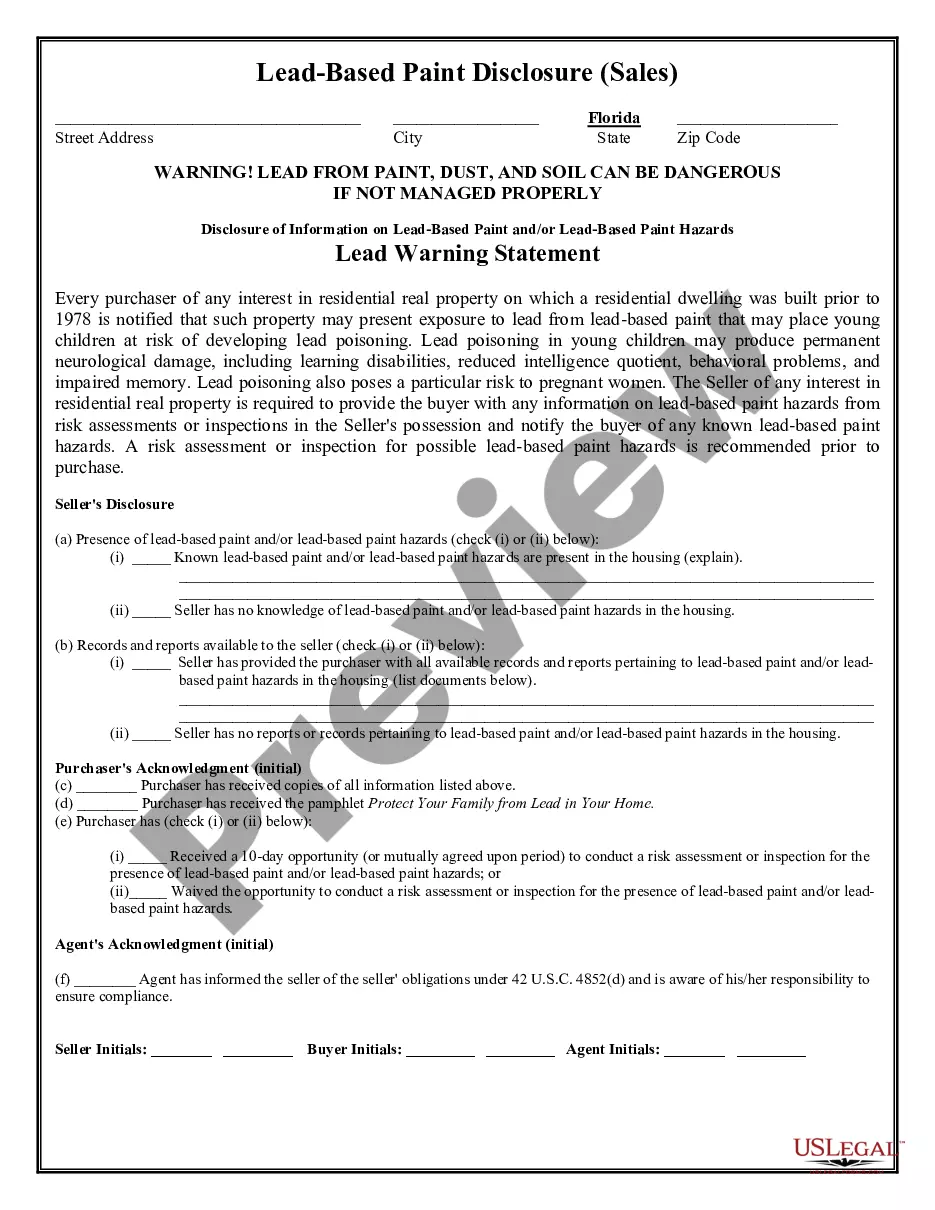

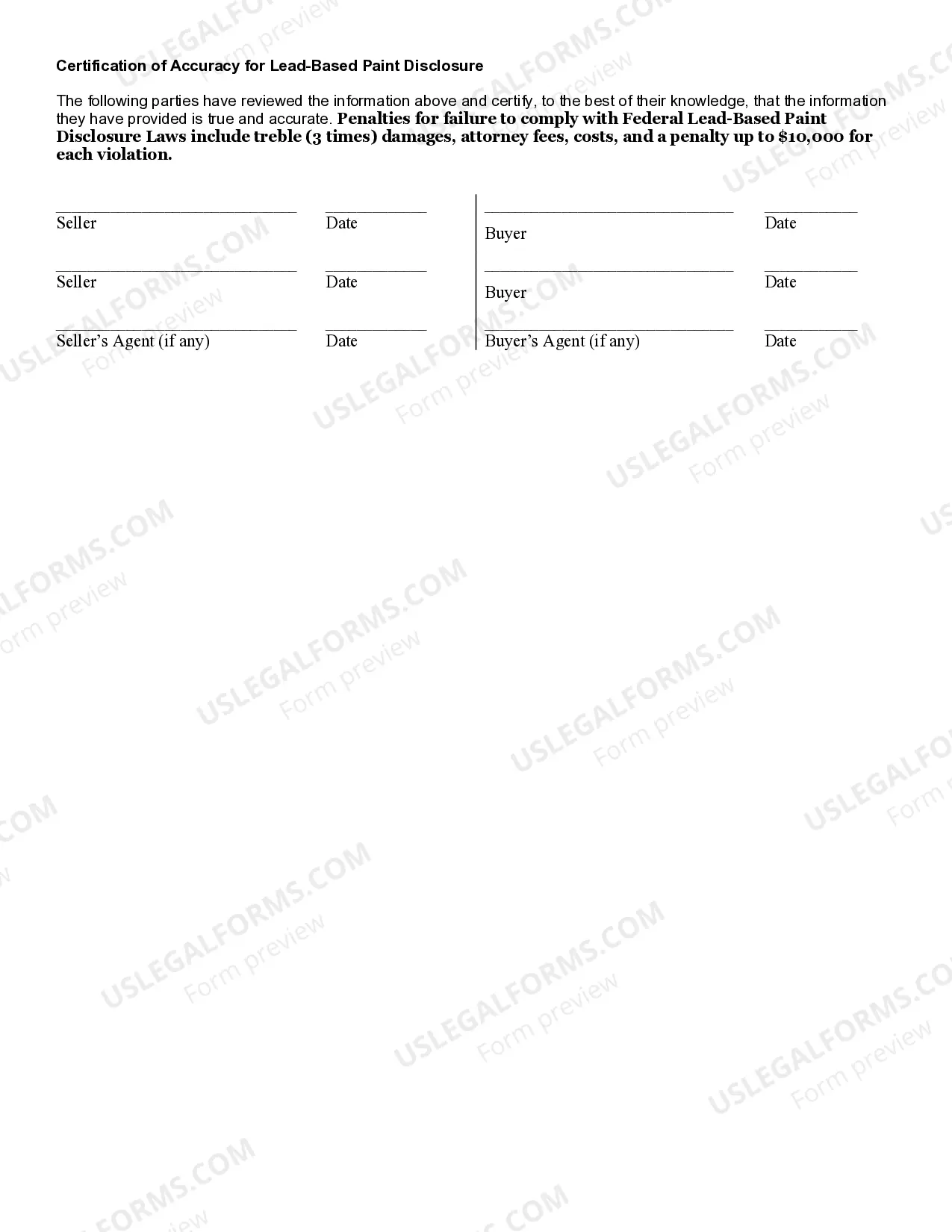

Lead-based Paint Disclosure Form Florida

Description

How to fill out Florida Lead Based Paint Disclosure For Sales Transaction?

It’s clear that you cannot transform into a law specialist instantly, nor can you master drafting the Lead-based Paint Disclosure Form Florida swiftly without a unique set of expertise.

Creating legal documents is a lengthy process that demands particular education and abilities. So why not entrust the preparation of the Lead-based Paint Disclosure Form Florida to the experts.

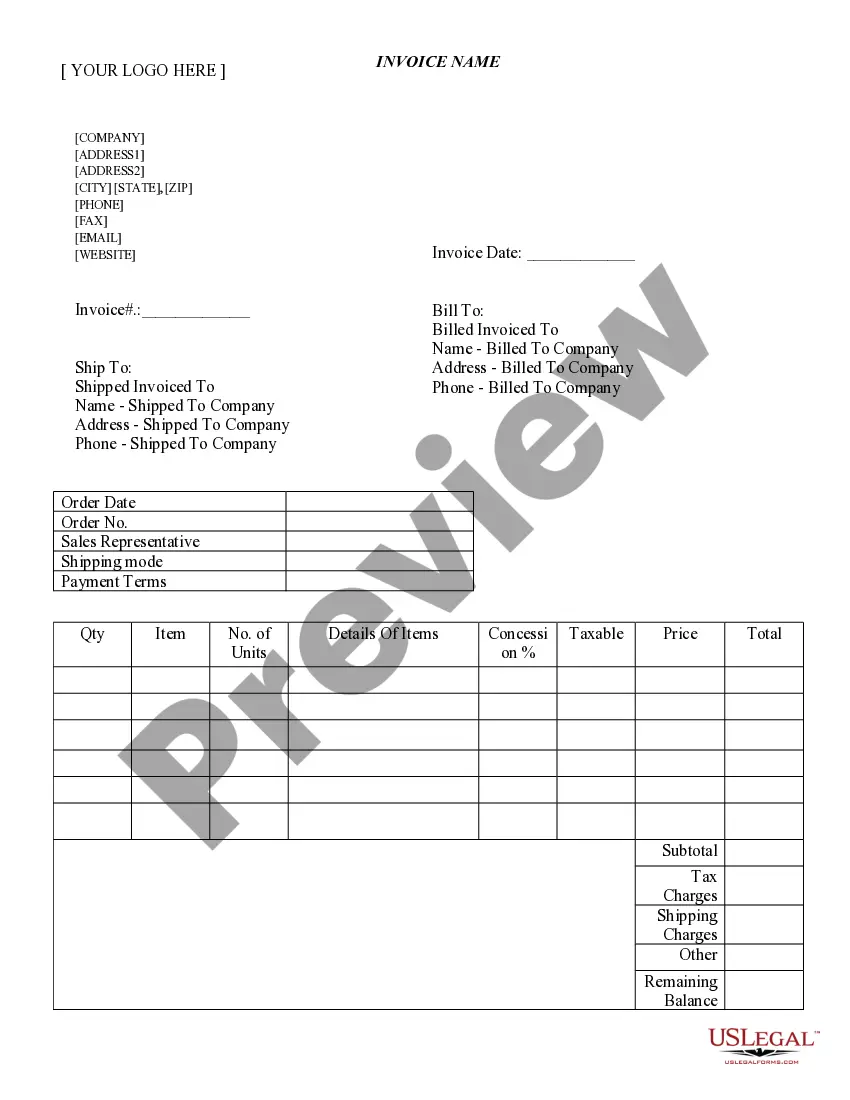

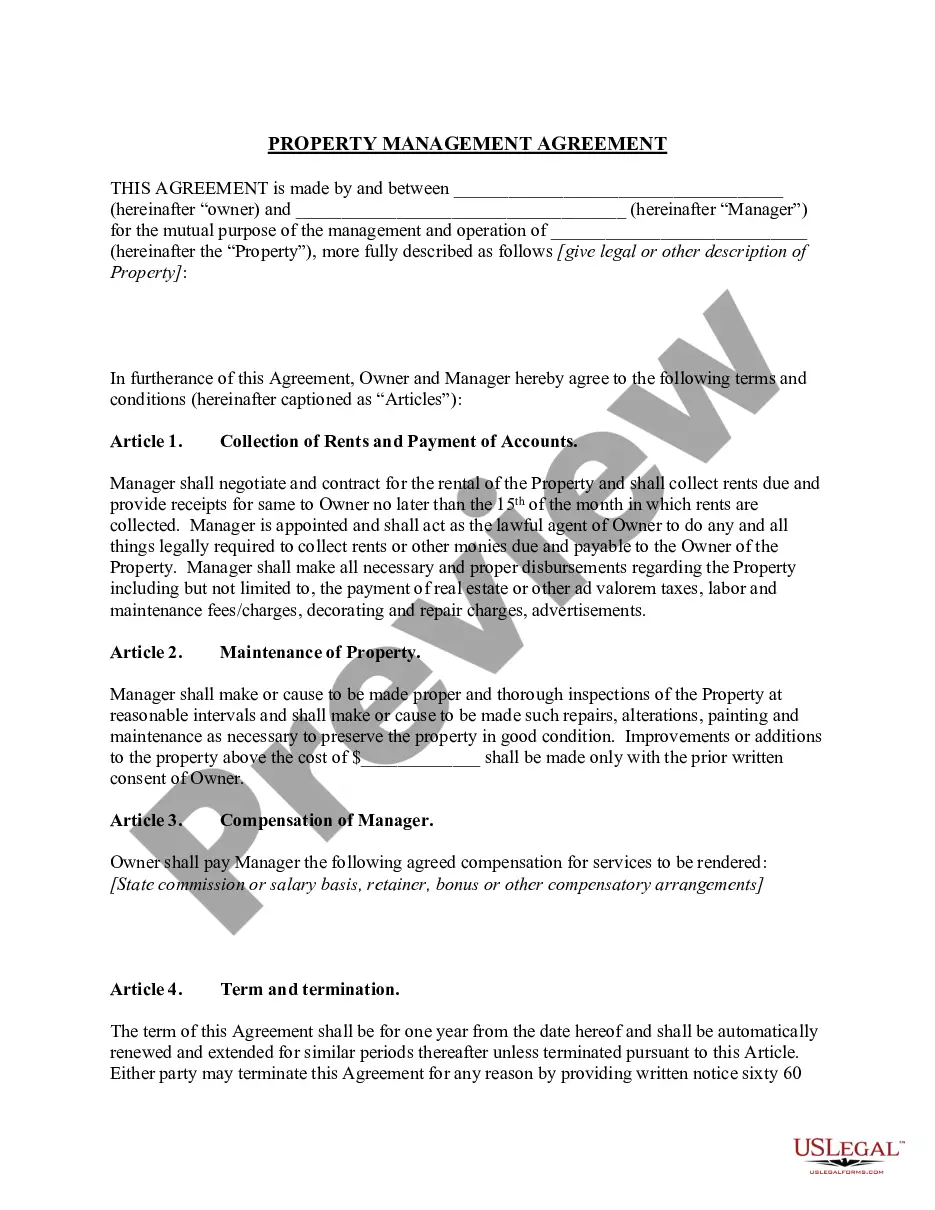

With US Legal Forms, one of the largest collections of legal documents, you can discover everything from court papers to templates for internal business correspondence. We understand how crucial compliance and adherence to federal and local laws and regulations are. That's why, on our platform, all templates are region-specific and current.

You can access your documents again from the My documents tab whenever you need. If you’re a current client, you can simply Log In and find and download the template from the same tab.

Regardless of the nature of your documents—whether they are financial, legal, or personal—our site has everything you need. Give US Legal Forms a try now!

- Locate the document you need by utilizing the search feature at the top of the page.

- Preview it (if this option is available) and read the supporting description to ascertain whether the Lead-based Paint Disclosure Form Florida is what you're looking for.

- Start your search anew if you require any other form.

- Sign up for a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is completed, you can obtain the Lead-based Paint Disclosure Form Florida, fill it out, print it, and send or mail it to the required individuals or entities.

Form popularity

FAQ

Employees who live and work in Texas will not have these deductions on their paychecks, since Texas does not have a state income tax.

The Texas tax power of attorney (Form 01-137) designates an agent to represent a taxpayer before the Texas Comptroller of Public Accounts. In most cases, it is accountants or attorneys that are appointed, although any individual can be named as the taxpayer's agent.

Texas doesn't tax individual income, so you will not need to fill out Texas state income tax forms. There are other potential taxes that a resident may owe, separate from income tax. Texas taxes vary greatly from person to person.

Since Texas does not collect an income tax on individuals, you are not required to file a TX State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

A Texas Tax Power of Attorney (Form 85-113) must be filled out to designate someone to represent you in tax matters that concern you before the Texas Comptroller of Public Accounts. This power of attorney grants the person you appoint the power to see your tax information and make filings and decisions on your behalf.

TPCIGA is responsible for paying claims for unearned premium. You don't have to file your own claim. The Receiver will notify the guaranty association of your unearned premium claim. TPCIGA was created by the Texas Legislature to pay property and casualty claims if an insurance company fails.

Texas does not have a personal income tax, so that's one tax return you won't need to file. Just use 1040.com to file your federal return, and any returns you need to file for states that do have an income tax.

EFileTexas.Gov. Official E-Filing System for Texas. applying technology that enables everyone access to our justice system.