Trust For Minor Child In Will

Description

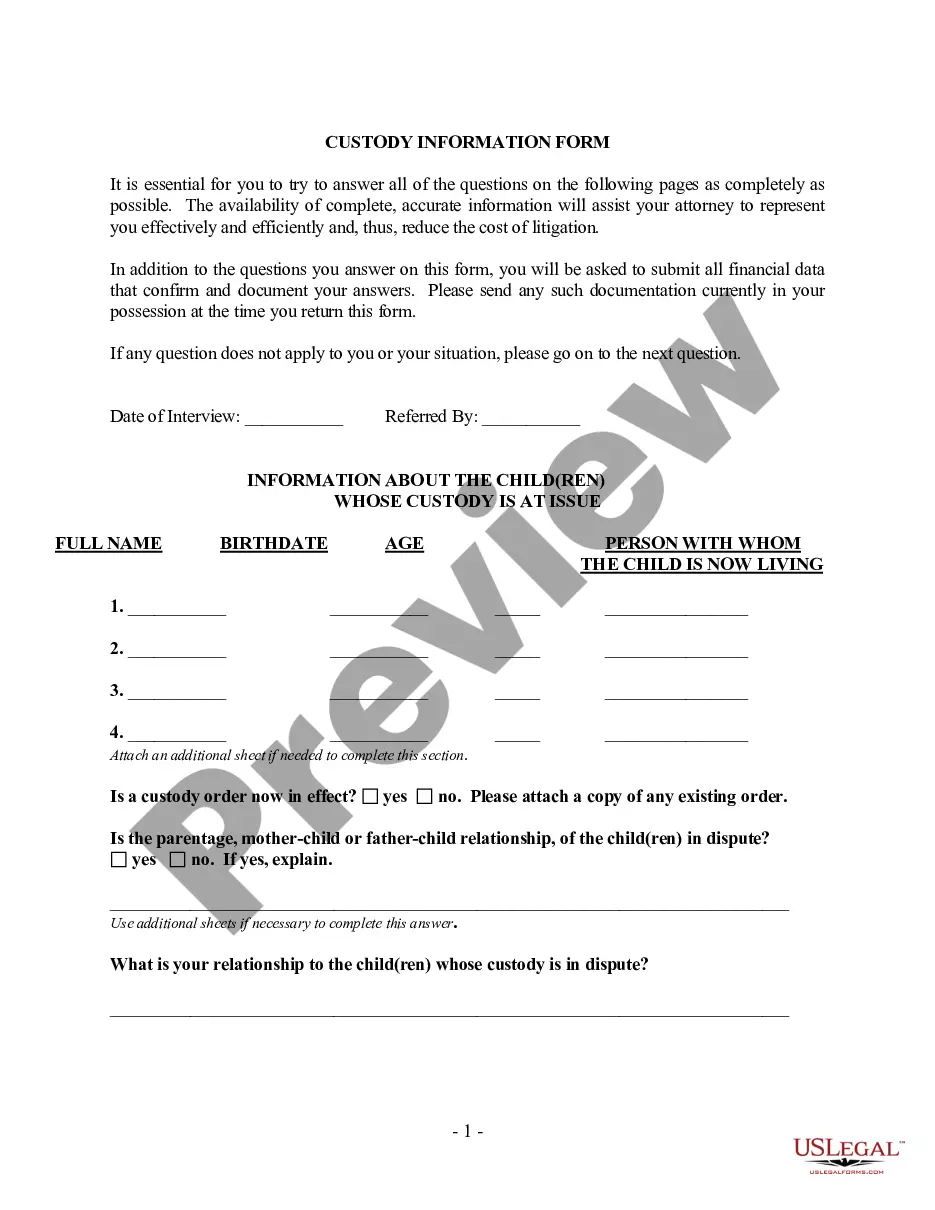

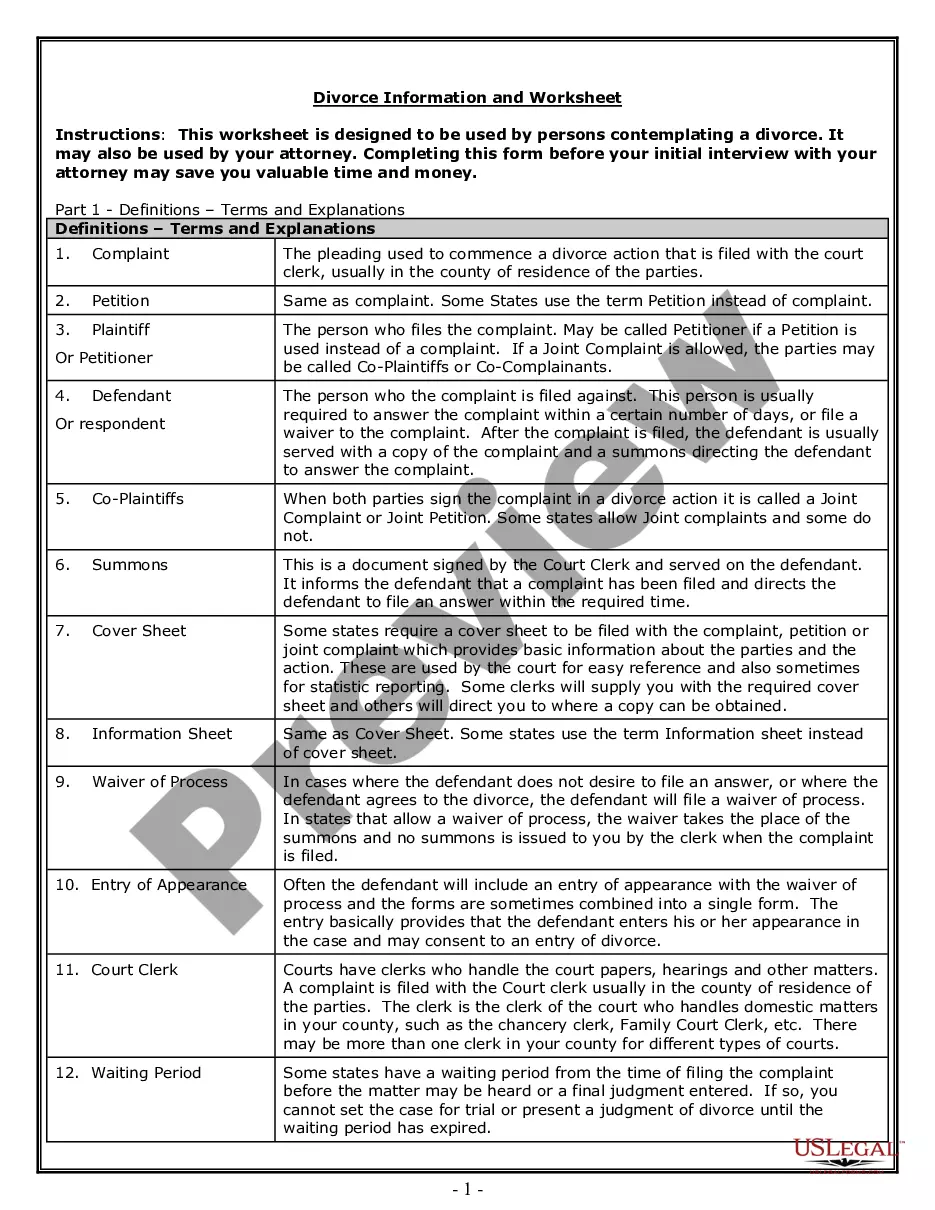

How to fill out Florida Living Trust For Husband And Wife With Minor And Or Adult Children?

Regardless of whether it is for corporate objectives or personal issues, everyone must confront legal matters at some stage in their lives.

Completing legal documentation necessitates meticulous care, beginning with selecting the appropriate form template. For instance, if you select an incorrect version of the Trust For Minor Child In Will, it will be denied upon submission. Thus, it is crucial to have a dependable source of legal documents like US Legal Forms.

With a vast US Legal Forms catalog available, you will never have to waste time searching for the correct sample across the web. Utilize the library’s straightforward navigation to find the suitable template for any situation.

- Locate the sample you require using the search bar or catalog browsing.

- Review the form’s details to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search tool to find the Trust For Minor Child In Will template you need.

- Acquire the template when it fulfills your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you prefer and download the Trust For Minor Child In Will.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Setting up a trust for a child can provide significant benefits, making it worthwhile for many parents. A trust for a minor child in a will can ensure your child's financial security and control how assets are distributed. Additionally, it can help minimize probate costs and protect the inheritance from potential creditors. Ultimately, this decision can offer peace of mind knowing that your child's future is secure.

Creating a trust for a minor child in a will involves several steps. First, you need to determine the type of trust that suits your child's needs, such as a revocable or irrevocable trust. Next, you can use resources like US Legal Forms to access templates and guides that simplify the process. Finally, appoint a trustworthy trustee who will manage the assets for your child until they reach adulthood.

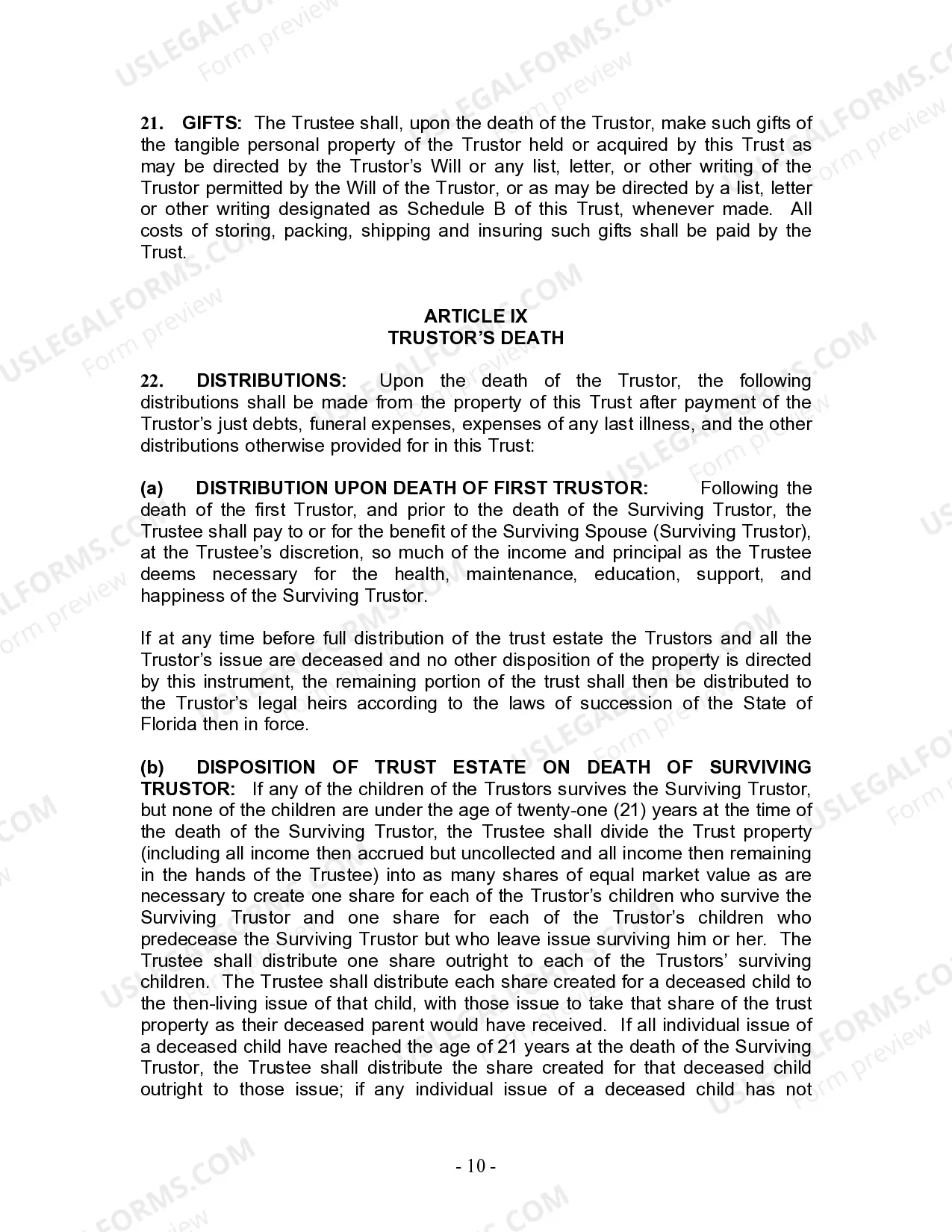

For a revocable living trust to take effect, it should be funded by transferring certain assets into the trust. Often people fund a living trust with real estate, financial accounts, life insurance, annuity certificates, personal property, business interests, and other assets.

The most common type of trust for children under 18 years of age is a custodial account. Custodial accounts are governed under the Uniform Gift to Minors Act (UMGA) or the Uniform Transfer to Minors Act (UTMA). UGMA lets minors own securities while UTMA lets minors own other kinds of property including real estate.

You should put your bank accounts in a living trust to ensure the funds are easily accessible for your beneficiaries when the time comes to inherit.

You can name a legal minor as the beneficiary of a trust. That's particularly important because, if you want to leave assets to a minor, a trust is how you'll do it.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.