Florida Llc Annual Report Sample For Llc

Description

How to fill out Florida Service Company Annual Report Form?

Whether for commercial objectives or for personal matters, everyone must confront legal circumstances at some point in their life.

Completing legal documents requires meticulous attention, starting from choosing the correct form template.

With a comprehensive US Legal Forms catalog available, you don’t have to waste time looking for the correct template across the web. Utilize the library’s straightforward navigation to locate the suitable form for any circumstance.

- For instance, if you select an incorrect version of the Florida Llc Annual Report Sample For Llc, it will be declined upon submission.

- Thus, it is vital to acquire a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain a Florida Llc Annual Report Sample For Llc template, follow these straightforward steps.

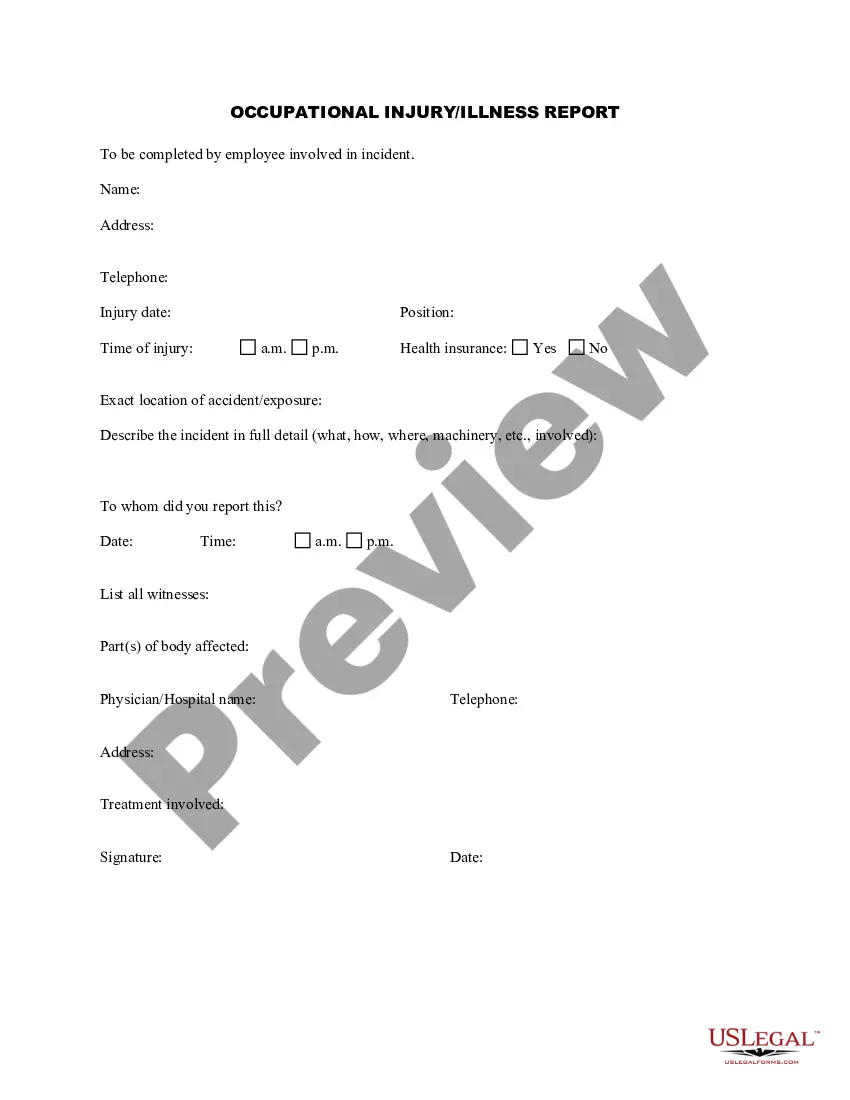

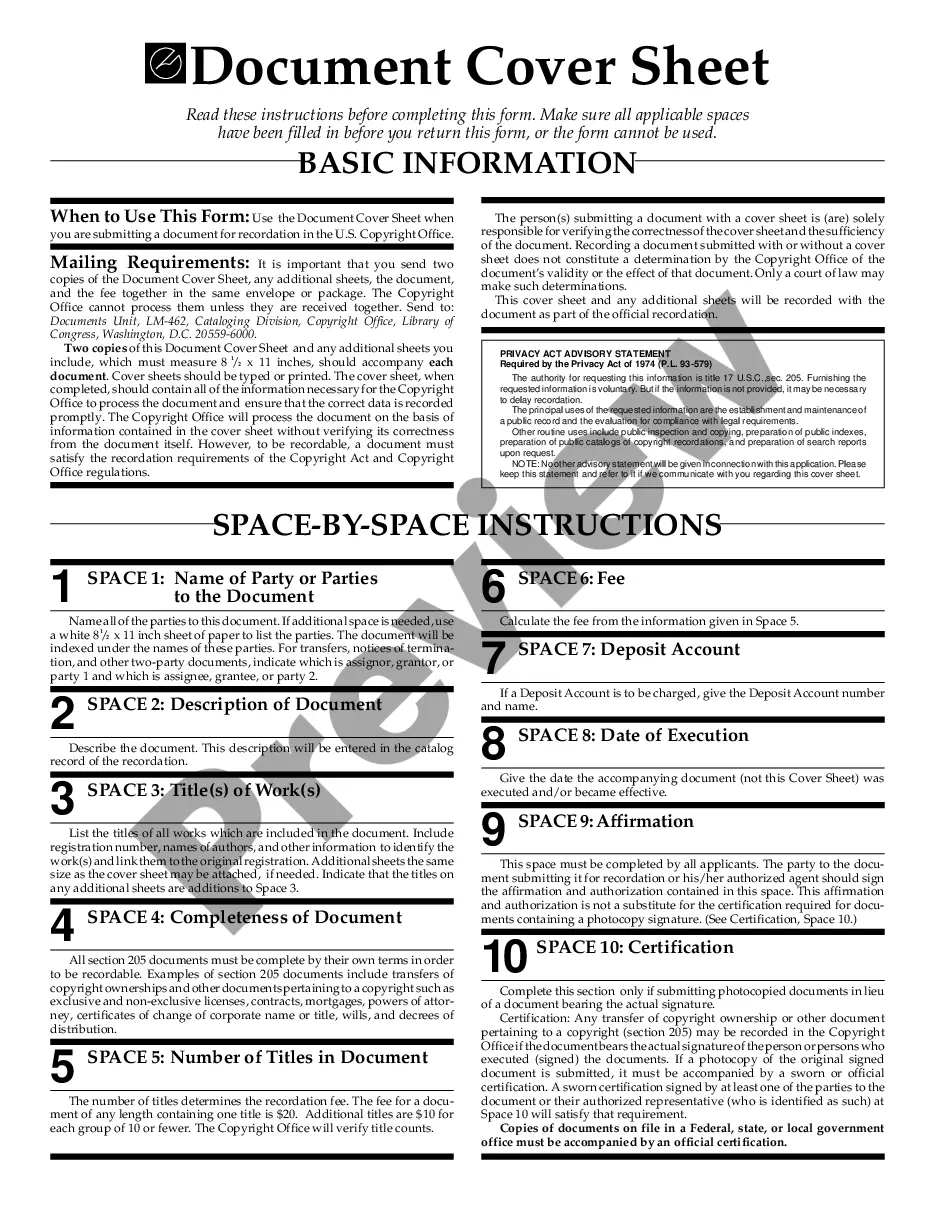

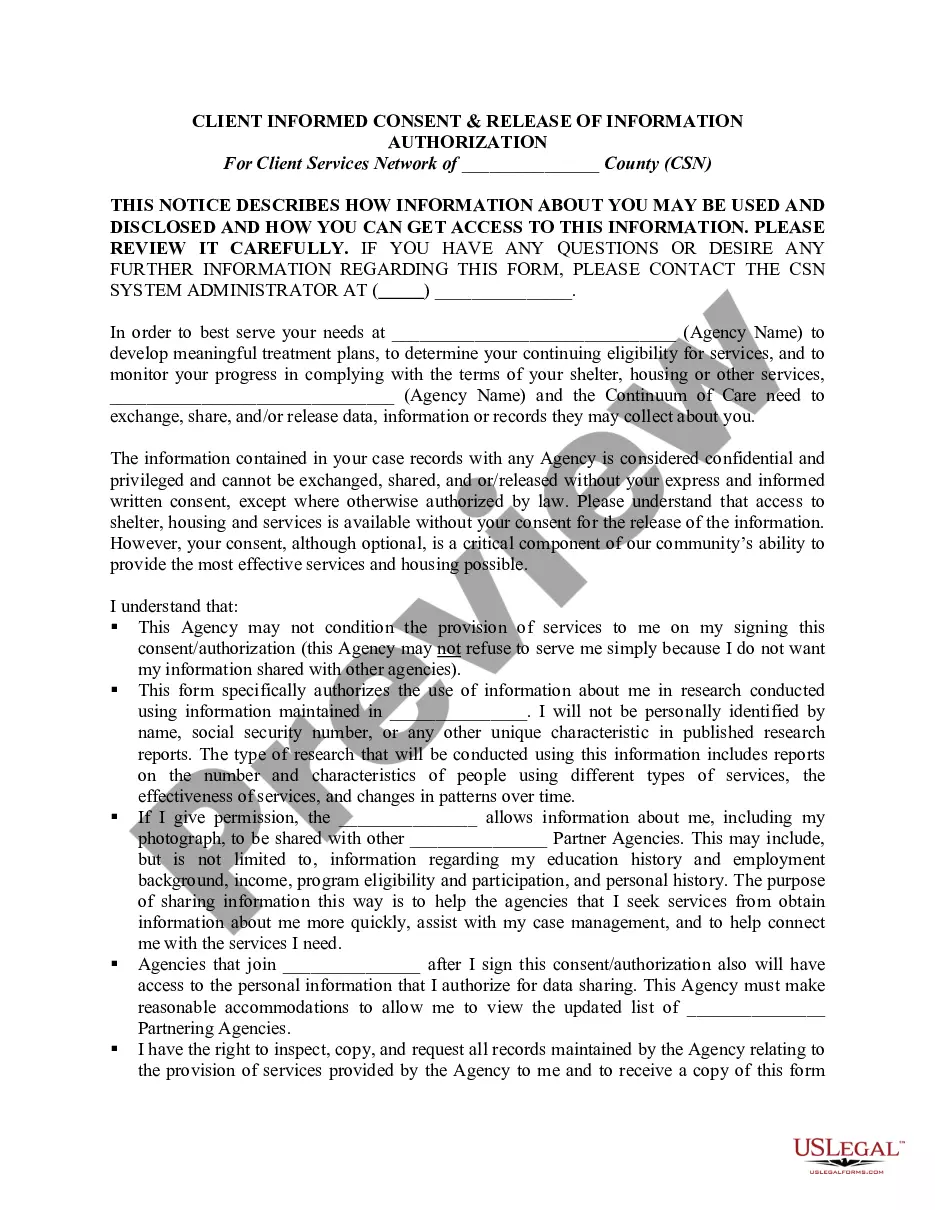

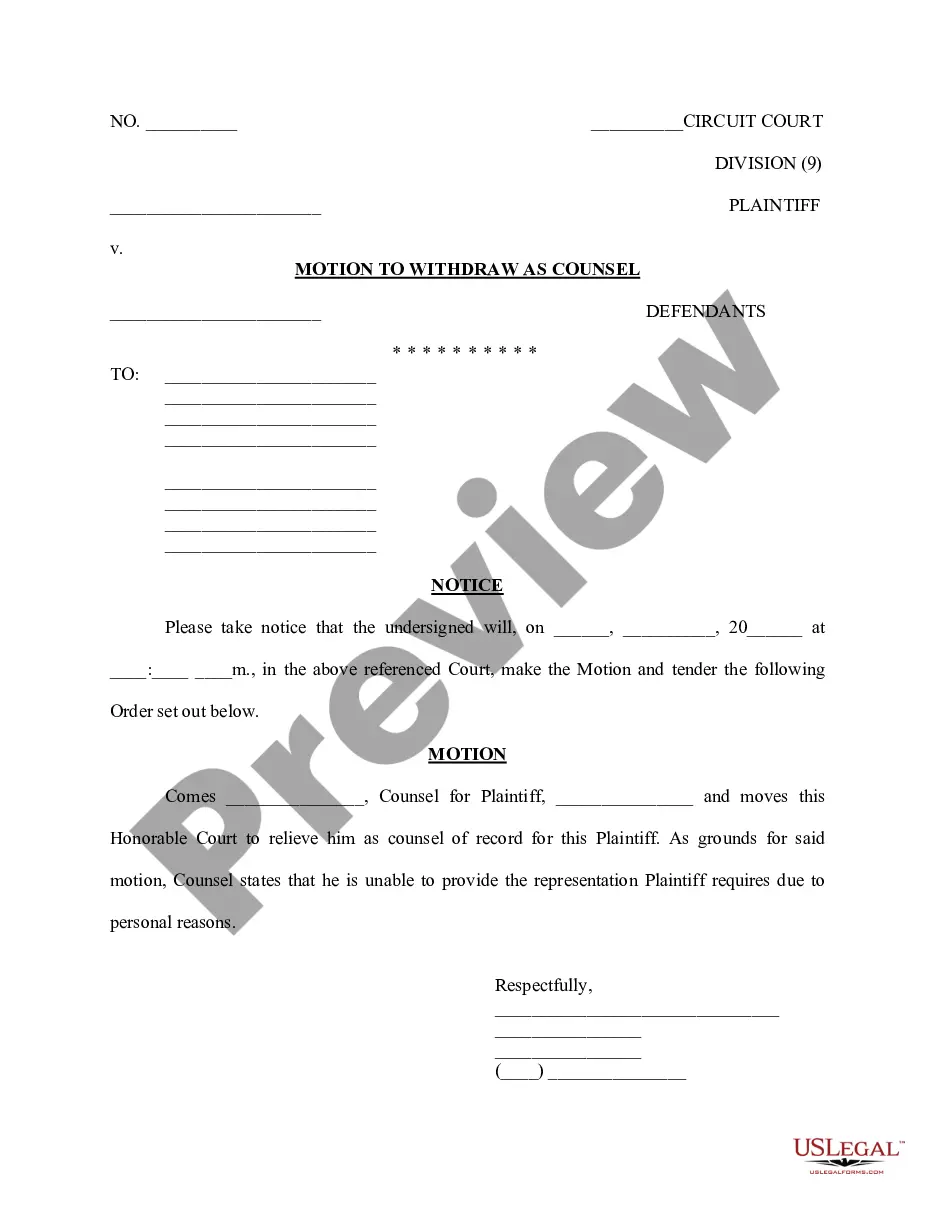

- Retrieve the template you need utilizing the search bar or catalog navigation.

- Review the form’s description to confirm it fits your situation, jurisdiction, and locality.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search option to find the Florida Llc Annual Report Sample For Llc sample you need.

- Obtain the template if it satisfies your requirements.

- If you possess a US Legal Forms account, just click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the document format you desire and download the Florida Llc Annual Report Sample For Llc.

- Once saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Filing Your Florida Annual Report The Florida Annual Report can only be filed online through Florida's Annual Report-Sunbiz page. However, the filing fee can be paid online or by mail with a check/money order. To file your report, go to the Sunbiz annual report login page and enter your 12 digit document number.

Annual reports for all corporations, limited liability companies, limited partnerships and limited liability limited partnerships are due each year between January 1 and May 1. The Department of State encourages business owners to file early. Submitting your annual report on time avoids a late fee.

After you form an LLC in Florida, you must file an Annual Report for your LLC and pay $138.75 every year. You need to file your Florida LLC Annual Report each year in order to avoid the penalty and keep your LLC in compliance and in good standing with the Florida Division of Corporations (aka ?Sunbiz?).

Annual Report Fees ServicePriceAnnual Report - Profit Corporation$150.00Annual Report - Non-Profit Corporation$61.25Annual Report - Limited Liability Company$138.75Annual Report - Limited Partnership or Limited Liability Limited Partnership$500.00

Annual Report Fees ServicePriceAnnual Report - Profit Corporation$150.00Annual Report - Non-Profit Corporation$61.25Annual Report - Limited Liability Company$138.75Annual Report - Limited Partnership or Limited Liability Limited Partnership$500.00