Partial Mortgage Release Form For Mortgage

Description

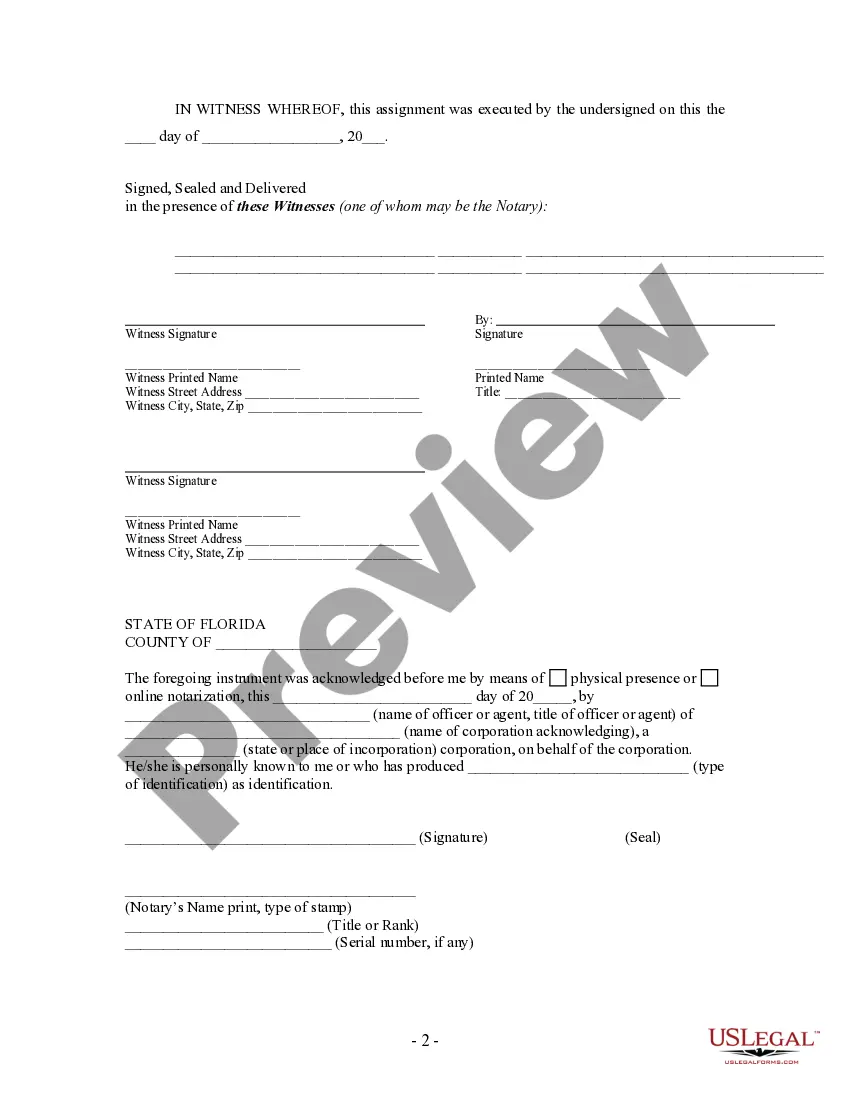

How to fill out Florida Partial Release Of Property From Mortgage For Corporation?

The Partial Mortgage Release Document For Mortgage displayed on this page is a reusable official template crafted by experienced attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with over 85,000 authenticated, state-specific documents for various business and personal circumstances. It’s the fastest, easiest, and most trustworthy method to acquire the forms you require, as the service assures the utmost level of data protection and anti-malware safety.

Re-download your documents whenever necessary. Access the My documents tab in your profile to retrieve any previously downloaded documents.

- Search for the document you need and review it.

- Browse through the sample you were looking for and view it or examine the form details to verify it meets your requirements. If it doesn’t, use the search feature to locate the right one. Click Buy Now once you have located the template you want.

- Register and sign in.

- Choose the pricing option that fits you and create an account. Use PayPal or a debit/credit card for a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Select the format you desire for your Partial Mortgage Release Document For Mortgage (PDF, Word, RTF) and download the document to your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form with an electronic signature.

Form popularity

FAQ

The Fair Debt Collection Practices Act was established to protect the consumer and set guidelines by which credit collectors must abide. What characteristics should be considered when choosing a collections agent? Professional, ethical, and reliable. What is an insufficient funds charge?

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Rhode Island Statute Of Limitations Creditors in Rhode Island have ten years to sue you for an unpaid loan, promissory note, or credit card. A creditor can still call and send you bills even after the statute of limitations has expired.

The FDCPA prohibits debt collectors from engaging in harassment or abuse, making false or misleading representations, and engaging in unfair practices. A debt collector cannot harass or abuse any person when collecting debts.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

A debt collection form is used by employers to get the contact information from debtors (people who owe you money).

The FDCPA creates a structure within which debt collectors are allowed to work in an attempt to make debt collection a fair and nonaggressive process. The law limits the time of day when collectors may call, the type of language they may use, and how they represent themselves.

The FDCPA creates a structure within which debt collectors are allowed to work in an attempt to make debt collection a fair and nonaggressive process. The law limits the time of day when collectors may call, the type of language they may use, and how they represent themselves.