Quitclaim Deed To Revocable Trust Form With Irs

Description

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

Drafting legal paperwork from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more affordable way of preparing Quitclaim Deed To Revocable Trust Form With Irs or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of more than 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-specific forms carefully put together for you by our legal professionals.

Use our platform whenever you need a trusted and reliable services through which you can easily find and download the Quitclaim Deed To Revocable Trust Form With Irs. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and navigate the catalog. But before jumping directly to downloading Quitclaim Deed To Revocable Trust Form With Irs, follow these recommendations:

- Review the form preview and descriptions to ensure that you have found the form you are looking for.

- Check if form you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Quitclaim Deed To Revocable Trust Form With Irs.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and turn document completion into something easy and streamlined!

Form popularity

FAQ

Although you can make a quitclaim deed yourself, we suggest hiring a real estate lawyer to ensure your deed is done right and meets the legal and filing requirements for Flordia and the local country recorders office where the property is located.

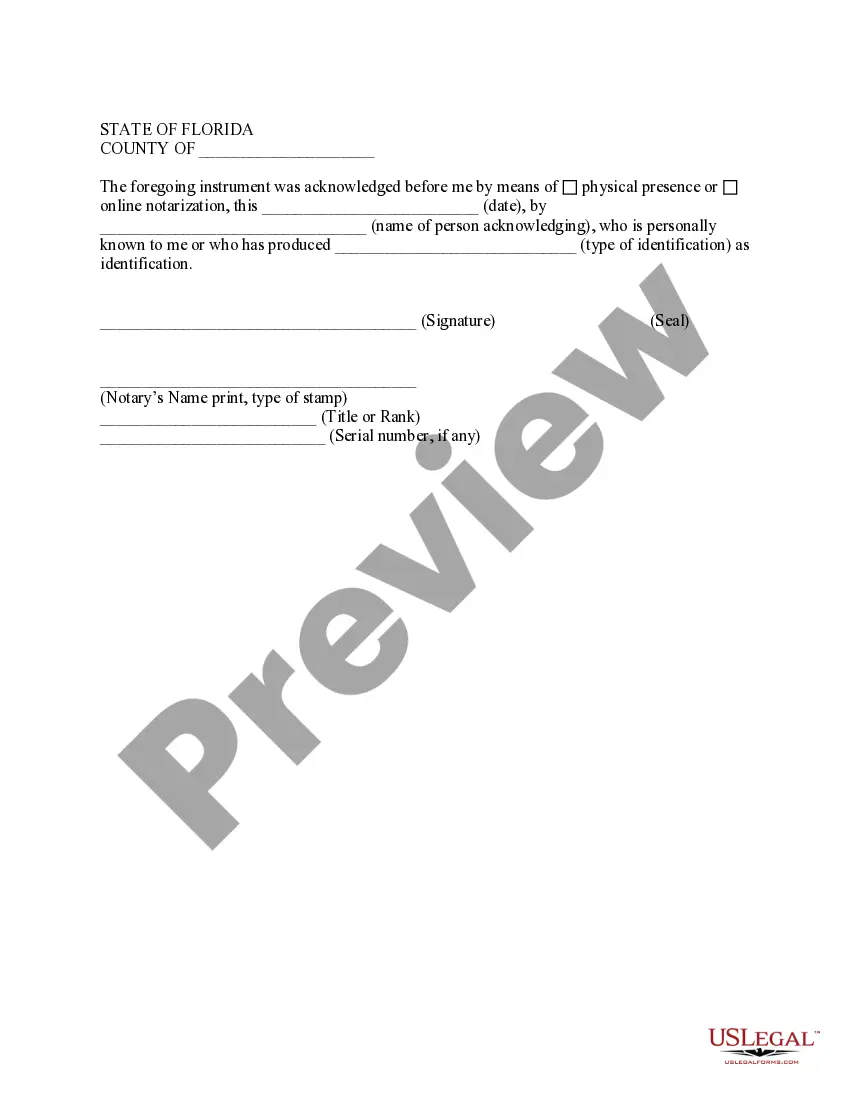

Ing to Florida Statute 695.26, a quitclaim deed must contain these certain elements: Name and address of person preparing the deed. Grantor's name and address. Grantee's name and address. Signatures of the grantors. Two witnesses for each signature/ Notary acknowledgment with signature.

Is there a transfer tax on a quitclaim deed in Florida? Yes, the county will charge a transfer tax for a quitclaim deed based on the amount of consideration paid for the property.

Family members can transfer property to one another without estate tax penalties by putting the property into a trust. When placed into an irrevocable trust, the property is no longer considered part of your estate after you die.

Due to this, quitclaim deeds typically are not used in situations where the property involved has an outstanding mortgage. After all, it would be difficult for many grantors to pay off a mortgage without proceeds from the sale of the property.