Death Certificate In Florida

Description

How to fill out Florida Affidavit - Death Certificate?

Locating a reliable source for obtaining the latest and suitable legal documents is a significant part of navigating red tape.

Acquiring the appropriate legal forms demands accuracy and carefulness, which is why it is essential to source Death Certificate In Florida exclusively from trustworthy providers, such as US Legal Forms.

Reduce the hassle associated with your legal paperwork. Explore the extensive US Legal Forms library where you can discover legal documents, assess their suitability for your case, and download them immediately.

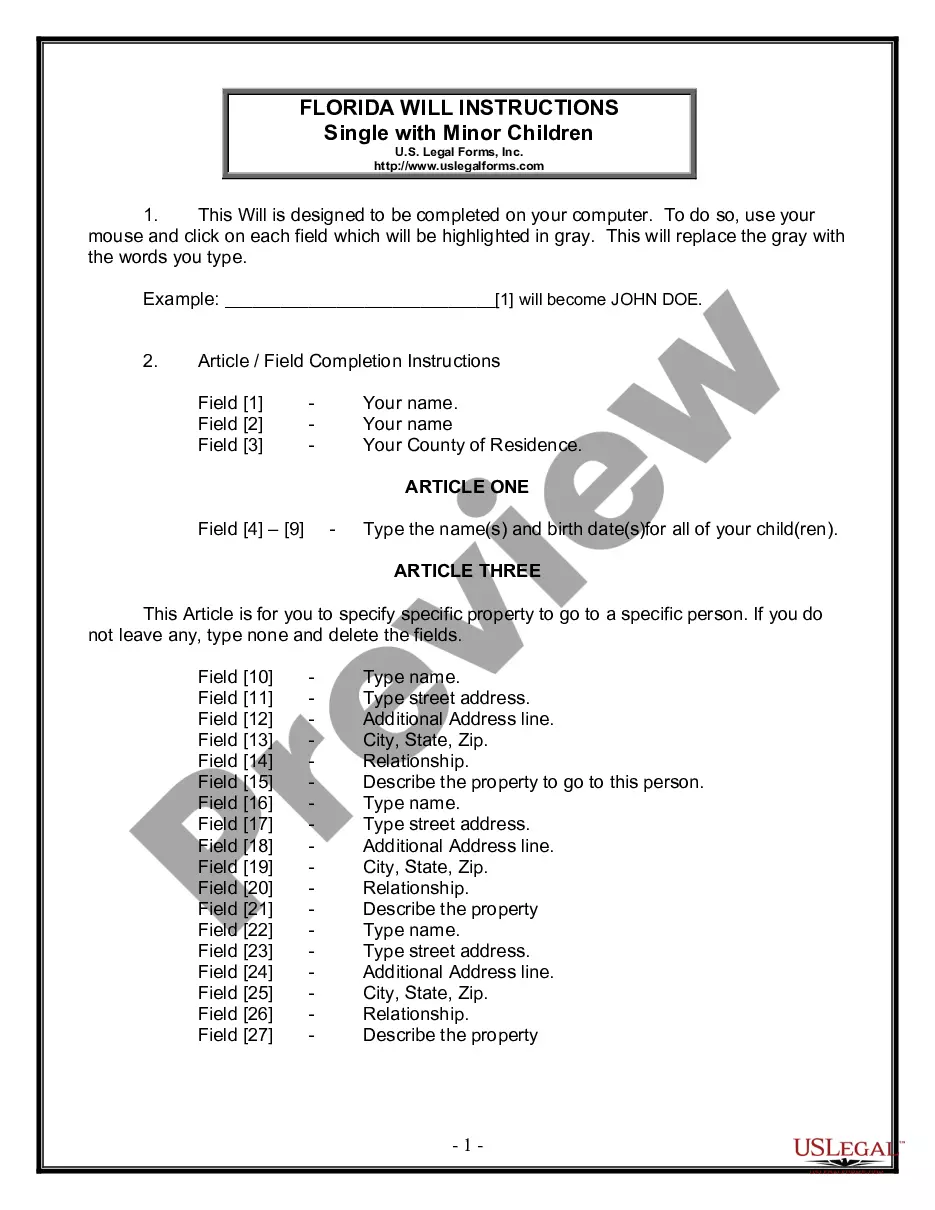

- Utilize the library navigation or search option to locate your document.

- Examine the form’s details to verify if it fulfills the criteria of your state and locality.

- Check the form preview, if available, to confirm that it is indeed the document you seek.

- Return to the search to find the correct template if the Death Certificate In Florida does not meet your needs.

- Once you are certain of the form’s appropriateness, download it.

- If you are a registered user, click Log in to verify and access your selected documents in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing option that fits your requirements.

- Proceed to registration to complete your transaction.

- Finalize your payment by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Death Certificate In Florida.

- Once you have the document on your device, you can edit it with the editor or print it and complete it manually.

Form popularity

FAQ

In Florida, the death certificate is usually prepared by the funeral home soon after the death occurs. Typically, you can expect to receive the official document within a few days, depending on the circumstances and the efficiency of the funeral provider. It’s essential to follow up with the funeral service or relevant authorities to ensure you get the death certificate in Florida as promptly as possible.

In Florida, the responsibility for filing a death certificate typically falls to the funeral home or the person handling the deceased's arrangements. They will gather the necessary information and submit the certificate to the Florida Department of Health within a specified timeframe. This process is crucial, as a death certificate in Florida is required for estate settlement and other legal proceedings.

Forms 1099 report non-employee income to the recipient of the money and to the IRS. Income reported on a 1099 is then entered on Form 1040 with several other financial details to determine whether you owe tax or can expect a refund. All taxpayers must file a 1040 if they earn more than a certain threshold of income.

2. Get yourself a contracting license. It is common for a city or county to only allow independent contractors to work if they have a contracting license. You should do this even if you work from your house, because there can be a penalty fee if you skip it; fortunately, it is a pretty inexpensive and simple process.

As an independent contractor, vendor, freelancer or other individual receiving nonemployee compensation, you typically do not work for the person or business as an employee. If you don't work as an employee, you'll typically have your earnings reported on a Form 1099-NEC and will need to prepare a W-9.

9s and 1099s are tax forms that are required when employers work with an independent contractor. Form 9 is completed by the independent contractor and provides details on who they are. Form 1099NEC is completed by the employer and details the wages paid to the contractor.

How to Write a Contractor Agreement Outline Services Provided. The contractor agreement should list all services the contractor will provide. ... Document Duration of the Work. Specify the duration of the working relationship. ... Outline Payment Terms. ... Outline Confidentiality Agreement. ... Consult with a Lawyer.

Complete Form 1099-NEC, Nonemployee Compensation Businesses that pay more than $600 per year to an independent contractor must complete Form 1099-NEC and provide copies to both the IRS and the freelancer by the specified annual deadline.

What is Form W-9? A W-9 is sent by a client to a contractor to collect their contact information and tax number. Then, the client uses that info to fill out a Form 1099. It's the client's duty, as someone who is contracting work, to send the contractor Form W-9 before the end of the financial year.

If you are a contractor employed by a firm or individual to provide a service, they will almost certainly require you to fill out a W-9 form. You must validate information such as your name, residence, and tax id. The IRS website has all of the W-9 pages available and step-by-step instructions on filling them out.