Attorney Powers Power With Bank

Description

How to fill out Florida Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Whether for commercial purposes or personal matters, everyone must address legal issues at some point in their lives.

Filling out legal papers requires meticulous care, starting from selecting the correct form template.

Once downloaded, you can complete the form using editing software or print it and fill it out by hand. With a vast US Legal Forms collection available, you won’t have to waste time searching for the correct sample online. Utilize the library’s easy navigation to find the suitable template for any circumstance.

- For instance, if you choose an incorrect variant of the Attorney Powers Power With Bank, it will be dismissed upon submission.

- Thus, it is vital to obtain a trustworthy source of legal documents like US Legal Forms.

- To acquire an Attorney Powers Power With Bank sample, follow these straightforward steps.

- Find the template you require using the search bar or catalog navigation.

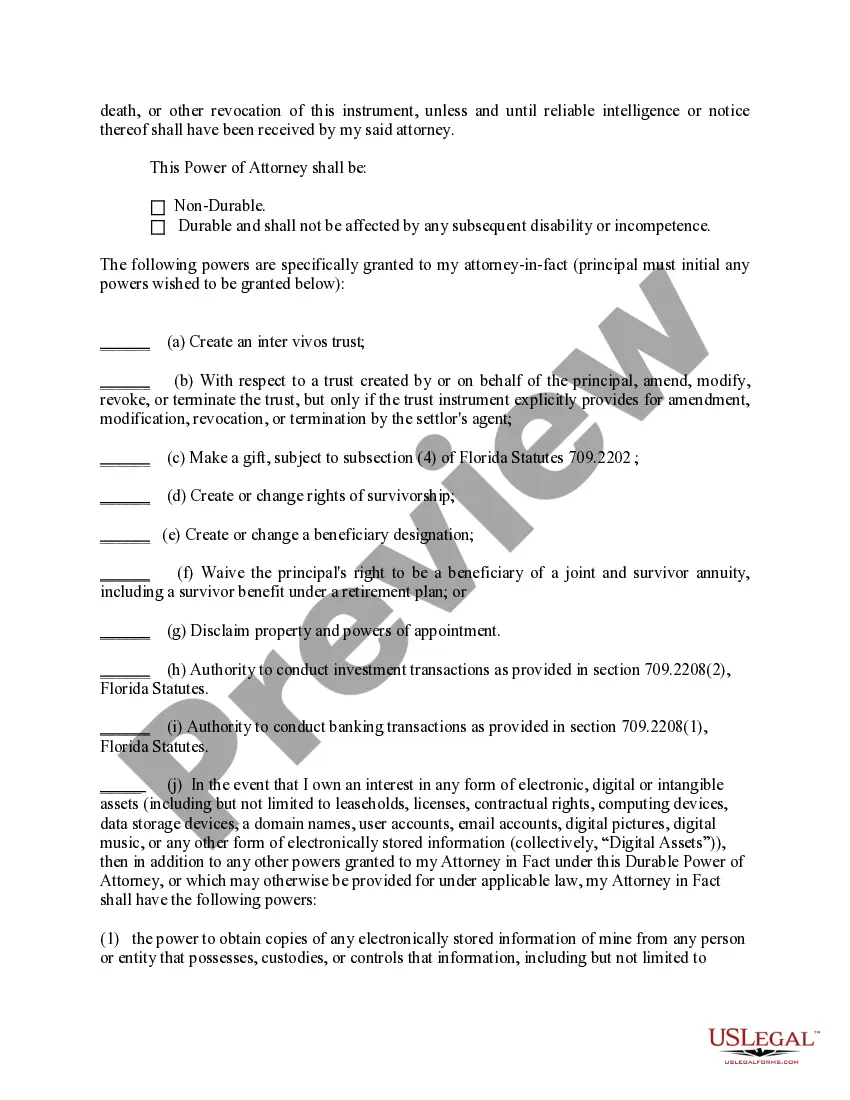

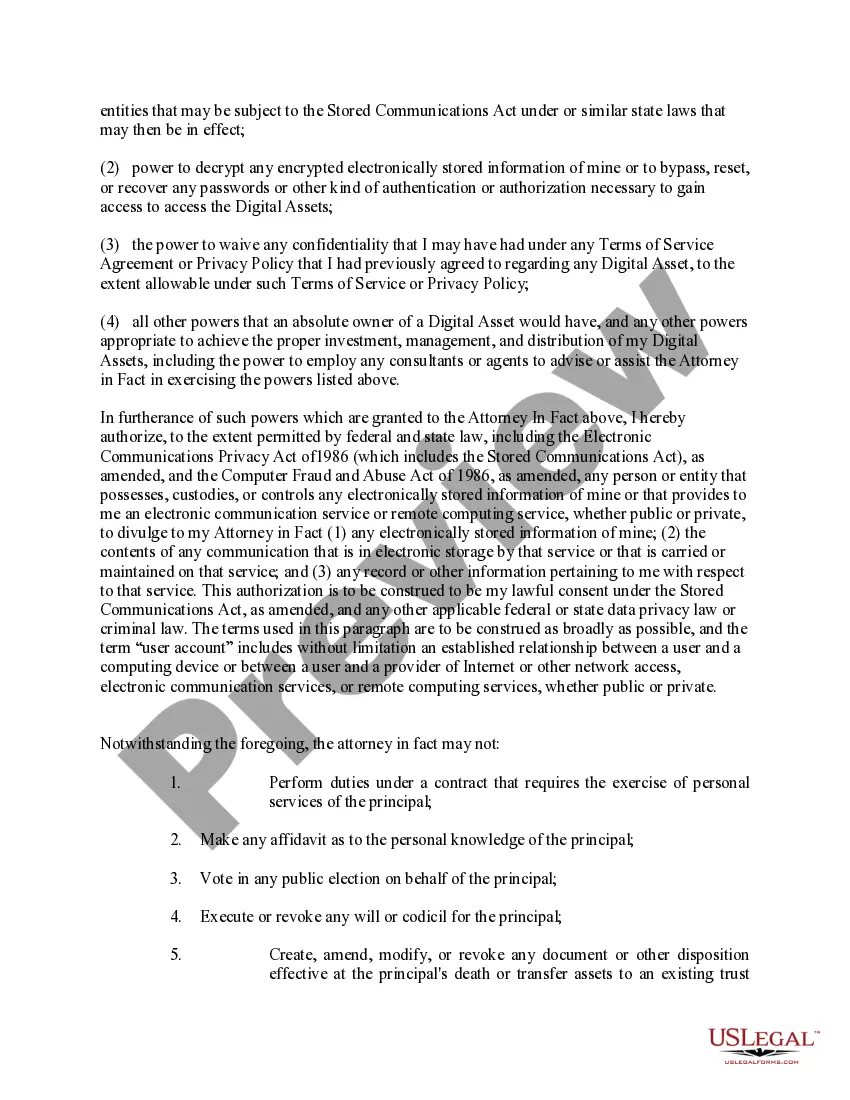

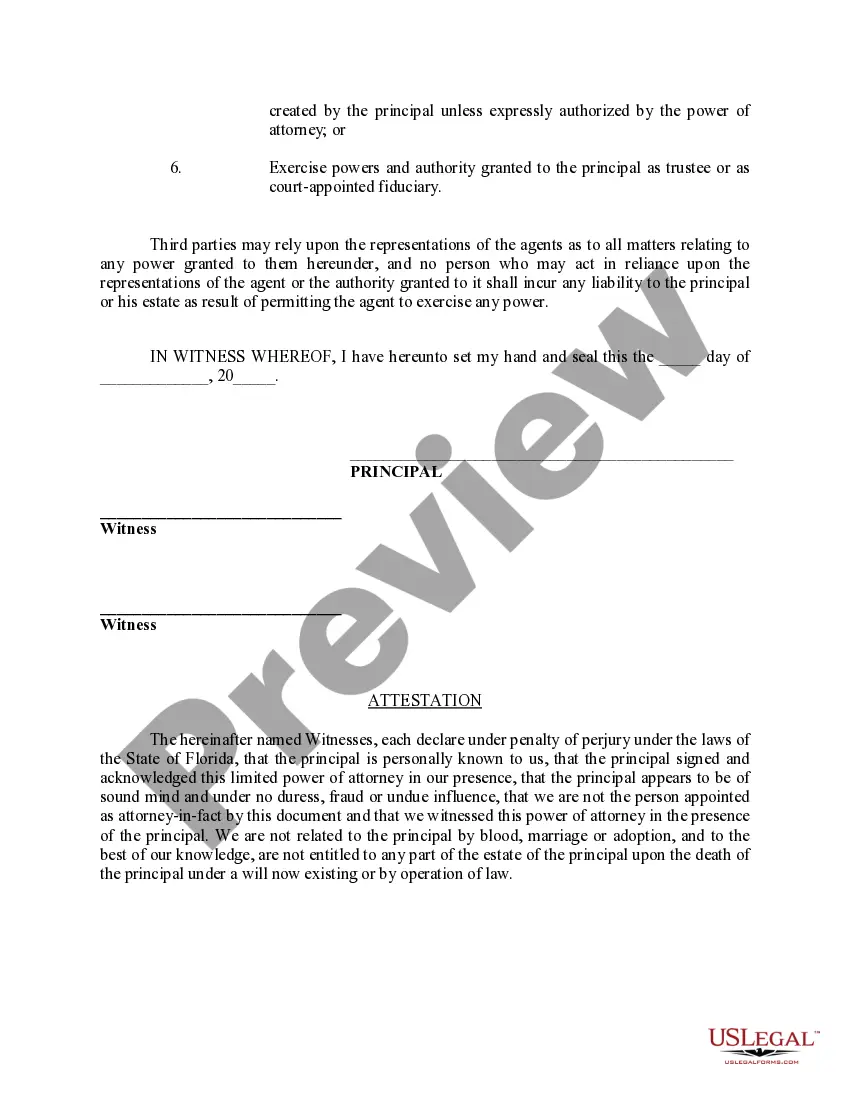

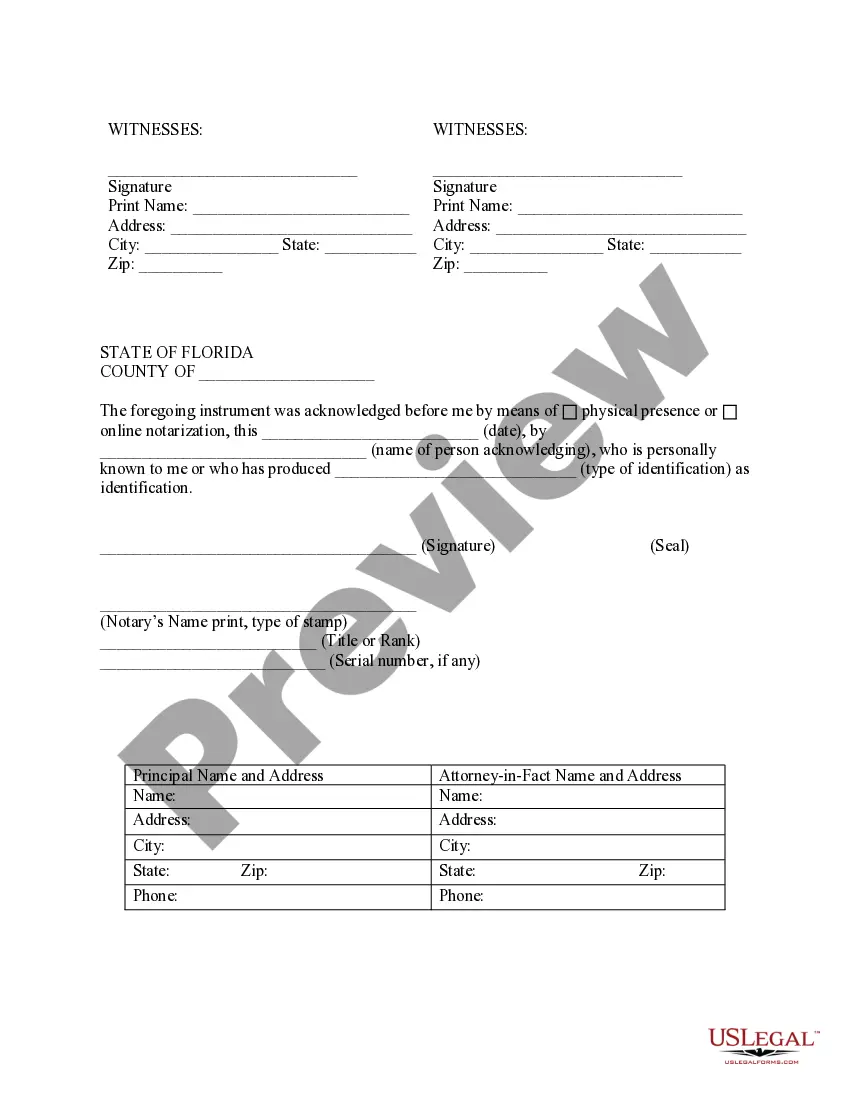

- Review the description of the form to confirm it aligns with your situation, state, and county.

- Click on the preview of the form to examine it.

- If it is the wrong document, return to the search tool to find the Attorney Powers Power With Bank sample you seek.

- Download the file if it satisfies your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you haven’t created an account yet, you can download the form by clicking Buy now.

- Choose the appropriate payment option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the desired document format and download the Attorney Powers Power With Bank.

Form popularity

FAQ

A power of attorney works with bank accounts by granting authority to the appointed person to manage financial matters. This includes accessing accounts, making deposits, and handling withdrawals based on the terms defined in the document. Presenting the power of attorney to the bank allows the financial institution to recognize your authority. It's important to understand your rights and responsibilities when exercising these attorney powers with bank accounts.

Most banks do not offer notarization services for power of attorney documents, as this is typically handled by a notary public. You can usually find notary services at local offices, libraries, or even online platforms. Ensure the power of attorney is notarized before presenting it to the bank for best results. Understanding the role of notarization can help solidify your attorney powers with bank accounts.

To file a power of attorney with a bank, first ensure the document is valid and fully executed according to the state's laws. Visit your local branch with the original power of attorney and any required identification documents. The bank may have specific procedures for accepting the POA, so it's beneficial to ask a representative for guidance. This way, you maximize the chances of smooth processing and recognition of your attorney powers with bank accounts.

There are various reasons a bank may deny a power of attorney, including unclear wording in the document or if the authority granted exceeds bank policies. If the POA appears outdated or does not include the required elements, the bank may refuse to honor it. Communicating directly with your bank can clarify any concerns and allow you to rectify any issues. It’s essential to understand how attorney powers with bank accounts are recognized.

A bank may deny a power of attorney for several reasons, including if the document is not properly executed. If the power of attorney lacks necessary signatures or does not meet state requirements, the bank might reject it. Additionally, banks may have specific policies regarding the acceptance of POA documents. It's advisable to check with the financial institution to understand what is needed for acceptance.

A power of attorney allows you to act on behalf of another person, including handling their bank accounts. The appointed attorney can access account information, make withdrawals, and manage transactions as specified in the document. It’s crucial to present the power of attorney to the bank to ensure they recognize your authority. Understanding the guidelines and limitations will help you use attorney powers effectively with bank accounts.

To protect your elderly parents' bank accounts, consider setting up a power of attorney. This legal document allows you to manage their finances and make decisions on their behalf. It's important to discuss this process with your parents to understand their wishes and ensure they feel comfortable. Utilizing resources like USLegalForms can help you navigate the requirements and create a valid power of attorney.

Yes, you can generally obtain a power of attorney at a bank. Many financial institutions offer services to help you set up attorney powers power with bank. This process typically requires you to provide specific information about your financial assets and the person you want to designate as your agent. Additionally, using a platform like US Legal Forms can make this process easier by providing the necessary templates and guidance to ensure everything is completed correctly.

While banks often accept powers of attorney, they can set their own policies about which documents they will recognize. Generally, a well-drafted power of attorney that meets state laws is more likely to be accepted. If you encounter issues, it could be helpful to inquire about their specific requirements. You can rely on resources from US Legal Forms to ensure your power of attorney aligns with the legal expectations of your bank.

The processing time for a power of attorney at a bank can vary, but typically, it may take a few days to a couple of weeks. Factors influencing this timeline include the bank's internal procedures and the complexity of the document. To speed up the process, ensure you have all necessary documentation ready and correctly filled out. Using services like US Legal Forms can help streamline this process by providing clear templates for your attorney powers power with banks.