Corrective Quit Claim Deed Florida Without Consent

Description

How to fill out Florida Deed Of Correction - Failure To Attach Legal Description?

Utilizing legal documents that adhere to federal and state laws is crucial, and the internet provides numerous choices to select from.

However, what's the benefit of spending time seeking the correct Corrective Quit Claim Deed Florida Without Consent sample online when the US Legal Forms online repository already consolidates such templates in one location.

US Legal Forms is the largest online legal database with more than 85,000 fillable templates created by attorneys for various business and personal situations.

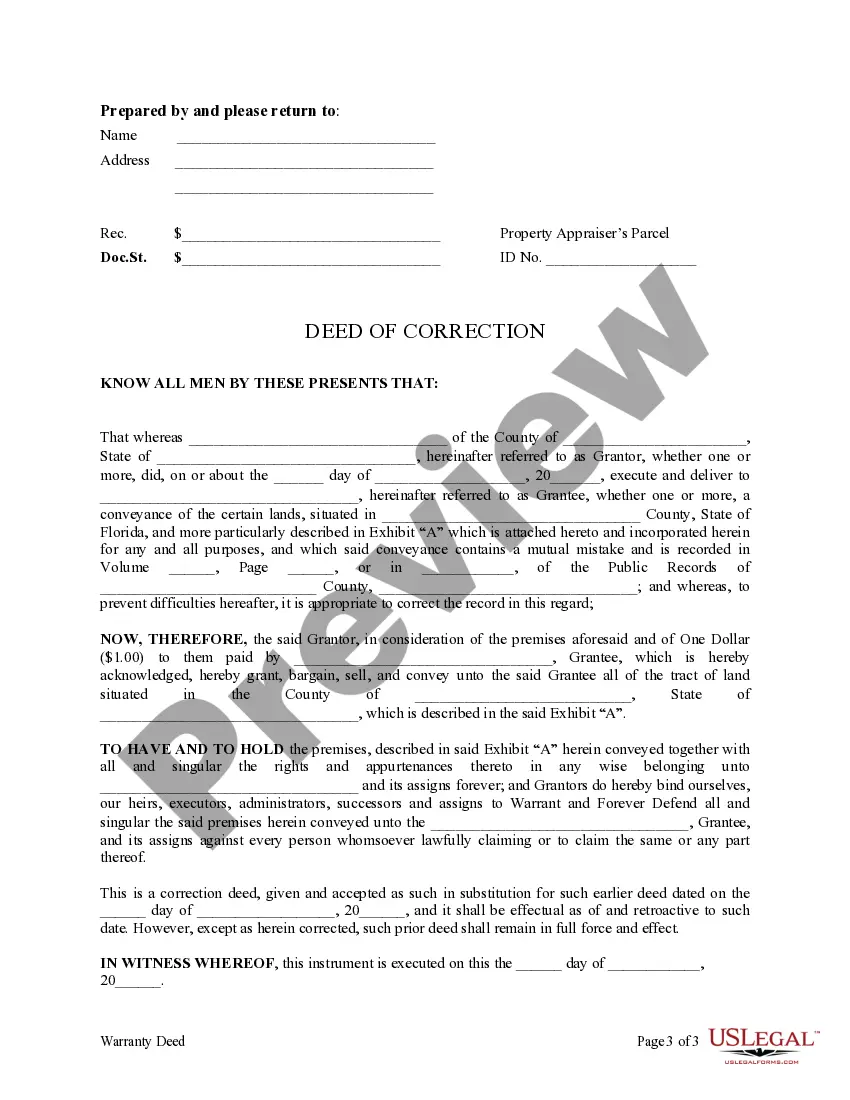

Explore the template using the Preview option or via the text outline to ensure it fits your needs.

- They are easy to navigate with all documents categorized by state and intended use.

- Our specialists keep pace with legal updates, ensuring your documents are always current and compliant when obtaining a Corrective Quit Claim Deed Florida Without Consent from our site.

- Acquiring a Corrective Quit Claim Deed Florida Without Consent is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, sign in and retrieve the document sample you need in your desired format.

- If you are new to our site, follow the steps outlined below.

Form popularity

FAQ

Typically, a General Warranty Deed is used. One or more of the identified heirs may wish to transfer or sell their interest in the property. The Deed is signed by the heirs for this purpose. Once the deed is signed and notarized, the property may be transferred or sold ing to the heirs' wishes.

Texas general warranty deeds The most common type of deed used in Texas is a general warranty deed. This type of deed guarantees the title comes without any liens, easements, or other title problems. A general warranty deed also assures the buyer that there will be no issues with the title.

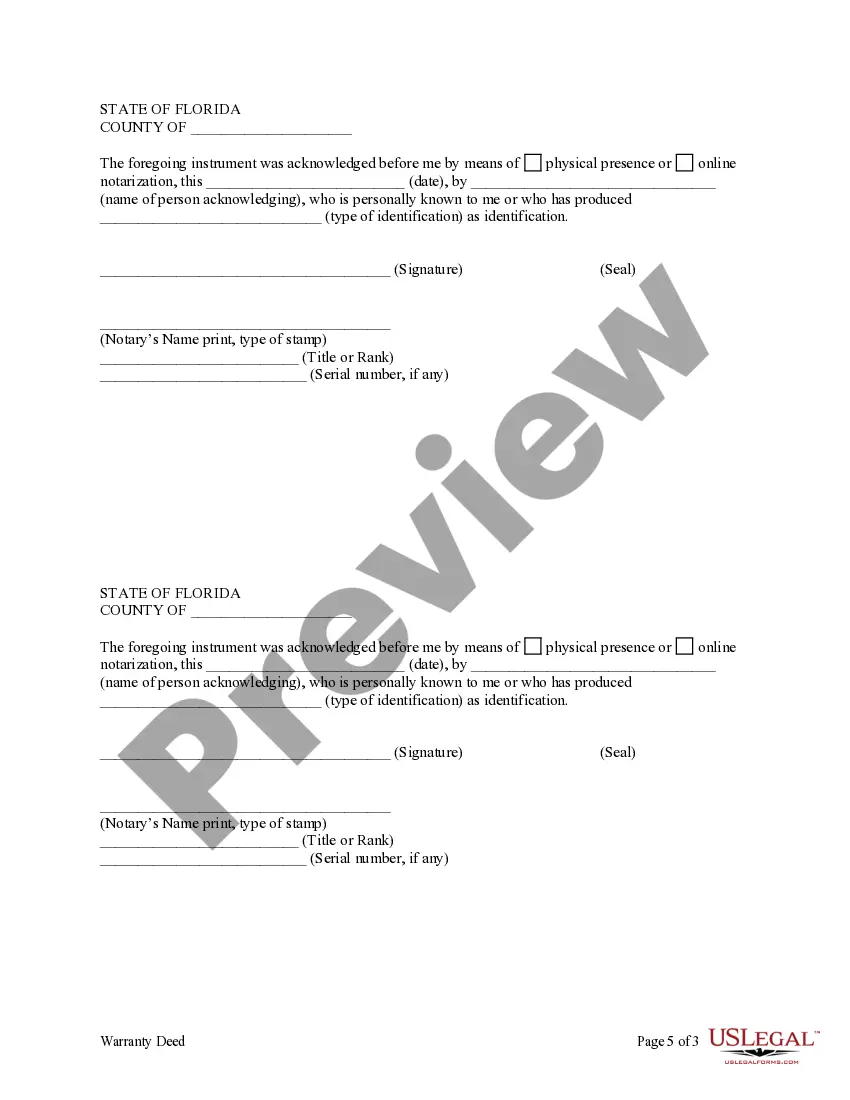

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

These deeds need to be in writing and signed by the person giving the property in front of any notary. Once it has been properly prepared and signed, the deed needs to be filed with the county clerk for the county in which the property is located. The county will charge a filing fee of about $30 to $40.

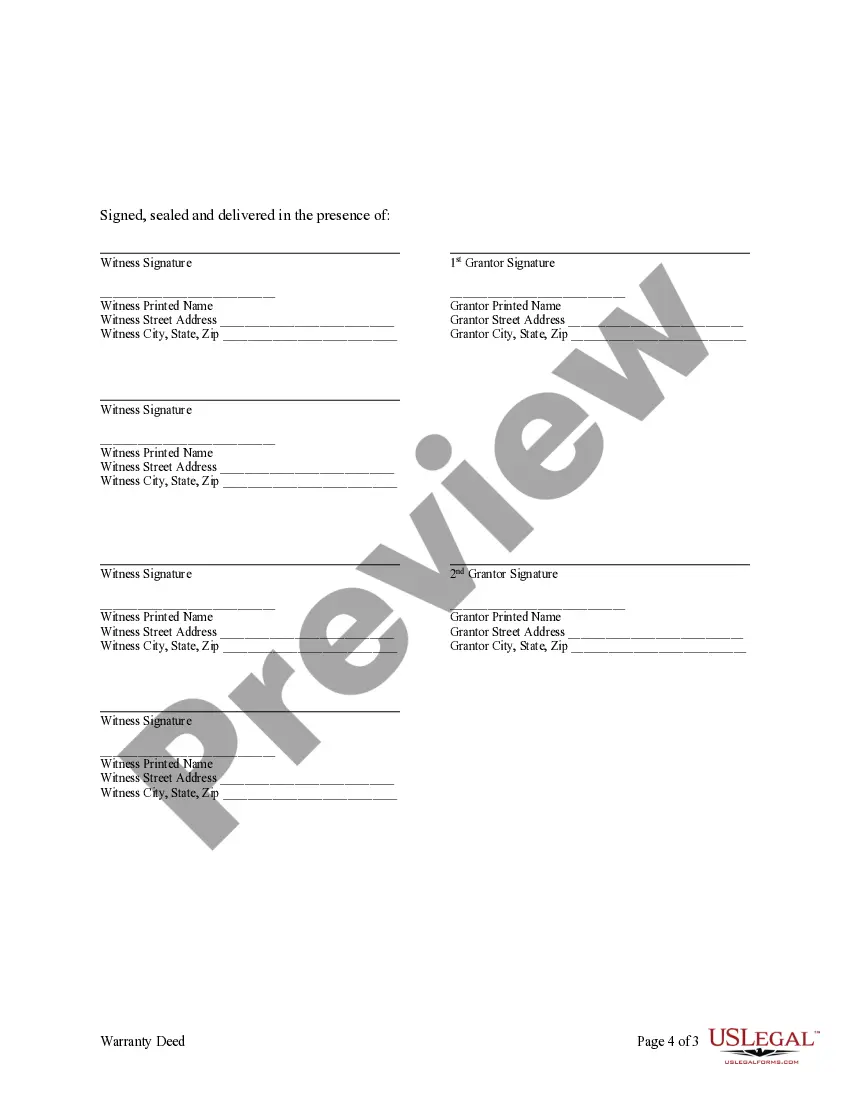

A deed must be in writing. You cannot use an oral agreement to transfer real estate. The grantor must sign the deed in front of a notary or two credible witnesses. A grantor can only transfer their own rights to property.

All transfers of real estate in Texas are either in exchange for something, such as money or services, or for no money or services, which is a Gift Deed. Using this deed to transfer real estate property is the same as any other deed, except there is no money or services given for the transfer. The property is free.

Do you have to pay taxes on a gift deed in Texas? Yes, gift taxes can be a factor when transferring ownership of real estate, but only if the property is valued over the federal gift limit.