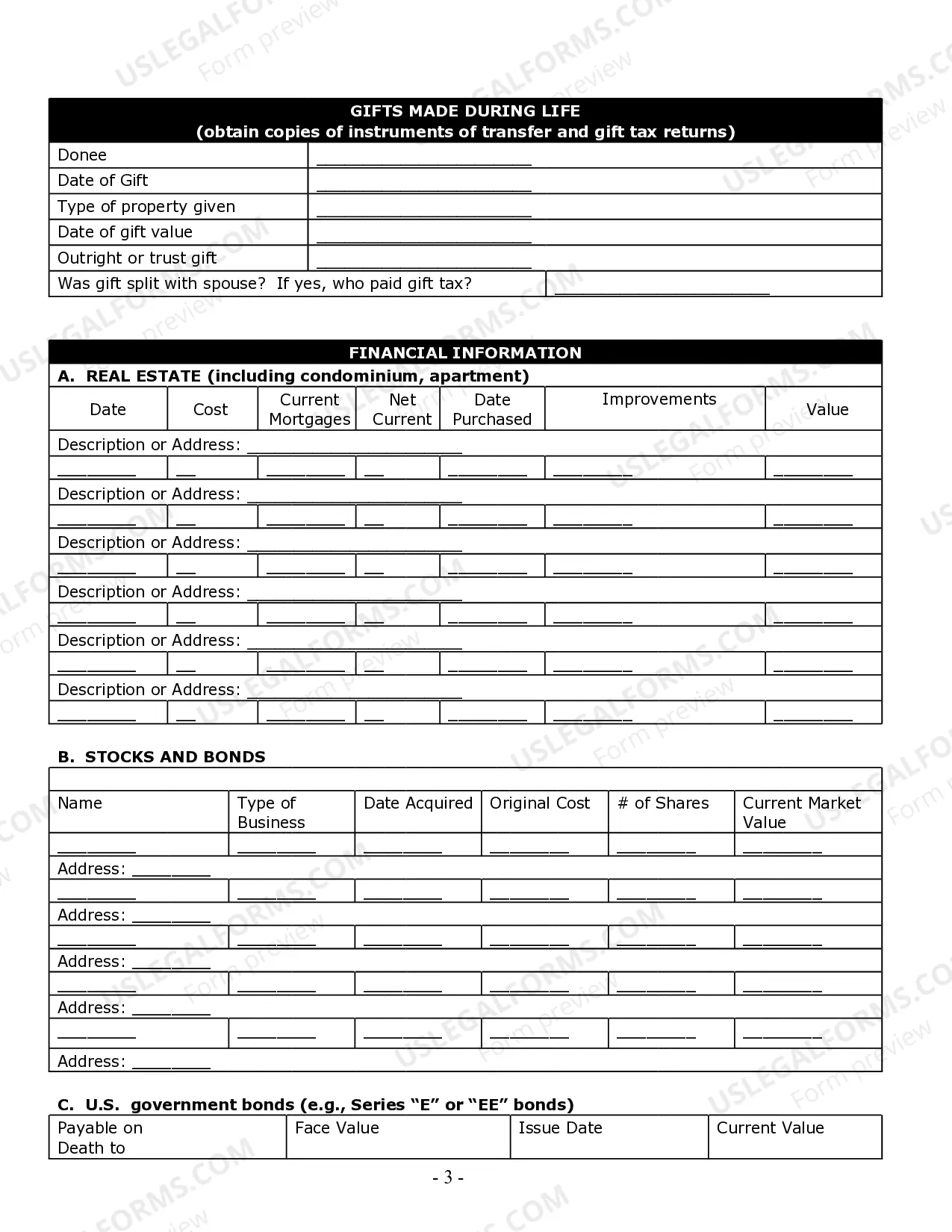

Filling out an estate planning questionnaire requires careful consideration and honest responses. Start by listing your personal information, assets, debts, and beneficiaries. Reflect on your wishes for those assets after your death. Our estate planning questionnaire and worksheets with answers pdf simplifies this process, guiding you through each section and ensuring you don’t miss any important details.

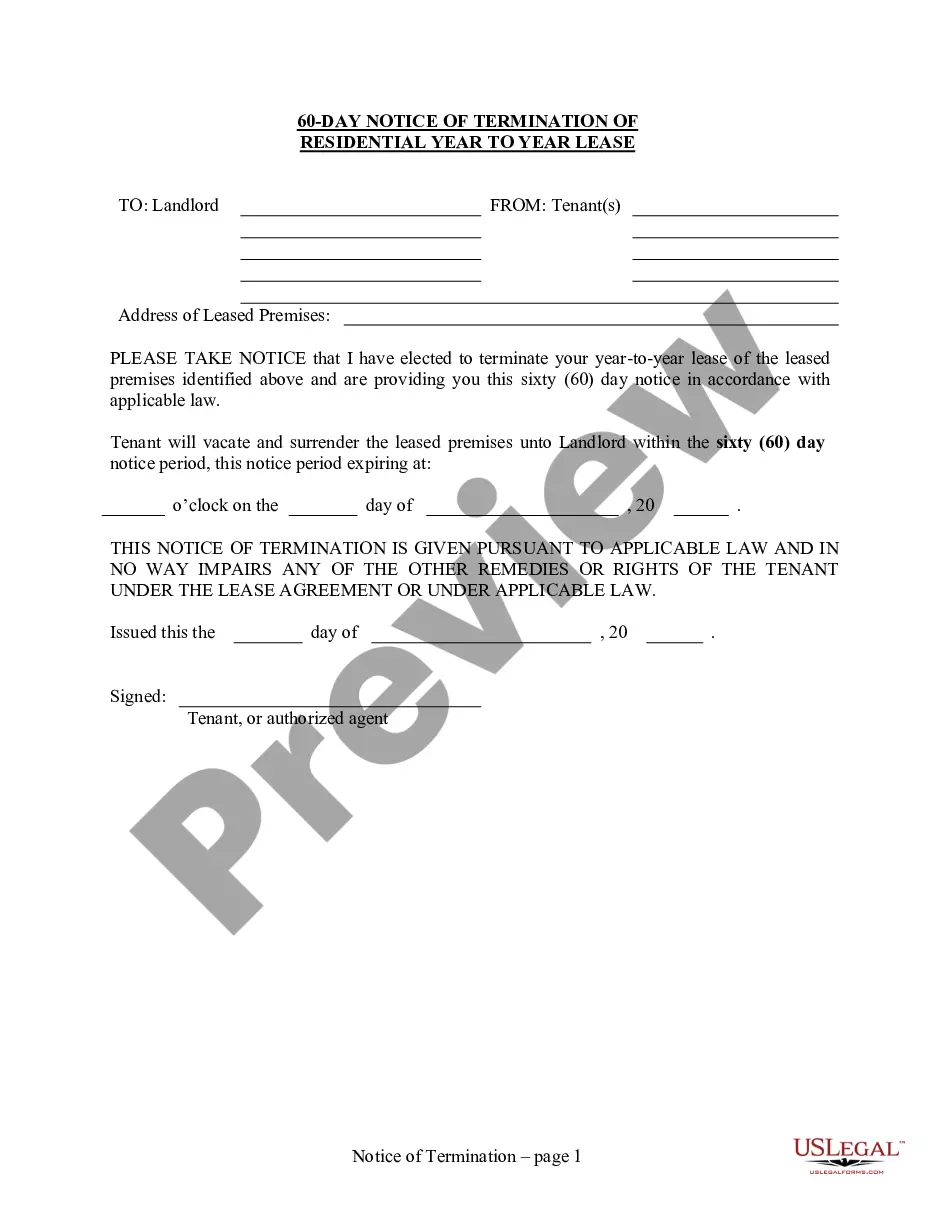

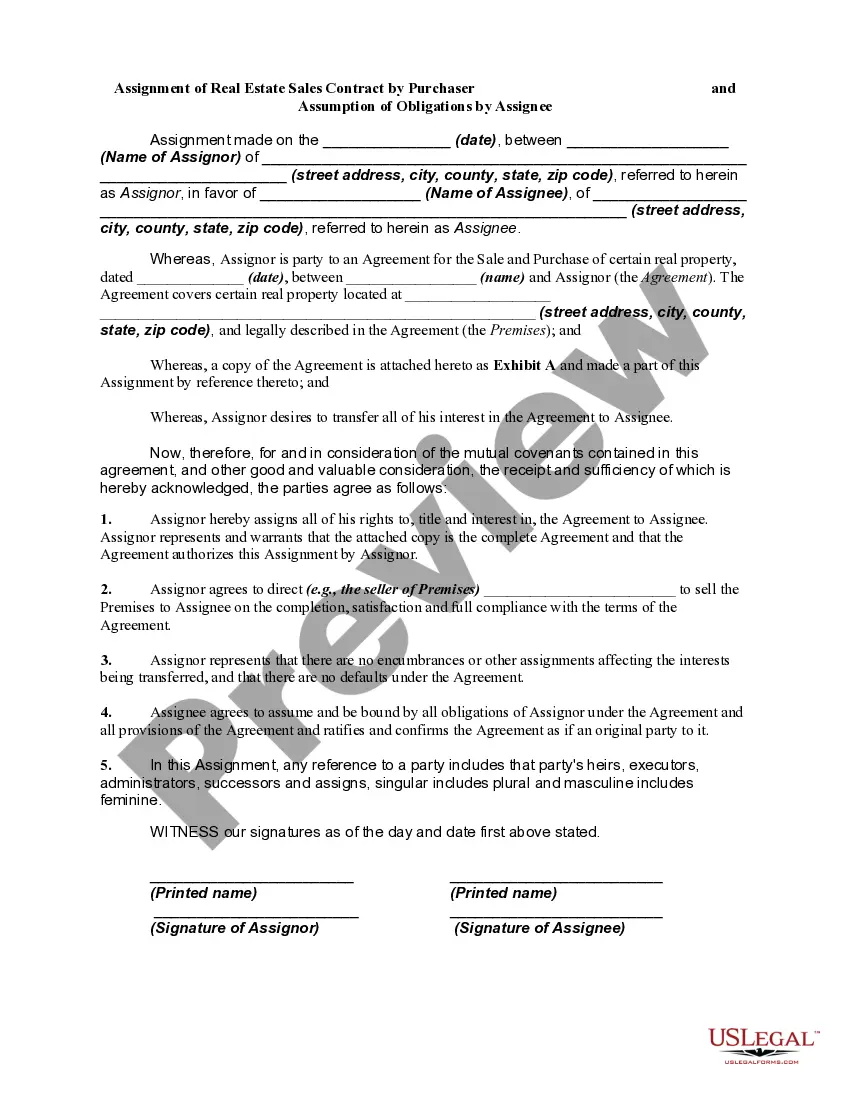

Certain assets cannot be included in a will, such as life insurance policies and retirement accounts, which have designated beneficiaries. Additionally, joint tenancy properties typically transfer automatically upon death. Understanding these exceptions is crucial for effective estate planning, and our estate planning questionnaire and worksheets with answers pdf can provide insight on how to manage these assets appropriately.

Preparing for an estate planning appointment involves gathering essential documents and reflecting on your goals. Create a list of your assets, debts, and any specific wishes you have for your estate. Bring along any existing estate documents, such as wills or trusts. Utilizing our estate planning questionnaire and worksheets with answers pdf can facilitate this preparation, ensuring you cover all necessary points.

The 5 by 5 rule is slightly different but complements the 5 or 5 rule. It allows individuals to withdraw up to 5% of the trust value annually or use the accumulated amounts up to a total of 5 times. This rule ensures greater flexibility in accessing trust assets. To navigate these strategies, our estate planning questionnaire and worksheets with answers pdf can be a valuable resource.

The 5 or 5 rule in estate planning allows for the distribution of certain assets without creating tax implications. Specifically, it refers to the ability to withdraw amounts up to 5% of the total trust value each year, without incurring gift taxes. Understanding this rule ensures that your estate plan operates efficiently and in accordance with tax laws. To further assist you, consider using our estate planning questionnaire and worksheets with answers pdf for clarity.

To plan your estate effectively on your own, begin by educating yourself about the necessary documents, including wills and trusts. Utilize an estate planning questionnaire and worksheets with answers pdf for structured guidance as you outline your goals and intentions. Platforms like US Legal Forms provide resources that empower you to create your estate plan confidently, ensuring that your assets are distributed according to your wishes.