Power Of Attorney Form For Irs

Description

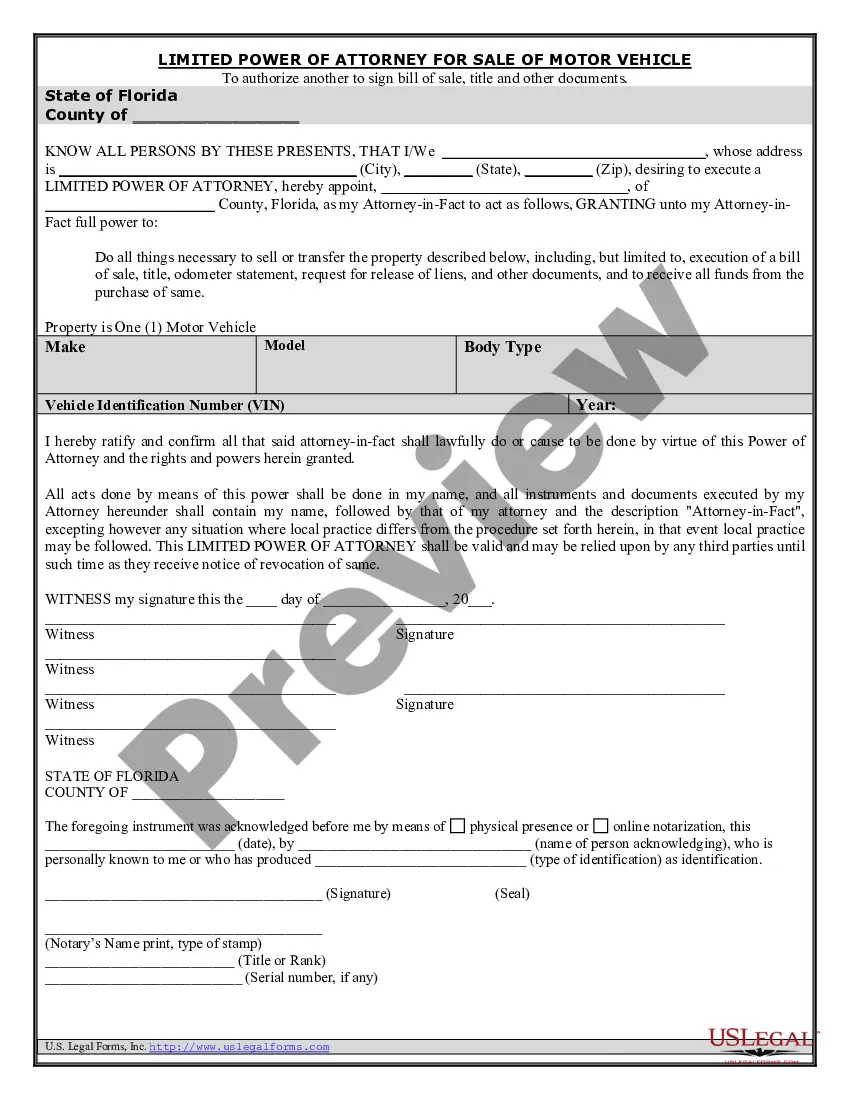

How to fill out Florida Power Of Attorney For Sale Of Motor Vehicle?

- If you're a returning user, start by logging into your account to access previously saved documents. Ensure your subscription is active, or renew it as needed.

- For first-time users, browse through our extensive library. Utilize the preview mode to verify that the form aligns with your needs and adheres to your local jurisdiction's requirements.

- Should you find discrepancies or need alternative forms, use the Search feature at the top to refine your results until you locate the exact document you require.

- Once you've identified the correct template, proceed by selecting the Buy Now button, followed by choosing your desired subscription plan. You'll need to create an account to access our forms.

- Complete the purchase using your credit card or PayPal account for a smooth transaction.

- Finally, download the power of attorney form onto your device. You can revisit it anytime via the My Forms section of your profile.

US Legal Forms empowers users by offering a vast collection of over 85,000 legal documents, including the power of attorney form for IRS. This ensures that you have the means to handle your legal needs efficiently.

Ready to simplify your IRS documentation process? Get started with US Legal Forms today and experience the ease of accessing the forms you need.

Form popularity

FAQ

A Certified Public Accountant (CPA) may need a Power of Attorney form for IRS to represent clients effectively in tax matters. This authority enables the CPA to access sensitive financial information, discuss issues with the IRS, and navigate complex tax regulations on behalf of the client. Having this power streamlines the process and enhances the CPA's ability to deliver valuable tax guidance.

In the case of a deceased person, the executor or administrator of the estate is responsible for signing the form 2848, or the Power of Attorney form for IRS. This individual is legally designated to manage the deceased's tax matters and can handle necessary communications with the IRS. Properly completing the form ensures that tax issues are settled efficiently and honors the deceased's legal obligations.

To submit the Power of Attorney form for IRS, complete IRS form 2848 and mail or fax it to the appropriate IRS office. Ensure all necessary signatures are included, and consider using USPS for mailing to confirm receipt. After submission, it is wise to follow up with the IRS to verify that the form has been processed and that your representative is authorized.

A Power of Attorney (POA) for the IRS refers specifically to the legal authority you grant to someone to act on your behalf in tax matters. By using the Power of Attorney form for IRS, you enable your chosen representative to handle communications with the IRS, file documents, and resolve tax issues. This arrangement can be particularly beneficial if you lack the time or expertise to manage your tax affairs.

Executing a form 2848, the Power of Attorney form for IRS, empowers your chosen representative to manage your tax issues effectively. This includes the ability to discuss your case with the IRS, submit forms, and negotiate tax liabilities. Consequently, this can ease your tax burden and create a more streamlined process when handling complex tax matters.

The primary difference between IRS form 2848 and 8821 lies in their purposes. Form 2848 is the Power of Attorney form for IRS, granting the authority to represent you in tax matters. In contrast, form 8821 allows someone to receive your tax information without representation authority. Choosing the right form depends on whether you need someone to act on your behalf or simply to receive information.

Any taxpayer who wants to appoint someone to handle their tax matters should file the form 2848, or the Power of Attorney form for IRS. This includes individuals, businesses, and estates requiring assistance with IRS matters. By filing the form, you ensure that your authorized representative can manage your tax affairs efficiently.

The IRS form 2848, also known as the Power of Attorney form for IRS, allows a taxpayer to authorize an individual to represent them before the IRS. This form permits the designated representative to discuss the taxpayer's tax matters, respond to IRS inquiries, and negotiate on their behalf. Utilizing this form ensures that the appointed person has the authority to act in your best interest when dealing with tax issues.

To upload a power of attorney form for IRS, you generally need to submit it via mail or fax to the appropriate IRS office specified on the form. The IRS does not currently have an online portal for uploading these forms directly. Double-check the IRS instructions to ensure you are sending it to the correct location. For ease of use, consider using platforms like USLegalForms to navigate the submission process more effectively.

Processing a power of attorney can take anywhere from 4 to 6 weeks, depending on the agency involved. The IRS follows a similar timeline for the power of attorney form for IRS. It’s important to keep records and maintain communication with the IRS for updates. By using USLegalForms, you can ensure that your submissions are clear and correctly formatted, which aids in a smoother process.