Mortgage Deed Template With Extra Payments

Description

How to fill out Florida Mortgage Deed From Individual?

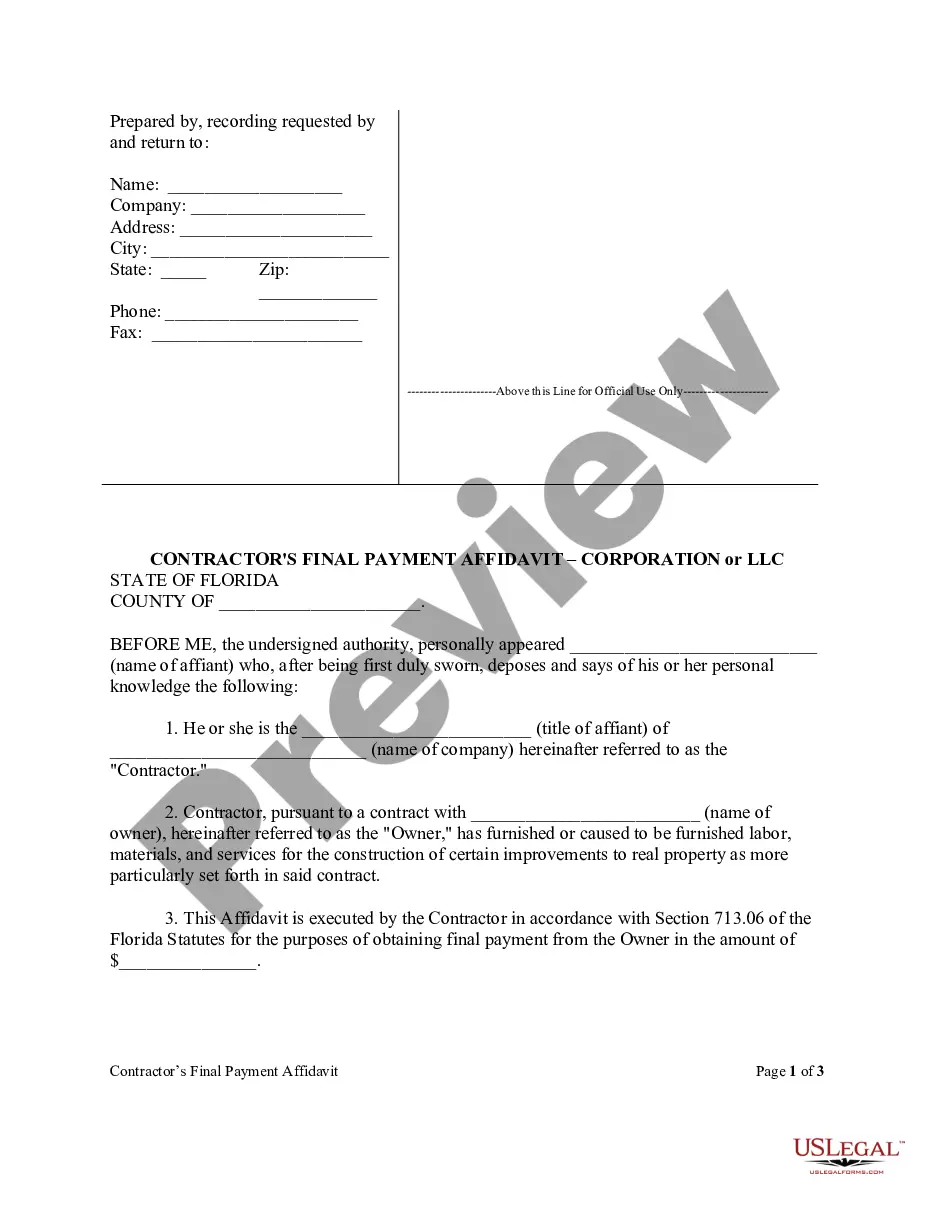

The Mortgage Deed Template With Extra Payments displayed on this page is a reusable formal document crafted by expert attorneys in accordance with federal and local laws and regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal professionals more than 85,000 verified, state-specific documents for any business and personal scenario. It’s the quickest, simplest, and most dependable method to acquire the forms you require, as the service ensures the highest level of data security and anti-malware safeguards.

Register for US Legal Forms to have verified legal templates for every situation in life at your fingertips.

- Search for the document you need and examine it.

- Choose the pricing plan that fits you and create an account.

- Select the format you want for your Mortgage Deed Template With Extra Payments (PDF, DOCX, RTF) and download the sample to your device.

- Print the template to complete it by hand or use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with an eSignature.

- Access the same document again whenever necessary.

Form popularity

FAQ

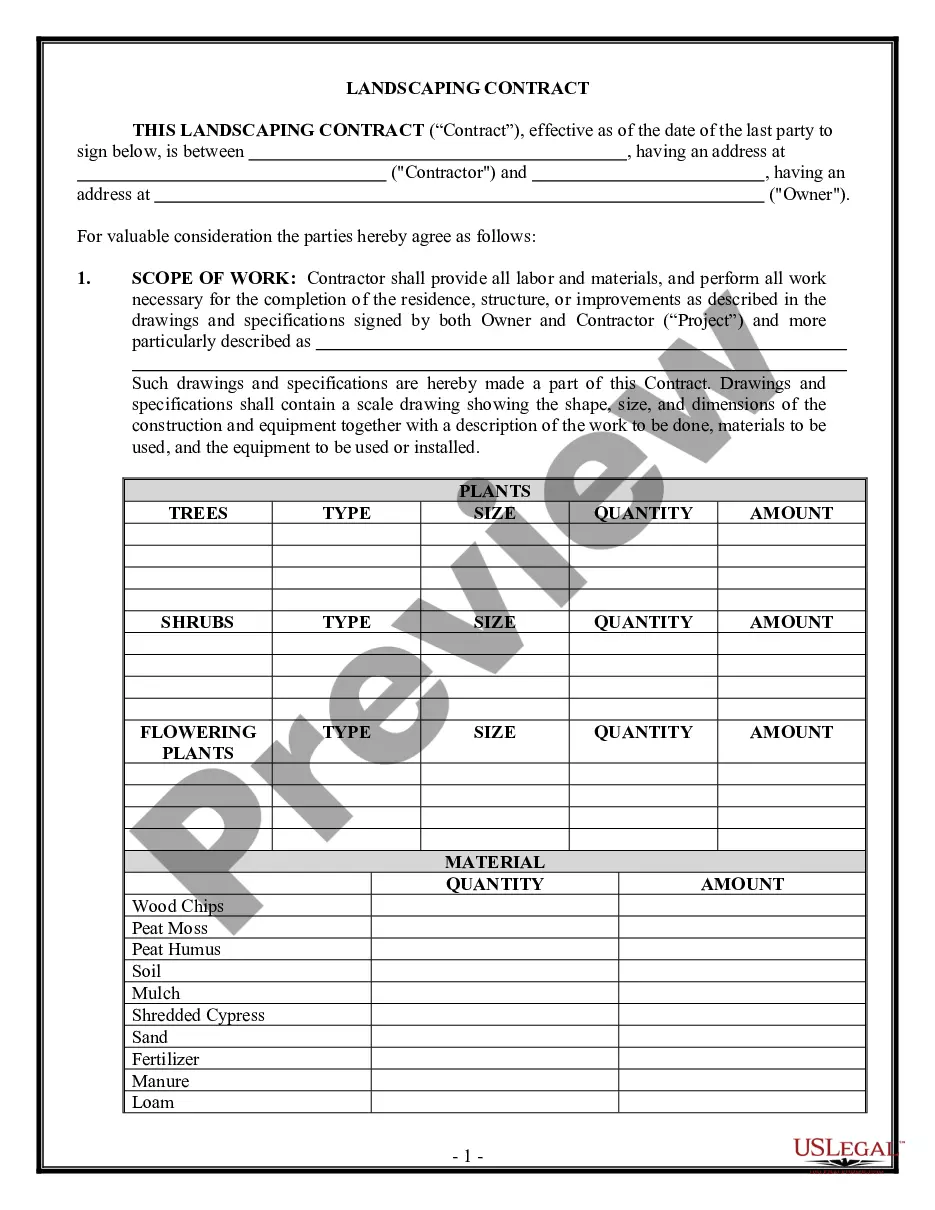

Mortgage Note Details The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.

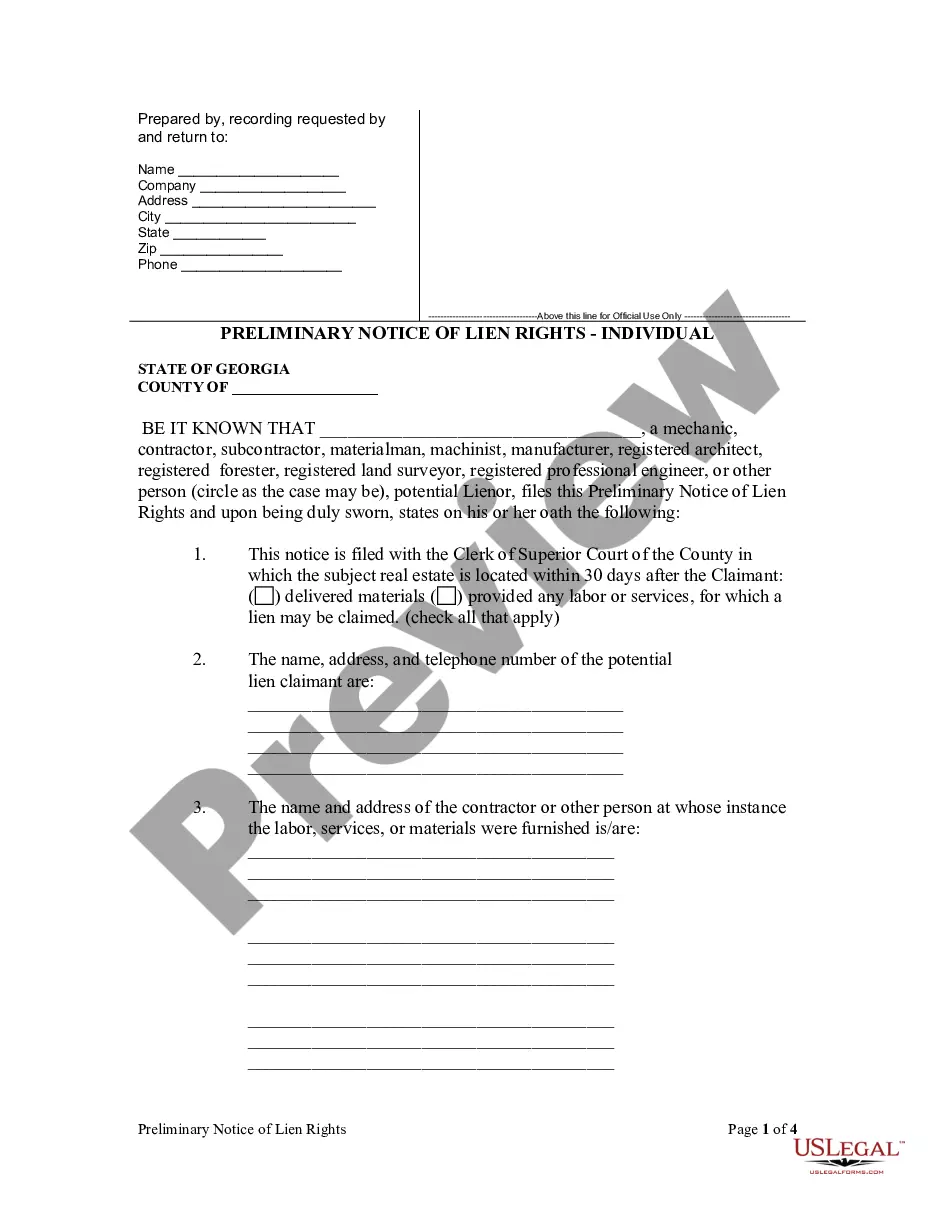

The question is often raised: ?After sending a default notice demanding payment, can a lender accept a partial payment?? The easy answer is that a lender can, of course, accept a partial payment. However, there are potential ramifications of accepting a partial payment after making demand for a specific payment.

Once you're 45 days past due, your loan servicer may assign someone to your account. They'll contact you and let you know about your options. After 60 days ? or two missed mortgage payments ? you'll incur a second late fee. The late payment will also be reported to the credit bureaus.

If the demand feature is checked "yes," the lender can require that you immediately pay the entire loan balance (principal and interest) at any time. The lender can make this demand on you for any reason or for no reason. Be sure to check your. Think carefully about whether you want to agree to a demand feature.

The promissory note portion includes: The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.1.