Corrective Quit Claim Deed Florida Without Notice

Description

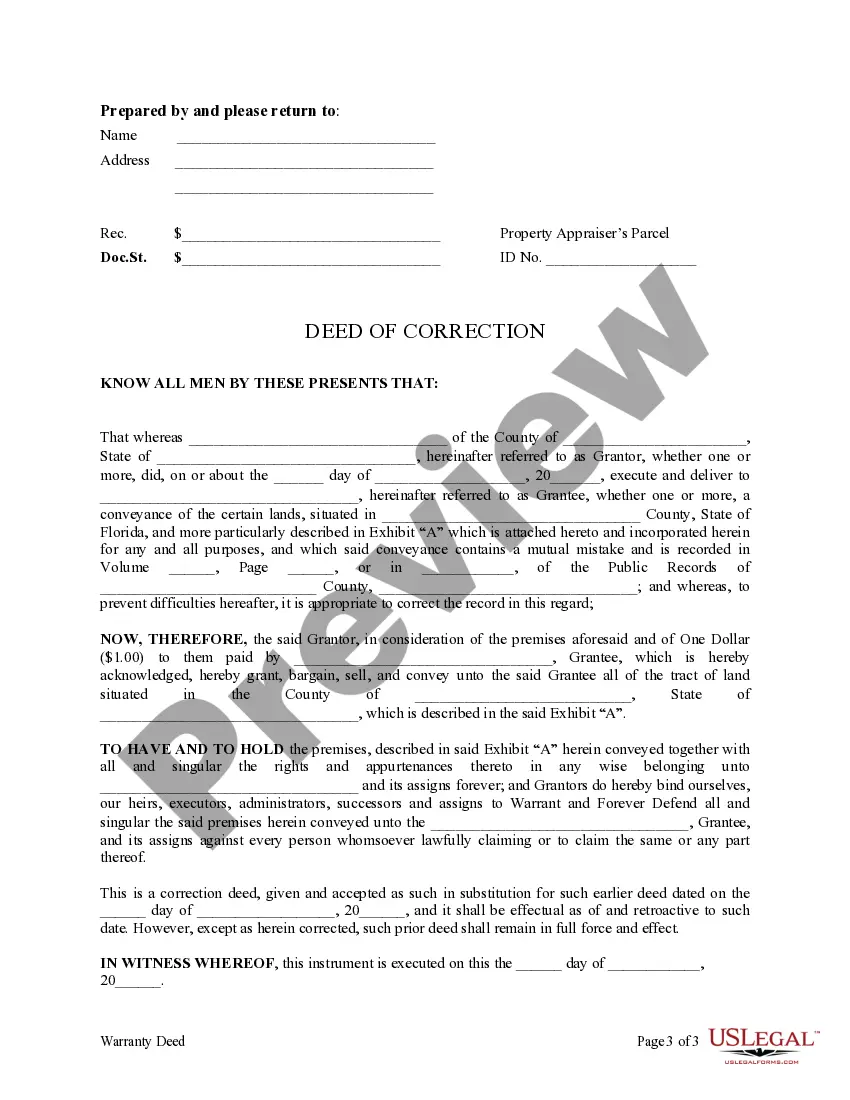

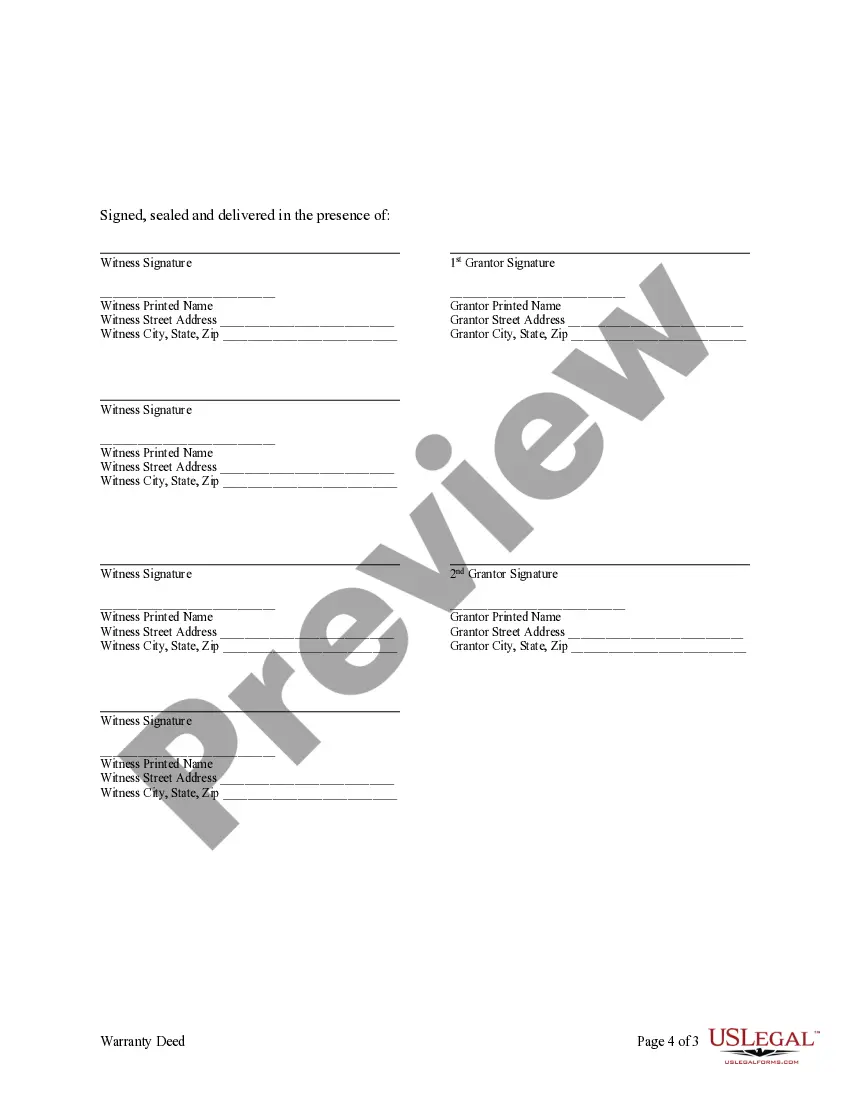

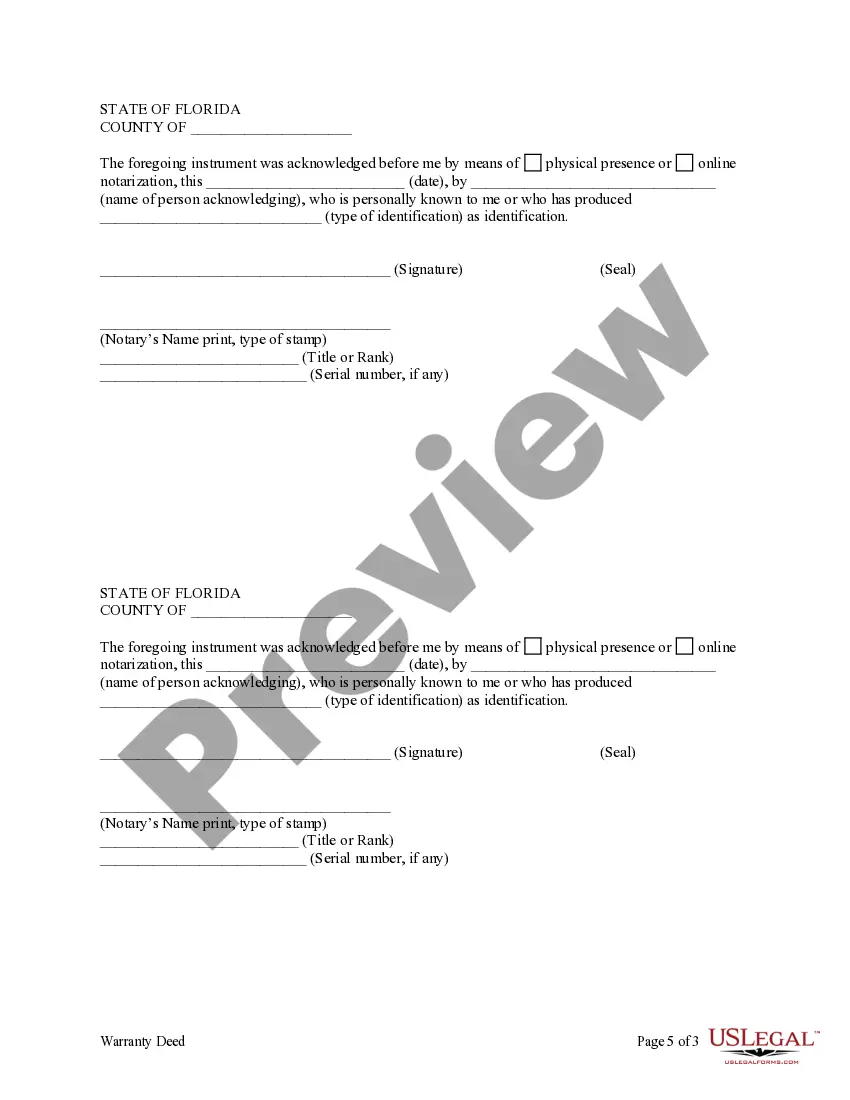

How to fill out Florida Deed Of Correction - Failure To Attach Legal Description?

Managing legal documents and tasks can be a lengthy addition to your daily schedule.

Corrective Quit Claim Deed Florida Without Notice and similar forms frequently necessitate searching for them and comprehending how to fill them out correctly.

Consequently, whether you are managing financial, legal, or personal issues, possessing a thorough and user-friendly online repository of forms will be immensely beneficial.

US Legal Forms is the premier online platform for legal templates, offering over 85,000 state-specific forms and various tools to assist you in completing your paperwork effortlessly.

Simply Log In to your account, search for Corrective Quit Claim Deed Florida Without Notice, and download it instantly from the My documents section. You can also access previously downloaded forms.

- Browse the library of pertinent documents available to you with a single click.

- US Legal Forms delivers state- and county-specific forms that are available for download at any time.

- Protect your document management processes by utilizing a premium service that allows you to assemble any form in minutes without extra or concealed fees.

Form popularity

FAQ

Entities Not Subject to Franchise Tax sole proprietorships (except for single member LLCs); general partnerships when direct ownership is composed entirely of natural persons (except for limited liability partnerships);

Form 05-102 - Texas Franchise Tax Public Information Report ? Each corporation, LLC, limited partnership, professional association, and financial institution that has a franchise tax responsibility must file a Public Information Report (PIR) to satisfy their filing obligation.

How much does the Texas annual franchise tax report cost? There is no filing fee for your franchise tax report. The only payment due is any franchise tax owed for that filing year, plus a $1 service fee for online payments.

If your company's annual revenue is $20 million or less, you can use the EZ Computation method to file your tax return. This method applies a tax rate of . 331 percent to all Texas-based earnings.

Businesses with less than $1.23 million in annual revenue select ?File a No Tax Due Information Report.? Click ?Continue.?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

You can file your franchise tax report, or request an extension of time to file, online.

The annual franchise tax report is due May 15. If May 15 falls on a weekend or holiday, the due date will be the next business day.