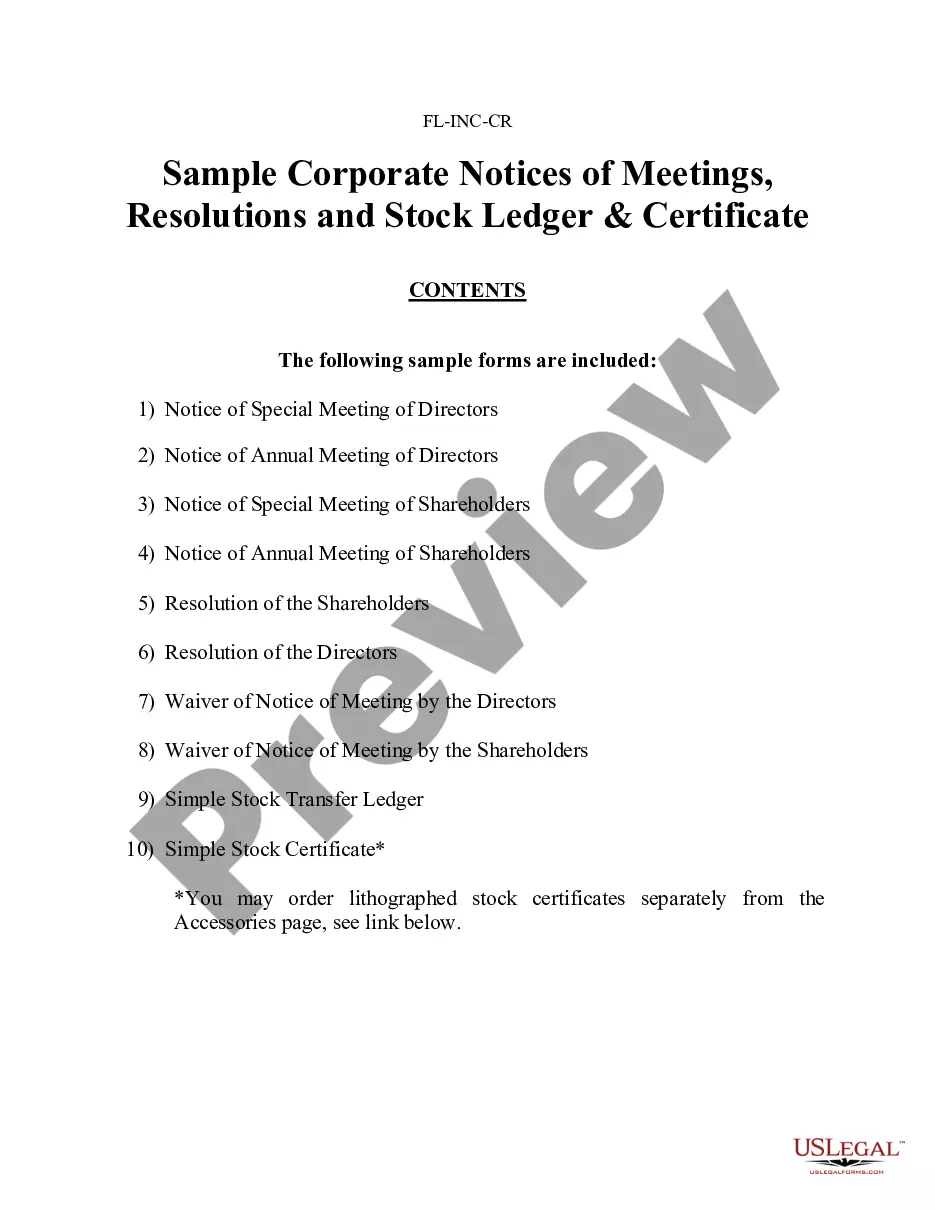

Sample Stock Ledger Form

Description

Form popularity

FAQ

An LLC ledger is a record that documents the financial and ownership details of an LLC, including member contributions and distributions. It serves as an essential tool for transparency and accountability among members. To effectively manage these records, consider utilizing a sample stock ledger form tailored to your LLC’s specific needs.

An LLC can have a stock account if it chooses to issue shares, although this is less common. A stock account would function similar to a corporate account, helping track ownership and transactions. For ease of use, an LLC might benefit from a sample stock ledger form to manage these records effectively.

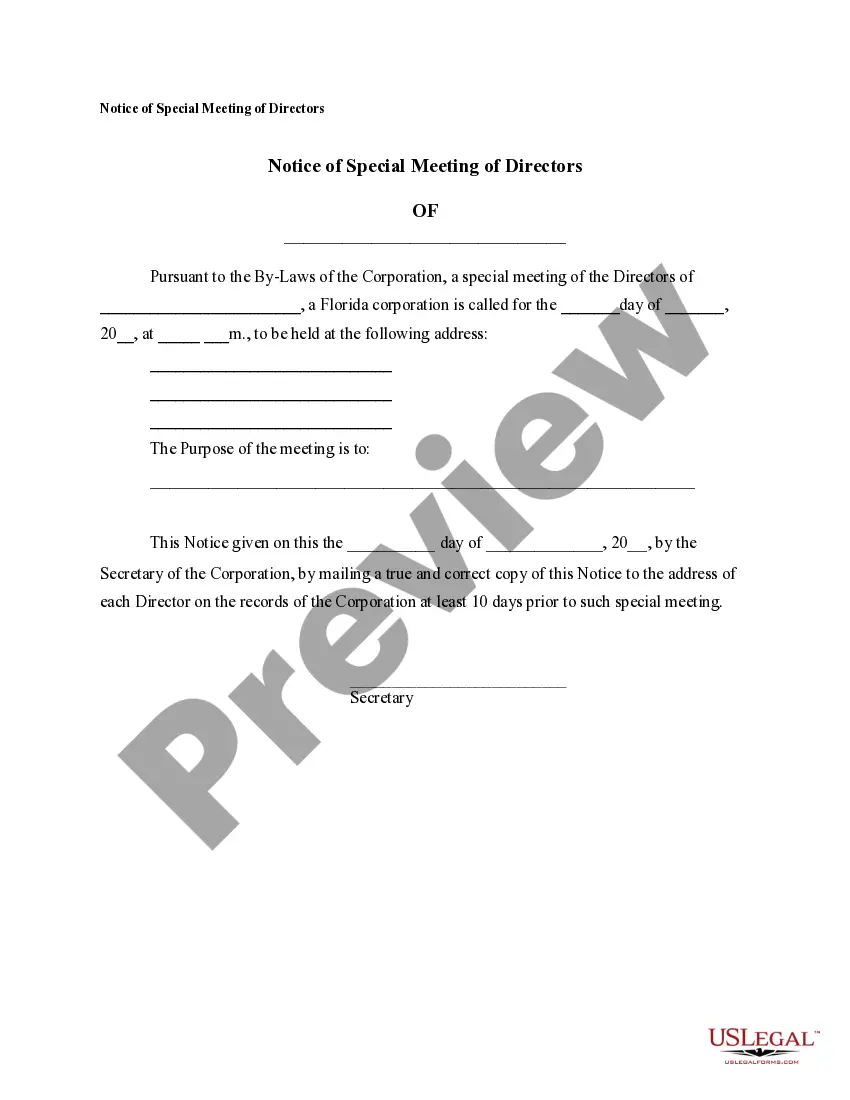

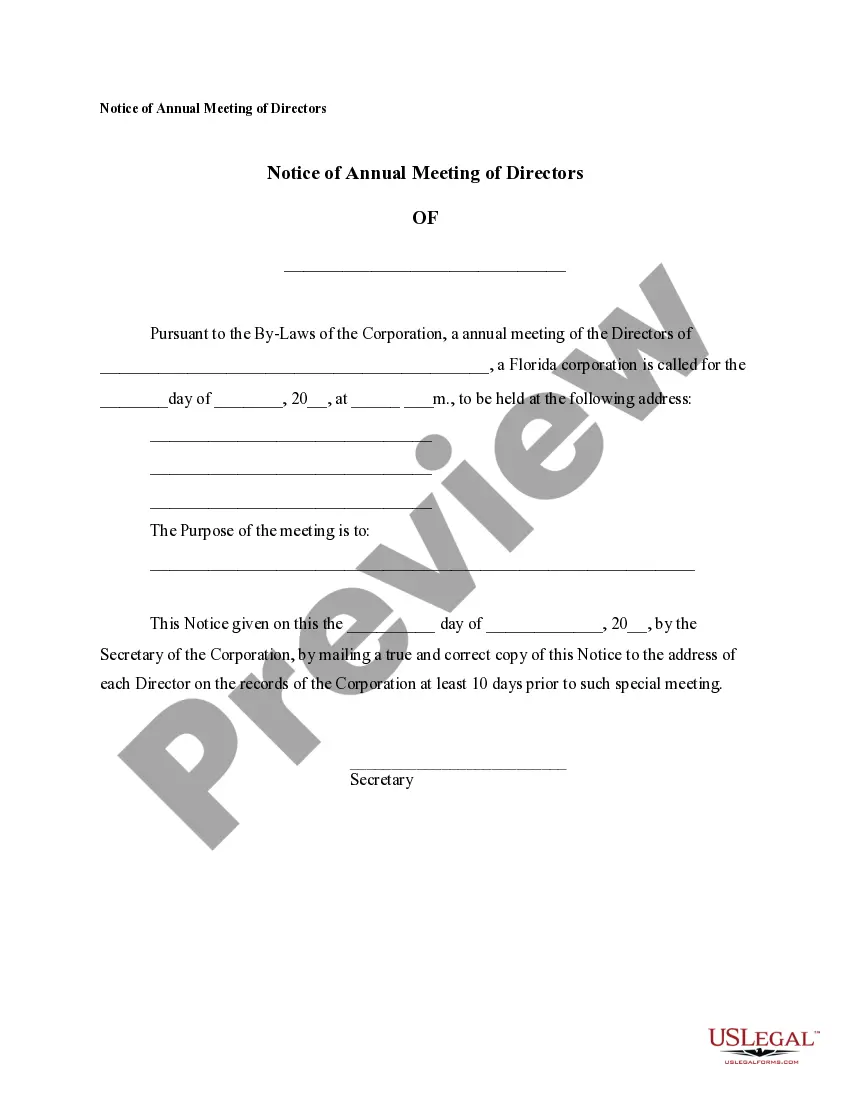

Creating a stock ledger involves outlining the necessary details like stockholder information, number of shares, and transaction dates. Start by creating a template that captures these critical data points. Utilizing a sample stock ledger form can help ensure your ledger adheres to best practices, fostering better tracking and management of equity.

While LLCs typically do not have share registers, they do maintain records of ownership through membership registries. These registries detail member contributions and ownership stakes. If an LLC decides to issue shares, adopting a sample stock ledger form will help streamline the management of these registrations.

A common stock ledger is a record that shows the ownership of shares in a corporation. It indicates who owns shares, how many shares are held, and any changes in ownership. A sample stock ledger form can be a useful tool for organizations to manage and maintain accurate ownership records efficiently.

LLCs do not typically use stock ledgers because they generally do not have stock as corporations do. Instead, they may use membership ledgers to track ownership interests among members. If an LLC chooses to structure itself with share distributions, it may opt for a sample stock ledger form to accommodate those changes.

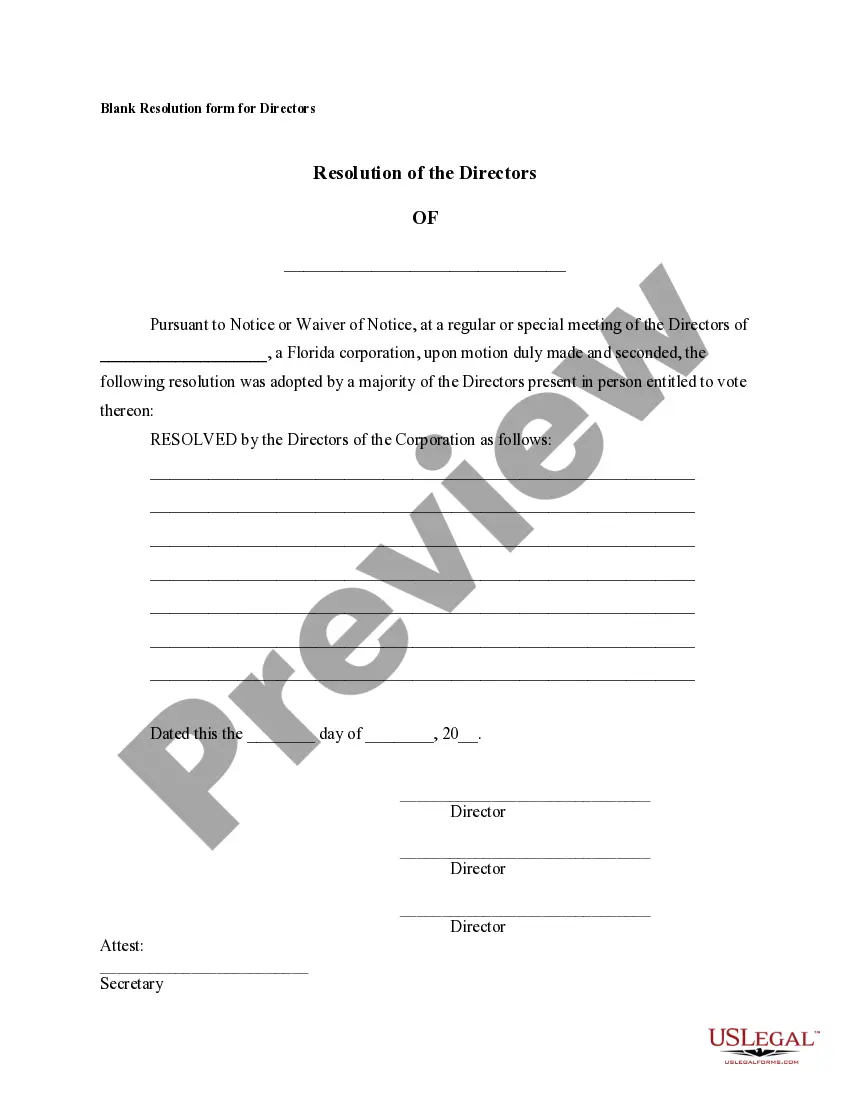

A stock transfer ledger usually contains columns for the date of transfer, names of the transferor and transferee, number of shares, and transaction details. It is designed for clarity and accuracy, providing a snapshot of ownership changes. For businesses that deal with shares, utilizing a sample stock ledger form can simplify management and record-keeping.

An LLC typically does not have a stock ledger since it doesn't issue stock like a corporation. Instead, an LLC maintains an ownership ledger to record member contributions and ownership percentages. However, if an LLC decides to issue shares, it can develop a sample stock ledger form to track these shares efficiently.

To effectively fill out a stock transfer form, you should start by gathering all required information, such as the names of the current and new stockholders, the number of shares being transferred, and the type of stock. Then, accurately complete each section of the sample stock ledger form, ensuring clarity in your details to avoid processing delays. It is also advisable to review the company’s bylaws regarding stock transfers, as these may have specific requirements. Utilizing platforms like US Legal Forms can simplify the process, offering you ready-to-use templates that guide you through every step.

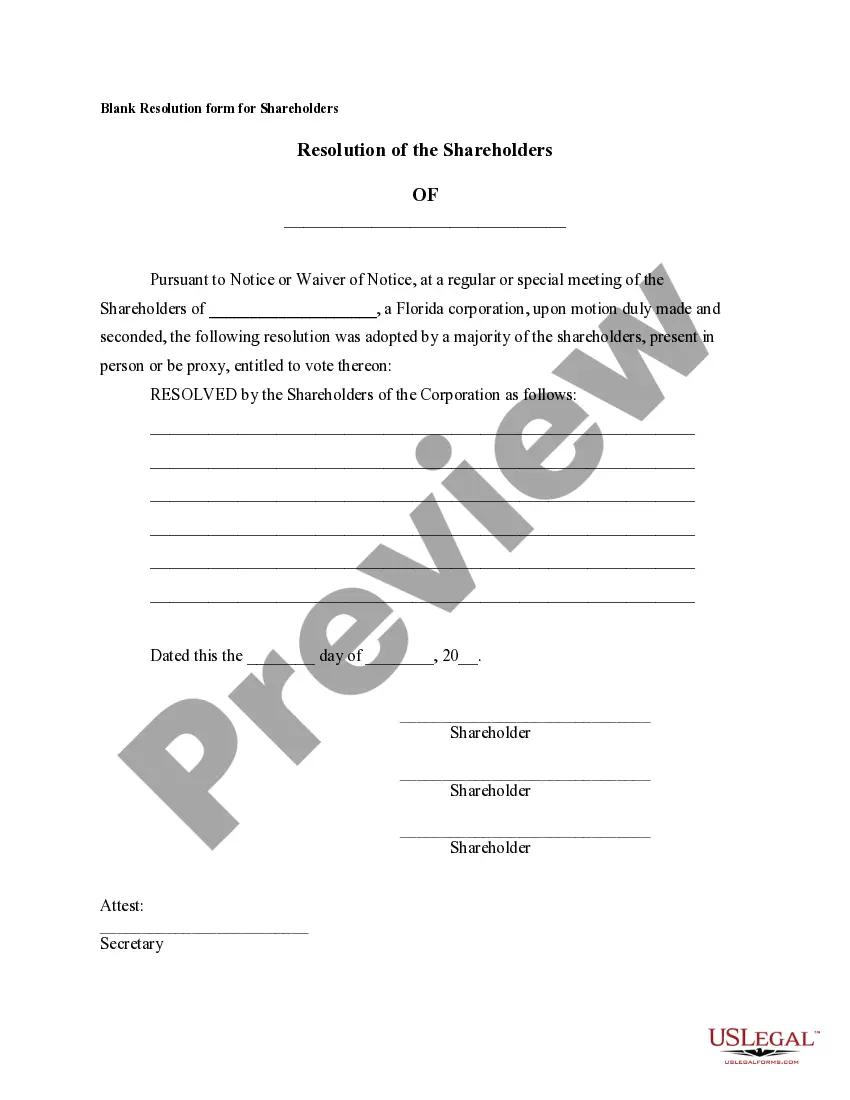

A shareholder ledger typically features columns for names, contact information, share amounts, and transaction history. You can visualize this format through a sample stock ledger form, which provides a clear layout for managing and tracking shareholder information. This organized approach helps ensure transparency and accountability.