Confirmatory Deed Vs Corrective Deed

Description

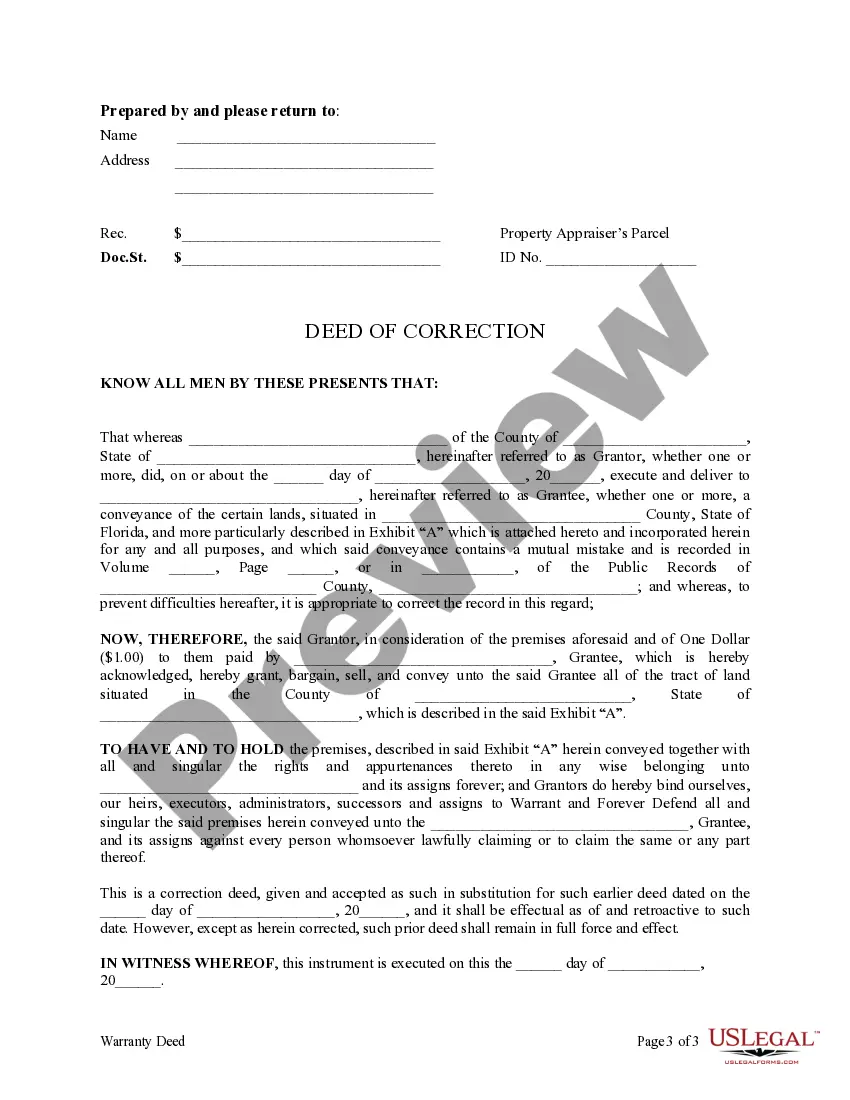

How to fill out Florida Deed Of Correction - Failure To Attach Legal Description?

Managing legal documents and tasks can be a lengthy extra to your whole day.

Confirmatory Deed vs Corrective Deed and similar forms generally necessitate that you look for them and comprehend how you can fill them out accurately.

Thus, regardless of whether you are addressing financial, legal, or personal issues, having a comprehensive and straightforward online repository of forms readily available will be highly beneficial.

US Legal Forms is the premier online resource for legal templates, featuring over 85,000 state-specific forms and numerous tools to aid you in completing your documents with ease.

Simply Log In to your account, locate Confirmatory Deed vs Corrective Deed, and download it directly from the My documents section. You can also access previously stored forms.

- Browse the collection of relevant documents accessible to you with just one click.

- US Legal Forms offers you state- and county-specific forms available for download at any time.

- Safeguard your document management processes with a top-tier service that allows you to prepare any form in minutes without additional or concealed charges.

Form popularity

FAQ

The type of deed, whether it is a confirmatory deed or corrective deed, is determined by the specific issues at hand. A confirmatory deed serves to affirm the intent of the original deed, while a corrective deed aims to fix errors or omissions in the original document. Understanding these distinctions helps you choose the appropriate deed for your situation. For personalized assistance, consider using UsLegalForms to access reliable legal resources.

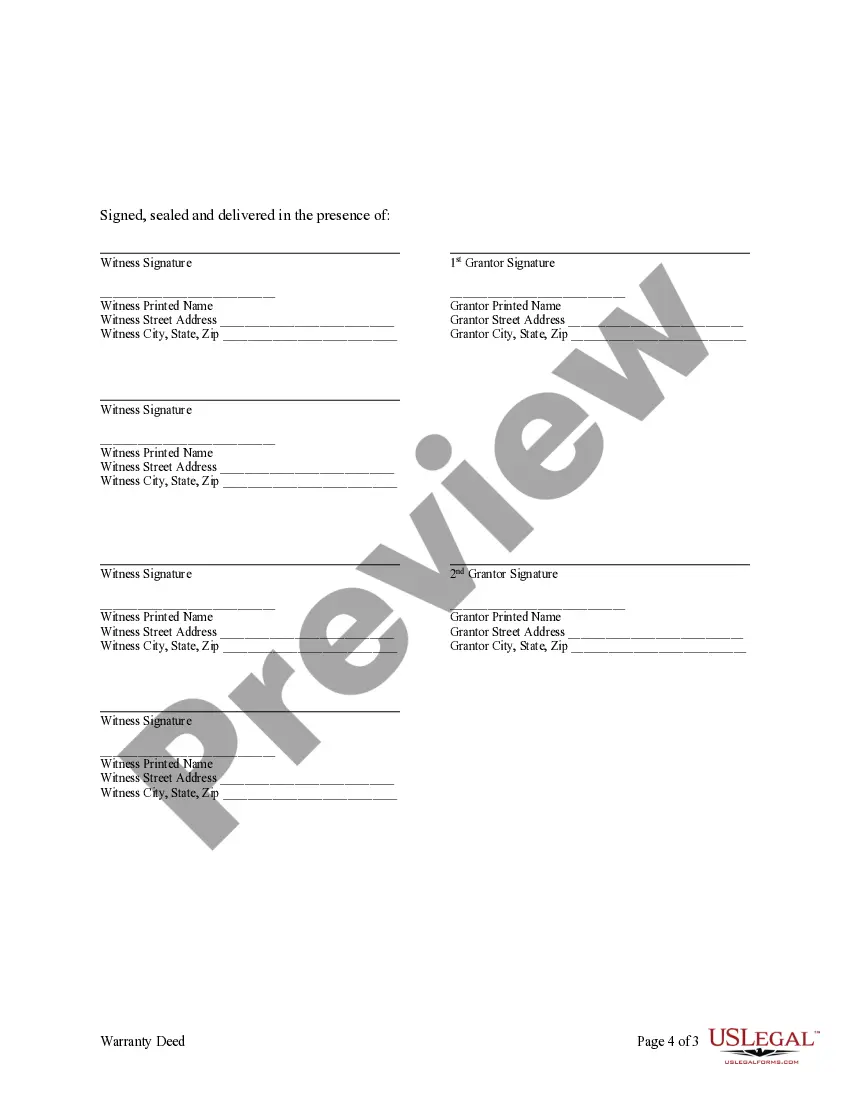

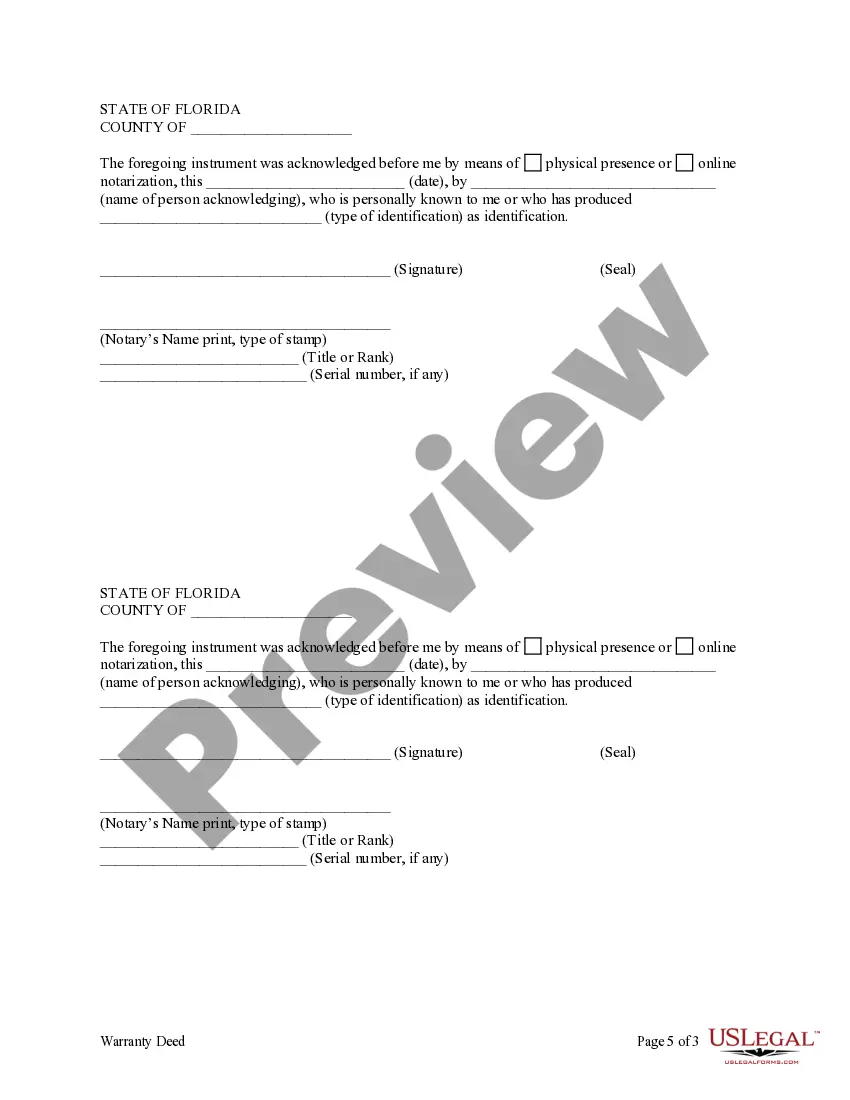

To file a corrective deed in Florida, create a new deed that specifically corrects the inaccuracies of the original document. Next, sign the deed before a notary and then file it with the county clerk’s office in the appropriate jurisdiction. This process not only resolves any issues but also clarifies property ownership, further highlighting the differences between a confirmatory deed vs corrective deed.

A deed of ratification serves to confirm and validate a previous deed that may have had minor errors or omissions. This legal document allows parties to rectify and solidify their intentions, ensuring that all terms are honored. Understanding how it differs from a confirmatory deed vs corrective deed is crucial, as both serve distinct purposes in property law.

To file a corrective deed in California, first prepare your corrective deed document, ensuring it clearly indicates the error and the intent to correct it. Next, sign the document in front of a notary public, then record it with the county recorder’s office where the original deed was filed. This process helps clarify ownership and resolves discrepancies, making it essential to understand the difference between a confirmatory deed vs corrective deed.

In Pennsylvania, a confirmatory deed is used to affirm the ownership of property, often employed to fix errors in earlier deeds. This process can streamline property transfers and clarify ownership without the need for a complete re-do of a deed. Understanding the confirmatory deed vs corrective deed differences can guide you through Pennsylvania's specific legal requirements.

A confirmation deed is a type of document that verifies or emphasizes the accuracy of a previous deed. It may correct minor mistakes without redefining the terms of ownership. Knowing about confirmatory deed vs corrective deed helps you determine which document best serves your needs.

A confirmatory deed is typically signed by the property owner or grantor. In some cases, witnesses may also need to sign depending on state laws. It’s crucial to understand the procedural differences between a confirmatory deed vs corrective deed to ensure legal validity.

The meaning of a confirmatory deed centers around ensuring that property ownership is correctly recorded. It acts as an affirmation of a previously existing deed, helping to resolve any discrepancies. To navigate complexities like confirmatory deed vs corrective deed, consider consulting platforms like uslegalforms.

A confirmation document is a written statement that certifies or verifies something. In real estate, it often confirms the details of transactions or agreements associated with a property. Knowing the nuances of a confirmatory deed vs corrective deed will assist in maintaining accurate documentation.

A confirmation of a mortgage form is a document that verifies the details of a mortgage agreement. This document typically provides the amount borrowed and terms of repayment. If you've recently closed a mortgage, understanding a confirmatory deed vs corrective deed can help clarify your rights in property ownership.