Employee Filed For Unemployment

Description

How to fill out Florida Employment Employee Personnel File Package?

Whether for business purposes or for individual matters, everyone has to deal with legal situations at some point in their life. Completing legal documents needs careful attention, beginning from picking the appropriate form sample. For instance, if you pick a wrong edition of the Employee Filed For Unemployment, it will be turned down when you submit it. It is therefore important to get a reliable source of legal files like US Legal Forms.

If you need to get a Employee Filed For Unemployment sample, follow these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Look through the form’s information to make sure it matches your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to locate the Employee Filed For Unemployment sample you require.

- Download the template when it meets your needs.

- If you already have a US Legal Forms account, just click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Employee Filed For Unemployment.

- Once it is downloaded, you can fill out the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time seeking for the appropriate template across the web. Take advantage of the library’s simple navigation to get the right template for any situation.

Form popularity

FAQ

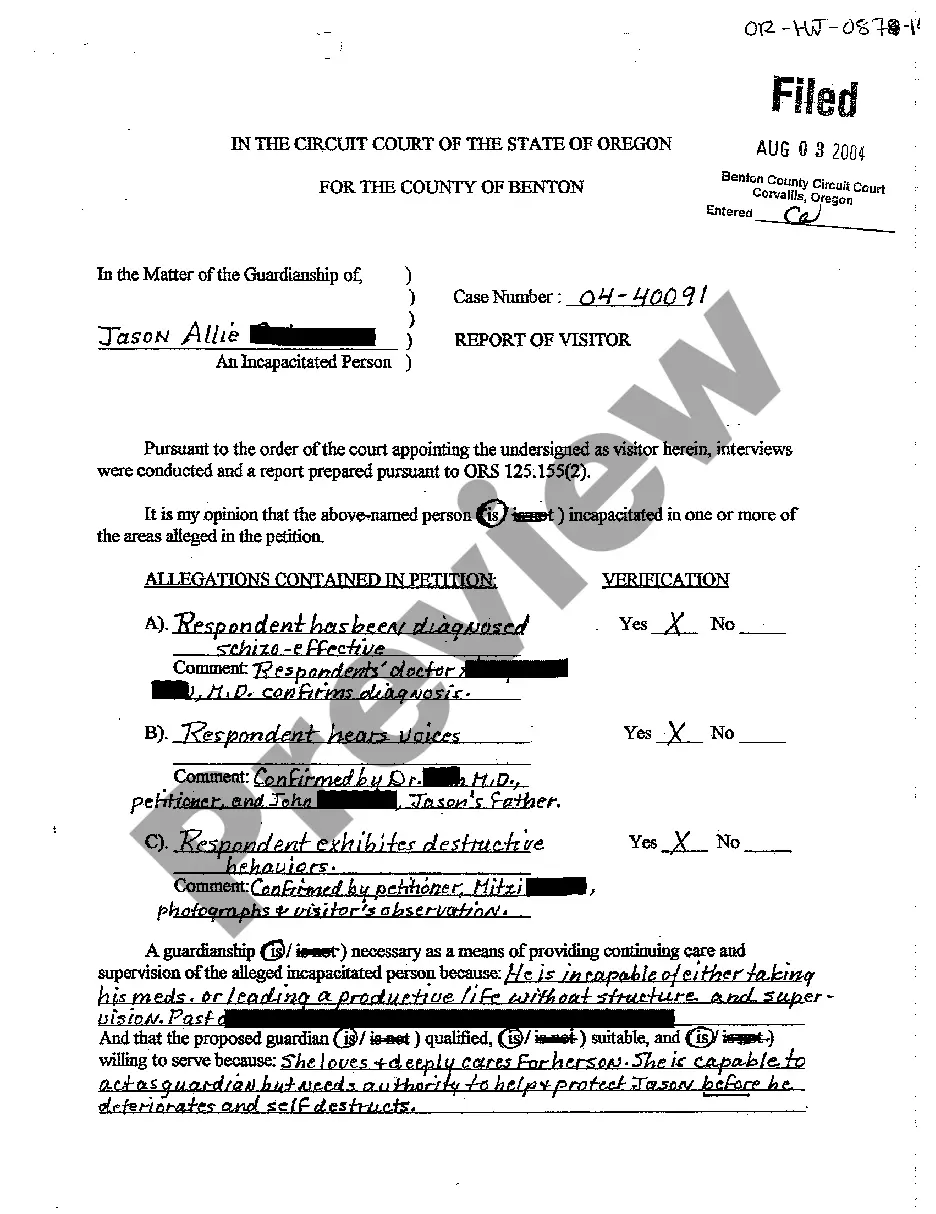

An employee can file a claim any time after he or she is terminated or his or her hours are reduced. After a claim is filed, there is a mandatory one-week waiting period in which the EDD will process the employee's claim and determine whether or not the employee is eligible to receive unemployment benefits.

Average unemployment insurance tax rate drops to 1.16% AUSTIN ? Today, the Texas Workforce Commission (TWC) announced the average unemployment insurance (UI) tax rate for all employers will be 1.16% for calendar year (CY) 2023. Last year, the average tax rate was 1.35%.

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

Unemployment benefits are paid by employers through taxes and reimbursements. Unemployment benefits pay part of an eligible person's income while they look for a new job. To be eligible, someone must have lost their job through no fault of their own.

The average tax rate for experience-rated employers is 0.89%. The maximum UI tax rate, paid by 4.2% of Texas employers, will be 6.23%, down 0.08 percentage points from CY 2022 at 6.31%.